Athleisure Market Size, Share, Trends, Industry Analysis Report

: By Product Type, End Users, Distribution Channel (Online and Offline), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 128

- Format: PDF

- Report ID: PM2140

- Base Year: 2024

- Historical Data: 2020-2023

Athleisure Market Overview

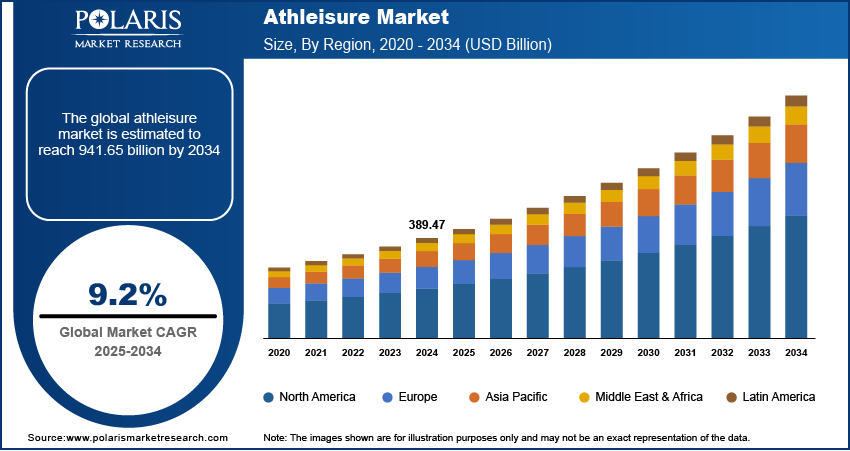

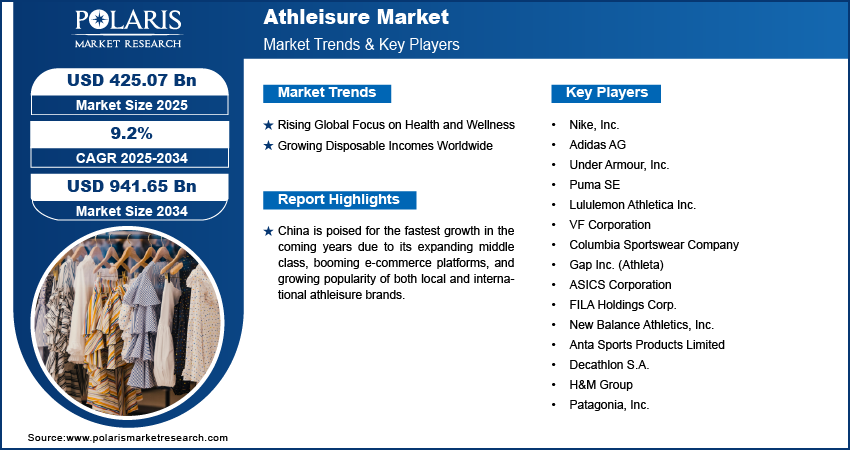

The global athleisure market size was valued at USD 389.47 billion in 2024. The market is projected to grow from USD 425.07 billion in 2025 to USD 941.65 billion by 2034, exhibiting a CAGR of 9.2% from 2025 to 2034.

The global athleisure market revolves around the production and distribution of clothing and footwear that seamlessly blends comfort, functionality, and style. Athleisure products, designed for both athletic activities and casual wear, appeal to a wide range of demographics, including fitness enthusiasts, professionals, and casual consumers. These products feature breathable fabrics, moisture-wicking properties, and sustainable materials, enhancing their appeal to eco-conscious consumers with advancements in material technology.

The athleisure market growth is driven by several factors, including changing consumer lifestyles, increased awareness of health and fitness app, and a preference for versatile and stylish apparel. Evolving fashion trends and the global rise of fitness culture have made athleisure a dominant segment in the apparel industry. In addition, athleisure’s versatility has positioned it as a wardrobe staple across age groups, blending performance wear and leisurewear into a cohesive category that caters to diverse consumer needs.

To Understand More About this Research: Request a Free Sample Report

Athleisure Market Dynamics

Rising Global Focus on Health and Wellness

As more people prioritize fitness and healthy living, there has been a surge in demand for activewear that offers both comfort and performance. Athleisure, which blends athletic and leisurewear, has become a popular choice for individuals seeking versatile apparel suitable for both workouts and casual wear. This shift towards a more health-conscious lifestyle, with a greater emphasis on physical activity, mindfulness, and overall well-being, is fueling the demand for athleisure products. Brands are capitalizing on this trend by offering a wide range of stylish, functional, and technologically advanced activewear, thereby driving the athleisure market expansion. Moreover, fitness trends such as yoga, pilates, and home workouts, especially post-pandemic, have contributed to the rising popularity of athleisure, as it caters to both fitness and everyday fashion needs.

Growing Disposable Incomes Worldwide

Increasing disposable incomes globally, especially in emerging economies, is another key driver of the athleisure market development. For instance, in 2024, real disposable incomes have maintained a growth rate of 3% or greater on a monthly basis, according to data from the Department of Commerce. Consumers are becoming more willing to spend on premium, high-quality apparel that combines comfort, style, and performance. This is particularly notable among the younger generation, including millennials and Gen Z, who view athleisure as a staple in their wardrobe. These consumers are not only investing in fitness and sportswear but also in athleisure, which offers a balance between fashion and functionality. Thus, as disposable income increases, the demand for branded and high-end athleisure products also grows, providing ample prospects for premium brands to capitalize on the expanding consumer base.

Athleisure Market Segment Insights

Athleisure Market Assessment Based on Product Type

The global athleisure market, based on product type, is segmented into tops, bottoms, footwear, outerwear, and accessories. In 2024, the footwear segment held the largest market share, driven by the growing popularity of sneakers and multi-purpose athletic footwear. Modern consumers value footwear that offers comfort, durability, and style, making it a preferred choice for workouts and casual outings alike. This demand has encouraged brands to innovate with new designs and technologies, such as cushioned soles and lightweight materials, which cater to diverse customer needs.

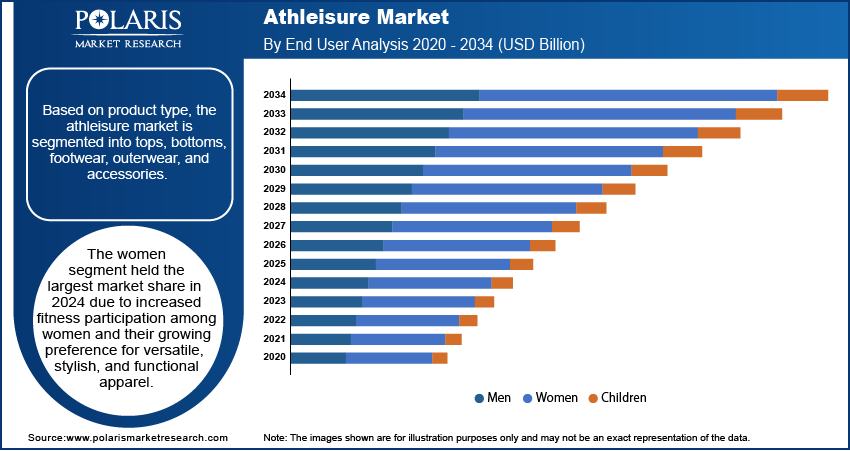

Athleisure Market Evaluation Based on End User

The global athleisure market, based on end user, is segmented into men, women, and children. The women segment dominated the market in 2024 due to increased fitness participation among women and their growing preference for versatile, stylish, and functional apparel. Companies are investing heavily in creating women-centric designs with vibrant patterns, size inclusivity, and improved functionality. Marketing strategies focusing on empowerment and active lifestyles further solidify this segment's dominance.

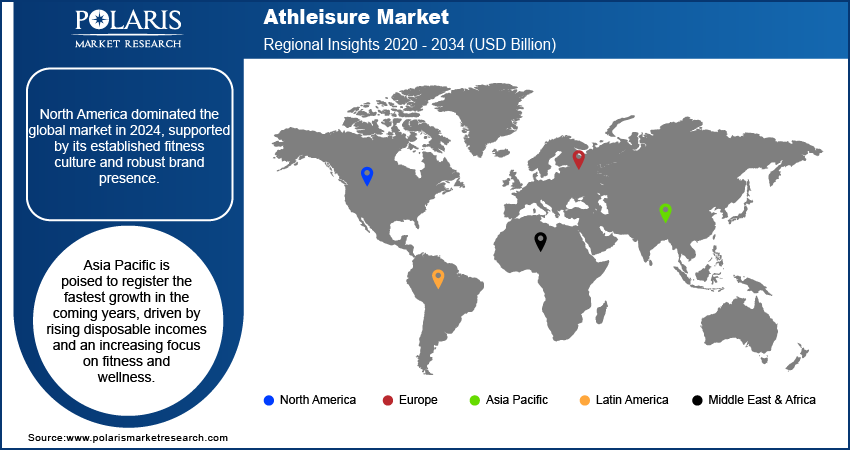

Athleisure Market Regional Analysis

By region, the market report offers athleisure market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the global market in 2024, supported by its established fitness culture, and high consumer spending. For instance, in 2023, the US witnessed a record 242 million individuals aged six and older engaging in at least one sport or fitness activity, marking a 2.2% increase from 2022. This surge highlights the nation's established fitness culture, with nearly 80% of Americans participating in physical activities. Moreover, America has a strong presence of brands such as Nike and Lululemon, which capitalize on this demand by consistently offering innovative and trendy products. Consequently, North America dominated the global market in 2024.

The US athleisure market accounted for the largest market share in 2024 due to with widespread adoption across all age groups. Consumers favor high-quality, stylish, and performance-oriented apparel that integrates seamlessly into both active and casual lifestyles.

The Asia Pacific athleisure market is poised to register the fastest growth from 2025 to 2034, driven by rapid urbanization, rising disposable incomes, and an increasing focus on fitness and wellness. China, in particular, leads this growth due to its expanding middle class, booming consumer-to-consumer e-commerce platforms, and growing popularity of both local and international athleisure brands. Chinese consumers seek value-for-money options that combine quality and style, providing significant opportunities for market expansion

Athleisure Market – Key Players and Competitive Landscape

The major companies dominate the market through their strong global presence, extensive product portfolios, and innovative marketing strategies. Nike and Adidas lead with advanced designs and collaborations with celebrities and athletes. Lululemon excels in the premium segment with its focus on quality and innovation. Emerging players like Anta Sports and Decathlon leverage affordable pricing to expand in developing regions. These brands continually invest in sustainability, technology, and consumer engagement to maintain their competitive edge, driving growth and shaping industry trends.

A few of the key market players are Nike, Inc.; Adidas AG; Under Armour, Inc.; Puma SE; Lululemon Athletica Inc.; VF Corporation; Columbia Sportswear Company; Gap Inc. (Athleta); ASICS Corporation; FILA Holdings Corp.; New Balance Athletics, Inc.; Anta Sports Products Limited; Decathlon S.A.; H&M Group; and Patagonia, Inc.

List of Key Companies in Athleisure Market

- Nike, Inc.

- Adidas AG

- Under Armour, Inc.

- Puma SE

- Lululemon Athletica Inc.

- VF Corporation

- Columbia Sportswear Company

- Gap Inc. (Athleta)

- ASICS Corporation

- FILA Holdings Corp.

- New Balance Athletics, Inc.

- Anta Sports Products Limited

- Decathlon S.A.

- H&M Group

- Patagonia, Inc.

Athleisure Industry Developments

In January 2025, CAVA Athleisure brand has launched ADPTTM, its first proprietary fabric blend designed for optimal comfort and mobility. Composed of spandex and nylon, this innovative material is available in over 50 designs and colors, offering a balance of stretch and durability for various activities.

In January 2025, Primark launched its largest athleisure collection, featuring 150 items, including high-support sports bras, moisture-wicking leggings, and lightweight running jackets, all designed for optimal performance and style.

In November 2024, PUMA partnered with Aston Martin Aramco Formula One Team, focusing on high-performance clothing. PUMA aims to elevate both brands and drive innovation in motorsport attire ahead of the 2025 Formula One season as the Official Athleisure, Sportswear, and Technical Gear Partner.

Athleisure Market Segmentation

By Product Type Outlook (Revenue – USD Billion, 2020–2034)

- Tops

- Bottoms

- Footwear

- Outerwear

- Accessories

By End User Outlook (Revenue – USD Billion, 2020–2034)

- Men

- Women

- Children

By Distribution Channel Outlook (Revenue – USD Billion, 2020–2034)

- Online

- Offline

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Athleisure Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 389.47 billion |

|

Market Size Value in 2025 |

USD 425.07 billion |

|

Revenue Forecast by 2034 |

USD 941.65 billion |

|

CAGR |

9.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global market was valued at USD 389.47 billion in 2024 and is projected to grow to USD 941.65 billion by 2034.

• The global market is projected to register a CAGR of 9.2% from 2025 to 2034.

• In 2024, North America dominated the global market, supported by its established fitness culture, high consumer spending, and robust brand presence.

• A few of the key players in the market are Nike, Inc.; Adidas AG; Under Armour, Inc.; Puma SE; Lululemon Athletica Inc.; VF Corporation; Columbia Sportswear Company; Gap Inc. (Athleta); ASICS Corporation; FILA Holdings Corp.; New Balance Athletics, Inc.; Anta Sports Products Limited; Decathlon S.A.; H&M Group; and Patagonia, Inc.

• The women segment led the market in 2024, primarily due to increased fitness participation among women and their growing preference for versatile, stylish, and functional apparel

• In 2024, footwear emerged as the top-performing segment, driven by the growing popularity of sneakers and multi-purpose athletic footwear.