Asset Management System Market Size, Share, Trends, Industry Analysis Report: By Asset Type, Function (Cloud and On-Premise), Solution, Industry and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 125

- Format: PDF

- Report ID: PM5492

- Base Year: 2024

- Historical Data: 2020-2023

Asset Management System Market Overview

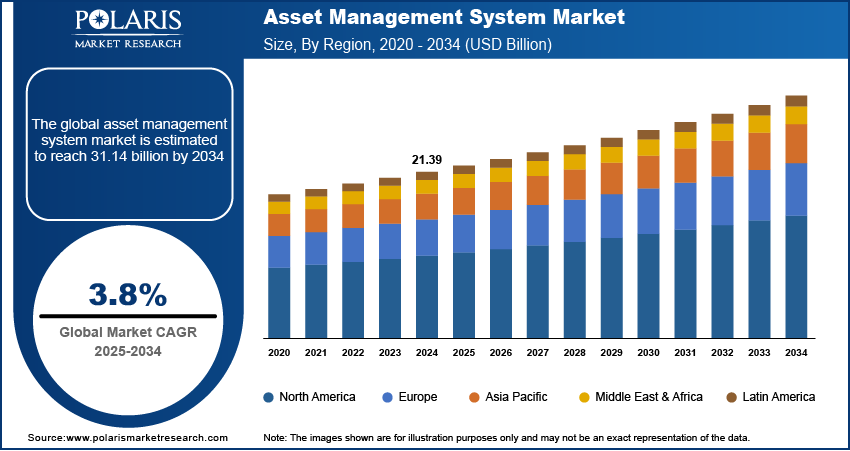

The global asset management system market size was valued at USD 21.39 billion in 2024. The market is projected to grow from USD 22.19 billion in 2025 to USD 31.14 billion by 2034, exhibiting a CAGR of 3.8% from 2025 to 2034.

An asset management system is a software solution designed to help organizations track, manage, and optimize the lifecycle of their physical and digital assets. It provides tools for monitoring asset performance, maintenance, and compliance, ensuring efficiency and cost-effectiveness.

Businesses are increasingly focusing on improving productivity and reducing costs, making operational efficiency a top priority. Asset management systems play a crucial role in achieving this by enabling organizations to track and optimize the use of both physical and digital assets. These systems offer detailed insights into asset performance, ensuring that maintenance is carried out on time and minimizing downtime. In addition, automating tasks like inventory management and maintenance scheduling improves overall efficiency, cuts unnecessary spending, and maximizes asset utilization. This leads to significant cost savings, faster operations, and better resource allocation, driving the widespread adoption of asset management solutions across industries.

To Understand More About this Research: Request a Free Sample Report

Technological advancements, such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML), are revolutionizing asset management systems. IoT sensors enable real-time monitoring of assets, allowing businesses to track their condition and performance remotely. AI and ML improve predictive maintenance by analyzing data to forecast asset failures before they occur. These innovations increase the accuracy and efficiency of asset management, reducing downtime and repair costs. Thus, technological advancements are fueling the increased use of asset management systems across various industries, thereby contributing to the asset management system market revenue.

Asset Management System Market Dynamics

Rise of Industry 4.0

Industry 4.0, characterized by automation and data-driven decision-making, is revolutionizing manufacturing and various other industries. The rise of smart factories and interconnected systems has led businesses to integrate their operations and increasingly rely on digital technology. In these environments, asset management systems are crucial for supporting automated operations and ensuring that machinery and equipment function optimally. These systems allow for seamless tracking, predictive maintenance, and data collection throughout the production process. As the adoption of Industry 4.0 increases, the demand for integrated and intelligent asset management systems to address the complexities of modern, automated operations continues to rise. This, in turn, is propelling the asset management system market development.

Growing Logistics Industry

Logistics companies are growing worldwide and handling more assets like vehicles, warehouses, and equipment. As a result, tracking and maintaining these assets efficiently has become more important than ever. In 2023, the US logistics industry employed over 237,100 people, according to the US Bureau of Labor Statistics, showing strong industry growth. With this expansion, companies need better asset management solutions to keep operations smooth and organized. This rising demand for asset tracking and maintenance tools is helping the asset management system market grow steadily.

Asset Management System Market Segment Insights

Asset Management System Market Assessment by Asset Type Outlook

The asset management system market assessment, based on asset type, includes manufacturing assets, returnable transport assets, electronics assets, personnel, and others. The manufacturing assets segment is expected to witness the fastest growth during the forecast period. The need to effectively manage a wide range of assets, including machinery, equipment, and tools, is increasing as manufacturing industries expand and modernize. These systems help optimize asset utilization and improve productivity. Additionally, the growing emphasis on automation and smart factories is fueling the demand for asset management systems for manufacturing assets, thereby driving segmental growth in the global market.

Asset Management System Market Evaluation by Solution Outlook

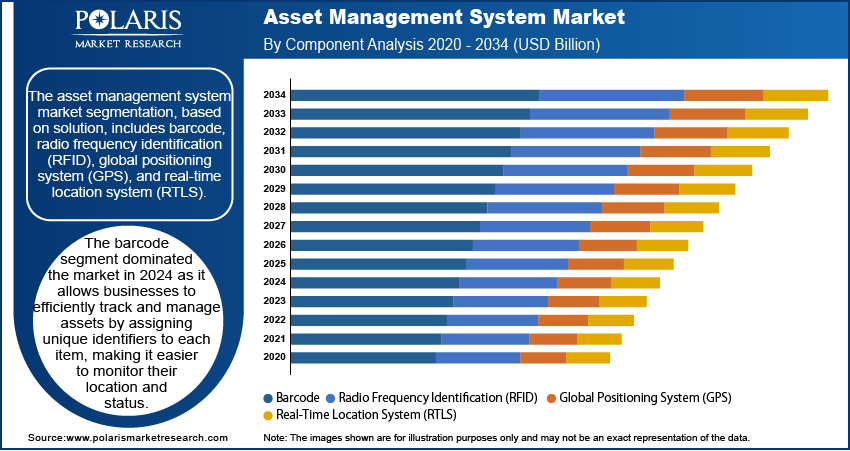

The asset management system market evaluation, based on solution, includes barcode, radio frequency identification (RFID), global positioning system (GPS), and real-time location system (RTLS). The barcode segment dominated the market in 2024. Barcode technology allows businesses to efficiently track and manage assets by assigning unique identifiers to each item, making it easier to monitor their location and status. This solution is cost-effective, easy to implement, and requires minimal training for employees. Barcode scanning improves accuracy and reduces human error, ensuring that asset records are kept up-to-date in real-time. Its simplicity and effectiveness in asset tracking across industries like logistics, healthcare, and manufacturing have made barcode solutions the leading choice for businesses looking to optimize their asset management processes, contributing to the segment’s leading market position.

Asset Management System Market Regional Analysis

By region, the study provides the asset management system market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the global market in 2024, driven by the high adoption of advanced technologies across various industries. The region is home to numerous large enterprises in sectors like manufacturing, logistics, and healthcare, where asset management systems play a crucial role in improving operational efficiency. The presence of leading software vendors and the growing demand for automation, data analytics, and cloud-based solutions have also contributed to the regional market dominance. Additionally, strict regulatory standards across industries have encouraged companies to adopt robust asset management systems to ensure compliance and operational transparency, driving asset management system market expansion in the region.

The Asia Pacific asset management system market is expected to record a significant share during the forecast period, fueled by rapid industrialization, rising digital transformation, and increasing investments in infrastructure. For instance, according to Japan’s Ministry of Trade, Economy and Industry, Japan recorded a production index of 101.6 in December 2024, highlighting rapid industrialization in the country. Emerging economies such as China, Japan, and South Korea are seeing high demand for asset management solutions, particularly in the manufacturing, transportation, and energy sectors. Additionally, the growing focus on smart factories, automation, and IoT technologies has increased the need for effective asset tracking and management systems, thereby driving the regional market growth.

The asset management system market in India is experiencing substantial growth due to the country’s booming industrial and technological sectors. The need for efficient asset tracking and management is increasing as businesses in manufacturing, logistics, and healthcare are growing in the country. The rising adoption of IoT, automation, and cloud-based technologies is further driving demand for asset management solutions. Additionally, India’s large and diverse economy, combined with its growing infrastructure and digital initiatives, has led to a significant rise in the adoption of advanced asset management systems, consequently driving market growth in India.

Asset Management System Market – Key Players and Competitive Insights

The asset management system market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the market by introducing innovative products to meet the demand of specific sectors. This competitive environment is amplified by continuous progress in product offerings. Major players in the asset management system market include Data logic.; Honeywell International; Impinj; Mojix; Sato Holdings Corporation; Stanley Black and Decker; Topcon Corporation; Trimble; Ubisense Group; and Zebra Technologies Corporation.

Honeywell International Inc. is a multinational conglomerate corporation headquartered in Charlotte, North Carolina. The company offers products across four key areas: Home and Building Technologies, Aerospace, Safety & Productivity Solutions (SPS), and Performance Materials and Technologies (PMT). Honeywell Aerospace provides aircraft engines, avionics, flight management systems, and services to airlines, airports, manufacturers, space programs, and militaries. The Home and Building Technologies segment offers products, solutions, software, and technologies that help customers of homes stay in control and connected to their comfort, energy, and security. The PMT segment manufactures and develops process technologies, materials, and automation solutions. Moreover, the SPS segment provides software, products, and connected solutions, including footwear and personal protection equipment designed for play, work, and outdoor activities. Honeywell's Asset Tracking and Monitoring Solutions provide near real-time visibility of remote field assets, including workers, fleets, and data acquisition systems. This enables smarter business decisions through location tracking and key operational data insights.

Trimble Inc. is a US-based technology company specializing in software, hardware, and services that serve various industries. Founded in 1978, the company initially focused on global navigation satellite system (GNSS) technology and has since broadened its product range. Trimble operates in sectors such as construction, agriculture, geospatial, transportation, and logistics, offering solutions that integrate physical and digital processes to improve operational efficiency. The company's operations are divided into several key segments. The Engineering and Construction segment provides tools for planning, design, and management of civil infrastructure projects, including building information modeling (BIM) software and construction equipment management systems. The Field Solutions segment focuses on field service management with mobile applications designed for scheduling, compliance monitoring, and performance analytics in industries like telecommunications and utilities. The Mobile Solutions segment includes fleet management systems that enhance route planning and logistics operations through advanced mapping technologies. Additionally, Trimble develops advanced devices that integrate embedded technologies for GNSS applications, military navigation systems, and RFID solutions for inventory management. Trimble has a global presence with significant operations in North America. The company also operates in Europe and has a growing footprint in Asia Pacific. In 2022, Trimble relocated its headquarters from Sunnyvale, California to Westminster, Colorado. Trimble offers asset management solutions that streamline operations, boost collaboration, and mitigate risk throughout the entire asset lifecycle. Their Trimble Unity platform helps manage and maintain all infrastructure assets, enabling efficient planning, design, building, operation, and maintenance using centralized data and connected digital workflows.

List of Key Companies in Asset Management System Market

- Data logic.

- Honeywell International

- Impinj

- Mojix

- Sato Holdings Corporation

- Stanley Black and Decker

- Topcon Corporation

- Trimble

- Ubisense Group

- Zebra Technologies Corporation

Asset Management System Industry Developments

In June 2024, Trimble launched its asset lifecycle management software suite, Trimble Unity. The company stated that the software suite offers cloud-first solutions for capital project and infrastructure management, providing unprecedented data visibility and process control for asset owners.

In March 2022, Aptean launched its new cloud-based enterprise asset management (EAM) solution, Aptean EAM, offering scalable maintenance management for manufacturers, streamlining operations, and reducing downtime through advanced analytics and intuitive workflows.

Asset Management System Market Segmentation

By Asset Type Outlook (Revenue, USD Billion, 2020–2034)

- Manufacturing Assets

- Returnable Transport Assets

- Electronics Assets

- Personnel

- Others

By Function Outlook (Revenue, USD Billion, 2020–2034)

- Check-In/Check-Out

- Repair & Maintenance

- Movement Tracking

- Others

By Solution Outlook (Revenue, USD Billion, 2020–2034)

- Barcode

- Radio Frequency Identification (RFID)

- Global Positioning System (GPS)

- Real-Time Location System (RTLS)

By Industry Outlook (Revenue, USD Billion, 2020–2034)

- Healthcare

- Industrial Manufacturing

- Process Industry

- Retail

- Transportation and Logistics

- Hospitality

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Asset Management System Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 21.39 billion |

|

Market Size Value in 2025 |

USD 22.19 billion |

|

Revenue Forecast by 2034 |

USD 31.14 billion |

|

CAGR |

3.8% from 2025–2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The asset management system market size was valued at USD 21.39 billion in 2024 and is projected to grow to USD 31.14 billion by 2034.

The global market is projected to register a CAGR of 3.8% during the forecast period, 2025–2034.

North America had the largest share of the global market in 2024.

A few of the key players in the market are Data logic.; Honeywell International; Impinj; Mojix; Sato Holdings Corporation; Stanley Black and Decker; Topcon Corporation; Trimble; Ubisense Group; and Zebra Technologies Corporation.

The barcode segment dominated the asset management system market in 2024 as it allows businesses to efficiently track and manage assets by assigning unique identifiers to each item, making it easier to monitor their location and status.

The manufacturing assets segment is expected to witness the fastest growth during the forecast period due to the rising need to effectively manage a wide range of assets, including machinery, equipment, and tools.