Atmospheric Resource Extraction Market Size, Share, Trends, Industry Analysis Report: By Resource Type (Water Extraction from Air, Carbon Dioxide Capture, Oxygen & Nitrogen Extraction, and Others), Application, Technology, End User, and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America) – Market Forecast, 2025 - 2034

- Published Date:Apr-2025

- Pages: 128

- Format: PDF

- Report ID: PM5517

- Base Year: 2024

- Historical Data: 2020-2023

Atmospheric Resource Extraction Market Overview

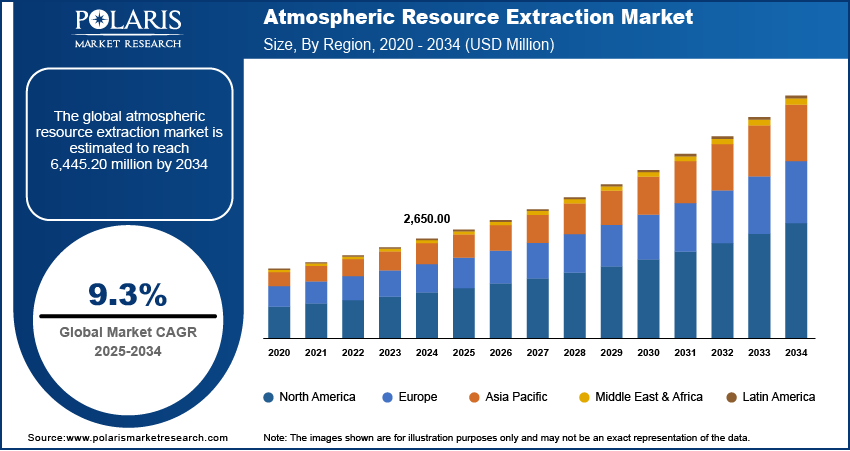

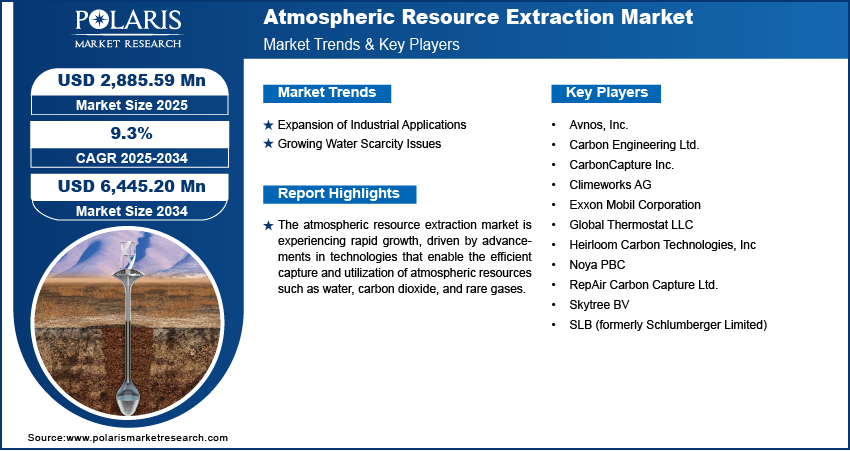

The global atmospheric resource extraction market size was valued at USD 2,650.00 million in 2024. The market is projected to grow from USD 2,885.59 million in 2025 to USD 6,445.20 million by 2034, exhibiting a CAGR of 9.3% during the forecast period.

Atmospheric resource extraction refers to the process of capturing and utilizing valuable components from the atmosphere, such as water vapor, carbon dioxide, nitrogen, oxygen, and rare gases, for commercial, industrial, and environmental applications. Growing concerns over water shortages and the depletion of natural resources have led to increased funding for atmospheric water generation and gas extraction technologies. Private enterprises are leveraging innovations to create commercial solutions that cater to industries such as agriculture, space exploration, and manufacturing, thus, boosting atmospheric resource extraction market demand.

Companies are focusing on scalable solutions to enhance the market, making it more viable for commercial and industrial applications. Recently, in September 2024, SLB (formerly Schlumberger) launched its direct lithium extraction (DLE) system. This system is expected to produce lithium for electric vehicle batteries by 2027, demonstrating a commitment to scalable solutions in atmospheric resource extraction. This development highlights the industry's focus on scalable technologies to enhance the atmospheric resource extraction market value, making it more feasible for commercial and industrial applications.

To Understand More About this Research: Request a Free Sample Report

Atmospheric Resource Extraction Market Dynamics

Expansion of Industrial Applications

The atmospheric resource extraction market is growing fast because it is being used in many industries. Since December 2021, NASA has started using space technology to improve farming. For example, the AeroPod, which was first made to stabilize instruments in space, is now used to map fields and check crop health more accurately. This shows how the market is expanding into agriculture. In space exploration, the European Space Agency (ESA) has also helped develop these technologies. By October 2024, ESA’s projects have improved farming and life sciences by using microgravity to grow stronger crops and improve production. These efforts show how useful atmospheric resource extraction is in different areas, making it an important and growing industry.

The pharmaceutical industry has also benefited from these technologies. Microgravity environments have facilitated the development of new drug formulations and more effective delivery systems, addressing challenges in drug discovery and disease modeling. This innovation represents a significant opportunity for pharmaceutical companies aiming to enhance their research and development capabilities. These advancements in farming, space exploration, and medicine demonstrate the value of atmospheric resource extraction technologies, driving the market's growth.

Growing Water Scarcity Issues

The increasing water scarcity in arid and drought-prone regions is a major factor driving the atmospheric resource extraction market demand. Countries facing severe droughts, such as those in the Middle East, Africa, and parts of the US, are investing in atmospheric water generation. For instance, in February 2024, Egypt's Helwan Metal Equipment Company partnered with Japan's Mizuha Co. to co-produce an atmospheric water generator capable of producing 1,000 liters per day. This collaboration aims to serve markets in Egypt, the Arab region, and Africa, highlighting a strategic move to enhance water accessibility in these areas.

Similarly, in November 2024, Aquaria initiated a USD 26 million project in the United States to install atmospheric water generators in 1,000 Hawaiian homes. These devices collectively produce 260 gallons of water daily, reflecting a significant investment in alternative water sources to combat local water scarcity. These initiatives across diverse regions demonstrate a global trend toward adopting atmospheric water generation technologies to mitigate water scarcity challenges, driving the atmospheric resource extraction market's growth.

Atmospheric Resource Extraction Market Segment Insights

Atmospheric Resource Extraction Market Assessment by Resource Type

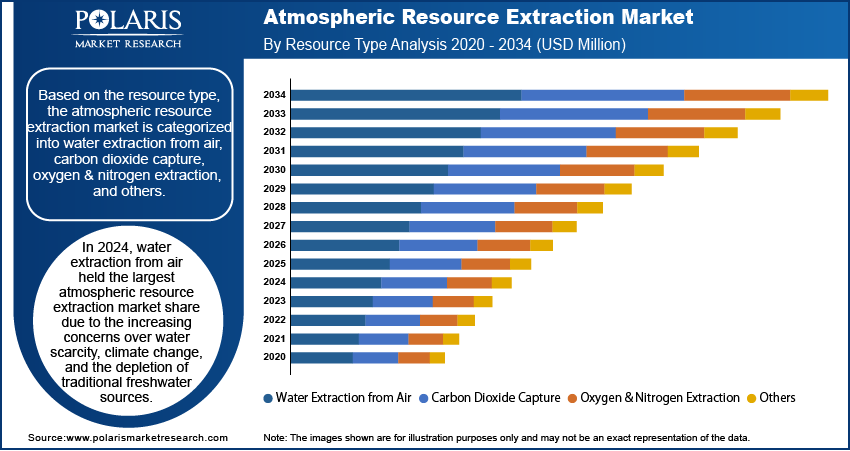

On the basis of resource type, the atmospheric resource extraction market is segmented into water extraction from air, carbon dioxide capture, oxygen & nitrogen extraction, and others. In 2024, water extraction from air held the largest atmospheric resource extraction market share. This dominance is due to the increasing concerns over water scarcity, climate change, and the depletion of traditional freshwater sources. The growing adoption of atmospheric water generators (AWGs) in arid regions where conventional water sources are insufficient has further contributed to the market growth. Countries facing severe drought conditions, such as India, the UAE, and parts of Africa, are actively deploying AWGs for potable water production. India, in particular, has intensified its efforts to integrate AWGs into its water infrastructure. In September 2023, an AWG was inaugurated at Ghoom Girls' Higher Secondary School in Darjeeling. This initiative, led by the CSIR-Indian Institute of Chemical Technology (CSIR-IICT) in collaboration with Maithri Aquatech, with objectives of addressing the school's chronic water shortages by providing a sustainable source of potable water. These innovations and practical uses of AWGs are helping the water extraction from air segment grow, thus, strengthening its position in the market.

Atmospheric Resource Extraction Market Evaluation by Application Insights

The atmospheric resource extraction market segmentation, based on application, includes space exploration & colonization, industrial gas supply, environmental sustainability & carbon capture, military & defense applications, and others. In 2024, the industrial gas supply segment accounted for a significant market share due to rising demand for gases such as oxygen, nitrogen, and carbon dioxide across various industries. For instance, the healthcare sector relies heavily on oxygen for medical treatments, while nitrogen is widely used in food packaging and electronics manufacturing. To meet the escalating demand for industrial gases across sectors such as healthcare, food packaging, and electronics manufacturing, leading companies have strategically expanded their production capacities. For instance, in April 2024, Linde increased the capacity of its Mims, Florida facility by 50%, following a similar expansion in 2020, to supply oxygen, nitrogen, and argon to various industries. These strategic expansions have reinforced the dominance of the industrial gas supply segment within the market.

Atmospheric Resource Extraction Market Regional Analysis

By region, the study provides atmospheric resource extraction market insights into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Asia Pacific held a considerable share of the global market in 2024, driven by the region's substantial investments, commitment to expand their power generation capabilities, and proactive approach to renewable energy adoption. As per the International Renewable Energy Agency (IRENA), in 2024, Asia led the world in renewable energy expansion, adding a record 473 gigawatts (GW) of new capacity which accounted for a 69% share, totaling 326 GW. This rapid growth was fueled by ambitious government policies, increasing private sector participation, and the rising need for clean energy solutions. The country’s push for green energy aligns with its goal of achieving carbon neutrality by 2060, further driving atmospheric resource extraction market growth.

The atmospheric resource extraction market in Europe is projected to grow rapidly during the projection period, driven by significant growth in renewable energy and creating a strong foundation for atmospheric resource extraction technologies. The European Union’s goal of reaching carbon neutrality by 2050 has led to rapid expansion in wind, solar, and hydroelectric power, creating a solid base for atmospheric resource extraction technologies. These clean energy sources help capture and use atmospheric resources efficiently while reducing environmental impact. Additionally, Poland and Hungary are playing a key role in Europe's solar energy boom. Between January and July 2024, solar power output in the top five countries in this region grew by 55% compared to the previous year, with Poland and Hungary leading the way. Europe is well-positioned to lead in the market, with increasing renewable energy adoption and supportive policies.

Atmospheric Resource Extraction Market – Key Players and Competitive Insights

The atmospheric resource extraction market is highly competitive, driven by the rising demand for sustainable resource recovery and advancements in extraction technologies. Leading companies focus on developing innovative solutions for water extraction from air, carbon capture, and industrial gas separation to address environmental challenges and resource shortages. Growing demand for atmospheric resource solutions and evolving sustainability goals drive continuous innovation, while strategic partnerships, acquisitions, and technological advancements play a crucial role in determining market share and industry leadership. Major players in the market include Climeworks AG; Carbon Engineering Ltd.; Global Thermostat LLC; Heirloom Carbon Technologies, Inc; Soletair Power Oy; CarbonCapture Inc.; Avnos, Inc.; Noya PBC; Skytree BV; RepAir Carbon Capture Ltd.; Exxon Mobil Corporation; SLB (formerly Schlumberger Limited), and others.

Carbon Engineering Ltd. is a Canadian clean energy company specializing in Direct Air Capture (DAC) technology, which removes carbon dioxide (CO₂) directly from the atmosphere. Founded in 2009 and headquartered in Squamish, British Columbia, the company aims to combat climate change by capturing CO₂ for permanent storage or conversion into low-carbon fuels. Carbon Engineering's DAC technology is scalable and designed to be integrated with industrial applications. In 2023, the company was acquired by Occidental Petroleum's subsidiary, 1PointFive, to accelerate large-scale carbon removal projects. With global partnerships, Carbon Engineering continues to drive innovation in atmospheric carbon extraction and utilization.

Climeworks AG is a Switzerland-based company specializing in direct air capture (DAC) technology to remove carbon dioxide (CO₂) from the atmosphere. Founded in 2009, the company develops modular DAC systems that capture CO₂ for permanent storage or commercial reuse. Climeworks operates large-scale CO₂ removal plants, including Orca (2021) and Mammoth (2024) in Iceland, which use geological storage to sequester CO₂ underground. The company collaborates with industries and governments to support carbon neutrality goals and is a key player in the atmospheric resource extraction market, advancing sustainable climate solutions.

List of Key Companies in Atmospheric Resource Extraction Market

- Avnos, Inc.

- Carbon Engineering Ltd.

- CarbonCapture Inc.

- Climeworks AG

- Exxon Mobil Corporation

- Global Thermostat LLC

- Heirloom Carbon Technologies, Inc

- Noya PBC

- RepAir Carbon Capture Ltd.

- Skytree BV

- SLB (formerly Schlumberger Limited)

- Soletair Power Oy

Atmospheric Resource Extraction Market Developments

October 2024: Rio Tinto acquired Arcadium for USD 6.7 billion to obtain Arcadium's direct lithium extraction (DLE) technology. This technology significantly accelerates lithium extraction compared to traditional methods, enhancing the atmospheric resource extraction market value by making lithium production more efficient and scalable.

September 2024: SLB launched a direct lithium extraction system following successful tests in Nevada. This technology aims to efficiently extract lithium, a critical mineral for energy storage solutions, thereby contributing to the atmospheric resource extraction market.

November 2023: Aclara announced advancements in sustainable rare earth element extraction using their proprietary Circular Mineral Harvesting process. This method minimizes environmental impact by eliminating the need for explosives, crushing, or milling and recycles approximately 95% of water and 99% of the main reagent used.

Atmospheric Resource Extraction Market Segmentation

By Resource Type Outlook (Revenue, USD Million, 2020–2034)

- Water Extraction from Air

- Carbon Dioxide Capture

- Oxygen & Nitrogen Extraction

- Others

By Application Outlook (Revenue, USD Million, 2020–2034)

- Space Exploration & Colonization

- Industrial Gas Supply

- Environmental Sustainability & Carbon Capture

- Military & Defense Applications

- Others

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Adsorption-Based Extraction

- Cryogenic Distillation

- Membrane Separation

- Others

By End User Outlook (Revenue, USD Million, 2020–2034)

- Aerospace & Space Agencies

- Industrial Gas Companies

- Environmental & Sustainability Organizations

- Military & Government Agencies

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Atmospheric Resource Extraction Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,650.00 million |

|

Market Size Value in 2025 |

USD 2,885.59 million |

|

Revenue Forecast in 2034 |

USD 6,445.20 million |

|

CAGR |

9.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global atmospheric resource extraction market size was valued at USD 2,650.00 million in 2024 and is projected to grow to USD 6,445.20 million by 2034.

The global market is projected to register a CAGR of 9.3% from 2025 to 2034.

Asia Pacific held a considerable share of the global market in 2024.

A few of the key players in the market are Climeworks AG; Carbon Engineering Ltd.; Global Thermostat LLC; Heirloom Carbon Technologies, Inc; Soletair Power Oy; CarbonCapture Inc.; Avnos, Inc.; Noya PBC; Skytree BV; RepAir Carbon Capture Ltd.; Exxon Mobil Corporation; and SLB (formerly Schlumberger Limited).

In 2024, water extraction from air held the largest share.

In 2024, the industrial gas supply segment accounted for a significant market share.