Artificial Tendons and Ligaments Market Size, Share, Trends, Industry Analysis Report: By Application, End Use (Hospitals and Outpatient Facilities), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast 2025–2034

- Published Date:Nov-2024

- Pages: 128

- Format: PDF

- Report ID: PM5234

- Base Year: 2024

- Historical Data: 2020-2023

Artificial Tendons and Ligaments Market Overview

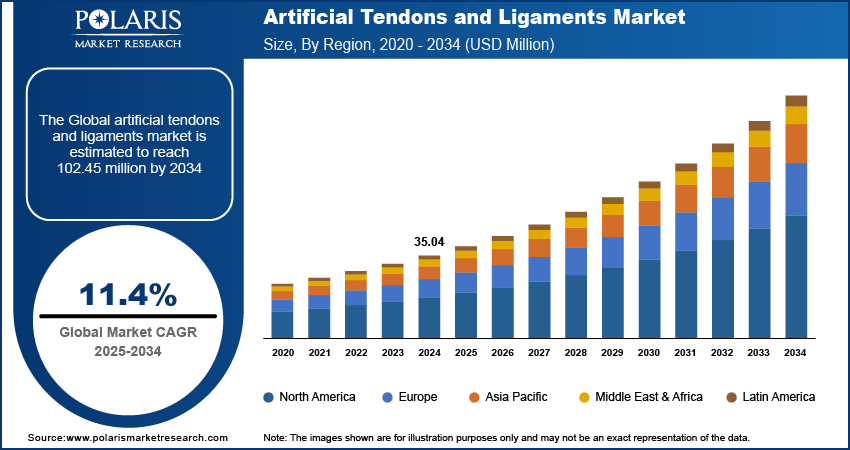

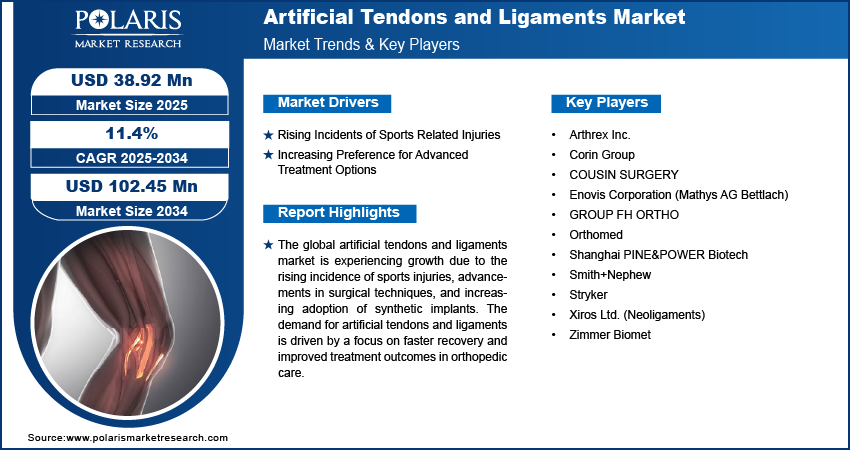

The artificial tendons and ligaments market size was valued at USD 35.04 million in 2024. The market is projected to grow from USD 38.92 million in 2025 to USD 102.45 million by 2034, exhibiting a CAGR of 11.4% during the forecast period.

Artificial tendons and ligaments are synthetic or bioengineered materials designed to replace or support damaged natural tendons and ligaments in the body. They aim to restore function and stability to joints and musculoskeletal structures.

The artificial tendons and ligaments market is growing due to the rising number of sports injury cases and the increasing geriatric population. Innovations in biomaterials and tissue engineering techniques have improved the effectiveness and biocompatibility of artificial tendons and ligaments. Additionally, the growing trend of minimally invasive procedures is propelling the demand for artificial tendons and ligaments, as they offer improved recovery times and reduced post-operative complications. Furthermore, rising healthcare expenditure and increasing awareness about sports medicine are expected to contribute to the market expansion in the coming years. Overall, the artificial tendons and ligaments market is balanced for substantial growth as technological advancements continue to reshape orthopedic implants.

To Understand More About this Research: Request a Free Sample Report

Artificial Tendons and Ligaments Market Driver Analysis

Rising Incidents of Sports Related Injuries

As more individuals engage in recreational and professional sports activities, the likelihood of injuries such as ligament tears, tendon ruptures, and joint damage has increased. Thus, there is a growing demand for effective surgical solutions that can restore functionality and enable faster recovery. Additionally, advancements in medical technology such as biomaterials development, 3D printing of customized implants, tissue engineering, and minimally invasive surgical techniques have led to the development of more durable and biocompatible materials, which are being increasingly used in the repair of damaged tendons and ligaments. Therefore, the combined factors of higher sports injury rates and improved treatment approaches drive the artificial tendons and ligaments market growth.

Increasing Preference for Advanced Treatment Options

The advanced treatments promise quicker recovery times and improved outcomes. Thus, patients prefer advanced treatment options owing to the rising awareness of advanced technologies. Innovations such as bioengineered platforms and minimally invasive surgical techniques are becoming more attractive. Additionally, the focus on patient education boosts demand for artificial tendons and ligaments, as advised patients are more likely to choose advanced options over traditional methods in orthopedic care. For instance, in January 2024, Arthrex launched TheNanoExperience.com. This website showcases the science and benefits of Nano arthroscopy, a modern, minimally invasive orthopedic procedure that could facilitate a speedy return to activity with reduced pain.

Artificial Tendons and Ligaments Market Segment Insights

Artificial Tendons & Ligaments Market Breakdown by Application Outlook

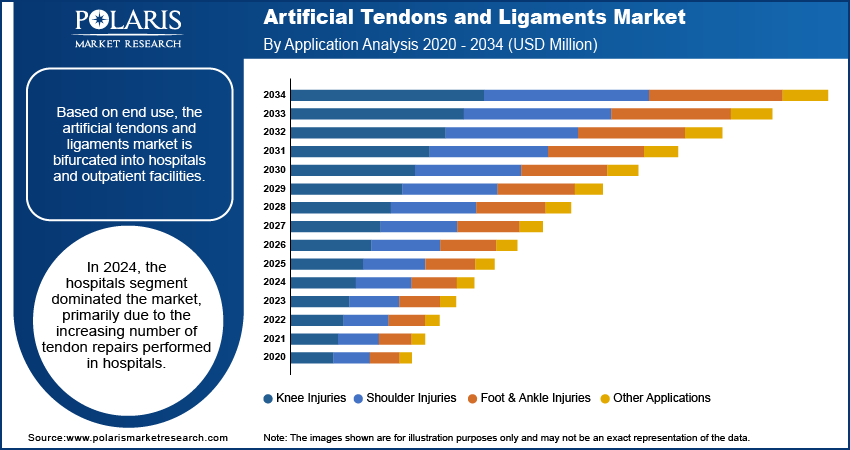

The global artificial tendons and ligaments market, based on application, is segmented into knee injuries, shoulder injuries, foot & ankle injuries, and other applications. In 2024, the knee injuries segment accounted for the largest market share, primarily due to the increasing incidence of anterior cruciate ligament (ACL) injuries. ACL injuries are common among athletes and active individuals, resulting from sudden stops, jumps, or changes in direction during sports. Consequently, advancements in medical technology have improved the success rates of knee surgeries, further fueling market growth for this segment.

Artificial Tendons and Ligaments Market Breakdown by End Use Outlook

The global artificial tendons and ligaments market, based on end use, is segmented into hospitals and outpatient facilities. In 2024, the hospital segment dominated the market due to the increased number of tendon repairs performed in hospitals. Moreover, hospitals have equipped equipment and specialized healthcare professionals, which motivates people to perform artificial tendon and ligament surgeries in hospitals, thereby contributing to the segment's dominant position.

The outpatient facilities segment is expected to experience the fastest growth in this market during the forecast period, driven by the rising adoption of minimally invasive surgical procedures for tendons and ligament repairs. These innovative techniques reduce recovery times and facilitate a higher volume of outpatient surgeries. Furthermore, as healthcare providers increasingly prioritize patient convenience and cost-effectiveness, the shift toward outpatient procedures is anticipated to improve access to treatment while relieving the burden on hospital resources.

Artificial Tendons and Ligaments Market Breakdown by Regional Outlook

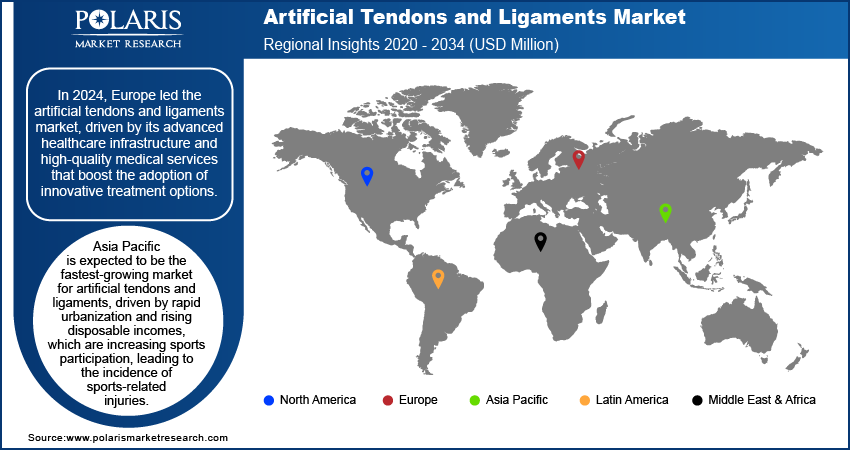

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Europe dominated the artificial tendons and ligaments market due to its robust healthcare infrastructure and superior medical service standards. Europe has a strong network of research institutions and universities that promote the development of advanced medical technologies, including artificial tendons and ligaments. Furthermore, the increasing incidence of sports-related injuries and a growing aging population in Europe contribute to the demand for these advanced medical solutions. The European Commission published its fifth Eurobarometer report on sports and physical activity. The data indicates that 38% of Europeans participate in sports or exercise at least weekly, while 17% engage in physical activity with less frequency. This highlights a significant ongoing necessity for initiatives aimed at improving sports participation and physical activity throughout Europe. Concurrently, these dynamics have positioned Europe as a leader in the market for artificial tendons and ligaments, establishing it as a center for innovation and accessibility in treatment solutions.

Asia Pacific is projected to be the fastest-growing market for artificial tendons and ligaments due to rapid urbanization and increasing disposable incomes, which are leading to a rise in sports participation, consequently boosting the incidence of sports-related injuries. Additionally, advancements in healthcare infrastructure and the adoption of minimally invasive surgical techniques are improving access to treatment options. This convergence of trends positions Asia Pacific for significant growth in this market.

Artificial Tendons & Ligaments Market – Key Players and Competitive Insights

The competitive landscape of the artificial tendons and ligaments market is shaped by global leaders and emerging regional players aiming to capture market share. Leading companies such as Smith & Nephew and Stryker focus on product innovation, leveraging their robust R&D capabilities and extensive distribution networks to offer advanced solutions for tendons and ligament repair. These industry leaders prioritize improving the efficiency, portability, and affordability of their products to meet evolving healthcare demands. Additionally, smaller regional players are innovating with specialized products tailored for local markets, employing strategies such as collaborations with healthcare providers and expansions into emerging economies. Common competitive strategies in the artificial tendons and ligaments market include mergers, acquisitions, and partnerships with healthcare facilities to improve market reach and product offerings. A few major players are COUSIN SURGERY, Smith+Nephew, Zimmer Biomet, Xiros Ltd. (Neoligaments), Orthomed, Shanghai PINE&POWER Biotech, Arthrex Inc., Corin Group, Enovis Corporation (Mathys AG Bettlach), Stryker, and GROUP FH ORTHO.

Smith+Nephew, headquartered in Watford, England, focuses on medical technology solutions for the repair and treatment of soft and hard tissues. It is divided into three primary business segments—orthopedics, sports medicine and ENT, and advanced wound management. In March 2023, the company introduced the UltraTRAC QUAD ACL Reconstruction Technique, featuring a combination of innovative tools such as Quadtrac Quadriceps Tendons Harvest Guide System, the Ultrabutton Adjustable Fixation Devices, X-WING Graft Preparation System, and X-WING Graft Preparation System. This technique offers a wide approach to ACL reconstruction, providing surgeons with diverse options to cater to different graft preferences effectively.

Stryker, based in Michigan, US, specializes in medical technology and provides advanced products and services across MedSurg, neurotechnology, orthopedics, and spine to enhance patient care and healthcare outcomes. In July 2024, Stryker finalized its acquisition of Artelon, a private company known for its innovative soft tissue fixation products used in foot, ankle, and sports medicine procedures.

Key Companies in the Artificial Tendons and Ligaments Market

- Arthrex Inc.

- Corin Group

- COUSIN SURGERY

- Enovis Corporation (Mathys AG Bettlach)

- GROUP FH ORTHO

- Orthomed

- Shanghai PINE&POWER Biotech

- Smith+Nephew

- Stryker

- Xiros Ltd. (Neoligaments)

- Zimmer Biomet

Artificial Tendons and Ligaments Market Developments

In April 2022, The CoNextions TR Tendons Repair System received FDA 510(k) clearance, marking a significant advancement in treating tendon lacerations in the hand, wrist, and forearm. This innovative system offers a stronger, quicker, and smoother repair process compared to traditional suture methods.

Artificial Tendons and Ligaments Market Segmentation

By Application Outlook (Revenue, USD Million, 2020–2034)

- Knee Injuries

- Shoulder Injuries

- Foot & Ankle Injuries

- Other Applications

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Hospitals

- Outpatient Facilities

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Artificial Tendons and Ligaments Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 35.04 million |

|

Market Size Value in 2025 |

USD 38.92 million |

|

Revenue Forecast by 2034 |

USD 102.45 million |

|

CAGR |

11.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global artificial tendons and ligaments market size was valued at USD 35.04 million in 2024 and is projected to grow to USD 102.45 million by 2034.

The global market is projected to register a CAGR of 11.4% during the forecast period.

In 2024, Europe held the largest share of the market due to the presence of advanced healthcare infrastructure and a high standard of medical services that promote the adoption of innovative treatment options.

A few key players in the market are COUSIN SURGERY, Smith+Nephew, Zimmer Biomet, Xiros Ltd. (Neoligaments), Orthomed, Shanghai PINE&POWER Biotech, Arthrex Inc., Corin Group, Enovis Corporation (Mathys AG Bettlach), Stryker, and GROUP FH ORTHO.

In 2024, the knee injuries segment led the market due to the increasing incidence of anterior cruciate ligament (ACL) related injuries.

The outpatient facilities segment is expected to grow at a higher rate in this market, driven by the rising adoption of minimally invasive surgical procedures for tendons and ligament repairs.