Automated Test Equipment Market Size, Share, Trends, Industry Analysis Report: By Type, Component, (Industrial PCs, Handlers/Probers, Mass Interconnect, and Others), End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025 – 2034

- Published Date:Jan-2025

- Pages: 120

- Format: PDF

- Report ID: PM1409

- Base Year: 2024

- Historical Data: 2020-2023

Automated Test Equipment Market Overview

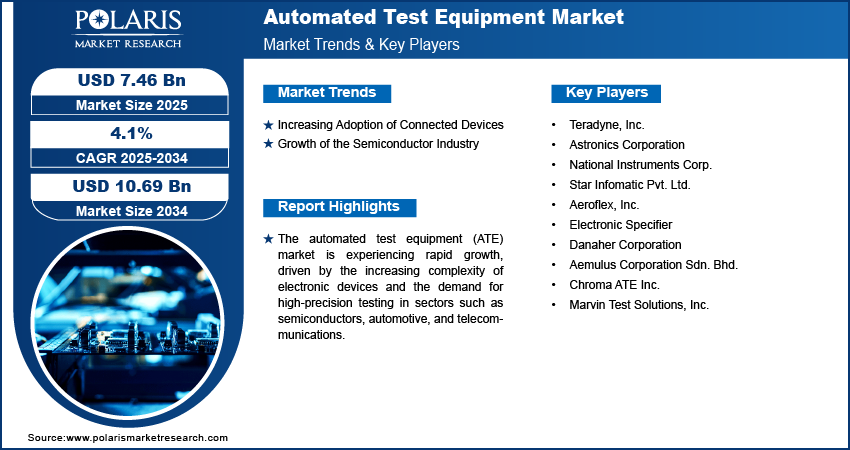

Global automated test equipment market size was valued at USD 7.17 billion in 2024. It is projected to grow from USD 7.46 billion in 2025 to USD 10.69 billion by 2034, exhibiting a CAGR of 4.1% during the forecast period.

Automated test equipment (ATE) refers to computer-controlled systems designed to perform testing and analysis of electronic devices, hardware, and components to ensure functionality, quality, and performance.

The automated test equipment (ATE) market growth is driven by advancements in cost-effective quality control and improved product reliability. ATE systems play a major role across various applications, such as wireless communication, radar systems, electronic component manufacturing, and in testing electronics, hardware, software, semiconductors, and avionics. It minimizes reliance on manual labor, reducing personnel costs and accelerating production timelines while preventing faulty devices from reaching the market, by automating testing processes.

Market.png)

To Understand More About this Research: Request a Free Sample Report

ATE is essential in ensuring product quality and reliability, offering consistent and repeatable testing procedures that uphold strict performance standards as consumer electronics evolve rapidly, with increasing complexity in devices such as smartphones, tablets, and gaming consoles. Additionally, ATE provides precise and efficient testing solutions to handle complex electric circuits and diverse functionalities driving the market revenue. These systems reduce human error and enable manufacturers to meet the growing demand for high-performing, reliable products while maintaining strict quality benchmarks. For instance, in October 2022, Chroma ATE Inc. launched the Chroma 3650-S2, a high-performance power IC test platform. This system supports up to 768 digital I/O and analog pins and offers power supply capacities of up to 3000V or 160A per channel.

Automated Test Equipment Market Dynamics

Increasing Adoption of Connected Devices (IoT and AI-Based Technologies)

The rise of the Internet of Things (IoT) has led to more connected devices, increasing the need for better testing solutions. Devices like smart home products, industrial gadgets, and wearable tech all need thorough testing to make sure they work well and are reliable. Automated testing equipment is becoming essential for this because it can test devices more accurately and consistently than manual methods.

The market for automated test equipment is growing rapidly because IoT devices are being used more and more. New developments in IoT technology, self-driving cars, and progress in the defense and aerospace sectors are influencing this growth. Companies are now focusing on getting products to market faster, improving product quality, and cutting down testing costs to keep customers happy.

For instance, in December 2021, Advantest launched the T2000 IP Engine 4, an image-processing solution designed for testing CMOS image sensors (CIS) used in high-resolution smartphones. This new engine offers faster image processing speeds, helping to reduce testing times and costs in the semiconductor industry. The T2000 IP Engine 4 aims to streamline the testing process for the increasingly complex and high-performance image sensors found in modern smartphones by leveraging advanced computing technologies. These innovations necessitate swift and dependable testing procedures to ensure their success in the market.

Growth of Semiconductor Industry

The semiconductor industry is witnessing significant growth driven by the escalating demand for electronic components across diverse sectors, such as the automotive industry and consumer electronics. This surge is primarily fueled by advancements in technology and the proliferation of electronic devices, which necessitate high-performance and reliable components. For instance, according to a report published by NITI Aayog in July 2024 outlining India's ambition to become global electronics manufacturing hub, targeting USD 500 billion in production by FY30. The strategy focuses on localizing components, expanding into new sectors such as wearables and automotive electronics, and strengthening R&D capabilities. This growth is expected to generate 5.5 to 6 billion jobs and increase India's export share to USD 240 billion.

ATE is integral to the semiconductor manufacturing process, ensuring that chips and other critical components meet stringent quality standards before their integration into end products. It enhances the overall manufacturing workflow, reduces production costs, and minimizes the risk of faulty components by providing precise and efficient testing solutions. This pivotal role in quality assurance and efficiency is a key factor contributing to the expansion of the automated test equipment market revenue.

Automated Test Equipment Market Segment Analysis

Automated Test Equipment Market Assessment by Type Insights

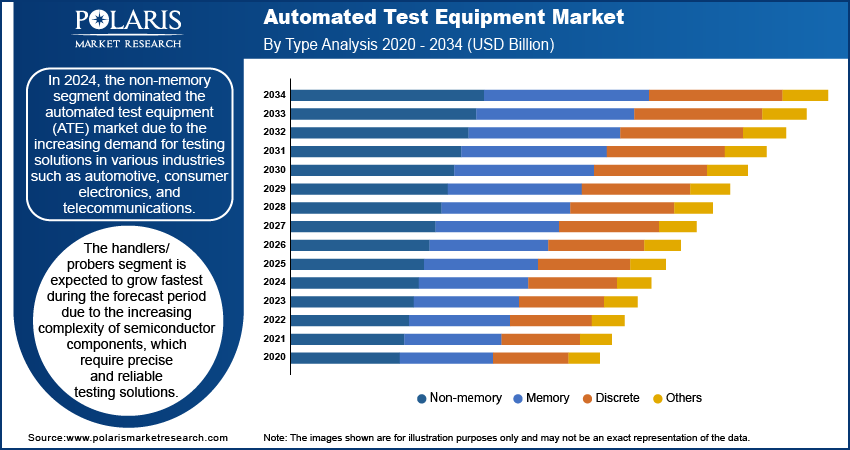

The global automated test equipment market segmentation, based on the type, includes non-memory, memory, discrete, and others. In 2024, the non-memory segment dominated the automated test equipment (ATE) market due to the increasing demand for testing solutions in various industries, such as automotive, consumer electronics, and telecommunications. Non-memory components, including integrated circuits (ICs) and discrete devices, require advanced testing for performance, reliability, and functionality. The rapid development of next-generation technologies, such as IoT devices and automotive electronics, has increased the need for high-precision testing of non-memory components. This segment has seen significant investments in ATE systems, contributing to its market dominance. Additionally, the growth of smart devices and wearables has further reinforced the demand for non-memory ATE solutions.

Automated Test Equipment Market Evaluation by Component Insights

The global automated test equipment market segmentation, based on the component, includes industrial PCs, handlers/probers, mass interconnect, and others. The handlers/probers segment is expected to grow fastest during the forecast period due to the increasing complexity of semiconductor components, which require precise and reliable testing solutions. Handlers and probers play a crucial role in automating the testing process, particularly for high-volume manufacturing of ICs and other electronic components. The demand for automated testing of semiconductors and electronic devices will boost the segment as industries such as automotive, telecommunications, and consumer electronics continue to expand. Additionally, advancements in technology, such as the shift towards IoT and 5G, further contribute to the growth of this segment.

Automated Test Equipment Market Regional Insights

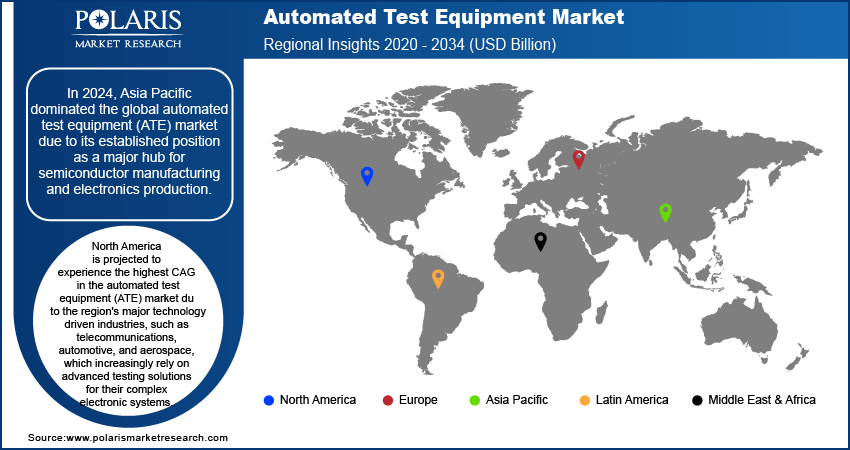

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and Middle East Africa. In 2024, Asia Pacific dominated the ATE market due to its established position as a major hub for semiconductor manufacturing and electronics production. The increasing demand for advanced technologies, such as 5G, IoT, and electric vehicles, has driven substantial growth in the semiconductor sector, leading to higher demand for ATE solutions. Additionally, the presence of large-scale manufacturing plants and ongoing investments in R&D and infrastructure further solidified Asia Pacific's market dominance. The region also benefits from government initiatives aimed at strengthening the electronics manufacturing sector, contributing to its continued market leadership.

For instance, according to a 2020 report by the Ministry of Electronics and Information Technology, the Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS) was launched to strengthen India's electronics manufacturing sector. The scheme offers a 25% financial incentive on capital expenditure for manufacturing key electronic components, semiconductors, and related products such as ATMP units and specialized sub-assemblies. It applies to both new investments and the expansion of existing units. The scheme is open for five years from the acknowledgment of an application and is administered by a designated nodal agency aimed at promoting high value added manufacturing.

North America is projected to experience the highest automated test equipment market CAGR during forecast period. This is due to the region's major technology driven industries, such as telecommunications, automotive, and aerospace, which increasingly rely on advanced testing solutions for their complex electronic systems. The rapid adoption of next generation technologies such as 5G, electric vehicles, and IoT devices has further fueled demand for ATE. Additionally, North America boasts strong R&D infrastructure and high levels of investment in semiconductor manufacturing, which contributes to a growing need for automated testing solutions. The supportive business environment and government initiatives aimed at bolstering domestic manufacturing also play a significant role in this growth projection.

Automated Test Equipment Market – Key Players & Competitive Analysis Report

The competitive landscape of the automated test equipment (ATE) industry is shaped by both global leaders and regional players competing to expand their market share through innovation, strategic partnerships, and geographical diversification. Major global players such as Advantest, Teradyne, and Keysight Technologies utilize their strong R&D capabilities and vast distribution networks to offer advanced testing solutions for semiconductors, consumer electronics, and automotive industries. Market trends highlight the growing demand for advanced ATE systems capable of testing emerging technologies, including 5G, IoT devices, and autonomous vehicles. The ATE market is poised for significant growth, fueled by the increasing complexity of electronic devices and the need for precision testing. Regional companies focus on addressing local market needs, offering cost-effective solutions, and tapping into emerging markets, particularly in Asia Pacific, which is expected to witness the fastest growth in the ATE sector. Competitive strategies include mergers and acquisitions, collaborations with semiconductor manufacturers, and the introduction of next generation testing solutions to meet the evolving demands of the electronics industry. A few major players in the automated test equipment market are Teradyne, Inc., Astronics Corporation, National Instruments Corp., Star Infomatic Pvt. Ltd.; Aeroflex, Inc.; Electronic Specifier; Danaher Corporation, Aemulus Corporation Sdn. Bhd.; Chroma ATE Inc.; Marvin Test Solutions, Inc

Teradyne Inc. is a global leader in automated test equipment and industrial automation. They create innovative products and bring them to market using advanced testing and robotics solutions, ensuring high-quality performance and rapid time-to-market. Their portfolio includes advanced electronic test systems and task automation robots, serving diverse industries worldwide. With a commitment to integrity, customer success, and corporate social responsibility. In March 2024 Teradyne Robotics teams with NVIDIA to supercharge robots with AI. This collaboration boosts efficiency and unlocks new applications for cobots and AMRs, fueling ATE market growth.

Danaher Corporation is an American global conglomerate founded in 1984. Headquartered in Washington, D.C., Danaher specializes in designing, manufacturing, and marketing a diverse range of medical, industrial, and commercial products and services. The company operates through three main segments, including Life Sciences, Diagnostics, and Environmental & Applied Solutions, leveraging the Danaher Business System (DBS) to drive operational efficiency and continuous improvement across its operations. Danaher Corporation, with a strategy focused on strategic acquisitions, has evolved from its initial industrial roots into a leading innovator in science and technology.

List of Key Companies in Automated Test Equipment Market

- Teradyne, Inc.

- Astronics Corporation

- National Instruments Corp.

- Star Infomatic Pvt. Ltd.

- Aeroflex, Inc.

- Electronic Specifier

- Danaher Corporation

- Aemulus Corporation Sdn. Bhd.

- Chroma ATE Inc.

- Marvin Test Solutions, Inc.

Automated Test Equipment Market Developments

January 2023: Roos Instruments launched the RI8607 50 GHz Test Set, which enhances Cassini's vector measurement system. This versatile instrument expands testing capabilities to 50 GHz, making it suitable for demanding applications in automotive radar and cellular backhaul.

May 2021: Astronics Corporation launched antimicrobial outlet units. These innovative devices go beyond standard functionality by incorporating antimicrobial properties for enhanced hygiene. This advancement caters to airlines and passengers, aiming to elevate the overall travel experience.

January 2021: Teradyne and Syntiant collaborated to accelerate the time to market for Syntiant’s innovative artificial intelligence (AI) processors. The collaboration utilized Teradyne’s UltraFLEX platform, which facilitated the qualification and production of Syntiant's neural decision processors. This partnership enables the processors to deliver advanced AI capabilities with remarkably low power consumption, under 1 MW.

Automated Test Equipment Market Segmentation

By Type Outlook (Revenue USD Billion, 2020–2034)

- Non-Memory

- Memory

- Discrete

- Others

By Component Outlook (Revenue USD Billion, 2020–2034)

- Industrial PCs

- Handlers/Probers

- Mass Interconnect

- Others

By End User Outlook (Revenue USD Billion, 2020–2034)

- Automotive

- Healthcare

- Consumer Electronics

- Aerospace and Defense

- IT and Telecommunication

- Others

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Automated Test Equipment Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 7.17 billion |

|

Market Size Value in 2025 |

USD 7.46 billion |

|

Revenue Forecast in 2034 |

USD 10.69 billion |

|

CAGR |

4.1 % from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation |

FAQ's

The global automated test equipment market size was valued at USD 7.17 billion in 2024 and is projected to grow to USD 10.69 billion by 2034.

The global market is projected to grow at a CAGR of 4.1% during the forecast period 2025-2034.

Asia Pacific dominated the automated test equipment market in 2024.

The key players in the market include Teradyne, Inc., Astronics Corporation, National Instruments Corp., Star Infomatic Pvt. Ltd.; Aeroflex, Inc.; Electronic Specifier; Danaher Corporation, Aemulus Corporation Sdn. Bhd.; Chroma ATE Inc.; and Marvin Test Solutions, Inc.

The non-memory automated test equipment dominated the market in 2024.

The handlers/probers segment is expected to grow fastest during the forecast period.