Arthroscopy Market Size, Share, Trends, Industry Analysis Report: By Product, Application (Knee, Shoulder, Foot & Ankle, Hip, Hand & Wrist, Sports Injuries, and Elbow), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 128

- Format: PDF

- Report ID: PM5281

- Base Year: 2024

- Historical Data: 2020-2023

Arthroscopy Market Overview

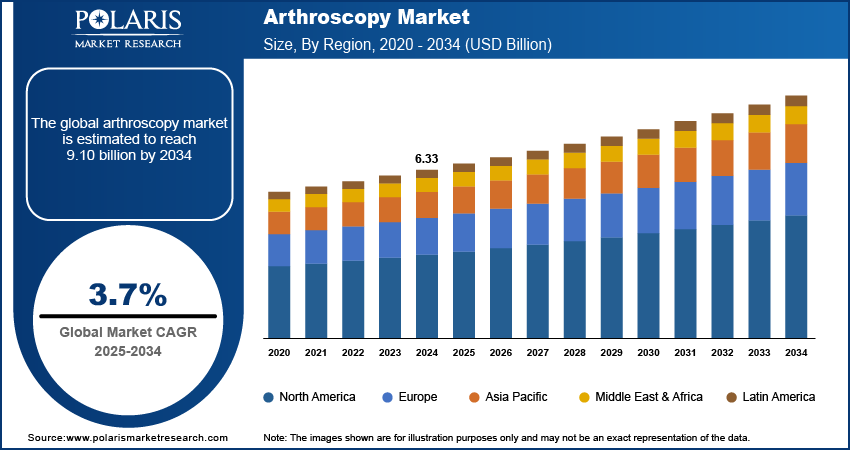

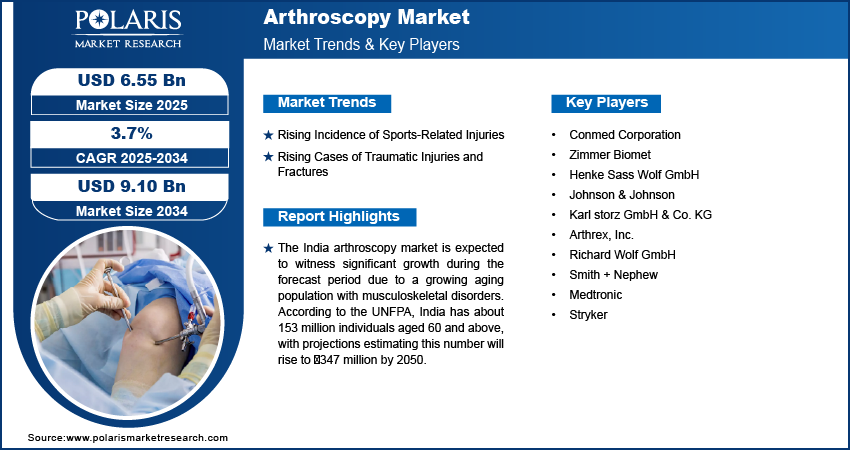

The arthroscopy market size was valued at USD 6.33 billion in 2024. The market is projected to grow from USD 6.55 billion in 2025 to USD 9.10 billion by 2034, exhibiting a CAGR of 3.7% during 2025–2034.

Arthroscopy is a minimally invasive surgical procedure used to diagnose and treat joint problems. In this procedure, a surgeon makes a small incision and inserts a thin, flexible tube with a camera, called an arthroscope, into the joint. The camera projects images of the inside of the joint onto a monitor, allowing the surgeon to view the joint’s structures (such as cartilage, ligaments, and other tissues) in detail. Arthroscopy enables precise examination, diagnosis, and sometimes the treatment of joint issues, such as tears, inflammation, or damage, avoiding the need for a large incision. Increased incidence of obesity is driving demand for arthroscopy. Obesity elevates the risk of joint degeneration and injuries, especially in weight-bearing joints such as knees and hips, leading to a higher likelihood of arthritis and joint issues that require arthroscopic intervention. Furthermore, the preference for minimally invasive surgeries is fueling the arthroscopy market demand, as patients and healthcare providers increasingly favor arthroscopy over traditional open surgeries. The smaller incisions and reduced trauma of arthroscopy result in faster recovery, lower infection rates, and shorter hospital stays, enhancing its appeal and expanding market share.

Advancements in arthroscopic technology are driving the arthroscopy market growth, with innovations such as high-definition cameras, 3D imaging systems, and advanced surgical tools enhancing precision and effectiveness. Moreover, rising awareness and accessibility are supporting global arthroscopy market expansion, as increasing knowledge of arthroscopic benefits drives demand for joint pain management and injury treatment. Expanding healthcare infrastructure in developing regions further contributes to the market growth.

To Understand More About this Research: Request a Free Sample Report

Arthroscopy Market Trend Analysis

Rising Incidence of Sports-Related Injuries

The growing popularity of sports and recreational activities can lead to the rising incidence of joint-related injuries, especially among younger, active individuals. According to Johns Hopkins, in the US, ∼30 million children and teens participate in organized sports, leading to over 3.5 million annual injury cases that result in lost participation time. Notably, nearly one-third of all childhood injury cases are sports-related, underscoring the significant injury risk associated with sports activities. Common injuries related to ligaments, cartilage, and tendons are frequently treated with arthroscopy. Therefore, the rising incidence of sports-related injuries is driving the arthroscopy market demand.

Rising Cases of Traumatic Injuries and Fractures

Increasing cases of traumatic injuries and fractures from accidents, falls, and other incidents are fueling demand for arthroscopy. In 2022, data from the Insurance Institute for Highway Safety (IIHS) revealed that the US recorded a total of 42,514 fatalities attributed to motor vehicle collisions. The data shows a mortality rate of 12.8 deaths per 100,000 populations and an incidence rate of 1.33 fatalities per 100 million vehicle miles traveled. Arthroscopic surgery effectively addresses joint damage, fractures, and soft tissue injuries by repairing ligaments, removing loose fragments, and stabilizing joints, driving market growth in emergency and trauma care.

Arthroscopy Market Segment Insights

Arthroscopy Market Assessment by Application Outlook

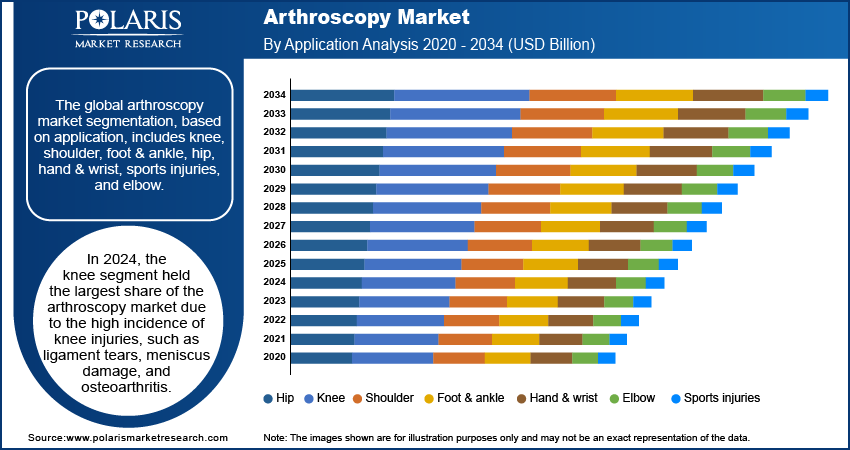

The global arthroscopy market segmentation, based on application, includes knee, shoulder, foot & ankle, hip, hand & wrist, sports injuries, and elbow. In 2024, the knee segment held the largest share of the arthroscopy market due to the high incidence of knee injuries, such as ligament tears, meniscus damage, and osteoarthritis. Knee arthroscopy is commonly used for diagnostic and therapeutic purposes, offering minimally invasive solutions that lead to quicker recovery times and improved outcomes. The increasing incidence of sports-related knee injuries and the aging population with degenerative knee conditions further contribute to the dominant market share of the knee segment.

Arthroscopy Market Evaluation by Product Outlook

The global arthroscopy market segmentation, based on product, includes visualization systems, ablation systems, powered shaver systems, arthroscopes, fluid management systems, arthroscopy implants, accessories, and disposables. The visualization systems segment is expected to witness the highest CAGR during the forecast period due to advancements in imaging technologies, such as high-definition cameras, 3D visualization systems, and enhanced lighting techniques. These innovations improve the clarity, precision, and real-time feedback during arthroscopic procedures, leading to better surgical outcomes, shorter recovery times, and increased patient safety. As a result, healthcare providers are increasingly adopting advanced visualization systems.

Arthroscopy Market Regional Analysis

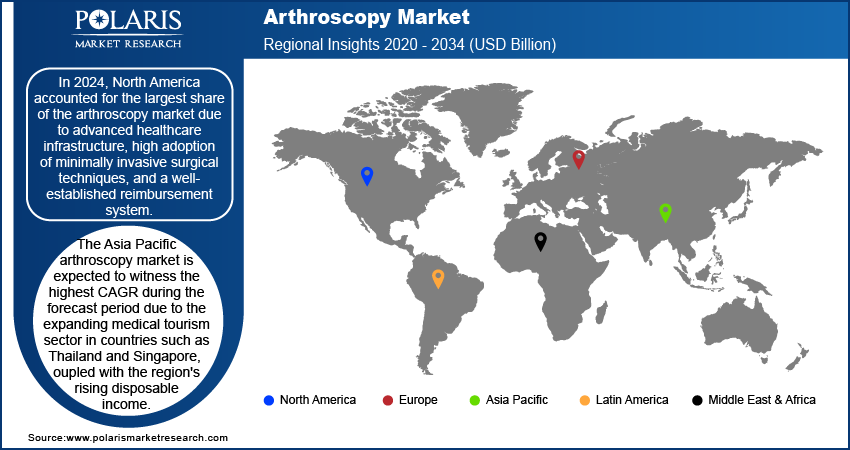

By region, the study provides arthroscopy market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest share of the arthroscopy market revenue due to advanced healthcare infrastructure, high adoption of minimally invasive surgical techniques, and a well-established reimbursement system. In January 2023, Arthrex launched TheNanoExperience.com, a resource focusing on nano arthroscopy, an advanced, minimally invasive orthopedic technique. The regional market growth is also attributed to a large number of sports-related injury cases, an aging population with musculoskeletal disorders, and increasing awareness of arthroscopic procedures. Additionally, North America’s strong focus on research and development, along with technological innovations in arthroscopy, further contributes to its dominant market share.

The US accounted for the largest arthroscopy market share in 2023 due to the presence of major players in the country. A few of the major market players are Stryker Corporation; Arthrex, Inc.; and Medtronic PLC. The presence of such key players in the country leads the way in innovation and product offerings, solidifying the US market's dominance.

The Asia Pacific arthroscopy market is expected to witness the highest CAGR during the forecast period. The expanding medical tourism sector in countries such as Thailand and Singapore, coupled with the region's rising disposable income, is fueling demand for arthroscopic procedures. The increasing prevalence of obesity, which often leads to joint degeneration and related issues, is also a significant factor. Additionally, rising awareness of minimally invasive surgeries and increasing incidence of sports-related injuries are driving the regional market growth.

The India arthroscopy market is expected to witness significant growth during the forecast period due to a growing aging population with musculoskeletal disorders. According to the UNFPA, India has about 153 million individuals aged 60 and above, with projections estimating this number will rise to ∼347 million by 2050.

Arthroscopy Market – Key Players and Competitive Analysis Report

The competitive landscape of the arthroscopy market is characterized by key strategies such as mergers and acquisitions, collaborations, and continuous technological advancements. Major companies in the market, including Stryker Corporation, Arthrex Inc., and Zimmer Biomet, are focusing on expanding their product portfolios and enhancing their market presence through strategic acquisitions.

Collaborations between industry leaders and medical institutions are contributing to the development of innovative arthroscopic technologies. Partnerships often focus on integrating advanced technologies such as 4K imaging systems, AI-driven surgical tools, and 3D visualization, which improve the precision and success rates of arthroscopic procedures.

The arthroscopic market is witnessing a surge in research and development efforts to introduce more cost-effective and user-friendly products. Technological advancements, such as enhanced imaging systems and minimally invasive instruments, are significantly improving the efficiency of arthroscopic surgeries, leading to faster recovery times and lower complication rates. This has sparked increased competition as companies strive to offer the most innovative and effective solutions to meet the growing demand for arthroscopy across various regions. Conmed Corporation; Zimmer Biomet; Henke Sass Wolf GmbH; Johnson & Johnson; Karl Storz GmbH & Co. KG; Arthrex, Inc.; Richard Wolf GmbH; Smith + Nephew; Medtronic; Stryker are among the major market players.

Stryker, a medical technology company, specializes in providing a wide range of healthcare solutions. The company manufactures orthopedic implants, surgical equipment, surgical navigation systems, neurotechnology, and spine products and also provides associated services. Stryker extensive product line includes patient handling equipment, intensive care disposable products, emergency medical equipment, communication devices, and endoscopic systems. In addition to this, Stryker offers neurovascular and spinal devices, neurosurgical equipment, and medical equipment for various medical conditions. In August 2024, Stryker agreed to acquire Vertos Medical Inc., a private company focused on minimally invasive treatments for chronic lower back pain from lumbar spinal stenosis. This acquisition aims to expand Stryker's spinal therapy portfolio.

Johnson & Johnson Services, Inc. is a multinational corporation based in New Brunswick, New Jersey, USA. The company operates through pharmaceuticals, medical devices, and consumer health products operations. The company's subsidiary, Janssen Pharmaceuticals, Inc., develops and markets drugs in various therapeutic areas, including neuroscience, oncology, infectious diseases, and immunology. Janssen Pharmaceuticals, Inc. is creating many well-known drugs, such as Risperdal (risperidone), Remicade (infliximab), and Zytiga (abiraterone). In November 2024, Johnson & Johnson MedTech secured an exclusive distribution contract with Responsive Arthroscopy Inc., engaged in sports soft tissue repair devices. This partnership supports Johnson & Johnson MedTech’s sports platform and enhances its product line to meet the growing demand in the sports soft tissue repair market.

Key Companies in Arthroscopy Market Outlook

- Conmed Corporation

- Zimmer Biomet

- Henke Sass Wolf GmbH

- Johnson & Johnson

- Karl storz GmbH & Co. KG

- Arthrex, Inc.

- Richard Wolf GmbH

- Smith + Nephew

- Medtronic

- Stryker

Arthroscopy Market Developments

In August 2024, Vericel Corporation announced that the US Food and Drug Administration had approved a supplemental Biologics License Application to expand the MACI label. This approval allows for the arthroscopic delivery of MACI for repairing symptomatic full-thickness cartilage defects in the knee, up to 4 cm² in size.

In November 2023, Pristine Surgical launched Summit 4K disposable surgical arthroscope across the US. Summit arthroscope is designed to enhance efficiency, consistency, and safety in endoscopy. It is available to hospitals and ambulatory surgery centers nationwide.

In June 2022, CONMED Corporation acquired In2Bones Global Inc., a company specializing in the manufacturing and distribution of medical devices designed to treat a wide range of disorders and injuries affecting both the upper extremities, such as the wrist, hand, and elbow, as well as the lower extremities, including the ankle and foot.

Arthroscopy Market Segmentation

By Product Outlook (Revenue, USD Billion; 2020–2034)

- Powered Shaver Systems

- Visualization Systems

- Fluid Management Systems

- Ablation Systems

- Arthroscopes

- Arthroscope Implants

- Accessories and Disposables

By Application Outlook (Revenue, USD Billion; 2020–2034)

- Hip

- Knee

- Shoulder

- Foot & Ankle

- Hand & Wrist

- Elbow

- Sports Injuries

By Regional Outlook (Revenue, USD Billion; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Arthroscopy Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.33 billion |

|

Market Size Value in 2025 |

USD 6.55 billion |

|

Revenue Forecast by 2034 |

USD 9.10 billion |

|

CAGR |

3.7% from 2024 to 2032 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 6.33 billion in 2024 and is projected to grow to USD 9.10 billion by 2034

The global market is projected to register a CAGR of 3.7% during the forecast period.

In 2024, North America dominated the market due to advanced healthcare infrastructure, high adoption of minimally invasive surgical techniques, and a well-established reimbursement system.

A few key players in the market are Conmed Corporation; Zimmer Biomet; Henke Sass Wolf GmbH; Johnson & Johnson; Karl Storz GmbH & Co. KG; Arthrex, Inc.; Richard Wolf GmbH; Smith + Nephew; Medtronic; Stryker.

In 2024, the knee segment held the largest market share due to the high incidence of knee injuries, such as ligament tears, meniscus damage, and osteoarthritis.

The visualization systems segment is expected to witness the highest CAGR during the forecast period due to advancements in imaging technologies, such as high-definition cameras, 3D visualization systems, and enhanced lighting techniques.