Autoinjectors Market Size, Share, Trends, Industry Analysis Report: By Usage (Disposable and Reusable), Technology, Route of Administration, Therapy Area, Volume, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5507

- Base Year: 2024

- Historical Data: 2020-2023

Autoinjectors Market Overview

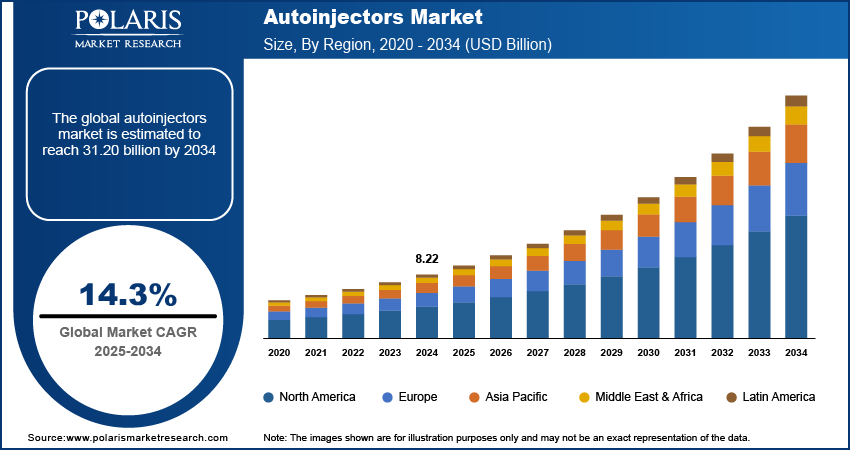

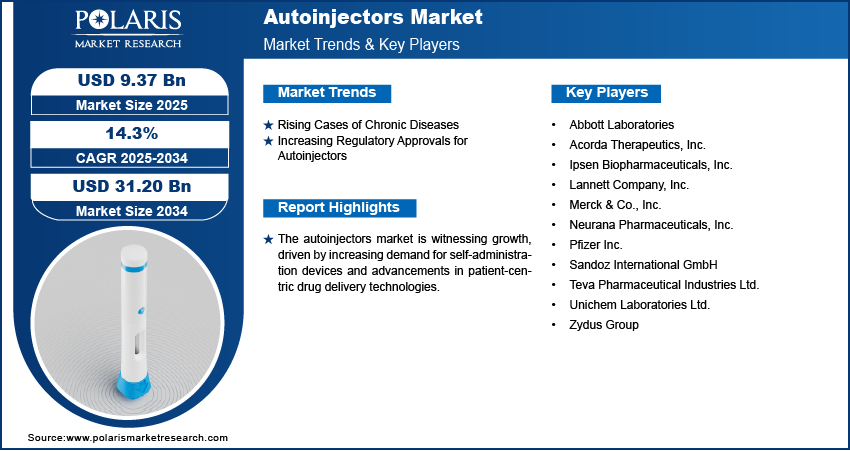

The global autoinjectors market was valued at USD 8.22 billion in 2024. It is expected to grow from USD 9.37 billion in 2025 to USD 31.20 billion by 2034, at a CAGR of 14.3% during the forecast period.

Autoinjectors are medical devices designed for the safe and efficient self-administration of injectable drugs, offering ease of use and improved patient compliance. The autoinjectors market is experiencing substantial growth, driven primarily by the increasing demand for biosimilars and biologics. These advanced drug formulations, widely used for treating chronic conditions such as autoimmune diseases and diabetes, require precise and frequent administration, making autoinjectors a preferred delivery method. A November 2022 NCBI report highlighted that the global incidence and prevalence of autoimmune diseases are rising annually, with estimated increases of 19.1% and 12.5%, respectively. The shift towards biologics has necessitated innovative drug delivery solutions that improve patient adherence and minimize administration errors, further propelling the autoinjectors market expansion. Additionally, pharmaceutical companies are investing in the development of user-friendly autoinjector designs to meet the growing needs of patients and healthcare providers.

To Understand More About this Research: Request a Free Sample Report

Another key driver fueling the autoinjectors market is the rising adoption of self-administered medicines, particularly among patients with chronic illnesses. The increasing majority of conditions, such as rheumatoid arthritis, multiple sclerosis, and anaphylaxis, have led to a demand for convenient, at-home drug administration solutions. For instance, an August 2024 WHO report estimates that more than 1.8 million people globally have multiple sclerosis (MS). While the condition can affect individuals of any age, it is more prevalent among young adults and women. Autoinjectors eliminate the need for frequent healthcare facility visits, empowering patients with greater independence while reducing the burden on medical infrastructure. Additionally, advancements in device technology, such as ergonomic designs and dose precision, have further boosted their widespread adoption. The push for patient-centric healthcare models, coupled with improved accessibility to self-injection therapies, continues to reinforce the market growth.

Autoinjectors Market Driver Dynamics

Rising Cases of Chronic Diseases

The rising prevalence of chronic diseases is driving the autoinjectors market demand, as conditions such as diabetes, rheumatoid arthritis, and multiple sclerosis require long-term medication management. For instance, a December 2024 WHO report revealed that non-communicable diseases (NCDs) caused 43 million deaths in 2021, accounting for 75% of non-pandemic-related deaths globally. Of these, 18 million were premature deaths under age 70, with 82% occurring in low- and middle-income countries. These diseases often necessitate regular and precise drug administration, making autoinjectors a preferred solution for both patients and healthcare providers. The convenience and ease of use offered by autoinjectors enhance patient compliance to prescribed therapies, reducing complications associated with missed or improper dosing. Additionally, as the global burden of chronic illnesses continues to rise, there is an increasing demand for self-administration devices that minimize dependency on healthcare facilities.

Increasing Regulatory Approvals for Autoinjectors

Regulatory bodies are placing a strong emphasis on improving medication safety, ensuring that autoinjectors meet strict efficacy and usability standards before reaching the market by facilitating the introduction of advanced and user-friendly drug delivery devices. For instance, in August 2024, the FDA approved Zurnai, the first nalmefene hydrochloride auto-injector, for emergency opioid overdose treatment in adults and children aged 12+. Amid rising overdose deaths, primarily from synthetic opioids, the FDA aims to improve access to overdose reversal options such as nalmefene and naloxone. These approvals improve patient confidence in self-injection therapies and also encourage pharmaceutical companies to develop innovative solutions tailored to different medical conditions. Moreover, streamlined approval processes and regulatory support for combination drug-device products are accelerating the availability of autoinjectors across various therapeutic applications.

Autoinjectors Market Segment Assessment

Autoinjectors Market Assessment by Usage

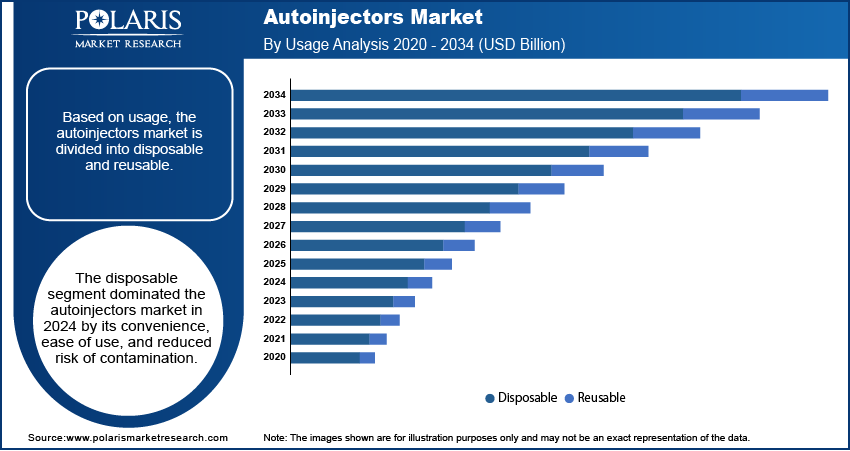

The global autoinjectors market segmentation, based on usage, includes disposable and reusable. The disposable segment dominated the market in 2024 by its convenience, ease of use, and reduced risk of contamination. Disposable autoinjectors are pre-filled and designed for single use, eliminating the need for maintenance or cleaning and making them highly preferred by both patients and healthcare providers. Their widespread adoption is driven by the growing majority of chronic diseases requiring frequent injections, such as rheumatoid arthritis and anaphylaxis, where patient observation is critical. Additionally, pharmaceutical companies are increasingly focusing on developing disposable autoinjectors to enhance drug delivery efficiency and ensure accurate dosing. The strong preference for single-use devices, coupled with strict regulatory guidelines highlighting safety and sterility, has further solidified the dominance of this segment.

Autoinjectors Market Evaluation by Therapy Area

The global autoinjectors market segmentation, based on therapy area, includes rheumatoid arthritis, multiple sclerosis, diabetes, anaphylaxis, and other therapies. The multiple sclerosis segment is expected to witness the fastest market growth during the forecast period due to the rising prevalence of the disease and the critical need for long-term treatment. Multiple sclerosis requires frequent administration of disease-modifying therapies, making autoinjectors a highly effective and patient-friendly solution for managing the condition. The increasing availability of self-injection biologics tailored for multiple sclerosis patients has further fueled the demand for these devices. Additionally, advancements in autoinjector technology, such as ergonomic designs and dose accuracy, have improved treatment adherence and patient outcomes. The demand for self-administered therapies in multiple sclerosis treatment is expected to drive rapid market growth in this segment as healthcare systems continue to emphasize patient-centric approaches.

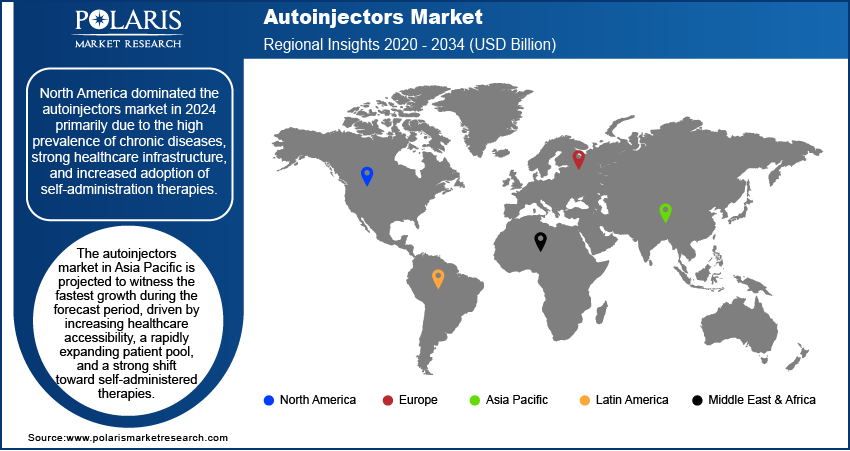

Autoinjectors Market Regional Insights

By region, the report provides the autoinjectors market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market revenue share in 2024 primarily due to the high prevalence of chronic diseases, strong healthcare infrastructure, and increased adoption of self-administration therapies for its convenience. The region has a well-established biopharmaceutical industry, driving the continuous development and commercialization of advanced autoinjector technologies. Favorable regulatory policies, coupled with rising awareness of patient-friendly drug delivery systems, have further accelerated growth opportunities. Additionally, North America has witnessed substantial investment in biologics and biosimilars, which rely on autoinjectors for efficient drug delivery. For instance, in February 2025, Alvotech and Teva Pharmaceuticals received FDA acceptance of a BLA for AVT06, a biosimilar to Eylea (aflibercept), used to treat eye disorders.

The autoinjectors market in Asia Pacific is projected to witness the fastest growth during the forecast period driven by increasing healthcare accessibility, a rapidly expanding patient pool, and a strong shift toward self-administered therapies. The region is also witnessing a surge in government-led healthcare reforms and initiatives aimed at improving chronic disease management, fostering greater adoption of autoinjectors. Additionally, rising investments in domestic pharmaceutical manufacturing and biosimilar production are improving affordability and availability, making these devices more accessible to a broader population. For instance, in June 2023, Samsung Biologics and Pfizer collaborated for commercial manufacturing of Pfizer’s multi-product biosimilar portfolio, focusing on oncology, inflammation, and immunology. Samsung will utilize its Plant 4 facility to support large-scale production under the expanded agreement. Additionally, the growing presence of international pharmaceutical companies, coupled with strategic collaborations to introduce cost-effective autoinjector solutions, is further driving expansion opportunities.

Autoinjectors Key Market Players & Competitive Analysis Report

The competitive landscape features global leaders and regional players competing for market share through innovation, strategic alliances, and regional expansion. Global players utilize strong R&D capabilities, technological advancements, and extensive distribution networks to deliver advanced solutions, meeting the growing demand for disruptive technologies and sustainable value chains. Autoinjectors market trends highlight rising demand for emerging technologies, digitalization, and business transformation driven by economic growth, geopolitical shifts, and macroeconomic trends. Global players focus on strategic investments, mergers and acquisitions, and joint ventures to strengthen their market position. Post-merger integration and strategic alliances are key strategies to improve competitive positioning and expand regional footprints. Regional companies, meanwhile, address localized needs by offering cost-effective solutions and leveraging economic landscapes.

Competitive benchmarking includes market entry assessments, expansion opportunities, and partnership ecosystems to meet the demand for innovative products and future-ready solutions. The market is experiencing technological advancements, such as disruptive technologies and digital transformation, reshaping industry ecosystems. Companies are investing in supply chain management, procurement strategies, and sustainability transformations to align with autoinjectors market demand, trends, and future development strategies. Pricing insights, revenue growth analysis, and competitive intelligence are critical for identifying opportunities and driving long-term profitability. A few key major players are AbbVie, Inc.; Amgen; Biogen Idec; Eli Lilly; Gerresheimer AG; Mylan N.V.; Owen Mumford; Pfizer, Inc.; Sanofi; SHL Medical AG; Teva Pharmaceutical; and Ypsomed.

Eli Lilly and Company is a pharmaceutical firm known for its drug delivery systems, including autoinjectors. Eli Lilly has developed and utilized these devices for several of their products. For instance, the company has collaborated with IDEO to design user-friendly injection pens such as Trulicity, which is an auto-injection pen used for treating type-2 diabetes. This device automates the insertion and retraction of the needle, making self-administration easier and less anxiety-inducing for patients. Additionally, Eli Lilly initially offered its weight-loss drug Zepbound in a single-dose autoinjector pen before transitioning to a more affordable vial format to increase accessibility and reduce costs. The company's focus on patient-centric design and innovative drug delivery systems positions it as an essential player in the pharmaceutical industry.

SHL Medical AG is a developer and manufacturer of advanced drug delivery systems, such as autoinjectors, pen injectors, inhalers, and wearable drug delivery systems. Founded in 1989, the company is headquartered in Zug, Switzerland, with operations in Europe, Asia, and the US. SHL Medical is renowned for its innovative solutions that enable the effective delivery of complex biologics and biosimilars. Their autoinjectors, such as the Molly family and Rotaject technology, are designed to accommodate high-volume and high-viscosity formulations, enhancing patient autonomy in managing chronic conditions such as diabetes and lupus. SHL collaborates with top pharmaceutical and biotech firms globally, providing contract manufacturing and engineering services. The company's commitment to innovation and customer satisfaction with substantial investments in R&D drives the development of next-generation drug delivery systems. SHL's products and services support the entire drug delivery value chain, from design to final assembly and packaging, ensuring seamless integration with pharmaceutical companies' needs.

Key Companies in Autoinjectors Market

- AbbVie, Inc.

- Amgen

- Biogen Idec

- Eli Lilly

- Gerresheimer AG

- Mylan N.V.

- Owen Mumford

- Pfizer, Inc.

- Sanofi

- SHL Medical AG

- Teva Pharmaceutical

- Ypsomed

Autoinjectors Market Developments

November 2024: Amneal Pharmaceuticals resubmitted its NDA for a DHE autoinjector to treat migraines and cluster headaches, with an FDA review expected by Q2 2025. The company also received FDA approval for exenatide, its first generic GLP-1 agonist for type 2 diabetes.

December 2024: Ypsomed began manufacturing its UnoPen at its Schwerin, Germany facility, boosting production capacity and supply chain efficiency. The facility uses advanced technology and sustainable practices to meet rising global demand, supporting Ypsomed’s commitment to reliable, high-quality drug delivery solutions.

Autoinjectors Market Segmentation

By Usage Outlook (Revenue, USD Billion, 2020 - 2034)

- Disposable

- Reusable

By Technology Outlook (Revenue, USD Billion, 2020 - 2034)

- Manual

- Automatic

By Route of Administration Outlook (Revenue, USD Billion, 2020 - 2034)

- Subcutaneous

- Intramuscular

By Therapy Area Outlook (Revenue, USD Billion, 2020 - 2034)

- Rheumatoid Arthritis

- Multiple Sclerosis

- Diabetes

- Anaphylaxis

- Other Therapies

By Volume Outlook (Revenue, USD Billion, 2020 - 2034)

- Up to 3ML

- Above 3ML

By End Use Outlook (Revenue, USD Billion, 2020 - 2034)

- Homecare Settings

- Hospitals & Clinics

- Ambulatory Surgical Centers

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Autoinjectors Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 8.22 billion |

|

Market Size Value in 2025 |

USD 9.37 billion |

|

Revenue Forecast in 2034 |

USD 31.20 billion |

|

CAGR |

14.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global autoinjectors market size was valued at USD 8.22 billion in 2024 and is projected to grow to USD 31.20 billion by 2034.

The global market is projected to register a CAGR of 14.3% during the forecast period.

North America dominated the autoinjectors market revenue share in 2024.

Some of the key players in the market are AbbVie, Inc.; Amgen; Biogen Idec; Eli Lilly; Gerresheimer AG; Mylan N.V.; Owen Mumford; Pfizer, Inc.; Sanofi; SHL Medical AG; Teva Pharmaceutical; and Ypsomed.

The disposable segment dominated the market in 2024.

The multiple sclerosis segment is expected to witness the fastest market growth during the forecast period.