Asia Pacific Smart Retail Market Size, Share, Trends, Industry Analysis Report: By Solutions (Software and Hardware), Application, and Country (India, China, Japan, Malaysia, South Korea, Indonesia, Australia, Vietnam, and Rest of Asia Pacific) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 125

- Format: PDF

- Report ID: PM5399

- Base Year: 2024

- Historical Data: 2020-2023

Asia Pacific Smart Retail Market Overview

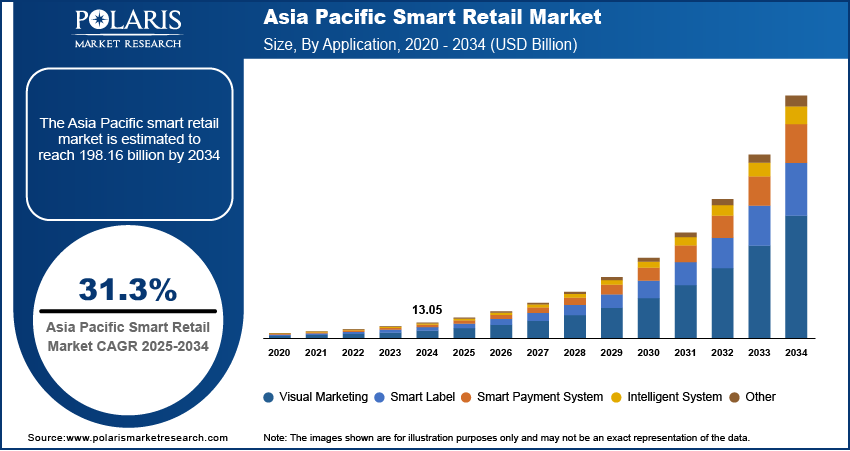

The Asia Pacific smart retail market size was valued at USD 13.05 billion in 2024. The market is projected to grow from USD 17.05 billion in 2025 to USD 198.16 billion by 2034, exhibiting a CAGR of 31.3% during 2025–2034. Smart retail refers to the use of advanced technologies, including AI, IoT, and data analytics, to improve the shopping experience and improve operational efficiency. It involves features such as personalized recommendations, automated checkout, and inventory management, providing a more seamless and engaging experience for customers.

Consumers in Asia Pacific are seeking personalized shopping experiences, which has pushed retailers to adopt smart technologies. Tools such as augmented reality (AR), facial recognition, and location-based offers help create unique and engaging shopping journeys. Smart stores offer personalized promotions or in-store navigation based on a customer’s preferences and purchase history. This shift toward customized experiences is especially prominent in countries such as China and India, where consumers are tech-savvy and expect brands to cater to their individual needs, thereby driving the Asia Pacific smart retail market demand.

To Understand More About this Research: Request a Free Sample Report

Mobile payments and digital wallets have become increasingly popular in Asia Pacific countries, particularly in China and India, where platforms such as Alipay, WeChat Pay, and Google Pay dominate. According to the National Payments Corporation of India, in January 2025, USD 951.91 million worth of transactions were made in India through Google Pay. This shift to digital payments has made shopping more convenient and efficient, as consumers can pay with their smartphones instead of cash or cards. Retailers are now integrating contactless payment systems and mobile apps to cater to this growing demand. The ease of mobile transactions is driving the adoption of smart retail technologies, as both customers and businesses benefit from faster, more secure payment solutions, consequently driving the Asia Pacific smart retail market growth.

Asia Pacific Smart Retail Market Dynamics

Increasing Adoption of E-commerce and Omnichannel Retailing

The rising penetration of e-commerce in Asia Pacific, especially with high smartphone usage and internet access, has forced retailers to blend online and offline shopping experiences. Consumers now expect to shop seamlessly across physical stores and digital platforms. To meet this demand, retailers are adopting smart technologies such as automated checkout, smart shelves, and integrated point of sales (POS) systems. These tools help retailers offer a more efficient and personalized shopping experience, driving them to invest more in omnichannel strategies to stay competitive. Thus, the increasing adoption of e-commerce and omnichannel retailing drives the Asia Pacific smart retail market development.

Rising Urbanization and Shift to Smart Cities

Asia Pacific is experiencing rapid urbanization, and many cities are evolving into smart cities with advanced infrastructure. According to the World Bank Group, in 2023, 63% of the total population in Asia Pacific lived in urban areas. This transformation is influencing how retailers operate, pushing them to adopt smarter technologies to cater to tech-savvy urban consumers. In major urban centers such as Tokyo, Seoul, and Mumbai, retailers are using Internet of Things (IoT) devices, smart payment systems, and digital signage to improve customer experiences and streamline operations. These innovations help businesses keep pace with urban growth while meeting the needs of digitally connected consumers who expect convenience and efficiency in their shopping experiences. Hence, the rising urbanization and shift to smart cities fuel the Asia Pacific smart retail market growth.

Asia Pacific Smart Retail Market Segment Analysis

APAC Smart Retail Market Assessment by Application Outlook

The Asia Pacific smart retail market segmentation, based on application, includes visual marketing, smart labels, smart payment systems, intelligent systems, and others. The visual marketing segment is expected to witness fastest growth during the forecast period. This approach uses digital displays, interactive signage, and augmented reality (AR) to create captivating in-store experiences. Retailers are increasingly adopting visual marketing tools to engage customers, enhance product presentations, and offer personalized shopping experiences. In countries such as Japan, China, and South Korea, where technological advancements are widespread, visual marketing strategies are helping businesses attract customers and boost sales. These innovations are driving the growth of the visual marketing segment.

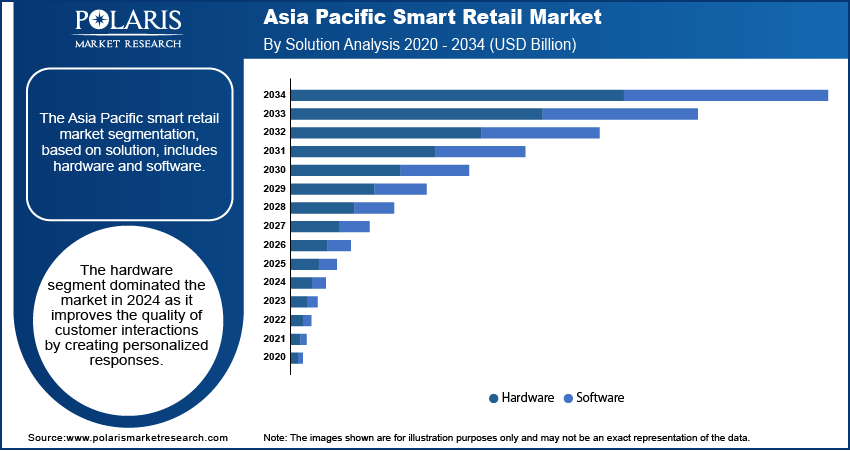

APAC Smart Retail Market Evaluation by Solution Outlook

The Asia Pacific smart retail market evaluation, based on solution, includes hardware and software. The hardware segment dominated the Asia Pacific smart retail market share in 2024. Hardware solutions include devices such as smart shelves, digital signage, automated checkout systems, and sensors that help retailers improve operational efficiency and improve customer experiences. These hardware solutions are critical for enabling features such as real-time inventory tracking, personalized advertisements, and seamless transactions. Retailers in the region are investing heavily in these technologies to stay competitive and meet growing customer expectations, thereby driving the growth of the hardware segment in the Asia Pacific smart retail market.

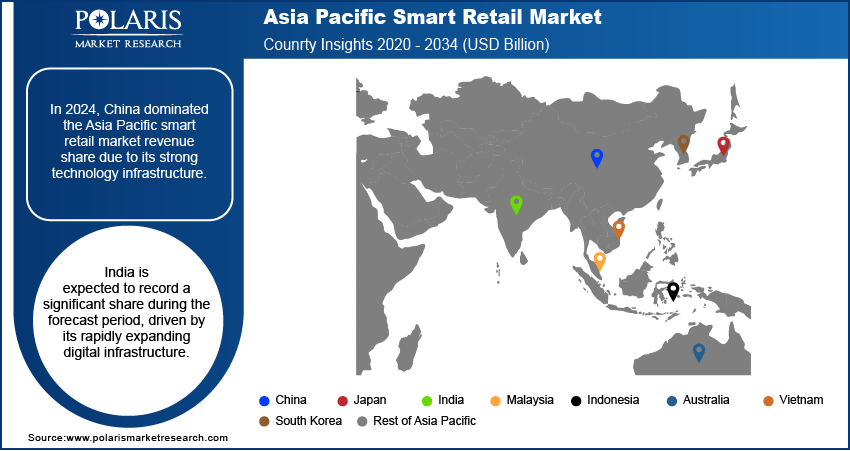

Asia Pacific Smart Retail Market Country Analysis

By country, the study provides the Asia Pacific smart retail market insights into India, China, Japan, Malaysia, South Korea, Indonesia, Australia, Vietnam, and the Rest of Asia Pacific. In 2024, China dominated the Asia Pacific smart retail market revenue share due to its strong technology infrastructure. The country has made significant advancements in digital technology, including 5G networks, artificial intelligence (AI), and Internet of Things (IoT) devices, which are helping transform the retail landscape. According to the People's Republic of China, in December 2023, China's 5G subscription surpassed the 1 billion mark, showcasing the robust 5G technology infrastructure. Retailers are adopting smart technologies such as automated checkout, facial recognition, and smart shelves to improve customer experiences and improve operational efficiency. Additionally, the government's support for innovation and digitalization, along with a tech-savvy population, is further driving the China smart retail market expansion.

India is expected to record a significant share during the forecast period, driven by its rapidly expanding digital infrastructure. The country's increasing internet penetration and smartphone usage are pushing more consumers toward online and mobile shopping. Retailers in India are adopting smart technologies such as digital payments, self-checkout systems, and AI-driven customer service tools to improve shopping experiences and operational efficiency. Additionally, the rise of e-commerce giants and the government's push for digitalization are fueling this transformation. India is becoming an important hub for the growth of smart retail solutions in the region as more urban areas embrace smart technologies, thereby driving the India smart retail market demand.

Asia Pacific Smart Retail Market – Key Players & Competitive Analysis Report

The Asia Pacific smart retail market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the Asia Pacific smart retail industry by introducing innovative products to meet the demand of specific sectors. This competitive environment is amplified by continuous progress in product offerings. A few major players in the market are IntelliVision; Probiz Technologies; InvenSense (TDK Corporation); Cisco Systems, Inc.; Honeywell International Inc.; Amazon.com, Inc. (Amazon); Bosch Global Software Technologies Private Limited; IBM; Cognizant; and Ingenico.

International Business Machines Corporation (IBM) is an American multinational technology company operating in over 75 countries. The company provides healthcare and healthcare payer solutions through the IBM Watson Health business. However, as of 2022, the IBM Watson Healthcare business was purchased by Merative. IBM Watson started in 2010, is a supercomputer that uses Digital Workplace (AI) and advanced analytical tools to operate optimally as a "question-answering" machine. For businesses and organizations, IBM Watson uses Digital Workplace to optimize employees' time, automate complex processes, and predict future outcomes. IBM provides retail solutions that leverage AI and hybrid cloud to optimize operations, improve customer experience, promote sustainability, and drive growth. The solution provides customer behavior forecasting, supply chain optimization, personalized marketing, seamless e-commerce experiences, smart checkout and self-service functionality, and inventory management solutions.

Cognizant Technology Solutions Corporation is an American multinational IT services company based in Teaneck, New Jersey. Founded in 1994 as a technology unit of Dun & Bradstreet, it became an independent entity in 1996. The company provides a range of services, including consulting, digital services, and business process outsourcing (BPO), across various industries. Cognizant's offerings include digital transformation services such as digital engineering, Internet of Things (IoT), data analytics, and cloud solutions. In addition to these, the consulting segment focuses on business strategy and technology consulting aimed at optimizing client operations. The company also provides application services involving the development, integration, testing, and maintenance of software applications. Infrastructure services are another key area, supporting IT infrastructure management and security for clients. Cognizant is organized into several business segments such as financial services, which encompasses banking and insurance; healthcare, serving healthcare providers and life sciences; products and resources, which addresses manufacturing, retail, and logistics; and communications, media, and technology, focusing on digital content and user experience. Cognizant operates globally with a presence in North America, Europe, Asia Pacific, and Latin America. Key markets include the US, India, Germany, Australia, China, Brazil, France, Spain, and Japan. Cognizant's Stores 360 offering provides comprehensive retail technology solutions, including store strategy, build, and launch services. It aims to reduce store opening times by 10-20% and operating expenses by 30–40%. The service covers predictive store management, control tower operations, and intelligent asset management. Cognizant commits to over 98% uptime for store systems and offers centralized asset management with enhanced data accuracy and demand forecasting.

List of Key Companies in Asia Pacific Smart Retail Market

- Amazon.com, Inc.

- Bosch Global Software Technologies Private Limited

- Cisco Systems, Inc.

- Cognizant

- Honeywell International Inc.

- IBM

- Ingenico

- IntelliVision

- InvenSense (TDK Corporation)

- Probiz Technologies

Asia Pacific Smart Retail Industry Developments

In August 2024, Advantech showcased its IoT and AI systems for smart retail at the NRF Retail Show 2024 in Singapore, emphasizing enhanced store operations, environmental monitoring, and AI-powered self-service solutions.

In February 2023, Singtel launched Singapore's first 5G-enabled smart retail showcase, featuring solutions from Apple and partners to enhance retail workflows, customer engagement, and operational efficiency through high-speed connectivity and MEC.

Asia Pacific Smart Retail Market Segmentation

By Solution Outlook (Revenue USD Billion, 2020–2034)

- Hardware

- Software

By Application Outlook (Revenue USD Billion, 2020–2034)

- Visual Marketing

- Smart Label

- Smart Payment System

- Intelligent System

- Other

By Country Outlook (Revenue USD Billion, 2020–2034)

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

Asia Pacific Smart Retail Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 13.05 billion |

|

Market Size Value in 2025 |

USD 17.05 billion |

|

Revenue Forecast by 2034 |

USD 198.16 billion |

|

CAGR |

31.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The Asia Pacific smart retail market size was valued at USD 13.05 billion in 2024 and is projected to grow to USD 198.16 billion by 2034.

The global market is projected to register a CAGR of 31.3% during the forecast period.

China held the largest share of the market in 2024.

A few key players in the market are IntelliVision; Probiz Technologies; InvenSense (TDK Corporation); Cisco Systems, Inc.; Honeywell International Inc.; Amazon.com, Inc. (Amazon); Bosch Global Software Technologies Private Limited; IBM; Cognizant; and Ingenico.

The hardware segment dominated the market in 2024 as it helped retailers improve operational efficiency and enhance customer experiences.

The visual marketing segment is expected to witness the fastest growth during the forecast period due to its rising adoption of visual marketing tools to engage customers, enhance product presentations, and offer personalized shopping experiences.