Asia Pacific Cell Culture Market Share, Size, Trends, Industry Analysis Report, By Product; By Consumables (Plates, Flasks, Dishes, Vials, Tubes, Bottles, and Others); By Application; By Country; Segment Forecast, 2018 - 2030

- Published Date:Jul-2023

- Pages: 115

- Format: PDF

- Report ID: PM3540

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

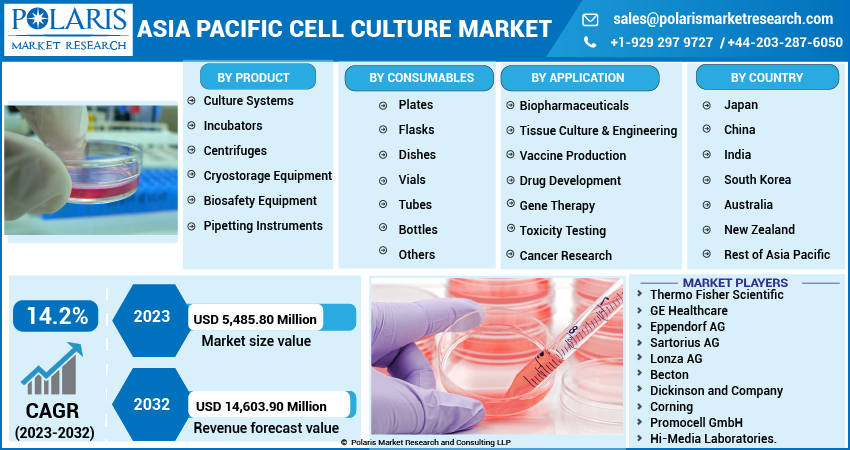

The asia pacific cell culture market was valued at USD 5,034.9 million in 2022 and is expected to grow at a CAGR of 14.2% during the forecast period. The Asia Pacific has emerged as a prominent region in the cell culture market, witnessing significant growth in recent years. The market is driven by increasing investments in life sciences research, the rise in demand for biopharmaceuticals, and advancements in healthcare infrastructure.

The key driver of the cell culture market in the Asia Pacific is the growing focus on research and development activities in life sciences. Governments and private organizations across the region are investing heavily in research initiatives, fostering collaborations with academic institutions and industry players. This has led to numerous research facilities and laboratories with advanced cell culture technologies.

The increasing demand for biopharmaceuticals is also a major contributor to the growth of the asia pacific cell culture market in the region. Asia Pacific countries are witnessing a rise in the prevalence of chronic diseases, an aging population, and an increasing need for advanced therapeutics. Biopharmaceuticals, such as monoclonal antibodies and vaccines, require cell culture techniques for production, driving the demand for cell culture products and technologies.

Moreover, the improving healthcare infrastructure in the Asia Pacific has facilitated the adoption of cell culture techniques. Countries like China, India, and Japan have significantly invested in healthcare facilities, including expanding pharmaceutical manufacturing capabilities. This has created a favorable environment for the growth of the cell culture market, as pharmaceutical companies in the region increasingly rely on cell culture for drug discovery, development, and production.

The market was affected the COVID-19 pandemic due to the disruptions caused by lockdowns, travel restrictions, and supply chain challenges that impacted research activities and the production of biopharmaceuticals. However, the market also experienced an increased demand for cell culture-based testing, vaccine development, and antibody production. The overall impact was a mixed scenario with temporary setbacks and opportunities arising from the pandemic response.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

Technological advancements have paved the way for developing more sophisticated and efficient cell culture techniques and products. These advancements include serum-free and chemically defined media formulations, three-dimensional (3D) cell culture systems, and advanced bioreactor technologies.

Serum-free and chemically defined media formulations have gained popularity in the region due to their advantages over traditional serum-containing media, such as improved reproducibility, reduced risk of contamination, and better control over cell culture conditions. These media formulations provide a more defined environment for cell growth and are particularly valuable for the production of biopharmaceuticals, where consistency and quality are critical.

The adoption of 3D cell culture systems is also expanding in the region. 3D cell cultures better mimic the in vivo microenvironment and offer advantages in cell behavior, drug discovery, and tissue engineering applications. They allow for more accurate evaluation of drug efficacy and toxicity, making them valuable tools for preclinical research.

Furthermore, advanced bioreactor technologies are gaining traction in the market. Bioreactors provide controlled and scalable environments for cell culture, enabling the production of large quantities of cells or biopharmaceuticals. These technologies facilitate process optimization, increased productivity, and enhanced product quality, making them valuable for commercial-scale cell culture operations.

Report Segmentation

The market is primarily segmented based on product, consumables, application, and country.

|

By Product |

By Consumables |

By Application |

By Country |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Culture Systems had the highest revenue share in 2022

Culture Systems has emerged as the market leader, capturing the highest revenue share 2022. The company's success can be attributed to its robust portfolio of cell culture products and solutions and its strong presence and distribution network across the region.

Culture Systems' offerings are known for their high quality, reliability, and innovative features, meeting the diverse needs of researchers, biopharmaceutical companies, and academic institutions. With a customer-centric approach and continuous focus on product development and customer support, Culture Systems has established itself as a trusted and preferred partner in the region's rapidly growing cell culture market.

The plate segment dominated the market in 2022

In 2022, Plates emerged as the dominant player in the market, capturing the largest market share. The company's success can be attributed to its superior range of cell culture products, including plates specifically designed for diverse research and biopharmaceutical applications. Plates' products are known for their high quality, reliability, and ability to provide optimal cell growth conditions. With a strong market presence and effective distribution network in the Asia Pacific region, Plates has successfully met the growing demand for cell culture solutions and established itself as the preferred choice among researchers and biotech companies.

China dominated the Asia pacific cell culture market in 2022

In 2022, China emerged as the dominant force in the market, capturing the largest market share. The country's strong market position can be attributed to several factors. Firstly, China has witnessed significant growth in its biopharmaceutical industry, leading to increased demand for cell culture products. Additionally, the country has made substantial investments in research and development, fostering innovation and driving the adoption of cell culture technologies. Furthermore, China's large population and expanding healthcare sector have contributed to the growth of the cell culture market. With its robust infrastructure, skilled workforce, and supportive government initiatives, China has positioned itself as a key player in the market.

Competitive Insight

Some of the major players operating in the Asian market include China, India, Japan, South Korea, Indonesia, Malaysia, Singapore, Taiwan, Thailand, Philippines, Vietnam, Rest of Asia Pacific.

Recent Developments

- In October 2021, Thermo Fisher Scientific introduced the Gibco Cell Therapy Systems (CTS) NK-Xpander Medium. This medium is designed to support the growth and culture of functional natural killer (NK) cells on a large scale. It provides an optimized environment for NK cell expansion, enabling researchers and manufacturers to meet the increasing demand for NK cell-based therapies in cell therapy and immunotherapy applications

Asia Pacific Cell Culture Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 5,485.80 million |

|

Revenue forecast in 2030 |

USD 14,603.90 million |

|

CAGR |

14.2% from 2018 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2021 |

|

Forecast period |

2018 – 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2018 to 2030 |

|

Segments Covered |

By Product, By Consumables, By Application, By Region |

|

Country scope |

Japan, China, India, South Korea, Australia, New Zealand, Rest of Asia Pacific |

|

Key Companies |

China, India, Japan, South Korea, Indonesia, Malaysia, Singapore, Taiwan, Thailand, Philippines, Vietnam, Rest of Asia Pacific |

FAQ's

key companies in asia pacific cell culture market are China, India, Japan, South Korea, Indonesia, Malaysia, Singapore

The asia pacific cell culture market is expected to grow at a CAGR of 14.2% during the forecast period.

The asia pacific cell culture market report covering key segments are product, consumables, application, and country.

key driving factors in asia pacific cell culture market are Increasing Demand For Cell Culture Technology In Vaccine Production.

The asia pacific cell culture market size is expected to reach USD 14,603.90 million by 2030.