Asia Pacific Veterinary Clinical Trials Market Size, Share, Trends, Industry Analysis Report: Information By Animal Type (Livestock Animal, Companion Animal, Other Animals), By Intervention, By Indication, By End User, and By Country– Market Forecast, 2024 - 2032

- Published Date:Jul-2024

- Pages: 115

- Format: PDF

- Report ID: PM4995

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

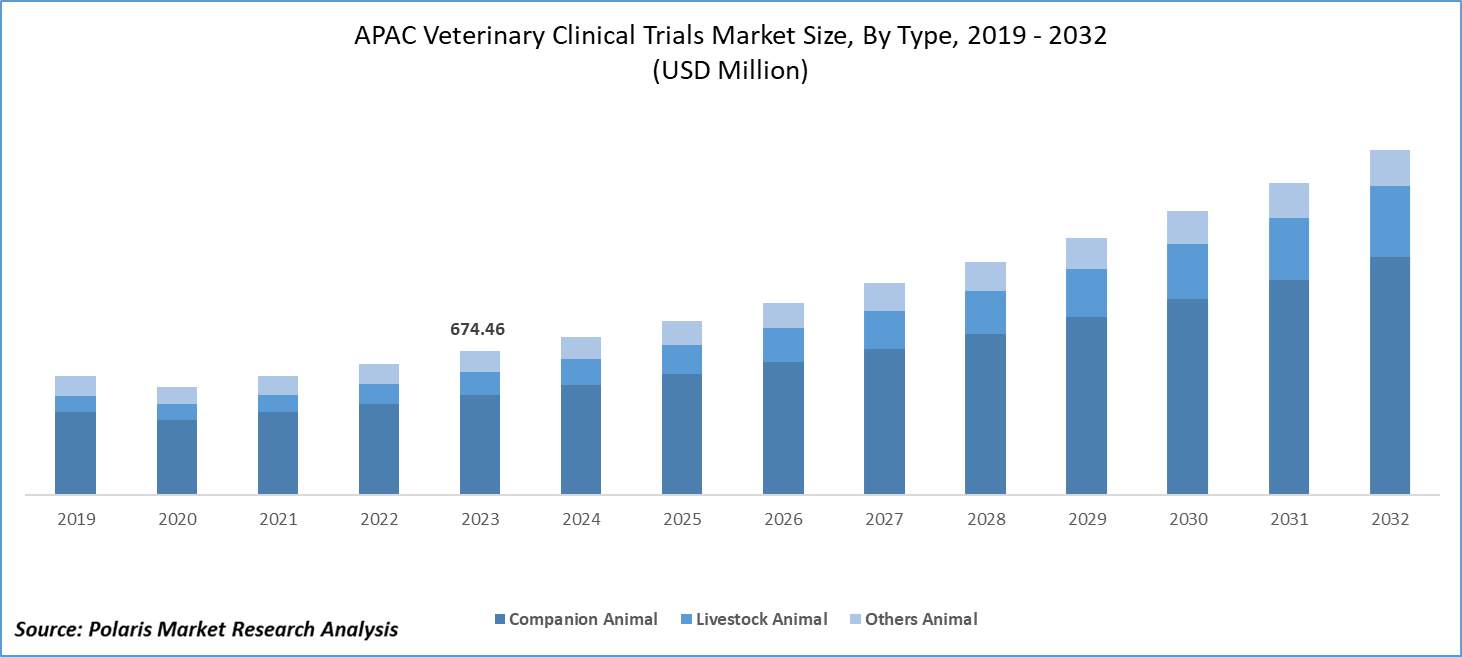

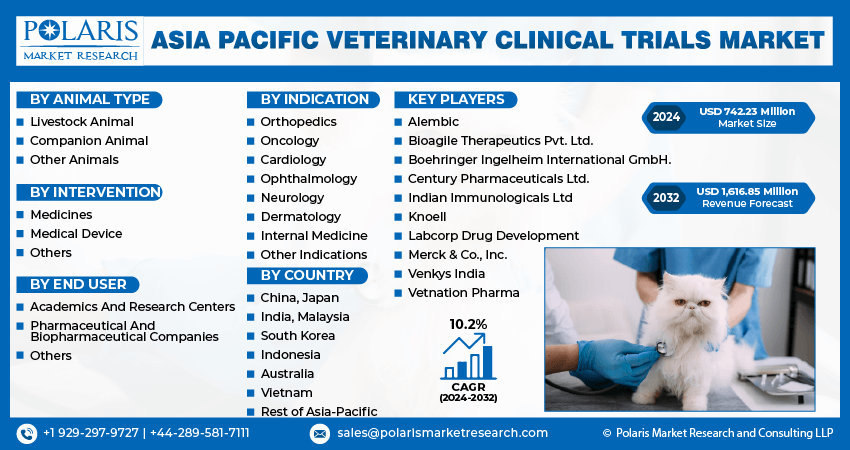

Asia Pacific veterinary clinical trials market size was valued at USD 674.46 million in 2023. The Asia Pacific veterinary clinical trials industry is projected to grow from USD 742.23 million in 2024 to USD 1,616.85 million by 2032, exhibiting a compound annual growth rate (CAGR) of 10.2% during the forecast period 2024 - 2032.

The veterinary clinical trials market involves controlled studies to assess the safety and efficacy of new treatments for animals, which is crucial for advancing veterinary medicine. It supports innovation and ensures safe therapies for animals. The growing adoption of animals is a major factor propelling the Asia-Pacific veterinary clinical trials market. Additionally, increasing awareness about animal healthcare is driving the growth of the market revenue.

Many APAC countries have robust agricultural sectors that rely heavily on livestock. The health and productivity of livestock animals are crucial, driving the demand for veterinary medicines and clinical trials. Countries like India, China, and Indonesia have large livestock populations, which require ongoing health management and new treatment options. This creates a significant market for veterinary clinical trials.

Regulatory frameworks in countries like China, Japan, Australia, and India are evolving to support the conduct of veterinary clinical trials, ensuring that new products meet stringent safety and efficacy standards before reaching the market. This regulatory support fosters confidence among stakeholders and encourages investments in research and development within the veterinary sector.

To Understand More About this Research: Request a Free Sample Report

Furthermore, collaborations between pharmaceutical companies, academic institutions, and research organizations are expanding research capabilities and promoting innovation in veterinary clinical trials. These partnerships facilitate knowledge exchange, resource sharing, and the development of tailored healthcare solutions for regional animal health challenges, driving the demand in the Asia-Pacific veterinary clinical trials market.

APAC Veterinary Clinical Trials Market Trends

The Rise in Livestock Population is Driving the Market Growth

The rising livestock population is a significant driver for the growth of the Asia-Pacific veterinary clinical trials market CAGR. The growing middle class in many APAC countries leads to higher consumption of meat and dairy products, increasing the demand for healthy and productive livestock. The need for animal by-products such as leather, wool, and gelatin also contributes to maintaining healthy livestock populations requiring proper healthcare.

A larger livestock population requires comprehensive health management strategies, including preventive healthcare, to avoid diseases that can spread rapidly among animals. Thus, increased livestock numbers lead to a higher incidence of diseases, necessitating the development of effective treatments. Clinical trials are essential for testing these treatments, thus contributing to the increase in the demand for the Asia Pacific veterinary clinical trials market.

For instance, in October 2023, the Agriculture and Horticulture Development Board reported that the USDA's latest forecast signifies China's beef production will increase by 2.7% in 2024, reaching a historically high level of 7.7 million tonnes. The growth is mainly driven by a substantial live cattle inventory, following a period of domestic beef herd expansion. This rising livestock population highlights the need for proper healthcare and medicines, thereby contributing to the demand for the Asia-Pacific veterinary clinical trials market.

Increasing Technological Advancements

Asia Pacific veterinary clinical trials market is experiencing significant growth due to rising technological advancements. Innovations in digital health and telemedicine are transforming the way data is collected and monitored during trials, enhancing efficiency and accuracy. Advances in biotechnology and veterinary pharmaceuticals are leading to the development of new treatments and vaccines, which require rigorous clinical testing.

Additionally, modern diagnostic tools and techniques are improving disease detection and management in animals, further driving the need for comprehensive clinical trials to ensure the safety and efficacy of new veterinary products. These technological advancements are not only streamlining the clinical trial process but also expanding the scope and scale of veterinary research in the region. Various companies in India are providing innovative devices for companion animal research, driving the growth of the Asia Pacific veterinary clinical trials market.

For instance, in December 2023, Fujifilm India Pvt Ltd, a medical imaging and diagnostic technologies company, partnered with A’alda Vet India Pvt Ltd to enhance healthcare facilities for pets. Through this collaboration, Fujifilm India will supply creative medical and screening devices to animal hospital, an initiative by A’alda Vet aimed at raising the standards of veterinary care in India. These advanced devices drive technological advancements in veterinary research, contributing to the growth of the Asia-Pacific veterinary clinical trials market revenue.

Asia Pacific Veterinary Clinical Trials Market Segment Insights

Veterinary Clinical Trials Animal Type Insights

Asia Pacific veterinary clinical trials market segmentation, based on animal type, includes companion animals, livestock animals, and other animals. The livestock animal segment is expected to witness the fastest CAGR during the forecast period. Growing demand for meat, dairy, and other livestock products in the region necessitates the expansion of livestock populations. This increase drives the need for effective healthcare solutions to maintain animal health and productivity.

For instance, in April 2022, according to the Indian Council of Agriculture and Research, India had a diverse livestock population of approximately 536 million, comprising 192.49 million cattle, 109.85 million buffaloes, 148.88 million goats, 74.26 million sheep, 9.06 million pigs, and 851.5 million poultry. Disease outbreaks pose a significant challenge to livestock and poultry production, resulting in substantial economic losses. Many of the diseases are zoonotic, affecting both animal health and human welfare.

Effective animal health management is crucial to mitigate productivity losses and enhance overall livestock production. The availability of vaccines has played a crucial role in transforming the livestock sector. For instance, the widespread adoption of the Peste des Petits Ruminants (PPR) vaccine developed by ICAR-IVRI, Mukteshwar campus, has reduced disease incidence by over 75%. Similarly, the Foot-and-Mouth Disease (FMD) vaccine developed at ICAR-IVRI, Bengaluru campus, has significantly reduced outbreaks of this highly contagious disease, thereby securing the livelihoods of marginalized farmers. Such vaccine research for reducing the prevalence of diseases in livestock contributes to boosting the Asia Pacific veterinary clinical trials market share.

Veterinary Clinical Trials Indication Insights

The APAC veterinary clinical trials market segmentation, based on indication, includes orthopedics, oncology, cardiology, ophthalmology, neurology, dermatology, internal medicine, and other indications. In 2023, the dermatology segment accounted for a significant share of the Asia Pacific veterinary clinical trials market due to dermatological issues that are common among pets and livestock in APAC countries. Skin diseases, allergies, and infections require specialized treatments and therapies, driving the demand for clinical trials to test new medications and treatments.

Favorable regulatory environments, government support, and, most importantly, collaborations between pharmaceutical companies and their investments are key drivers of research and development in dermatological treatments. This collective effort facilitates clinical trials to meet regulatory standards and bring new products to market, underscoring the industry's commitment to innovation.

For instance, in December 2022, an MoU was signed in Nagpur, attended by the Union Minister of Fisheries, Animal Husbandry and Dairying, the Chief Minister, and Deputy CM of Maharashtra, for the production of Goat Pox vaccine and "Lumpi-ProVac" vaccine. This agreement aims to facilitate large-scale production of the Goat Pox vaccine to meet future needs in India's livestock sector. The vaccine, which is currently utilized to control Lumpy Skin Disease in animals, has shown effective outcomes, demonstrating the significant impact of these initiatives.

Additionally, in October 2022, Indian Immunologicals Limited (IIL) announced plans to invest approximately Rs 700 crore in setting up a new animal vaccine manufacturing facility in Genome Valley, Hyderabad, recognized as the “Vaccine Hub of the World.” This facility aims to bolster the nation's vaccine security against economically significant diseases such as foot and mouth disease (FMD) and other emerging ailments.

The aforementioned initiative highlight the establishment of a large-scale vaccine manufacturing facility addressing dermatological skin diseases in animals, underscoring the increasing research and clinical studies. Thus, driving the growth of the Asia-Pacific veterinary clinical trials market.

Veterinary Clinical Trials Country Insights

By country, the study provides market insights into China, Japan, India, Malaysia, South Korea, Indonesia, Australia, Vietnam, and the rest of Asia-Pacific. The Indian veterinary clinical trials market is expected to witness the fastest growing CAGR during the forecast period. The region’s robust growth is due to the rise in livestock and poultry farming that necessitates the development of effective veterinary medicines and vaccines, thereby boosting the demand for clinical trials.

According to the Ministry of Fisheries, Animal Husbandry & Dairying, the livestock sector is a crucial part of India's agriculture, growing at a CAGR of 7.93% from 2014-15 to 2020-21. Its contribution to the total agriculture and allied sector GVA has increased from 24.32% to 30.13% during this period, reaching 4.90% of total GVA in 2020-21. As awareness about animal health grows with the increasing livestock population, initiatives like the Centrally Sponsored Scheme offers "Livestock Health and Disease Control (LH&DC) Scheme". This scheme aims to prevent, control, and contain economically and zoonotic important animal diseases through vaccination, capacity building of veterinary services, disease surveillance, and infrastructure strengthening.

In July 2021, the National Animal Disease Control Programme (NADCP) and the Livestock Health and Disease Control (LH&DC) scheme were merged into the Livestock Health and Disease Control Programme. These initiatives highlight the increasing focus on veterinary vaccination and are expected to contribute to the growth of the Asia Pacific veterinary clinical trials market in India.

The Japanese veterinary clinical trials market accounted for a significant share in 2023. Japan has a growing population of pet owners who prioritize the health and well-being of their pets. This trend fuels demand for advanced veterinary treatments, including clinical trials for cancer diagnostics and therapies. Companies in Japan are at the forefront of developing innovative cancer diagnostics and treatments for animals.

Further, collaborative contracts among pharmaceutical companies, biotechnology firms, and academic institutions are enhancing research capabilities and driving innovation in veterinary cancer treatments. These partnerships play a pivotal role in conducting comprehensive clinical trials.

For example, in March 2024, VolitionRx Limited entered into a supply contract with Fujifilm Vet Systems Co. Ltd to introduce the Nu. Q Vet Cancer Test to veterinarians in Japan. This agreement permits Fujifilm Vet Systems to distribute and conduct cancer screening benefits for dogs using the Nu. Q Vet Cancer Test across its network of central reference laboratories in Japan. The Nu. Q Vet Cancer Test serves as an accessible and cost-effective screening tool for early detection of cancer in dogs. Through Fujifilm Vet Systems, veterinarians in Japan achieve access to advanced testing faculty that enhances early cancer detection, leading to better treatment outcomes and improved animal care. Such agreements underscore the increasing demand for veterinary diagnostics in Japan, driving the need for innovative medications and fueling growth in the Asia Pacific veterinary clinical trials market.

Veterinary Clinical Trials Key Market Players & Competitive Insights

Leading market players drive innovation and competitiveness in the Asia Pacific veterinary clinical trials market through their reveal of a dynamic landscape shaped by technological advancements, strategic collaborations, and regulatory market developments.

Pharmaceutical companies, biotechnology firms, and academic institutions are leveraging collaborative partnerships to enhance research capabilities and drive innovation in areas such as cancer treatments and disease prevention, which collectively increases the demand of the Asia Pacific veterinary clinical trials market.

Major players in the Asia Pacific veterinary clinical trials market include Bioagile Therapeutics Pvt. Ltd., Boehringer Ingelheim International GmbH., Labcorp Drug Development, Merck & Co., Inc., knoell, Century Pharmaceuticals Ltd., Vetnation Pharma, Indian Immunologicals Ltd, Venkys India, and Alembic.

Merck & Co., Inc. is a major research-driven biopharmaceutical company pioneering health solutions that advance disease prevention and treatment for both humans and animals. The company offers a wide range of products tailored for companion animals, equines, swine, poultry, ruminants, and aquaculture. In 2024, Merck Animal Health received approval for BRAVECTO injection for dogs, providing immediate and sustained protection against fleas and ticks.

Indian Immunologicals Limited (IIL), headquartered in Hyderabad, India, is the major producer of vaccines in Asia. With multiple GMP manufacturing sites, IIL exports to over 50 countries. The company boasts a strong R&D pipeline and has launched several affordable animal and human vaccines in the Indian market. IIL specializes in developing various types of vaccines, including inactivated and live viral vaccines, toxoid vaccines, recombinant subunit vaccines, and live bacterial vaccines. In July 2023, IIL inaugurated a new facility in Dargaville for the production of sterile-filtered serum.

Key companies in the Asia Pacific veterinary clinical trials market include

- Alembic

- Bioagile Therapeutics Pvt. Ltd.

- Boehringer Ingelheim International GmbH.

- Century Pharmaceuticals Ltd.

- Indian Immunologicals Ltd

- Knoell

- Labcorp Drug Development

- Merck & Co., Inc.

- Venkys India

- Vetnation Pharma

Veterinary Clinical Trials Industry Developments

- October 2023: EQT announced its acquisition of VetPartners, a provider of veterinary and animal health services. VetPartners operates a network of 267 general practice clinics and specialty hospitals across Australia and New Zealand.

- September 2022: SK Telecom established Korea's first AI-based veterinary X-ray image diagnosis offering service, named ‘X Caliber.’ The new service has been developed using data augmentation technology to increase the amount and diversity of data sets and to enhance AI performance in clinical trial settings.

- January 2020: Ceva Animal Health signed several agreements aimed at developing new vaccine solutions tailored to the needs of Vietnamese livestock producers and a project focused on creating alternatives to antibiotics.

Asia Pacific Veterinary Clinical Trials Market Segmentation

Asia Pacific Veterinary Clinical Trials Animal Type Outlook

- Livestock Animal

- Companion Animal

- Other Animals

Asia Pacific Veterinary Clinical Trials Intervention Outlook

- Medicines

- Medical Device

- Others

Asia Pacific Veterinary Clinical Trials Indication Outlook

- Orthopedics

- Oncology

- Cardiology

- Ophthalmology

- Neurology

- Dermatology

- Internal Medicine

- Other Indications

Asia Pacific Veterinary Clinical Trials End User Outlook

- Academics And Research Centers

- Pharmaceutical And Biopharmaceutical Companies

- Others

Asia Pacific Veterinary Clinical Trials Country Outlook

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

Asia Pacific Veterinary Clinical Trials Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 674.46 million |

|

Market Size Value in 2024 |

USD 742.23 million |

|

Revenue Forecast in 2032 |

USD 1,616.85 million |

|

CAGR |

10.2% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, country, and segmentation. |

FAQ's

The APAC veterinary clinical trials market size was valued at USD 674.46 million in 2023 and is expected to grow at USD 1,616.85 million in 2032.

The Asia Pacific market is projected to grow at a CAGR of 10.2% during the forecast period.

The Indian veterinary clinical trials market is expected to witness the fastest-growing CAGR during the forecast period.

The key players in the APAC veterinary clinical trials market are Bioagile Therapeutics Pvt. Ltd., Boehringer Ingelheim International GmbH., Labcorp Drug Development, Merck & Co., Inc., knoell, Century Pharmaceuticals Ltd., Vetnation Pharma, Indian Immunologicals Ltd, Venkys India, and Alembic.

The livestock animal segment is expected to witness the fastest CAGR during the forecast period.

In 2023, the dermatology segment accounted for a significant market share.