Asia Pacific SGLT2 Inhibitors Market Size, Share, Trends, Industry Analysis Report: By Indication (Cardiovascular, Chronic Kidney Disease (CKD), Type 2 Diabetes, and Others), Drug, Distribution Channel, and Country (China, Japan, India, Malaysia, South Korea, Indonesia, Australia, Vietnam, and Rest of Asia Pacific) – Market Forecast, 2025– 2034

- Published Date:Jan-2025

- Pages: 120

- Format: PDF

- Report ID: PM5335

- Base Year: 2024

- Historical Data: 2020-2023

Asia Pacific SGLT2 Inhibitors Market Overview

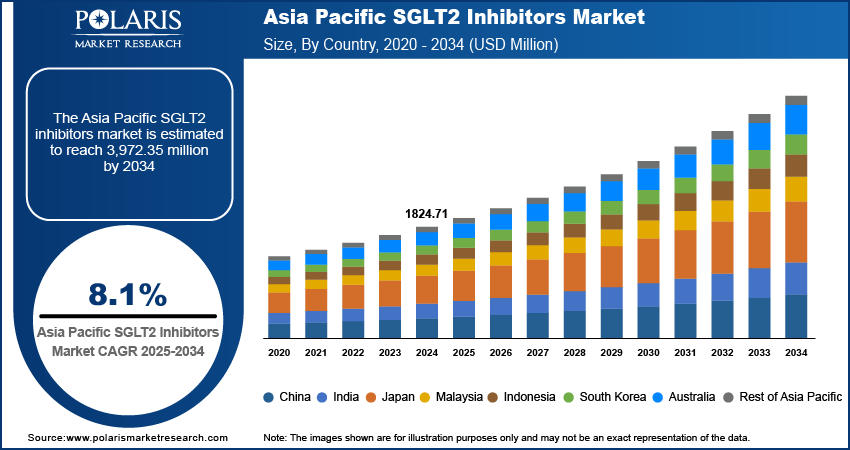

The Asia Pacific SGLT2 inhibitors market size was valued at USD 1,824.71 million in 2024. The market is projected to grow from USD 1,970.68 million in 2025 to USD 3,972.35 million by 2034, exhibiting a CAGR of 8.1% from 2025 to 2034.

The SGLT2 inhibitors market focuses on drugs that block sodium-glucose co-transporter 2 (SGLT2) to lower blood sugar in diabetic patients, improving glycemic control and offering cardiovascular and renal benefits. The aging population in countries with high diabetes prevalence, such as Japan, China, and South Korea, is a significant demographic driver for the Asia Pacific SGLT2 inhibitors market. Older adults are more susceptible to type 2 diabetes, which has resulted in increased demand for effective diabetes management medications like SGLT2 inhibitors. In addition, growing awareness among healthcare professionals and patients about the benefits of SGLT2 inhibitors in managing type 2 diabetes is contributing to the Asia Pacific SGLT2 inhibitors market growth.

Asia Pacific is experiencing significant growth in healthcare,with advanced infrastructure facilitates, which are necessary for the rapid identification and efficient management of diabetes. The region's advanced medical facilities, highly skilled healthcare practitioners, and comprehensive healthcare services ensure that patients have access to the latest and most effective treatments, including SGLT2 inhibitors. Consequently, SGLT2 inhibitors are significantly propelling market demand. Ongoing research and development in the pharmaceutical industry across the Asia Pacific have led to the continuous introduction of advanced SGLT2 inhibitors. Innovations such as combined therapies with other antidiabetic medications and enhanced formulations are broadening the range of therapeutic choices for patients, thereby fueling the Asia Pacific SGLT2 inhibitors market expansion.

To Understand More About this Research: Request a Free Sample Report

Asia Pacific SGLT2 Inhibitors Market Dynamics

Increasing Diabetes Prevalence in Asia Pacific Drives Market Growth

The rising prevalence of type 2 diabetes across the Asia Pacific, fueled by urbanization, lifestyle changes, and genetic predisposition, is driving the demand for effective diabetes management solutions like SGLT2 Inhibitors. According to the International Diabetes Federation, the Southeast Asia adult diabetes population is projected to rise to 113 million by 2030 and 151 million by 2045. Currently, 1 in 11 adults (90 million) live with diabetes, and over half of them are undiagnosed. In 2021, diabetes led to 747,000 deaths, and USD 10 billion was spent on managing the condition. Thus, the rising number of diabetes cases is fueling the need for SGLT2 inhibitors, boosting the Asia Pacific SGLT2 inhibitors market revenue.

Rapid Urbanization in Asia Pacific Boosts Market Growth

Rapid urbanization in the Asia Pacific has led to significant changes in dietary habits, with more people shifting from traditional, whole-food diets to high-calorie, processed foods. This shift towards processed foods, along with a more sedentary lifestyle, has fueled the surge in obesity rates, a major risk factor for the development of type 2 diabetes. As a result, the growing prevalence of type 2 diabetes is driving the demand for SGLT2 inhibitors, leading to Asia Pacific SGLT2 inhibitors market development.

Asia Pacific SGLT2 Inhibitors Market Segment Insights

Asia Pacific SGLT2 Inhibitors Market Outlook by Indication Insights

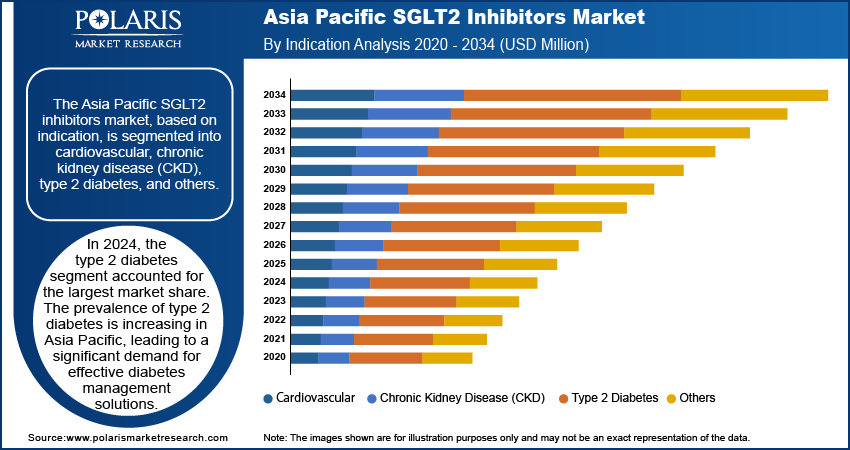

The Asia Pacific SGLT2 inhibitors market, based on indication, is segmented into cardiovascular, chronic kidney disease (CKD), type 2 diabetes, and others. In 2024, the type 2 diabetes segment accounted for the largest market share. The prevalence of type 2 diabetes is increasing in Asia Pacific, leading to a significant demand for effective diabetes management solutions. For instance, in 2021, Japan had an adult population of 93,187,400, with 11.8% having diabetes, totaling 11,004,999 total cases, according to the International Diabetes Federation. This high number of diabetes cases has led to an increase in the use of SGLT2 Inhibitors, significantly boosting the market share.

Furthermore, heightened awareness, early detection, and improved healthcare accessibility have contributed to the robust growth of the segment. Governments and healthcare organizations worldwide are actively introducing initiatives to counter the diabetes epidemic, resulting in increased adoption of advanced diabetes treatments such as SGLT2 inhibitors.

Asia Pacific SGLT2 Inhibitors Market Outlook by Distribution Channel Insights

The Asia Pacific SGLT2 inhibitors market, based on distribution channel, is segmented into hospital pharmacies, online pharmacies, and retail pharmacies. The hospital pharmacies segment is expected to witness the fastest growth from 2025 to 2034. The rising incidence of type 2 diabetes has led to an increase in hospital admissions for diabetes-related complications, including cardiovascular issues, renal problems, and diabetic ketoacidosis. This has created a greater need for effective diabetes management solutions, particularly SGLT2 inhibitors, within hospital settings.

Hospitals are well-equipped to provide comprehensive diabetes care, including prescribing and administering advanced medications like SGLT2 inhibitors. These inhibitors are widely used in hospitals due to their effectiveness in regulating blood glucose levels and offering additional health benefits, such as cardiovascular and renal protection. In addition, hospital pharmacies typically have access to the latest therapeutic methods, including next-generation SGLT2 inhibitors.

Asia Pacific SGLT2 Inhibitors Country Analysis

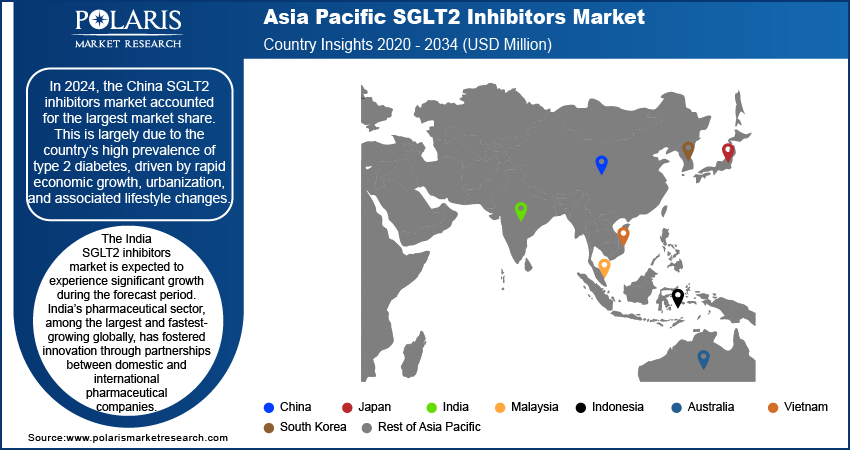

By country, the Asia Pacific SGLT2 inhibitors market report provides market insights into China, Japan, India, Malaysia, South Korea, Indonesia, Australia, Vietnam, and the Rest of Asia Pacific. In 2024, the China SGLT2 inhibitors market accounted for the largest market share. This is largely due to the country’s high prevalence of type 2 diabetes, driven by rapid economic growth, urbanization, and associated lifestyle changes. The shift towards sedentary behavior and increased consumption of high-calorie, processed foods has significantly contributed to rising obesity rates, a major risk factor for type 2 diabetes. Consequently, the growing number of type 2 diabetes cases has led to increased use of SGLT2 inhibitors in China.

The India SGLT2 inhibitors market is expected to experience significant growth during the forecast period. India’s pharmaceutical sector, among the largest and fastest-growing globally, has fostered innovation through partnerships between domestic and international pharmaceutical companies. These collaborations have intensified competition and accelerated advancements in diabetes medication, contributing significantly to the market demand in the country.

Asia Pacific SGLT2 Inhibitors Market – Key Players and Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Asia Pacific SGLT2 inhibitors market grow even more. Market participants are also undertaking a variety of strategic activities to expand their regional footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market environment, market participants must offer innovative solutions.

Manufacturing locally to minimize operational costs is one of the key business tactics used by market players to benefit clients and increase the market sector. In recent years, the Asia Pacific SGLT2 inhibitors market has witnessed several technological advancements. A few of the key players in the market are AstraZeneca; Boehringer Ingelheim International GmbH; Bristol-Myers Squibb Company; Eli Lilly and Company; Glenmark Pharmaceuticals Ltd.; Johnson & Johnson Services, Inc. (Janssen Pharmaceuticals, Inc.); Lexicon Pharmaceuticals, Inc.; Merck & Co., Inc.; Sanofi, Pfizer Inc.; Lupin; and Cipla limited.

Lupin Limited, a pharmaceutical company headquartered in India, specializes in drug discovery, development, and production. Its offerings include branded and generic formulations, biosimilar, over-the-counter and specialty drugs, as well as active pharmaceutical ingredients (APIs). The company focuses on therapeutic areas such as anti-tuberculosis, diabetes management, cardiovascular health, chronic obstructive pulmonary diseases, asthma, gynecology and women's health, central nervous system disorders, oncology, and others. In November 2023, Lupin Limited received tentative approval from the United States Food and Drug Administration for its Abbreviated New Drug Application for Canagliflozin Tablets in 100 mg and 300 mg strengths. This approval allows the company to market a generic equivalent of Invokana tablets.

Cipla Limited is a global pharmaceutical company that manufactures and markets products across various therapeutic areas, including cardiology, HIV, respiratory, oncology, and ophthalmology. The company also emphasizes critical care, infectious diseases, neurology, and women's health. In June 2020, Cipla collaborated with Boehringer Ingelheim to co-market three new oral anti-diabetics drugs: Boravo, Oboravo Met, and Tiptengio.

List of Key Companies in Asia Pacific SGLT2 Inhibitors Market

- AstraZeneca

- Boehringer Ingelheim International GmbH

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- Glenmark Pharmaceuticals Ltd.

- Johnson & Johnson Services, Inc. (Janssen Pharmaceuticals, Inc.)

- Lexicon Pharmaceuticals, Inc.

- Merck & Co., Inc.

- Sanofi

- Pfizer Inc.

- Lupin

- Cipla Limited

Asia Pacific SGLT2 Inhibitors Industry Developments

In January 2024, Jilin Huisheng Biopharmaceutical Co, Ltd. received approval from the China NMPA for the marketing of Ganagliflozin Proline Tablets. The company stated that tablets are indicated for improving blood sugar control in adult patients with type 2 diabetes, either through single use or in combination with metformin hydrochloride.

In February 2023, Zydus Lifesciences Limited received approval from the United States Food and Drug Administration (USFDA) to commercialize Canagliflozin tablets.

Asia Pacific SGLT2 Inhibitors Market Segmentation

By Indication Outlook

- Cardiovascular

- Chronic Kidney Disease (CKD)

- Type 2 Diabetes

- Others

By Drug Outlook

- Farxiga (Dapagliflozin)

- Inpefa (Sotagliflozin)

- Invokana (Canagliflozin)

- Jardiance (Empagliflozin)

- Qtern (Dapagliflozin/Saxagliptin)

- Other SGLT2 Inhibitors

By Distribution Channel Outlook

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

By Country Outlook

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

Asia Pacific SGLT2 Inhibitors Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,824.71 million |

|

Market Size Value in 2025 |

USD 1,970.68 million |

|

Revenue Forecast by 2034 |

USD 3,972.35 million |

|

CAGR |

8.1% from 2025 to 2034 |

|

Base year |

2024 |

|

Historical data |

2020–2023 |

|

Forecast period |

2025–2034 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Country scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The Asia Pacific SGLT2 inhibitors market size was valued at USD 1,824.71 million in 2024 and is anticipated to reach USD 3,972.35 million by 2034.

The market is projected to exhibit a CAGR of 8.1% from 2025 to 2034.

China had the largest market share in 2024.

A few of the key market players are AstraZeneca; Boehringer Ingelheim International GmbH; Bristol-Myers Squibb Company; Eli Lilly and Company; Glenmark Pharmaceuticals Ltd.; Johnson & Johnson Services, Inc. (Janssen Pharmaceuticals, Inc.); Lexicon Pharmaceuticals, Inc.; Merck & Co., Inc.; Sanofi, Pfizer Inc.; Lupin; and Cipla limited.

The type 2 diabetes segment dominated the market in 2024.

The hospital pharmacies segment is projected to witness the fastest growth during the forecast period.