Atomic Layer Deposition Market Share, Size, Trends, Industry Analysis Report

By Product (Thermal ALD, Metal ALD, Plasma-Enhanced ALD, and Others); By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 114

- Format: PDF

- Report ID: PM3267

- Base Year: 2023

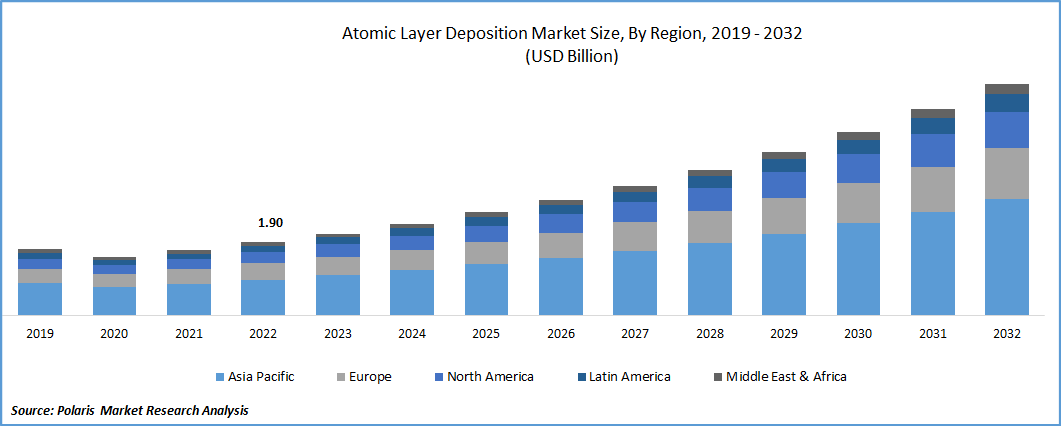

- Historical Data: 2019-2022

Report Outlook

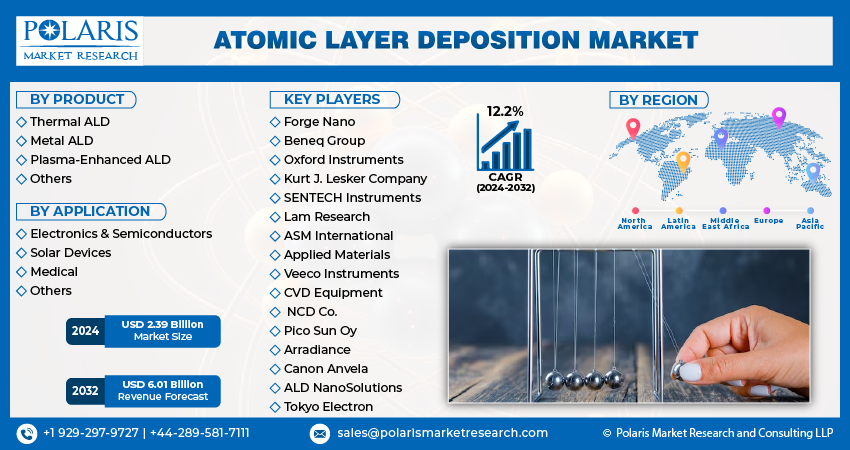

The global atomic layer deposition market was valued at USD 2.13 billion in 2023 and is expected to grow at a CAGR of 12.2% during the forecast period. The increasing adoption of the electronics and semiconductor solutions across the globe and surge in the need for novel materials and designs for improved chip production coupled with emerging trend towards miniaturization are among the primary factors driving the global market growth.

To Understand More About this Research: Request a Free Sample Report

Moreover, the rising innovation and continuous product development in the solar cells, and supported by huge investments especially in the renewable energy technology along with this, surge in demand for lightweight and portable devices with the introduction to various energy-efficient technologies, which in turn, influencing the growth of the market.

For instance, in February 2023, Forge Nano, a global leading materials science, announced the launch of its new brand identity and Atomic Armor, which enables the atomic level engineering and nanoscale surface engineering for building better materials. The new Atomic Armor is the crucial application of ALD coatings with high-speed, precision, and know-how, which will improve the product performance.

Moreover, the governments around the world are heavily focusing towards the promoting use of electric vehicles with the rising worries about the global warming and continuous environmental degradation. The rapid emergence of several novel technologies, that has led to significant increase in the demand and penetration for small and portable gadgets, are also likely to have a positive impact on the demand and growth of the market.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the atomic layer deposition market. The rapid emergence of the deadly coronavirus across the globe has resulted in several restrictions and regulations including lockdowns and other restrictions on trade activities, which halted the production facilities for many industries and high disruptions in supply chain, due to which, the demand and sales of atomic layer deposition declined significantly during the pandemic.

Industry Dynamics

Growth Drivers

The rising demand for microelectronics and consumer electronics globally due to introduction to variety of inexpensive and lightweight equipment including transistors, capacitors, inductors, diodes, resistors, and many others that are being significantly used in the production of mobile phones, tablets, laptops, and electronic toys among others, are major factors expected to boost the growth of the global atomic layer deposition market.

Furthermore, the extensive surge in the concerns regarding energy harvesting which resulting in high growth of the photovoltaic cells and widespread use of technology for the conversion of solar energy and electric energy along with the rise in demand for photovoltaic cells because of the low prices and range of applications including solar traffic lights, solar lamps, and solar power calculators, are also impacting the market in a positive way.

Report Segmentation

The market is primarily segmented based on product, application, and region.

|

By Product |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Thermal ALD Segment Accounted for the Largest Market Share in 2022

The widespread use of this type of ALD technique for depositing aluminum containing molecules and high prevalence for the aluminum oxide film using this technique are among the major factors driving the demand and growth of the segment. In addition, the increased awareness regarding its various excellent properties or features including high stability of various substrates and ease of access to the precursor materials are few other factors contributing to the segment growth.

The plasma-enhanced ALD segment is projected to expand at fastest growth rate during the anticipated period, which is mainly driven by an extensive rise in the demand and proliferation of the product due to its numerous beneficial features such as encouraged deposition of thin films at very low temperatures and comparatively better growth than traditional deposition approaches. Additionally, this technique is being widely used for the modification of surface by modifying nucleation and adhesion with the help of plasma exposure, that is being considered as a versatile method facilitating the nanoscale production in large range of emerging applications, thereby influencing the demand and growth of the segment.

Solar Devices Segment is Expected to Witness Highest Growth over the Forecast Period

The extensive growth of the segment can be largely attributed to increasing number of initiatives and steps taken towards the growing usage of green energy across the globe, in order to reduce the carbon footprint of greenhouse gases emissions mainly due to the wide utilization of conventional and power sources. Moreover, the rapidly increasing popularity of various types of new solar gadgets and rising problems of global warming, that resulting in higher adoption of environmentally friendly technologies.

The electronics & semiconductors segment held the majority market share in 2022, on account of high demand for electronic components from large number of industries including automotive industry. In addition, increasing focus of major semiconductor manufacturers towards the expansion of their manufacturing facilities or units with high investments on R&D activities, that are likely to fuel the demand of the market in the near future.

Asia Pacific Region Dominated the Global Market in 2022

The Asia Pacific region dominated the global market in 2022 with a holding of healthy market share, and is anticipated to maintain its dominance throughout the study period. The robust presence of major electronics manufacturers in India and China, South Korea, and Taiwan and high government spending on developing infrastructure to gain attention of leading market players to establish their manufacturing facilities in the region are key factors, propelling the expansion and growth of the market. The tremendous modernization and presence of major developing economies in the region coupled with increased consumer spending capacity, have paved the growth of the market.

North America region is likely to expand at substantial growth rate in the global market over the forecast period, owing to continuous rise in the demand for electric vehicles among people and rising number of solar energy projects and data centers built across the United States. Apart from this, the significant government regulatory support for promoting or supporting the domestic-level private investment and growing development in the interest for nuclear layer testimony, are further anticipated to create huge product demand over the next coming years.

Competitive Insight

Some of the major players operating in the global atomic layer deposition market include Forge Nano, Beneq Group, Oxford Instruments, Kurt J. Lesker Company, SENTECH Instruments, Lam Research, ASM International, Applied Materials, Veeco Instruments, CVD Equipment, NCD Co., Pico Sun Oy, Arradiance, Canon Anvela, ALD NanoSolutions, & Tokyo Electron.

Recent Developments

- In October 2022, Samco introduced Plasma Enhanced Atomic Layer Deposition system named “AD-800LP”. The new system R&D system equipped with the ICP plasma, which enables stable discharge even in the high-pressure range.

- In December 2021, Beneq unveiled its two new products to cater the growing demand for ALD in 300mm and compound semiconductors, named the Transform 300 and ProdigyTM. The Transform 300 is the only cluster tool available that combines thermal ALD and plasma ALD technologies.

Atomic Layer Deposition Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.39 billion |

|

Revenue forecast in 2032 |

USD 6.01 billion |

|

CAGR |

12.2% from 2024– 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024– 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Forge Nano Inc., Beneq Group, Oxford Instruments Plc, The Kurt J. Lesker Company, SENTECH Instruments GmbH, Lam Research Corporation, ASM International, Applied Materials Inc., Veeco Instruments Inc., CVD Equipment Corporation, NCD Co. Ltd., Pico Sun Oy, Arradiance LLC, Canon Anvela Corporation, ALD NanoSolutions Inc., and Tokyo Electron Ltd. |

FAQ's

key companies in atomic layer deposition market are Forge Nano, Beneq Group, Oxford Instruments, Kurt J. Lesker Company, SENTECH Instruments, Lam Research, ASM International, Applied Materials.

The global atomic layer deposition market expected to grow at a CAGR of 12.2% during the forecast period.

The atomic layer deposition market report covering key segments are product, application, and region.

key driving factors in atomic layer deposition market are high demand for microelectronics and consumer electronics.

The global atomic layer deposition market size is expected to reach USD 6.01 billion by 2032