Automotive Battery Thermal Management System Market Size, Share, Trends, Industry Analysis Report: By Technology (Active Battery Thermal Management System and Passive Battery Thermal Management System), Battery Type, Vehicle Type, Propulsion, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 119

- Format: PDF

- Report ID: PM1472

- Base Year: 2024

- Historical Data: 2020-2023

Automotive Battery Thermal Management System Market Overview

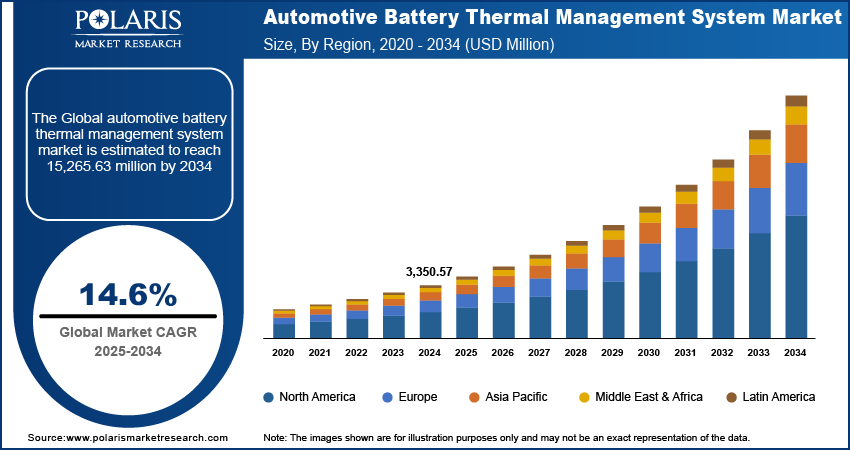

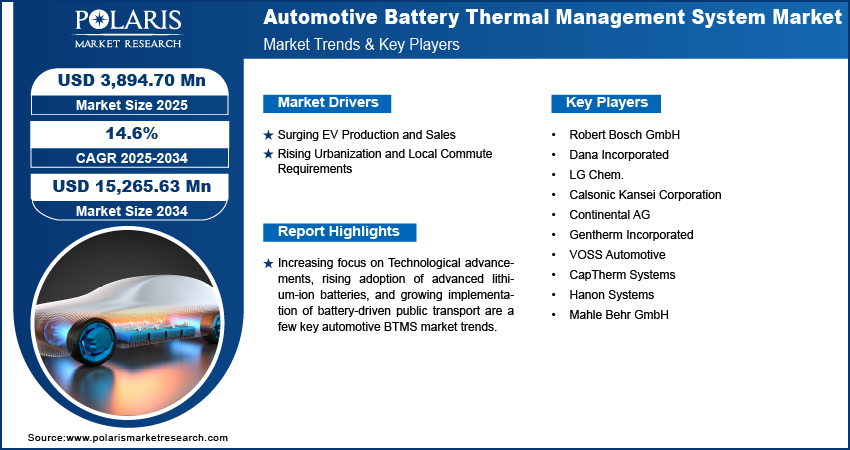

The global automotive battery thermal management system market size was valued at USD 3,350.57 million in 2024. The market is projected to grow from USD 3,894.70 million in 2025 to USD 15,265.63 million by 2034. It is projected to exhibit a CAGR of 14.6% from 2025 to 2034.

An automotive battery thermal management system (BTMS) controls and optimizes the operation and efficiency of batteries. The system encompasses various components and technologies, including an air cooling system, liquid cooling system, direct refrigerant cooling system, phase change material cooling system, and thermo-electric cooling system & heating. The use of automotive BTMS ensures optimal temperature control, energy efficiency, and improved performance in electric vehicle (EV) batteries.

To Understand More About this Research: Request a Free Sample Report

The booming automotive sector and increasing demand for electric vehicles (EVs) are driving the automotive thermal battery management system (BTMS) market development. The rising emphasis on enhancing battery performance and efficiency in automobiles further supports the automotive BTMS market expansion. The increasing environmental concerns have also accelerated the adoption of automotive battery thermal management systems.

Increasing focus on technological advancements, rising adoption of advanced lithium-ion batteries, and growing implementation of battery-driven public transport are the key automotive battery thermal management system market trends anticipated to drive market growth. The introduction of stringent emission norms imposed by governments worldwide, increased government initiatives for EV purchases, and the development of charging infrastructure are a few factors expected to create numerous growth opportunities for market participants in the coming years.

Automotive Battery Thermal Management System Market Dynamics

Surging EV Production and Sales

The growing adoption of EVs is driving the automotive battery thermal management system (BTMS) market expansion by necessitating the efficient management of EV batteries. With more consumers preferring EVs for environmental benefits and government initiatives and policies boosting their demand, there is a corresponding need for advanced automotive BTMS systems to maximize power output, increase battery life, and reduce the risk of thermal runaway. The US government offers incentives such as fleet acquisition, tax breaks, and R&D funding to encourage the adoption of EVs. Similarly, the Indian government is driving the adoption of EVs by offering incentives for developing EV infrastructure and manufacturing batteries locally. Thus, the implementation of government initiatives boosts the production and sales of EVs, impacting the market for automotive battery thermal management systems favorably.

Rising Urbanization and Local Commute Requirements

Several regions across the world are experiencing increasing urbanization, with more people moving to cities. The shift to urban areas is largely fueled by rapid industrialization and increasing work opportunities in urban areas. Moreover, urban residents are more inclined to technologically advanced and eco-friendly mobility options. Therefore, factors such as rising urbanization, growing disposable income, and the need for efficient local commutes are anticipated to drive the adoption of EVs, which is expected to drive the automotive BTMS market demand in the coming years.

Automotive Battery Thermal Management System Market Segment Insights

Automotive Battery Thermal Management System Market Outlook by Vehicle Type

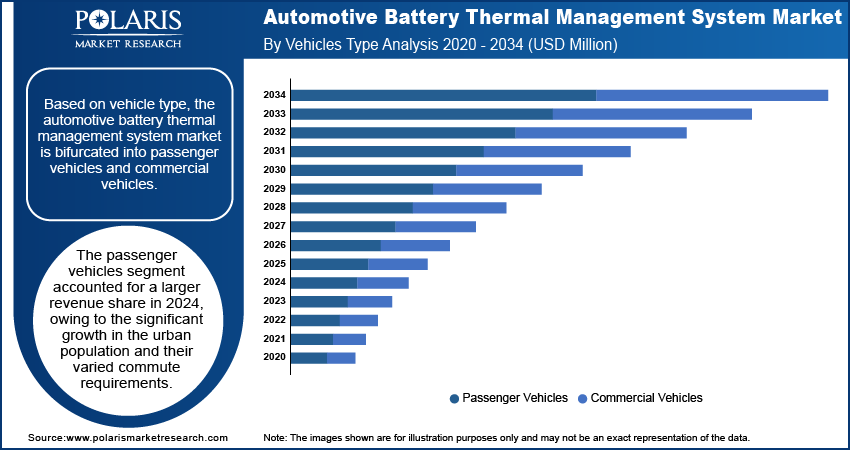

The automotive BTMS market segmentation, based on vehicle type, includes passenger vehicles and commercial vehicles. The passenger vehicles segment accounted for a larger revenue share in 2024. This is primarily due to the significant growth in the urban population and their varied commute requirements. Further, factors such as growing environmental concerns, rising fuel prices, and the low operating costs of EVs are driving the adoption of EVs for personal use, further contributing to the growth of the segment.

Automotive Battery Thermal Management System Market Evaluation by Propulsion

The automotive battery thermal management system market segmentation, based on propulsion, includes battery electric vehicles, plug-in hybrid electric vehicles, hybrid electric vehicles, and fuel cell vehicles. The hybrid electric vehicle segment is projected to witness the highest CAGR from 2025 to 2034. Hybrid EVs use an electric motor and battery system in addition to a combustion engine, resulting in better fuel economy as compared to conventional automobiles. They rely on regenerative braking to convert kinetic energy into electric energy that recharge the battery. The rising focus on lowering vehicle emissions and improving fuel economy is driving the demand for hybrid electric vehicles, thereby supporting the segment’s robust growth.

Automotive Battery Thermal Management System Market Regional Analysis

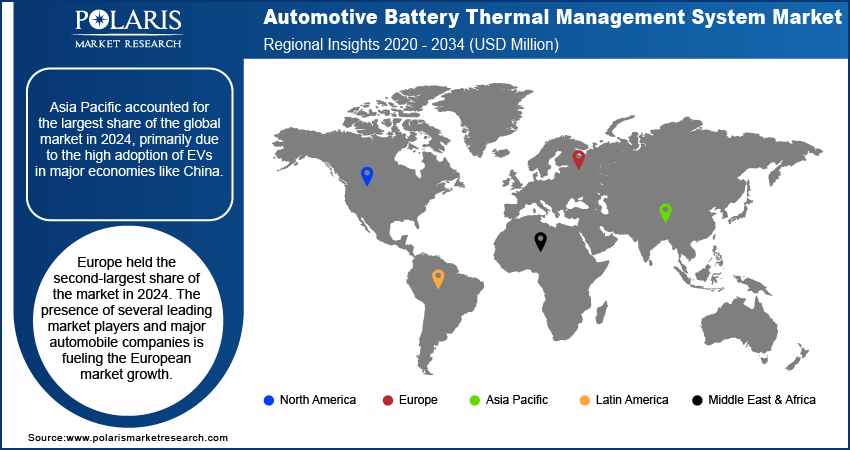

The market report offers automotive battery thermal management system (BTMS) market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific accounted for the largest share of the global market in 2024, owing to the high adoption of EVs in major economies such as China. Also, the rising penetration of EVs in other emerging countries, such as Japan, South Korea, and India is attributed to the presence of subsidies and tax exemption in the region, which drives the automotive BTMS market growth in the region.

Europe held the second-largest share of the automotive battery thermal management system (BTMS) market revenue in 2024. The presence of several leading market players and major automobile companies is fueling the European market growth. In addition, the growing support for electrification, rising stringency on vehicle emissions, and increasing investments in EV innovations are boosting the market expansion in Europe.

Automotive Battery Thermal Management System Market – Key Players and Competitive Insights

The automotive battery thermal management system market research report encompasses a thorough vendor share research for all the major market players. The market is highly competitive and has the presence of a large number of small and large vendors. The top market participants are introducing new products to cater to the growing customer needs. In addition, these companies are using strategic initiatives such as collaborations, partnerships, and mergers and acquisitions to enhance their offerings and expand their regional footprint.

To thrive in the competitive market environment, companies must deliver automotive thermal battery management systems that are efficient and cost-effective. A few key players in the market are Robert Bosch GmbH, Dana Incorporated, LG Chem., Calsonic Kansei Corporation, Continental AG, Gentherm Incorporated, VOSS Automotive, CapTherm Systems, Hanon Systems, and Mahle Behr GmbH.

List of Key Players in Automotive Battery Thermal Management System Market

- Robert Bosch GmbH

- Dana Incorporated

- LG Chem.

- Calsonic Kansei Corporation

- Continental AG

- Gentherm Incorporated

- VOSS Automotive

- CapTherm Systems

- Hanon Systems

- Mahle Behr GmbH

Automotive Battery Thermal Management System Industry Developments

February 2024: Betterfrost announced a partnership with DENSO and the Ontario Vehicle Innovation Network. With the partnership, Betterfrost aims to improve the ranges of its EVs in extreme cold or heat.

February 2024: Modine entered into a definitive agreement for the acquisition of Scott Springfield Manufacturing. Through this acquisition, the company aims to expand its line of products by including air handling units.

Automotive Battery Thermal Management System Market Segmentation

By Technology Outlook

- Active Battery Thermal Management System

- Passive Battery Thermal Management System

By Battery Type Outlook

- Conventional Batteries

- Solid-State Batteries

By Vehicle Type Outlook

- Passenger Vehicles

- Commercial Vehicles

By Propulsion Outlook

- Battery Electric Vehicles

- Hybrid Electric Vehicles

- Plug-in Electric Vehicles

- Fuel Cell Vehicles

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Automotive Battery Thermal Management System Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3,350.57 million |

|

Market Size Value in 2025 |

USD 3,894.70 million |

|

Revenue Forecast by 2034 |

USD 15,265.63 million |

|

CAGR |

14.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 3,350.57 million in 2024 and is projected to grow to USD 15,265.63 million by 2034.

The market is projected to register a CAGR of 14.6% from 2025 to 2034.

Asia Pacific accounted for the largest automotive battery thermal management system (BTMS) market share in 2024.

A few key players in the market are Robert Bosch GmbH, Dana Incorporated, LG Chem., Calsonic Kansei Corporation, Continental AG, Gentherm Incorporated, VOSS Automotive, CapTherm Systems, Hanon Systems, and Mahle Behr GmbH.

The passenger vehicles segment accounted for a larger automotive BTMS market revenue share in 2024.

The hybrid electric vehicle segment is projected to register the highest CAGR in the market during the forecast period.