Authentication and Brand Protection Market Share, Size, Trends, Industry Analysis Report, By Authentication Mode (Smartphone Authentication, and Blockchain Authentication); By Technology; By Offering; By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 122

- Format: PDF

- Report ID: PM2702

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

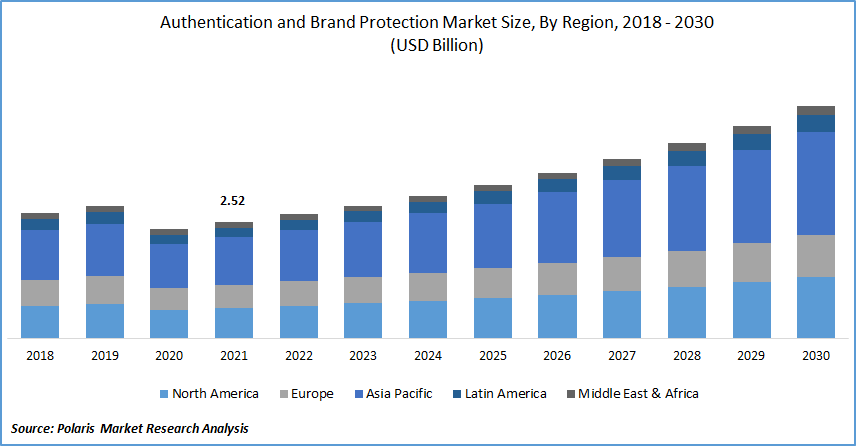

The global authentication and brand protection market was valued at USD 2.52 billion in 2021 and is expected to grow at a CAGR of 8.2% during the forecast period. The increasing emphasis on safeguarding brand and product integrity, the advent of track & trace innovations, stringent anti-counterfeiting statutes and regulations enforced by government agencies, and the expansion of the manufacturing industry are the primary factors driving the global market growth.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Authentication and brand safeguarding is used by the registered owner to protect service providers from utilizing its intellectual property without authorization. Authentication and brand security are growing in popularity in various industries, including electronics, medical products, automobile industries, food and beverages, clothing, luxury products, beauty products, and many others.

The tobacco industry's growing demands for authentication and brand protection to decrease cigarette counterfeiting drives the market growth. According to Authentix, Inc., if illegal cigarette commerce is removed, the United Kingdom's government will gain a minimum of US$ 31 billion in tax revenue. The increasing government proposals to control illicit tobacco commerce create enormous possibilities for expanding market players.

COVID-19 had a bad impact on the market, resulting in reduced revenue generation. As a result, the industry's growth trend has slowed during the first half of 2020. This trend is supposed to end in the second half of the year as demand rises due to increasing concerns about authentication and brand protection. Due to the worldwide slowdown and decreasing purchasing power, the supply of electronics, automobiles, luxury goods, and cosmetic products has been low. It is expected to remain so in the short term.

Furthermore, the negative impact of the disease outbreak and the measures taken to control it on multiple industries restrict the region's authentication and digital branding industry growth. Regardless of the emergence of counterfeit product difficulties and attempts to sabotage brand reputation, companies, particularly pharmacological and food and beverage players, are employing brand protection innovations.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Businesses such as automobiles, food and beverages, agricultural production, clothing and apparel, sportswear, and pharmaceutical are experiencing rapid growth, which is expected to drive the market for authentication and brand protection soon.

Businesses are also focusing on product launches for various industries boosting the market growth over the forecast period. For instance, in January 2019, Applied DNA Sciences Inc., an innovator in performance fabric and smart textiles for advanced active lifestyles, announced the signing of a quasi Memorandum of Understanding. with Tex-Ray Industrial Co., Ltd, an innovator in up with this trend and smart clothing for advanced active lifestyles.

Furthermore, according to the Organization for Economic Cooperation and Development (OECD), APAC has the nation's top digital economy due to the proliferation of technologies such as blockchain technology and cloud computing. According to the World Bank, in 2019, APAC was the nation's biggest market for many industry sectors, particularly fabric and clothing & apparel manufacturing, accounting for a significant share of the overall global market.

With rising consumer goods usage, stringent anti-counterfeiting policies, and enhanced concern for human safety, the APAC region is expected to be the most profitable market for authentication and brand protection technology companies.

Report Segmentation

The market is primarily segmented based on authentication mode, offering, technology, application, and region.

|

By Authentication Mode |

By Offering |

By Technology |

By Application |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Smartphone authentication is expected to hold a significant revenue share in 2021

Smartphone-based authentication solution helps brand owners to protect against counterfeiting and diversion. It helps to decide brand owners whether to deploy at warehouses, in logistics, or at the retailer. This solution is hard to detect but easy to use.

As data collection technology improves and is more available to consumers via the ever-present smartphone, more brands may be able to integrate reciprocal interaction with consumers via smartphones.

These days, more smartphones are efficient for image and code collection at high resolution with native and downloaded applications for digital interaction with products and manufacturers.

RFID authentication is expected to hold the significant revenue share

RFID tags have become effective tools for product selection. RFID can detect ingredients in seconds by using electromagnetic fields to recognize and track tags attached to objects. RFID thus aids in the improvement and tracking of the supply chain system, from manufacturing to distribution and retail outlets.

The overt segment industry accounted for the highest market share in 2021

Overt trading standards solutions can be employed for both product investigation and consumer confirmation. Holograms, security protection printers, and stamped optical films are a few of the obvious authentication options. Furthermore, visible technology-based verification and brand protection alternatives have a decorative touch and are comparatively cheap. The market is dominated by the overt segment because these authentication and brand protection alternatives are accessible to the naked eye, which accelerates the process of guaranteeing authenticity. Some of the open technologies that can be employed to design brand protection labels include cutting-edge security protection printing software, micro-optic optics films, holographic, and engraved optical films.

The pharmaceuticals segment is expected to witness fastest growth

The global pharmaceutical industry has benefited from the COVID-19 pandemic. Furthermore, federal regulations in different countries authorizing the incorporation of anti-counterfeit technology solutions in pharmaceutical products have contributed to the company's growth. In the past, customers have suffered significant losses as a result of the use of counterfeit medical products. On the other hand, end users are becoming more aware of the benefits of using authenticated goods. Medical device companies are increasingly focusing on obtaining product verification solutions to meet customers' requirements for authenticated products, allowing them to maintain customer loyalty for an extended period.

The availability of authenticating treatments is critical for pharmaceutical industries. Addressing the challenges presented by the continuous function of counterfeit medicines is a difficult task for pharmaceutical manufacturers. In November 2020, AlpVision, a Swiss company that specializes in virtual anti-counterfeiting innovations for product authentication and fraudulent protection, initiated the AlpVision Covid-19 Innovation to assist pharmaceutical companies in protecting their medicines from counterfeiting. As a result, various manufacturing players are acquiring product authentication solutions, such as verification and brand protection products, to combat counterfeiting.

Demand in Asia-Pacific is expected to witness significant growth

The region’s economic expansion and development of the manufacturing sector have had a significant impact on the need for authentication and brand protection. Furthermore, during the forecast period, APAC is expected to see a rise in the adoption of verification and trading standards solutions across sectors such as pharmaceuticals, automobiles, food & beverages, electronic parts, and luxury goods.

Because of both young and aging populations, the pharmaceutical industry is predicted to expand the fastest in China, India, and other APAC countries. Furthermore, rapid urbanization and the expansion of other key end-use industry sectors are expected to impact the market’s growth during the forecast period positively.

Growing company consciousness of verification and brand protection innovations, along with government regulations, is providing new opportunities for such solutions. In India, the Copyright Act of 1957 controls the protection under the law and implementation of copyright. Literary, intense, musical, and artistic projects, computer programs, films, and sound recordings all have copyright.

Moreover, the visibility of US-made products in different countries is substantial, and as a result, the popularity of safeguarding the brand through product authentication is constantly increasing. Equipment manufacturers in the United States spend significant amounts of money to ensure the legitimacy of their products.

Competitive Insight

Some of the major players operating in the global market include 3M Company, AlpVision SA, Applied DNA Sciences, Inc., Arjo Solutions, Authentic Vision, Authentix, Inc., Avery Dennison Incorporation, Centro Grafico dg S.p.A, De La Rue PLC, Eastman Kodak Company, and Giesecke + Devrient GmbH.

Recent Developments

- In May 2021, Avery Dennison Corporation and SUKU announced a new partnership only with Boisset Collection. Wine connoisseurs can simply press their mobile phone on the brand to discover more information about the wine, with exclusive substance, storytelling, clips, origin, flavourful notes, and a highly personalized message, by utilizing Avery Dennison's and SUKU's NFC (Near-Field Communication)-enabled labeling solution inside that wine label itself.

- In July 2021, Authentix acquired Strategic IP Information Pte Ltd (SIPI). This acquisition broadens its portfolio of data security innovations also to include online anti-counterfeiting and information rights alternatives, broadening the range of services available to brand protection customers.

Authentication and Brand Protection Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 2.69 billion |

|

Revenue forecast in 2030 |

USD 5.04 billion |

|

CAGR |

8.2% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Authentication Mode, By Offering, By Technology, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

3M Company, AlpVision SA, Authentic Vision, Applied DNA Sciences, Inc., Arjo Solutions, Authentix, Inc., Avery Dennison Corporation, Centro Grafico dg S.p.A, De La Rue PLC, Eastman Kodak Company, and Giesecke + Devrient GmbH. |