Asset Tokenization Market Size, Share, Trends, Industry Analysis Report: By Asset Type (Real Estate, Art and Collectibles, Commodities, Intellectual Property, Financial Instruments, Luxury Goods, and Others), Technology, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5501

- Base Year: 2024

- Historical Data: 2020-2023

Asset Tokenization Market Overview

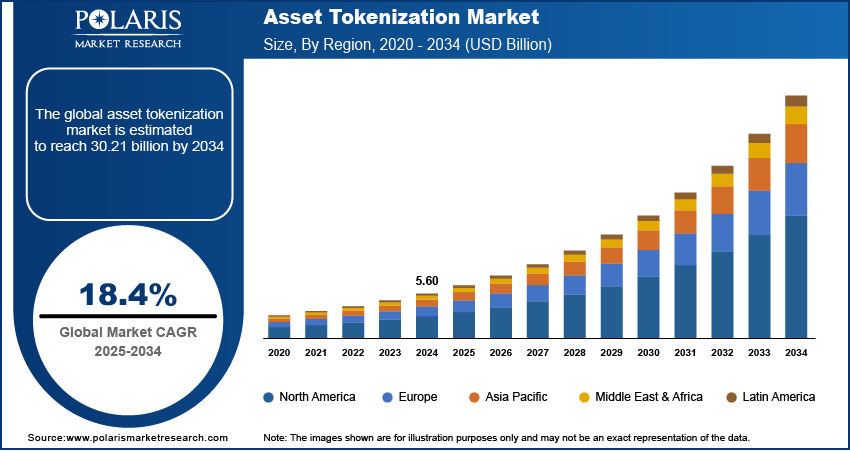

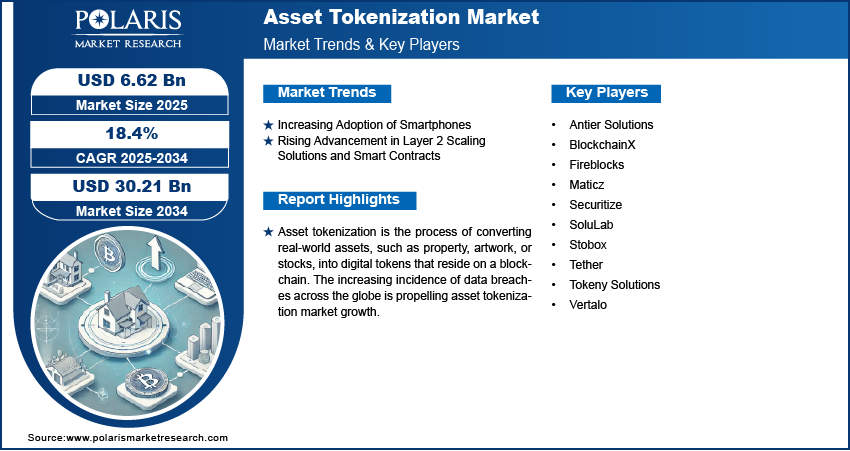

The global asset tokenization market size was valued at USD 5.60 billion in 2024. The market is projected to grow from USD 6.62 billion in 2025 to USD 30.21 billion by 2034, exhibiting a CAGR of 18.4 % during 2025–2034.

Asset tokenization is the process of converting real-world assets, such as property, artwork, or stocks, into digital tokens that reside on a blockchain. These tokens represent ownership or a share in the underlying asset and can be traded, sold, or held digitally. The core technology behind asset tokenization is blockchain, which ensures transparency, security, and immutability of ownership records. The applications of asset tokenization are vast and extend across various industries. Real estate, fine art, commodities, company shares, and even services are tokenized to raise funds or facilitate trading.

The increasing incidence of data breaches across the globe is propelling asset tokenization market growth. For instance, according to a report by the Internet Freedom Foundation, 278 GB of data was breached from BSNL’s telecom operations in 2024. Data breaches lead to significant financial losses, reputational damage, and regulatory penalties, driving companies to prioritize security-focused solutions that reduce the risk of unauthorized access and fraud. Asset tokenization, which leverages blockchain technology, provides a secure alternative by converting real-world assets into digital tokens that operate on decentralized networks. Additionally, data breaches fuel regulatory pressures, contributing to the increasing demand for asset tokenization. Governments and financial bodies are imposing stricter compliance requirements to safeguard consumer data and prevent illicit activities. This drives companies to adopt asset tokenization to demonstrate a commitment to security and regulatory adherence, reducing the likelihood of costly penalties and legal actions. Therefore, as data breaches increase worldwide, the demand for asset tokenization also spurs.

To Understand More About this Research: Request a Free Sample Report

The asset tokenization market demand is driven by increasing digitalization worldwide. Digitalization drives the demand for transparency and security, both of which asset tokenization provides. Blockchain technology, the backbone of tokenization, offers immutable and transparent records of all transactions. This feature builds trust among investors, as they can track the history and ownership of assets in real time. Additionally, the decentralized nature of blockchain enhances security by reducing the risk of fraud and hacking, making tokenized assets an attractive option in an increasingly digital era.

Asset Tokenization Market Dynamics

Increasing Adoption of Smartphones

Smartphones provide widespread access to digital platforms and applications, making it easier for individuals to participate in asset tokenization systems. For instance, according to the Groupe Speciale Mobile Association (GSMA) annual State of Mobile Internet Connectivity Report 2023, over half (54%) of the global population owns a smartphone. The advanced security features of smartphones, such as biometric authentication and encryption, ensure that users can safely interact with or use tokenized assets. This builds trust and confidence among investors, encouraging them to engage in asset tokenization. Additionally, the seamless integration of payment gateways and digital wallets on smartphones streamlines the process of buying, selling, and trading tokenized assets, driving demand. Hence, the asset tokenization market revenue is expanding with the rising adoption of smartphones.

Rising Advancement in Layer 2 Scaling Solutions and Smart Contracts

Technological innovations are enhancing the scalability and usability of tokenized assets. Advancements such as improved interoperability, Layer 2 scaling solutions, and smart contracts enable more efficient and seamless tokenization processes. These developments allow for faster transactions, reduced costs, and better integration with existing systems, making asset tokenization more attractive to investors and businesses. The rise of 5G and improved internet infrastructure is also contributing to the growing adoption of asset tokenization. Technological advancement further drives the convergence of traditional finance (TradFi) with decentralized finance (DeFi), accelerating the adoption of asset tokenization.

Asset Tokenization Market Segment Insights

Asset Tokenization Market Evaluation by Asset Type

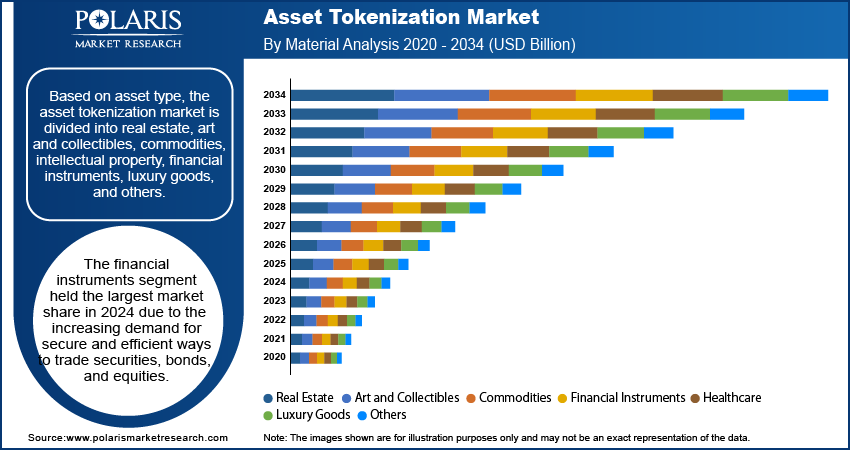

Based on asset type, the asset tokenization market is divided into real estate, art and collectibles, commodities, intellectual property, financial instruments, luxury goods, and others. The financial instruments segment held the largest asset tokenization market share in 2024 due to the increasing demand for secure and efficient ways to trade securities, bonds, and equities. Institutional investors and retail traders seek blockchain-based solutions to enhance transparency, reduce transaction costs, and eliminate intermediaries. Tokenized financial instruments allow instant settlements, lowering the risks associated with delays in traditional markets. Regulatory bodies in major financial hubs such as the US, Europe, and the Asia Pacific have implemented frameworks to support tokenized securities, further accelerating the adoption of financial instruments.

Asset Tokenization Market Insight by End User

In terms of end user, the asset tokenization market is segregated into institutional investors, retail investors, asset managers, fundraisers and issuers, and others. The retail investors segment is expected to grow at a robust pace in the coming years owing to the ability of asset tokenization to enable fractional ownership, allowing individuals to invest in high-value assets such as real estate, commodities, and fine art with lower capital requirements. Regulatory support and increasing trust in blockchain technology are estimated to further accelerate adoption, positioning retail investors as a key contributor in the asset tokenization market.

Asset Tokenization Market Regional Analysis

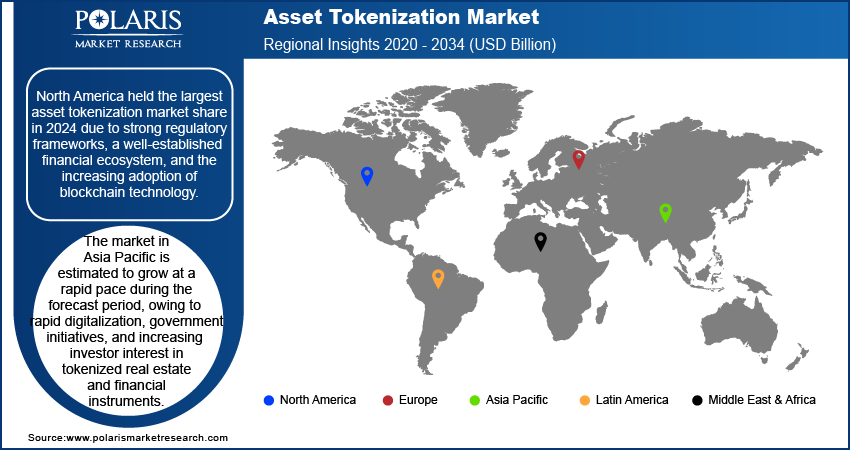

By region, the asset tokenization market report provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest asset tokenization market share in 2024 due to strong regulatory frameworks, a well-established financial ecosystem, and the increasing adoption of blockchain technology. The US dominated the region, with major financial institutions, fintech companies, and technology firms actively investing in tokenized assets. The Securities and Exchange Commission (SEC) and other regulatory bodies have provided clearer guidelines for digital securities, encouraging institutional investors to integrate blockchain-based solutions such as asset tokenization. The presence of major blockchain firms and innovation hubs in cities such as New York and San Francisco has further accelerated the asset tokenization market expansion. Additionally, the rising demand for alternative investment opportunities and the expansion of decentralized finance (DeFi) applications have positioned North America as a key region in the global market.

The market in Asia Pacific is estimated to grow at a rapid pace during the forecast period, owing to rapid digitalization, government initiatives, and increasing investor interest in tokenized real estate and financial instruments. Countries such as Singapore, Japan, and Hong Kong are establishing clear regulatory frameworks that support blockchain-based securities, attracting global investors and financial institutions. China’s focus on blockchain development, despite restrictions on cryptocurrencies, has also contributed to the region’s technological advancements, contributing to market growth. The rise of mobile-based investment platforms and growing financial inclusion across emerging economies, including India and Indonesia, is projected to drive the adoption of asset tokenization platforms further.

Asset Tokenization Market – Key Players and Competitive Insights

Major market players are investing heavily in research and development in order to expand their product portfolio, which will help the asset tokenization market grow even more. These market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The asset tokenization market is fragmented, with the presence of numerous global and regional market players. Major players in the market are Antier Solutions, BlockchainX, Fireblocks, Maticz, Securitize, SoluLab, Stobox, Tether, Tokeny Solutions, and Vertalo.

Tether, established in 2014, is a pioneering company in the cryptocurrency space known for its stablecoin USD₮. Tether has grown to become the largest stablecoin issuer globally, holding approximately 70% of the market share among stablecoins. It operates across multiple blockchains, including Ethereum, Tron, Solana, and others, offering a versatile platform for digital transactions. Tether plays a significant role in asset tokenization by offering stablecoins that facilitate seamless trading and settlement of tokenized assets.

Tokeny Solutions, founded in 2017 and headquartered in Luxembourg, is a major fintech company specializing in asset tokenization and compliance infrastructure for digital assets. Its platform enables the issuance, transfer, and management of tokenized securities with a focus on integrating compliance obligations directly into blockchain-based smart contracts. Tokeny leverages its expertise to provide institutional-grade solutions for financial institutions, including asset managers, investment banks, and real estate companies. Backed by Euronext, Tokeny has established itself as a trusted player in the global digital asset ecosystem. Tokeny Solutions plays a critical role in advancing asset tokenization, which involves converting real-world assets into blockchain-based digital tokens. The company’s flagship product, the T-REX platform, is a white-label solution that allows issuers to tokenize assets such as equities, debt instruments, and funds.

List of Key Companies in Asset Tokenization Market

- Antier Solutions

- BlockchainX

- Fireblocks

- Maticz

- Securitize

- SoluLab

- Stobox

- Tether

- Tokeny Solutions

- Vertalo

Asset Tokenization Industry Developments

November 2024: UBS Asset Management announced the launch of its first tokenized investment fund, “UBS USD Money Market Investment Fund Token,” built on Ethereum distributed ledger technology.

November 2024: Tether, a prominent company in the digital asset industry, announced the launch of Hadron by Tether, a platform designed to simplify the tokenization of everything from stocks to bonds, stablecoins, loyalty points, and more.

March 2024: Visa, a global company in digital payments, introduced the Visa tokenized asset platform that helps banks issue fiat-backed tokens.

Asset Tokenization Market Segmentation

By Asset Type Outlook (Revenue, USD Billion, 2020–2034)

- Real Estate

- Art and Collectibles

- Commodities

- Intellectual Property

- Financial Instruments

- Luxury Goods

- Others

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Blockchain Networks

- Smart Contract Platforms

- Tokenization Protocols

- Custody and Security Solutions

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Institutional Investors

- Retail Investors

- Asset Managers

- Fundraisers and Issuers

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Asset Tokenization Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 5.60 billion |

|

Market Size Value in 2025 |

USD 6.62 billion |

|

Revenue Forecast by 2034 |

USD 30.21 billion |

|

CAGR |

18.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global asset tokenization market size was valued at USD 5.60 billion in 2024 and is projected to grow to USD 30.21 billion by 2034.

The global market is projected to register a CAGR of 18.4% during the forecast period

North America had the largest share of the global market in 2024.

Some of the key players in the market are Antier Solutions, BlockchainX, Fireblocks, Maticz, Securitize, SoluLab, Stobox, Tether, Tokeny Solutions, and Vertalo.

The financial instruments segment dominated the market in 2024.

The retail investors segment is expected to grow at the fastest pace in the coming years.