Automotive Adhesive and Sealants Market Size, Share, Trends, Industry Analysis Report: By Resin Type (Epoxy, Acrylics, Polyurethanes, Rubber, Polyvinylchloride, Silicones, Synthetic Block, and VAE/EVA), Technology, Application, Vehicle, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 129

- Format: PDF

- Report ID: PM1586

- Base Year: 2024

- Historical Data: 2020-2023

Automotive Adhesive and Sealants Market Overview

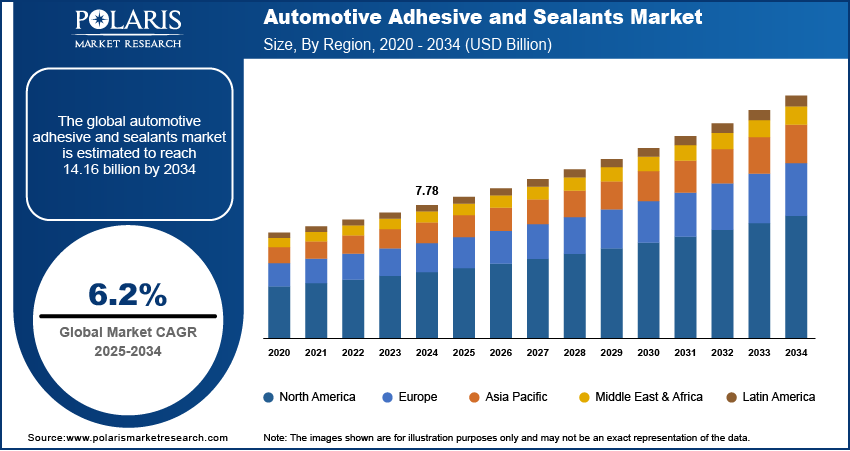

The global automotive adhesive and sealants market size was valued at USD 7.78 billion in 2024. The market is projected to grow from USD 8.25 billion in 2025 to USD 14.16 billion by 2034, exhibiting a CAGR of 6.2 % from 2025 to 2034.

Automotive adhesives and sealants are specialized materials used in the automotive industry to bond and seal various components of vehicles. These substances play a crucial role in modern vehicle manufacturing and assembly, providing solutions that enhance structural integrity, reduce weight, and improve overall vehicle performance.

The increasing emission regulations worldwide are propelling the global automotive adhesive and sealants market growth. Emission regulations usually require automakers to produce lighter, more fuel-efficient vehicles to reduce greenhouse gas emissions. Adhesives and sealants play a critical role in enabling this transition, as they provide strong, lightweight materials and bonding sheets that replace traditional mechanical fasteners such as bolts and welds. Additionally, adhesives and sealants contribute to improved aerodynamics and noise reduction, which contribute to low vehicle emissions, thereby aligning with regulatory emission norms. This growing emphasis on emission compliance fuels innovation and adoption of advanced adhesive materials in the automotive sector.

To Understand More About this Research: Request a Free Sample Report

The automotive adhesive and sealants market demand is driven by the growing popularity and adoption of electric vehicles. According to data published by the International Energy Agency, almost 14 million new electric cars were registered globally in 2023, bringing their total number on the roads to 40 million. EVs rely heavily on lightweight materials to offset the weight of batteries and enhance energy efficiency. Adhesives and sealants are vital for bonding these lightweight materials, providing structural strength without adding unnecessary weight. They are also essential in battery assembly, where they ensure durability, thermal management, and safety by sealing battery packs and protecting them from moisture, vibrations, and thermal expansion. Furthermore, adhesives contribute to noise, vibration, and harshness (NVH) reduction in EVs, enhancing passenger comfort in the quieter cabins of these vehicles. Therefore, as EV adoption increases, the demand for advanced adhesives and sealants designed for lightweight, high-performance, and durable applications continues to grow.

Automotive Adhesive and Sealants Market Dynamics

Increasing Developments in Adhesive and Sealant Compositions

Innovations such as high-strength adhesives, temperature-resistant sealants, and environmentally friendly formulations enable automakers to meet evolving design, safety, and regulatory requirements. For instance, advanced adhesives with improved bonding strength allow for the integration of lightweight materials such as composites and aluminum, supporting vehicle weight reduction and fuel efficiency goals. Enhanced thermal and chemical resistance properties make them ideal for use in advanced components, such as electric vehicle batteries and high-performance engines. Additionally, the development of eco-friendly adhesives with reduced volatile organic compounds (VOCs) aligns with the industry's shift toward greener manufacturing processes. These advancements not only expand the applications of adhesives and sealants but also drive their adoption as essential solutions in the production of next-generation vehicles. Thus, the increasing developments in adhesive and sealant compositions are projected to propel the global automotive adhesive and sealants market development.

Growing Production of Motor Vehicles Worldwide

According to data published by the European Automobile Manufacturers' Association, in 2022, 85.4 million motor vehicles were produced around the world, an increase of 5.7% compared to 2021. Manufacturers require more adhesives and sealants for applications such as bonding, sealing, insulation, and noise reduction, with increasing vehicle production. These adhesives are essential in assembling components such as body panels, windshields, interior trims, and electrical systems, ensuring structural integrity, durability, and enhanced performance. Additionally, the rising consumer demand for lightweight, fuel-efficient, and aesthetically appealing vehicles drives automakers to use advanced adhesives and sealants that enable the integration of innovative materials and designs. This surge in motor vehicle production continuously fuels the growth of the adhesive and sealant market.

Automotive Adhesive and Sealants Market Segment Insights

Automotive Adhesive and Sealants Market Assessment by Resin Type Insights

Based on resin type, the automotive adhesive and sealants market is categorized into epoxy, acrylics, polyurethanes, rubber, polyvinylchloride, silicones, synthetic block, and VAE/EVA. The polyurethanes segment accounted for a major automotive adhesive and sealants market share in 2024 due to its exceptional versatility and performance characteristics. Polyurethane adhesives and sealants provide superior bonding strength, flexibility, and resistance to environmental factors such as temperature fluctuations, moisture, and chemical exposure. These properties make them ideal for a wide range of automotive applications, including bonding metal, plastic, and composite materials, as well as sealing joints and gaps. The rising demand for lightweight vehicles further contributes to the growth of the segment, as polyurethane formulations enable the integration of lightweight materials while maintaining structural integrity. Additionally, advancements in polyurethane chemistry, such as fast-curing and environmentally friendly variants, have strengthened its appeal among auto manufacturers seeking efficient and sustainable solutions.

Automotive Adhesive and Sealants Market Evaluation by Vehicle Insights

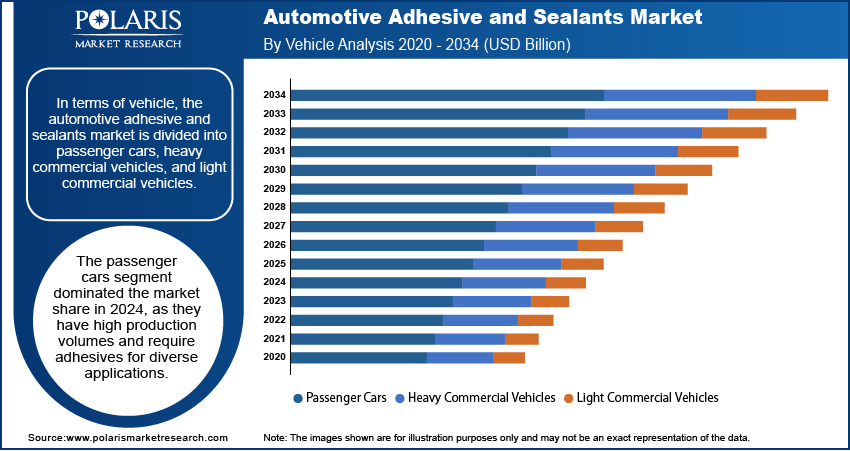

In terms of vehicle, the automotive adhesive and sealants market is divided into passenger cars, heavy commercial vehicles, and light commercial vehicles. The passenger cars segment dominated the market share in 2024 due to their high production volumes. Passenger cars require adhesives for diverse applications such as bonding lightweight components, ensuring structural integrity, reducing noise and vibration, and sealing gaps to enhance fuel efficiency and passenger comfort. The growing consumer preference for fuel-efficient and eco-friendly vehicles, along with advancements in electric vehicle (EV) production, has significantly increased the demand for adhesives and sealants in the segment. Additionally, stringent emission regulations and safety standards have driven manufacturers to adopt innovative adhesives to meet performance and regulatory requirements while maintaining cost efficiency.

The heavy commercial vehicle segment is expected to grow at a robust pace during the forecast period owing to the expanding logistics and transportation industries. The rise in e-commerce and global trade has spurred production and demand for heavy commercial vehicles that rely heavily on adhesives and sealants for structural bonding, sealing joints, and enhancing durability to reduce maintenance costs. The growth in long-haul electric trucks and hydrogen-powered vehicles further drives demand for adhesives and sealants, as these vehicles require specialized thermal management and sealing solutions for battery and fuel cell systems.

Automotive Adhesive and Sealants Market Regional Analysis

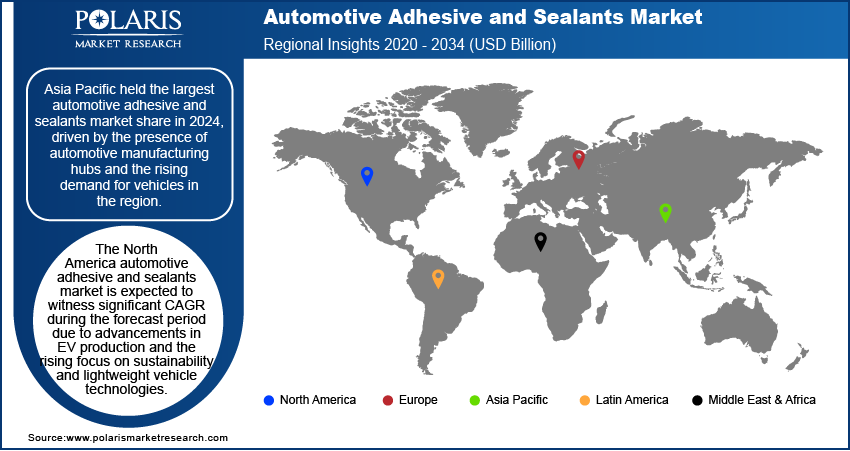

By region, the study provides the automotive adhesive and sealants market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific held the largest automotive adhesive and sealants market share in 2024 due to the presence of automotive manufacturing hubs and the rising demand for vehicles. Countries such as China, Japan, and India play a crucial role in this growth due to their high production capacities and investments in advanced manufacturing technologies. China, in particular, dominated the region with the largest market share, attributed to its extensive automotive production, broad EV market, and the presence of government initiatives promoting green mobility. The region's robust supply chain, availability of raw materials, and cost-effective manufacturing further support its dominance. Additionally, the rapid urbanization and rising disposable incomes across the Asia Pacific contribute to increased vehicle ownership, fueling the demand for adhesives and sealants in automotive applications.

The North America automotive adhesive and sealants market is expected to witness significant CAGR during the forecast period due to advancements in EV production and the rising focus on sustainability and lightweight vehicle technologies. The US leads this growth, owing to its strong automotive R&D capabilities and increasing investments in EV infrastructure and manufacturing. Stringent emission regulations and incentives for adopting eco-friendly vehicles have compelled automakers in North America to integrate advanced adhesives and sealants into their production processes. The rising trend of connected and autonomous vehicles in the region requires high-performance bonding materials for sensors, batteries, and other critical components, further increasing demand for adhesive and sealants.

Automotive Adhesive and Sealants Market – Key Players and Competitive Insights

Major market players are investing heavily in research and development in order to expand their offerings, which will help the automotive adhesive and sealants market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The automotive adhesive and sealants market is fragmented, with the presence of numerous global and regional market players. Major players in the automotive adhesive and sealants market include 3M; H.B. Fuller Company; Henkel AG & Co. KGaA; HUNTSMAN INTERNATIONAL LLC; Sika AG; PPG Industries, Inc.; Dow; Jowat SE; Permabond; Hernon Manufacturing Inc.; Evonik Industries AG; Solvay; Bostik; and Akzo Nobel N.V.

3M is a global player in the development and manufacturing of innovative adhesive and sealant solutions, particularly for the automotive industry. 3M's products are engineered to bond a wide variety of substrates, including metals, plastics, and glass, making them versatile solutions for modern automotive applications. One of the standout offerings from 3M is the 3M Polyurethane Adhesive Sealant 550, which is known for its fast curing time and ability to create strong, flexible bonds. This one-component polyurethane adhesive is moisture-curing, allowing it to bond effectively even in challenging environmental conditions. It is particularly effective for both similar and dissimilar materials, making it suitable for a range of applications, from body assembly to interior trim attachment.

PPG Industries, Inc. is a prominent player in the automotive adhesive and sealant market, renowned for its innovative solutions that enhance vehicle performance and manufacturing efficiency. One of PPG's key product lines is the CORABOND series, which includes structural adhesives engineered for high-performance bonding in automotive applications. These adhesives are designed to bond various materials such as metals, plastics, and composites, providing exceptional strength and durability.

List of Key Companies in Automotive Adhesive and Sealants Market

- 3M

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- HUNTSMAN INTERNATIONAL LLC

- Sika AG

- PPG Industries, Inc.

- Dow

- Jowat SE

- Permabond

- Hernon Manufacturing Inc.

- Evonik Industries AG

- Solvay

- Bostik

- Akzo Nobel N.V.

Automotive Adhesive and Sealants Industry Developments

May 2023: Henkel, a global leader in automotive adhesives, sealants, thermal materials, and functional coatings, launched a new injectable thermally conductive adhesive for EV battery systems.

March 2022: Bostik, a global company that develops and produces adhesives and bonding solutions for a variety of industries and consumers, announced a strategic partnership with DGE for adhesives and sealants distribution in EMEA across industries, such as automotive, electronics, luxury packaging, medical devices, and MRO.

Automotive Adhesive and Sealants Market Segmentation

By Resin Type Outlook (Volume – Kilotons, Revenue – USD Billion, 2020–2034)

- Epoxy

- Acrylics

- Polyurethanes

- Rubber

- Polyvinylchloride

- Silicones

- Synthetic Block

- VAE/EVA

By Technology Outlook (Volume – Kilotons, Revenue – USD Billion, 2020–2034)

- Hot Melt

- Reactive

- Sealants

- Solvent-Borne

- UV Cured Adhesives

- Water-Borne

By Application Outlook (Volume – Kilotons, Revenue – USD Billion, 2020–2034)

- Body in White (BIW)

- Paint Shop

- Powertrain

- Interior and Exterior Trim

- Glass Bonding

- Electronics

By Vehicle Outlook (Volume – Kilotons, Revenue – USD Billion, 2020–2034)

- Passenger Cars

- Heavy Commercial Vehicles

- Light Commercial Vehicles

By Regional Outlook (Volume – Kilotons, Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Automotive Adhesive and Sealants Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 7.78 billion |

|

Market Size Value in 2025 |

USD 8.25 billion |

|

Revenue Forecast by 2034 |

USD 14.16 billion |

|

CAGR |

6.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in kilotons, Revenue in USD billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global automotive adhesive and sealants market size was valued at USD 7.78 billion in 2024 and is projected to grow to USD 14.16 billion by 2034.

The global market is projected to register a CAGR of 6.2% during the forecast period.

Asia Pacific had the largest share of the global market in 2024.

Some of the key players in the market are 3M; H.B. Fuller Company; Henkel AG & Co. KGaA; HUNTSMAN INTERNATIONAL LLC; Sika AG; PPG Industries, Inc.; Dow; Jowat SE; Permabond; Hernon Manufacturing Inc.; Evonik Industries AG; Solvay; Bostik; and Akzo Nobel N.V.

The polyurethanes segment held the largest market share in 2024.

The passenger cars segment dominated the automotive adhesive and sealants market in 2024.