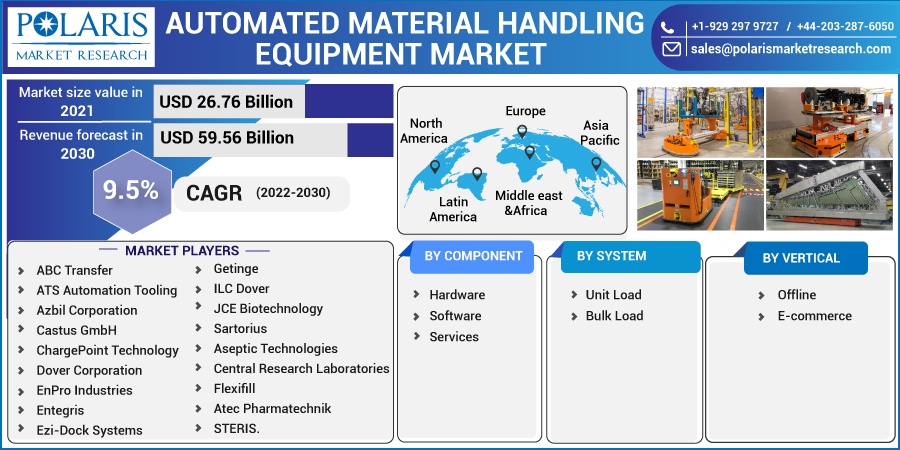

Automated Material Handling Equipment Market Share, Size, Trends, Industry Analysis Report, By Component (Hardware, Software, and Services); By System; By Vertical; By Region; Segment Forecast, 2022 – 2030

- Published Date:Oct-2022

- Pages: 124

- Format: PDF

- Report ID: PM2703

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

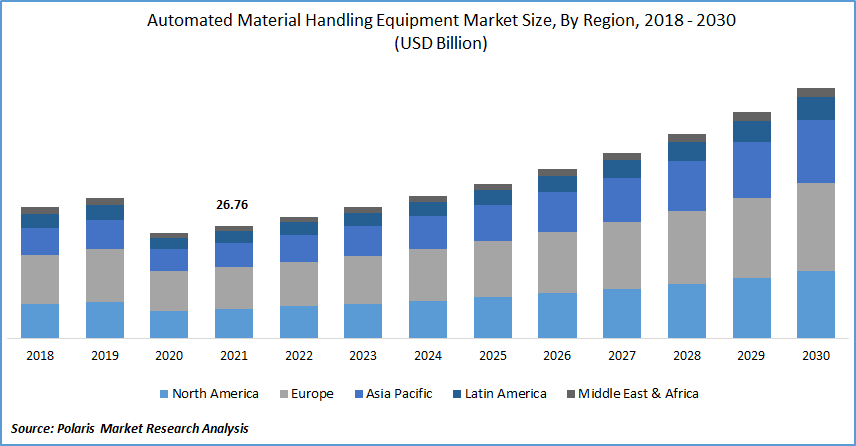

The global automated material handling equipment market was valued at USD 26.76 billion in 2021 and is expected to grow at a CAGR of 9.5% during the forecast period. Among the primary reasons driving market expansion are rapid industrialization, the rise of the fourth industrial revolution (Industry 4.0), and increasing implementation of internet of things (IoT), artificial intelligence (AI), and radio frequency identification (RFID) technologies.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

To eliminate human interaction and enhance logistics management, this equipment is increasingly regularly carried out utilizing automated material handling technology. Forecasting, production planning, resource allocation, inventory control, flow and process management, and after-sales support and services are also aided by it. As a result, many businesses rely on automated handling technology to improve customer service, minimize inventory, shorten delivery times, and cut total handling costs.

Aside from that, as the aerospace, agriculture, automotive, and construction industries grow, leading companies in these industries are implementing next-generation automated material handling equipment to modernize manufacturing processes, increase flexibility in warehouse operations, and improve supply chain transparency.

According to the Consumer Technology Association (CTA), the US consumer business generated over USD 375 billion in retail revenue in 2019. As the production and consumption of electronic devices grows, so will the demand for warehouse automation to enhance inventory management, customer service, cut product delivery time, and minimize handling costs in manufacturing and distribution.

Furthermore, in the electronics sector, these systems are suitable for the assembly and handling of tiny parts and products.

The COVID-19 epidemic has a significant influence on the world market for automated material handling equipment market. This is due to a significant rise in the volume of online retail transactions following the release of COVID-19. Consumer tastes are ever-changing, and as a result of the COVID-19 pandemic's installation of social distancing regulations, lockdowns, and other safeguards, consumers have turned to online purchases.

As a result, business-to-consumer (B2C) and business-to-business (B2B) e-commerce have increased substantially. B2C sales of pharmaceuticals, home products, and food have all increased online. However, the e-commerce industry's fast rise has put immense pressure on businesses to buy and supply a large number of items in a short period of time.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Introducing new technologies into these systems, such as machine learning, AI, IoT, and robotics, is a significant driver driving the market’s growth. The technologies provide seamless and real-time order picking in production operations, allowing enterprises to accelerate their material handling procedures.

Implementing sophisticated technology in distribution centers, such as automated guided vehicles (AGV), allows enterprises to process enormous numbers of repeated material moves, resulting in increased throughput. Such systems enable cars to make route decisions based on real-time feedback from environmental circumstances as well as the simplicity with which navigational corrections may be made.

The increasing use of these devices in packaging applications will give the substantial potential for growth in the automated material handling equipment market. Manufacturers in food and drinks, healthcare, e-commerce, and chemicals are introducing automated packing technology to ensure that orders are delivered to customers quickly. These solutions safeguard the goods during the manufacturing process and improve packing quality.

The versatility of these systems to function with a variety of package designs and pack sizes is expanding their usage for packing things. Furthermore, the technology optimizes the packing of small, big, and fragile items at fast speeds while eliminating human mistakes.

Report Segmentation

The market is primarily segmented based on component, system, vertical, and region.

|

By Component |

By System |

By Vertical |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Hardware Segment is Expected to Witness Fastest Growth

Among the hardware segment, components like cranes and lifting equipment, along with racking and storing equipment, have contributed the most share. Cranes and lifting equipment led the market, accounting for more than 35.0% of worldwide sales in 2021. The market for material handling equipment is expected to be driven by widespread application in numerous end-use sectors such as construction, manufacturing, motor vehicle lifts, and lifting accessories.

Traditional handling equipment is prone to picking mistakes, whereas continuous handling technology ensures smooth run picking, sorting, and packaging. Another significant benefit of continuous handling equipment is that it helps producers save costs and shorten delivery times owing to the technology's simplified procedure.

Racking and storage equipment is expected to grow prominently during the projected period, as the equipment aids in boosting storage capacity. Other advantages include the money saved by not renting additional storage space, the reduced workload, and the higher throughput.

Industrial trucks are preferred by manufacturers because they offer practical qualities such as a level surface or prongs that can be put beneath pallets or other types of storage platforms. Other vehicles need the use of a different piece of machinery for lifting. Another advantage of industrial trucks is that they may be electrically or manually lifted.

Unit Load Accounted for a Significant Market Share in 2021

Demand for unit load systems is expected to rise in the coming years. Individual goods are combined into a single unit, allowing for simple transfer using pallet jacks or forklift trucks. These systems offer effective handling, storing, and distributing in various dimensions and load weights while lowering handling costs and damage by restricting individual handling.

Consumer and industrial goods are transported as unit loads across the supply chain, preserving their integrity when handled as a single item. Several industries are adopting these material handling systems because of the benefits of handling several goods simultaneously, decreasing the number of trips and the time necessary for loading and unloading, and lowering the overall cost of handling.

E-Commerce is Expected to Hold the Significant Revenue Share

Because of the thriving e-commerce industry, the market share is predicted to expand exponentially throughout the forecast period. With an increase in customers migrating to online shopping, rapidly changing customer needs, and severe rivalry among online retailing organizations, there is a greater need for fast, accurate, and efficient customer service for delivering the items ordered.

Retailers employ automated handling systems to boost product throughput, eliminate order mistakes, and maximize handling and sorting efficiencies. Furthermore, the growing need for automated pick-and-place robots in logistics is driving the market.

The Demand in Asia-Pacific Region is Expected to Witness Significant Growth

During the projected period, the Asia Pacific market is predicted to develop rapidly. The growing expansion of the manufacturing sector across various industries, including automotive, metals and heavy machinery, and consumer electronics, has resulted in tremendous growth opportunities.

Rising government measures to promote warehouse automation in countries such as China and India contribute to the industry's increased revenue share. Furthermore, firms in the region are boosting their manufacturing capacity in order to reduce their reliance on other nations for machine parts imports. Such forces propel the region's manufacturing industries forward, increasing market expansion.

Competitive Insight

Some of the major players operating in the global market include BEUMER Group GmbH & Co. KG, Daifuku Co., Ltd, Hyster-Yale Materials Handling, Inc., Fives Group, KUKA AG, KNAPP Group, Kion Group AG, Murata Machinery, Schaefer Systems International, Inc., TGW Logistics Group, and Intelligrated, Inc.

Recent Developments

- In December 2021, KION Group will construct a new forklift truck manufacturing in China to provide supply chain solutions. The factory in Jinan has a total volume of roughly 140 million for future manufacture of industrial vehicles and supply chain solutions.

- In August 2021, Toyota Material Handling Japan launched the SenS+ operation assist system, which detects and identifies pedestrians and objects behind the forklift and automatically regulates and stops the truck's rearward travel.

Automated material handling equipment market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 28.80 billion |

|

Revenue forecast in 2030 |

USD 59.56 billion |

|

CAGR |

9.5% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Component, By System and By Vertical, and By Region. |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

BEUMER Group GmbH & Co. KG, Daifuku Co., Ltd, Hyster-Yale Materials Handling, Inc., Fives Group, KUKA AG, KNAPP Group, Kion Group AG, Murata Machinery, Schaefer Systems International, Inc., TGW Logistics Group, and Intelligrated, Inc. |