Attention Deficit Hyperactivity Disorder Market Share, Size, Trends, Industry Analysis Report, By Drug Type (Stimulants, Non-Stimulants); By Distribution Channel; By Demographics; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jun-2024

- Pages: 120

- Format: PDF

- Report ID: PM2960

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

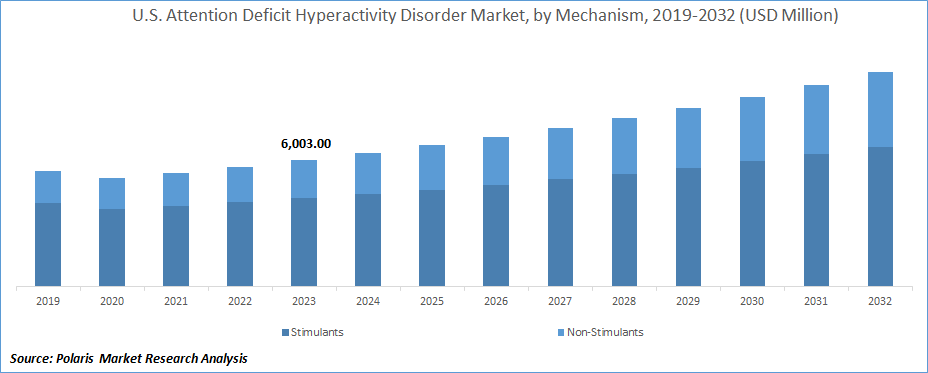

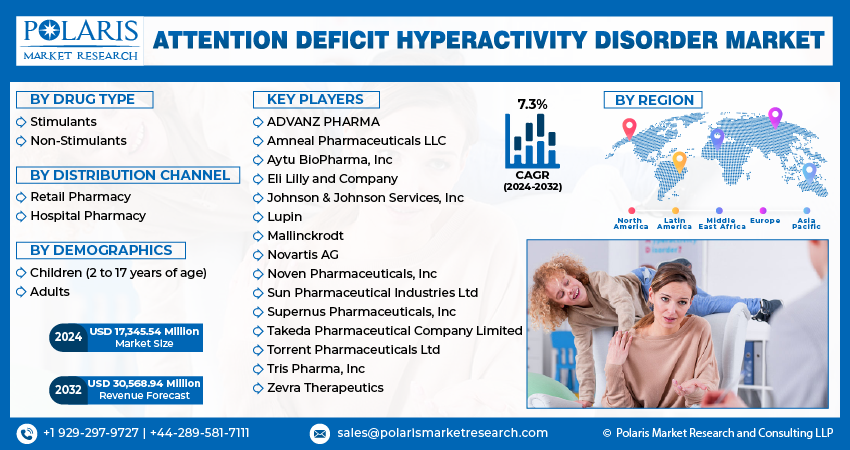

Attention deficit hyperactivity disorder market size was valued at USD 16,235.49 million in 2023. The market is anticipated to grow from USD 17,345.54 million in 2024 to USD 30,568.94 million by 2032, exhibiting the CAGR of 7.3% during the forecast period.

Industry Trends

The most common neurodevelopmental disorder, attention deficit hyperactivity disorder (ADHD), primarily affects children and often continues into adulthood. Key symptoms of ADHD include excessive daydreaming, forgetfulness, difficulty resisting temptation, trouble sharing, challenges in social interactions, hyperactivity, and difficulty paying attention. Treatment typically involves the use of both stimulant and non-stimulant medications.

To Understand More About this Research:Request a Free Sample Report

Several significant factors, including the increasing prevalence of the disorder, greater awareness among both physicians and patients and advancements in diagnostic and treatment methods, influence the ADHD market. However, challenges such as underdiagnosis, stringent regulatory processes, and high medication costs could hinder market expansion in the future.

Overall, the ADHD market is marked by a growing demand for products and services related to ADHD, driven by heightened awareness, improved diagnostic and treatment options, and the widespread occurrence of ADHD across various age groups. The market outlook suggests a promising future with opportunities for further innovation, research, and development to meet the needs of individuals affected by ADHD.

Key Takeaways

- North America dominated the market and contributed over 33% market share of the attention deficit hyperactivity disorder market size in 2023

- By drug type category, the stimulants segment dominated the global attention deficit hyperactivity disorder market size in 2023

- By distribution channel category, the hospital pharmacy segment is projected to grow with a significant CAGR over the attention deficit hyperactivity disorder market forecast period

What are the Market Drivers Driving the Demand for Market?

Increasing Prevalence of Attention Deficit Hyperactivity Disorder

The increasing prevalence of Attention Deficit Hyperactivity Disorder (ADHD) is a significant driving factor for the ADHD market, as it directly boosts the demand for diagnostic services, therapeutic interventions, and ongoing management solutions. Rising awareness among healthcare professionals and the general public about ADHD symptoms and their impact on quality of life has led to more frequent and earlier diagnoses. This has expanded the market for both pharmaceutical treatments, such as stimulants and non-stimulants, and behavioral therapies. Additionally, the recognition of ADHD as a chronic condition requiring long-term management further fuels market growth, encouraging ongoing research and development of new and improved treatment options. The growing acknowledgment of ADHD's prevalence among both children and adults broadens the market scope, driving demand for diverse treatment modalities tailored to different age groups and individual needs.

Which Factor is Restraining the Demand for the Market?

Lack of Proper Reimbursement

The issues associated with the reimbursement to treat mental disorders remain one of the major factors acting as a barrier to the growth of the market studied. According to the Bipartisan Policy Center (BPC) report in January 2019, poor reimbursement, workforce shortages, and lax government oversight of mental health parity laws limit access and integration of attention deficit hyperactivity health. According to the same report, same-day billing also presents an obstacle for providing care to some patients with attention deficit hyperactivity health issues. Medicare does not allow reimbursing for more than one evaluation and management (E/M) visit for providers in the same specialty for the same patient on the same day. The reimbursement rates from commercial insurers for attention deficit hyperactivity healthcare providers can restrain patient access to such care. The lower reimbursement is also preventing clinical from entering mental or attention deficit hyperactivity healthcare.

Report Segmentation

The market is primarily segmented based on drug type, distribution channel, demographics, and region.

|

By Drug Type |

By Distribution Channel |

By Demographics |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Drug Type Insights

Based on drug type category analysis, the market has been segmented on the basis of stimulants and non-stimulants. The stimulant drug type segment dominated the market due to its proven efficacy and rapid onset of action in managing ADHD symptoms. Stimulant medications, such as methylphenidate and amphetamines, are considered the first-line treatment for ADHD because they effectively enhance concentration, reduce impulsivity, and improve overall behavioral control in a majority of patients. Their widespread clinical use and strong endorsement by healthcare professionals contribute to their dominant market position.

Also, extensive research backing their safety and effectiveness, coupled with the availability of various formulations (e.g., immediate-release, extended-release), ensures they meet diverse patient needs, further cementing their leading role in the ADHD treatment landscape.

By Distribution Channel Insights

Based on distribution channel category analysis, the market has been segmented on the basis of retail pharmacy and hospital pharmacy. The hospital pharmacy segment is projected to witness a progressive growth rate in the forecasting years within the market as awareness and diagnosis of ADHD increases; more patients are seeking specialized care and comprehensive management plans often provided in hospital settings. Hospital pharmacies are integral in delivering specialized medications, particularly for newly diagnosed patients or those with complex cases requiring close monitoring and tailored treatment regimens. Furthermore, hospital pharmacies benefit from direct access to multidisciplinary teams of healthcare professionals, including psychiatrists, pediatricians, and neurologists, who collaborate to optimize ADHD management. The ongoing trend towards hospital-based care for comprehensive evaluations and management of ADHD, combined with the expansion of hospital networks and healthcare infrastructure, supports the robust growth of this segment.

Regional Insights

North America

North America led the market in 2023 since the region has a high prevalence of ADHD diagnoses, driven by greater awareness and recognition of the disorder among healthcare professionals and the public. Advanced healthcare infrastructure and extensive access to medical services facilitate early and accurate diagnosis and treatment of ADHD. Also, North America is home to several pharmaceutical companies that actively develop and market ADHD medications, contributing to a wide availability of both stimulant and non-stimulant treatment options. Robust research and development activities, supported by significant investment in mental health, further bolster the market.

Asia Pacific

The Asia Pacific region is projected to grow significantly in the market in the forecasting years because of the rising awareness about ADHD among parents, educators, and healthcare professionals, which is leading to increased diagnosis and treatment of the disorder. Improvements in healthcare infrastructure and access to medical services across the region are facilitating better management of ADHD. Economic growth and higher disposable incomes are enabling more families to seek professional help for ADHD, while government initiatives to improve mental health services and educational support for children with ADHD are further driving market growth.

Competitive Landscape

The competitive landscape for the market is characterized by the presence of several prominent pharmaceutical companies that dominate through extensive research and development efforts and comprehensive product portfolios. These leading firms continuously invest in developing new and improved medications, both stimulant and non-stimulant, to cater to the diverse needs of ADHD patients. The market is also witnessing increased competition from emerging players who focus on innovative drug delivery systems and non-pharmacological treatments, such as digital therapeutics and behavioral therapy apps. Strategic partnerships, mergers, and acquisitions are common as companies aim to expand their market reach and enhance their product offerings.

Some of the major players operating in the global market include:

- ADVANZ PHARMA

- Amneal Pharmaceuticals LLC

- Aytu BioPharma, Inc

- Eli Lilly and Company

- Johnson & Johnson Services, Inc

- Lupin

- Mallinckrodt

- Novartis AG

- Noven Pharmaceuticals, Inc

- Sun Pharmaceutical Industries Ltd

- Supernus Pharmaceuticals, Inc

- Takeda Pharmaceutical Company Limited

- Torrent Pharmaceuticals Ltd

- Tris Pharma, Inc

- Zevra Therapeutics

Recent Developments

- In January 2023, Noven Pharmaceuticals. Inc. launched XELSTRYM (dextroamphetamine) transdermal system, CII, the first and only amphetamine patch approved by the FDA for treating Attention-Deficit/Hyperactivity Disorder (ADHD) in adults and pediatric patients six years of age and older, was released. This company focuses on the development of transdermal treatments.

- In January 2023, Aytu BioPharma, Inc got FDA approval for Adzenys XR-ODT is as bioequivalent to Adderall XR(R) for ADHD Patients, and they also ensure the availability of Adzenys XR-ODT.

- In November 2021, Tris Pharma, Inc. announced that the U.S. Food and Drug Administration has approved Dyanavel XR (amphetamine), extended release once-daily tablets, CII, for the treatment of Attention-Deficit Hyperactivity Disorder (ADHD) in patients 6 years and older.

- In December 2022, Tris Pharma and Pediatrix Therapeutics announced expansion of partnership to commercialize Tris’s ADHD Portfolio and Pipeline Products in China.

Report Coverage

The attention deficit hyperactivity disorder market report emphasizes on key regions across the globe to provide better understanding of the type to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, drug type, distribution channel, demographics, and their futuristic growth opportunities.

Attention Deficit Hyperactivity Disorder Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 17,345.54 million |

|

Revenue forecast in 2032 |

USD 30,568.94 million |

|

CAGR |

7.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Drug Type, By Distribution Channel, By Demographics, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Attention Deficit Hyperactivity Disorder Market Size Worth USD 30,568.94 Million by 2032

attention deficit hyperactivity disorder market key players are ADVANZ PHARMA, Amneal Pharmaceuticals LLC, Aytu BioPharma

North America contribute notably towards the global attention deficit hyperactivity disorder market.

Attention deficit hyperactivity disorder market exhibiting the CAGR of 7.3% during the forecast period

The attention deficit hyperactivity disorder market report covering key segments are drug type, distribution channel, demographics, and region.