Aseptic Carton Packaging Market Size, Share, Trends, Industry Analysis Report: By Packaging (Standard, Slim, and Square), Material, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 116

- Format: PDF

- Report ID: PM5171

- Base Year: 2024

- Historical Data: 2020-2023

Aseptic Carton Packaging Market Overview

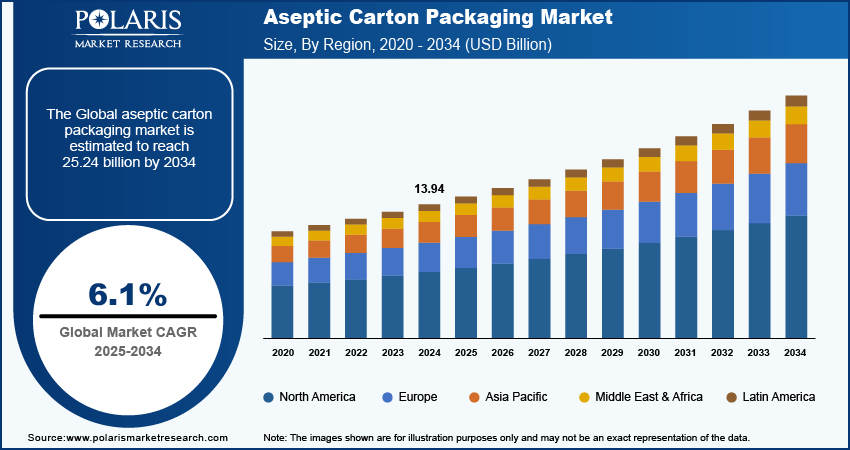

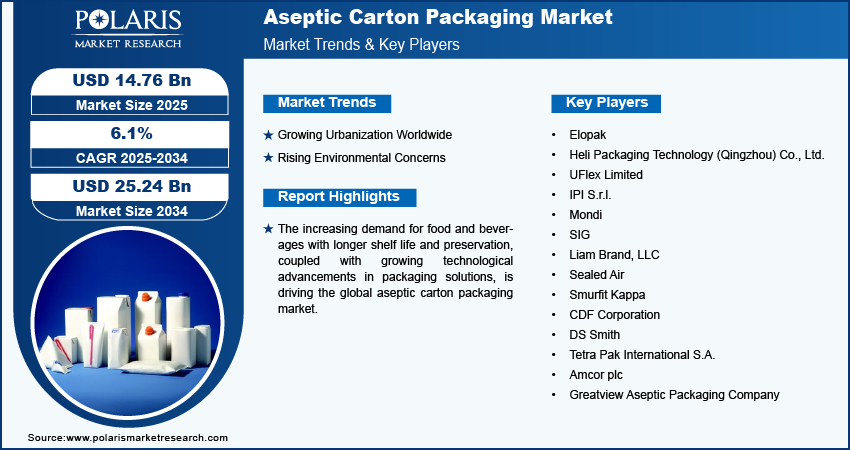

The aseptic carton packaging market size was valued at USD 13.94 billion in 2024. The market is projected to grow from USD 14.76 billion in 2025 to USD 25.24 billion by 2034, exhibiting a CAGR of 6.1% during the forecast period.

Aseptic carton packaging is a modern and sustainable method of packaging that has gained significant traction in various industries, such as food, beverages, and pharmaceuticals. This packaging technique involves filling commercially sterile products into sterile containers under aseptic conditions, which are then sealed to prevent contamination. This method helps extend the shelf life of products but also eliminates the need for preservatives and refrigeration, catering to the growing demand for healthier food options among consumers.

The increasing demand for longer shelf life and preservation of food and beverages is driving the global aseptic carton packaging market. Aseptic packaging allows products to be stored for months or even years without refrigeration, making it ideal for items such as juice, milk, and soups. This capability appeals to health-conscious consumers who prioritize longer shelf-life products.

To Understand More About this Research: Request a Free Sample Report

The aseptic carton packaging market growth is driven by rising advancements in technology. Advancements in filling technology and packaging machinery increase production efficiency, allowing manufacturers to scale up the production of aseptic cartons while reducing costs. In November 2021, SIG, an innovation and technology aseptic carton packaging company, unveiled SIG NEO, a major innovation in filling technology that can pack 18,000 cartons packs per hour.

Aseptic Carton Packaging Market Driver Analysis

Growing Urbanization Worldwide

Urban populations tend to be more aware of food safety issues, which drives the demand for packaging that ensures product integrity. Aseptic carton packaging provides a sterile environment that protects food and beverages from contamination, addressing safety concerns and enhancing consumer confidence. Furthermore, urban areas have a variety of retail formats, including convenience stores and smaller grocery outlets, which do not have extensive refrigeration capabilities. Aseptic cartons are an excellent solution for these retailers, as they allow for the sale of perishable products without the need for refrigeration. As per a report published by the United Nations, 55% of the world's population lives in urban areas, and is expected to increase to 68% by 2050. Therefore, growing urbanization worldwide propels the global aseptic carton packaging market growth.

Rising Environmental Concerns

There are rising environmental concerns among consumers, businesses, and governments across the world. Aseptic cartons are often made from renewable resources, such as paperboard, which appeals to environmentally conscious consumers looking for sustainable packaging options. Furthermore, many aseptic cartons are designed to be recyclable, which attracts consumers and companies committed to reducing landfill waste and promoting a circular economy. Therefore, rising environmental concerns fuel the global aseptic carton packaging market growth.

Aseptic Carton Packaging Market Segment Insights

Aseptic Carton Packaging Market Breakdown by Material Insights

Based on material, the aseptic carton packaging market is segmented into plastic, metal, glass, paper & paperboard, and others. The plastic segment accounted for a major market share in 2024 due to its versatility, lightweight nature, and cost-effectiveness. Manufacturers favor plastic for its ability to form a robust barrier against moisture, oxygen, and light, which enhances product shelf life. Additionally, advancements in plastic technology have led to the development of recyclable and biodegradable options, appealing to environmentally conscious consumers. The convenience of plastic packaging, which allows for easy handling and transportation, further contributes to its demand in the market. Brands in the food & beverage sector increasingly adopt plastic for its customization potential, enabling them to meet diverse consumer preferences and packaging requirements.

The paper & paperboard segment is expected to grow at a robust pace in the coming years owing to rising environmental concerns and increasing consumer demand for sustainable packaging solutions. Paper and paperboard packaging offer recyclability and biodegradability, aligning with the trend toward sustainability. Additionally, innovations in coating technologies enhance the performance of these materials, allowing them to compete effectively with plastic in terms of durability and moisture resistance. This shift toward sustainable practices is expected to position paper and paperboard as a key segment of the packaging industry in the future, attracting brands and consumers who prioritize environmental responsibility.

Aseptic Carton Packaging Market Breakdown by Application Insights

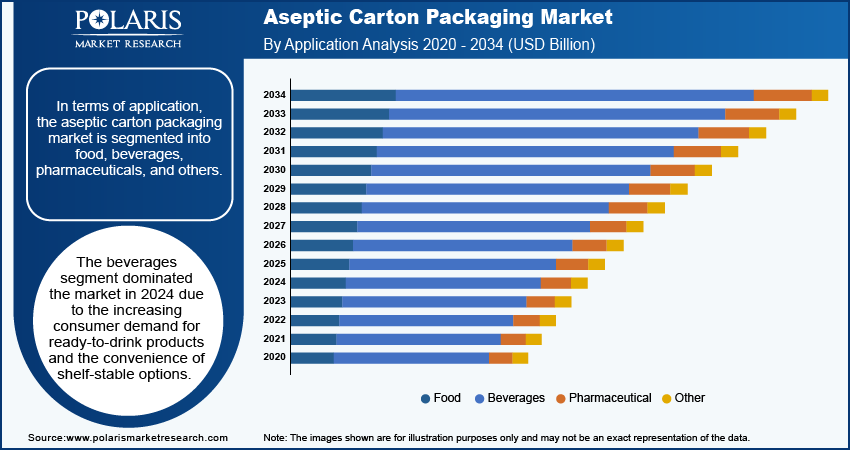

In terms of application, the aseptic carton packaging market is segmented into food, beverages, pharmaceuticals, and others. The beverages segment dominated the market in 2024 due to the increasing consumer demand for ready-to-drink products and the convenience of shelf-stable options. The growth of health-conscious trends has also contributed to this segment's dominance, as manufacturers introduce a wide range of functional drinks, including juices, smoothies, and plant-based beverages. Producers of these products are utilizing aseptic carton packaging solutions to preserve freshness and quality. Additionally, the rise in the adoption of e-commerce and retail channels for beverages has fueled the demand for aseptic carton packaging, as consumers easily buy a variety of packaged products with extended shelf life from such online platforms.

The food segment is projected to grow at a rapid pace during the forecast period owing to changing eating habits and an increasing focus on convenient meal options. Manufacturers are turning to aseptic packaging solutions that ensure product safety and freshness as consumers seek quick and easy meals without compromising on quality. Moreover, innovations in packaging technology are enhancing the preservation of flavors and nutrients, making these packaged food products more appealing.

Aseptic Carton Packaging Market Regional Insights

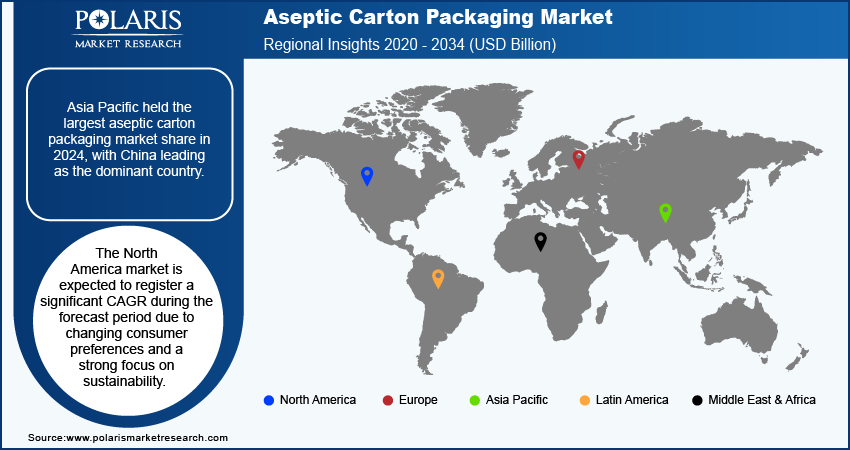

By region, the study provides the aseptic carton packaging market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific held the largest market share in 2024, with China leading as the dominant country. Consumers in the country prefer ready-to-eat meals and packaged beverages due to their busy lifestyles, prompting manufacturers to innovate and invest in advanced packaging solutions such as aseptic packaging. Additionally, the rise of e-commerce platforms facilitates access to a wide variety of products, further boosting market growth. The rising emphasis on food safety and quality also plays a significant role, as consumers seek products that ensure freshness and safety over extended periods.

The North America aseptic carton packaging market is expected to register a significant CAGR during the forecast period due to changing consumer preferences fo packaged beverages and a strong focus on sustainability. Brands in the region are increasingly adopting aseptic packaging that reduces waste and enhances product shelf life, aligning with the trend toward healthier and more convenient food options. The popularity of organic and plant-based products further supports the growth of aseptic carton packaging market in the region as manufacturers seek effective packaging solutions that maintain product integrity.

Aseptic Carton Packaging Market – Key Players and Competitive Insights

Major market players are investing heavily in research and development to expand their offerings, which will help the aseptic carton packaging market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments such as innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The aseptic carton packaging market is fragmented, with the presence of numerous global and regional market players. A few major players in the market are Elopak; Heli Packaging Technology (Qingzhou) Co., Ltd.; UFlex Limited; IPI S.r.l.; Mondi; SIG; Liam Brand, LLC; Sealed Air; Smurfit Kappa; CDF Corporation; DS Smith; Tetra Pak International S.A.; Amcor plc; and Greatview Aseptic Packaging Company.

Greatview Aseptic Packaging Company, founded in 2003 and headquartered in China, is a player in the aseptic carton packaging industry. It is recognized for its innovative solutions that cater to the growing demand for safe, sustainable, and efficient packaging for liquid food products. Greatview has established itself as a major player in the production of aseptic packaging materials, offering a wide range of products designed to meet the needs of various sectors, including dairy, beverages, and ready-to-eat meals. The company’s commitment to quality and sustainability is evident in its advanced manufacturing processes and its focus on developing environmentally friendly packaging solutions.

Elopak, established in Norway in 1957, is a global supplier of carton packaging solutions specializing in aseptic carton packaging for liquid food products. The company has evolved into a significant player in the packaging industry, known for its commitment to sustainability and innovation. Elopak’s flagship product, the Pure-Pak carton, represents a natural and environmentally friendly alternative to plastic bottles, aligning with the increasing consumer demand for sustainable packaging options. The company's operations span over 70 countries, with a robust production network that includes multiple manufacturing units across Europe and beyond. In May 2022, Elopak announced the market rollout of the Pure-Pak eSense carton: a more environmentally friendly aseptic carton made without an aluminum layer.

Key Companies in Aseptic Carton Packaging Market

- Elopak

- Heli Packaging Technology (Qingzhou) Co., Ltd.

- UFlex Limited

- IPI S.r.l.

- Mondi

- SIG

- Liam Brand, LLC

- Sealed Air

- Smurfit Kappa

- CDF Corporation

- DS Smith

- Tetra Pak International S.A.

- Amcor plc

- Greatview Aseptic Packaging Company

Aseptic Carton Packaging Industry Developments

October 2024: UFlex Limited, a flexible packaging company that manufactures and exports a wide range of packaging products and solutions, announced that its wholly owned subsidiary, Flex Asepto SAE, has decided to set up an Aseptic Packaging facility in Egypt.

October 2023: SIG, a provider of innovative and versatile packaging solutions, introduced SIG DomeMini, an aseptic carton pack for enhanced recycling and portability.

November 2021: SIG announced the launch of Combivita, a new family-size aseptic carton pack.

Aseptic Carton Packaging Market Segmentation

By Packaging Outlook (Revenue, USD Billion, 2020–2034)

- Standard

- Slim

- Square

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Plastic

- Metal

- Glass

- Paper & Paperboard

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Food

- Processed Food

- Dairy Food

- Fruits and Vegetables

- Beverages

- Ready-to-Drink Beverages

- Dairy Based Beverages

- Pharmaceutical

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Aseptic Carton Packaging Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 13.94 billion |

|

Market Size Value in 2025 |

USD 14.76 billion |

|

Revenue Forecast by 2034 |

USD 25.24 billion |

|

CAGR |

6.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global aseptic carton packaging market size was valued at USD 13.94 billion in 2024 and is projected to grow to USD 25.24 billion by 2034.

The global market is projected to record a CAGR of 6.1% during the forecast period.

Asia Pacific accounted for the largest share of the global market in 2024.

A few key players in the market are Elopak; Heli Packaging Technology (Qingzhou) Co., Ltd.; UFlex Limited; IPI S.r.l.; Mondi; SIG; Liam Brand, LLC; Sealed Air; Smurfit Kappa; CDF Corporation; DS Smith; Tetra Pak International S.A.; Amcor plc; and Greatview Aseptic Packaging Company.

The paper & paperboard segment is projected for significant growth in the global market during 2025–2034.

The beverages segment dominated the market in 2024.