Armored Vehicles Market Size, Share, Trends, Industry Analysis Report – By Platform (Combat Vehicles, Combat Support Vehicles, and Unmanned Armored Vehicles), Mobility, System, Mode of Operation, Type, Point of Sale, and Region; Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 117

- Format: PDF

- Report ID: PM5140

- Base Year: 2023

- Historical Data: 2019-2022

Armored Vehicles Market Outlook

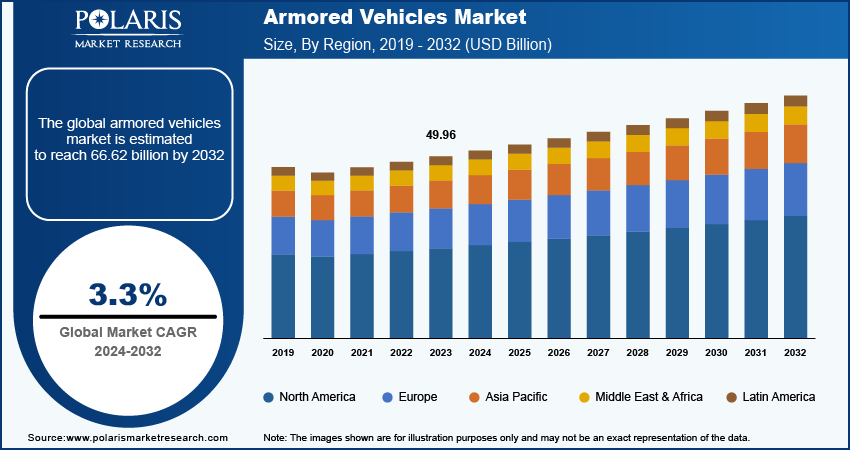

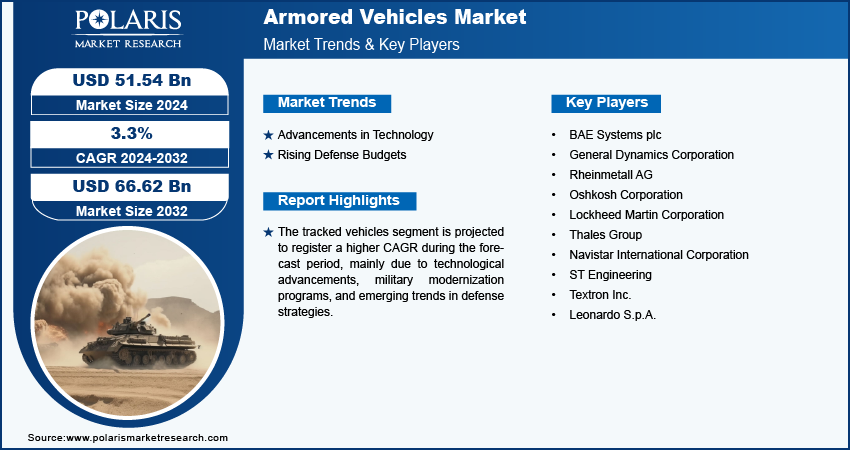

The armored vehicles market size was valued at USD 49.96 billion in 2023. The market is anticipated to grow from USD 51.54 billion in 2024 to USD 66.62 billion by 2032, exhibiting a CAGR of 3.3% during 2024–2032.

Armored Vehicles Market Overview

The armored vehicles market encompasses the production and sale of military and civilian vehicles designed to provide protection against ballistic threats and explosives. These vehicles are used for defense, law enforcement, and security purposes, prioritizing safety and durability in high-risk environments. Governments and defense establishments are increasingly investing in armored military vehicles to improve their defense capacities against threats such as terrorism, insurgency, and geopolitical tensions. Furthermore, technological advancements have made it possible to develop highly sophisticated armored tanks that provide better protection levels, maneuverability performance, and fire power. All these factors drive the armored vehicles market growth. For instance, in January 2024, British Company signed a contract with the UK Ministry of Defence to equip the Challenger 3 Main Battle Tank (MBT) with an advanced modular armor system.

To Understand More About this Research: Request a Free Sample Report

Factors such as introducing new military land vehicles with advanced technologies, replacing aging equipment, enhancing capabilities, addressing geopolitical factors, and promoting competition and innovation collectively boost the growth of the armored vehicles market.

In February 2024, the Indian Army announced its plan to upgrade tanks, which includes acquiring new models in the future. The army also stated that it is planning to issue the request for proposal this year to establish a USD 6.87 billion mega project for the production of future ready combat vehicles (FRCVs). This initiative is expected to address the bad strategies seen during the war in Ukraine. FRCVs will be equipped with artificial intelligence (AI) and active protection systems before they are introduced into service.

Growth Drivers

Advancements in Technology

The development of armored vehicles relies heavily on advanced technologies and autonomous driving technology for testing. These capabilities combine machine learning algorithms, AI sensors, connectivity features used to detect threats, and safe navigation through complex terrains. They also ensure that missions are successful. Self-driving features reduce the chances of mistakes using the human brain, enhance the time it takes for someone to think, and increase the safety of jobs for soldiers stationed in dangerous places in war. All these advantages are driving the armored vehicles market growth.

In May 2024, Kodiak Robotics and Textron Systems collaborated to develop a Self-Driving Military Vehicle for military ground. The project aims to promote the emergence of military automobiles that run automatically, which enhances their functions and safety in the armed forces.

Rising Defense Budgets

Growth in funding levels enhances countries' ability to buy or produce the latest military equipment that can help boost their security from terrorist attacks or regional wars, which are on the rise due to economic disparities among nations. For instance, in April 2024, the UK government introduced a significant increase in their defense spending. The spending is expected to upsurge to 2.5% of GDP by 2030, totaling USD 94.03 billion annually. This increase is directed toward reinforcing the defense industrial base, supporting advanced military technologies, and upgrading key defense systems, thereby contributing to market growth.

Restraining Factors

High Investments in Advanced Technology

High investments in advanced technology act as a restraint on the armored vehicles market by significantly increasing production costs, making it more challenging for manufacturers to maintain competitive pricing. The integration of advanced technologies such as autonomous systems, AI-powered targeting, and advanced defensive capabilities requires substantial research and development efforts, driving up the overall cost of armored vehicle production, which is hindering market growth.

Report Segmentation

The armored vehicles market is primarily segmented on the basis of platform, mobility, system, mode of operation, type, point of sale, and region.

|

By Platform |

By Mobility |

By System |

By Mode of Operation |

By Type |

By Point of Sale |

By Region |

|

|

|

|

|

|

|

By Platform Analysis

Combat Vehicles Segment Accounted for Largest Revenue Share of Armored Vehicles Market

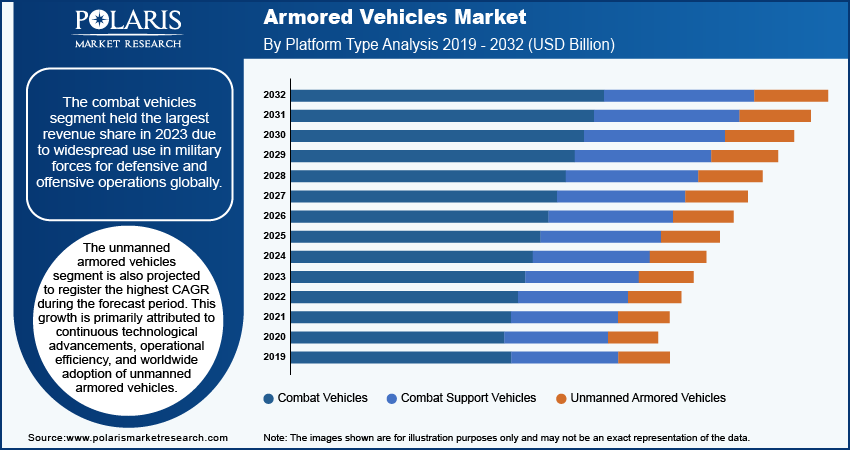

The combat vehicles segment held the largest revenue share in 2023 due to widespread use in military forces for defensive and offensive operations globally. For instance, in April 2024, under the fourth order for full-rate production, the US Marine Corps was awarded USD 25 million to supply the contractors with new Amphibious Combat Vehicle-Personnel (ACV-P) units by the BAE Systems, which had earlier received a USD 181 million contract.

The unmanned armored vehicles segment is also projected to register the highest CAGR during the forecast period. This growth is primarily attributed to continuous technological advancements, operational efficiency, and worldwide adoption of unmanned armored vehicles. Moreover, tactical advantages such as surveillance and target acquisition without putting human lives at risk facilitate the segment’s growth. For instance, in April 2024, Japan selected Milrem Robotics as the supplier for three THeMIS unmanned ground vehicles (UGVs). These UGVs will come with Milrem’s Intelligent Functions Kit (MIFIK), which will enable them to function autonomously both on the road and off the road.

By Mobility Analysis

Tracked Segment to Witness Higher Growth

The tracked vehicles segment is projected to register a higher CAGR during the forecast period, mainly due to technological advancements, military modernization programs, and emerging trends in defense strategies. Moreover, during combat situations, rough terrain requires vehicles with excellent off-road capacity, which drives the armored vehicles market growth for the tracked segment.

The wheeled segment held a larger revenue share in 2023. Wheeled vehicles have various advantages, such as speed, mobility, and cost-effectiveness, making them suitable for numerous applications, including troop transport, reconnaissance, and logistics support. They are used in urban lands and at missions of peacekeeping where maneuverability is advantageous.

Armored Vehicles Market Regional Insights

North America Held Largest Share of Global Armored Vehicles Market in 2023

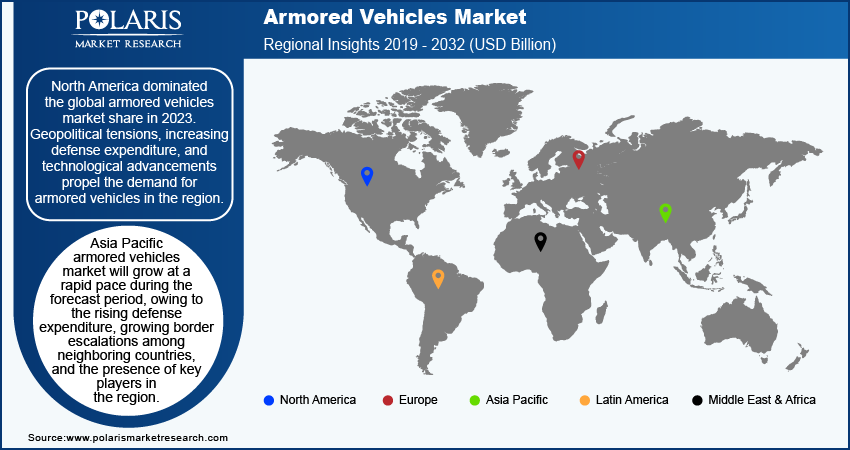

North America dominated the global armored vehicles market share in 2023. Geopolitical tensions, increasing defense expenditure, and technological advancements propel the demand for armored vehicles in the region. In April 2024, General Dynamics was awarded a potential five-year, USD 518.8 million contract by the US Army to provide system technical support services for the Stryker armored vehicles.

Asia Pacific armored vehicles market will grow at a rapid pace during the forecast period, owing to the rising defense expenditure, growing border escalations among neighboring countries, and the presence of key players in the region. Moreover, expanded partnerships among market players enable them to stay competitive in the region. In February 2024, the Indian Army floated a tender for 155 mm towed howitzers. As per the Indian Defense Ministry, these arms are crucial equipment required in the Indian Artillery Force.

Key Market Players and Competitive Insights

The armored vehicles market exhibits fragmentation, with increased defense expenditure driven by geopolitical conflict and collaboration among key and local players positively influencing the global market. Ongoing expansion initiatives, such as partnerships and collaborations, are intensifying market competition. For instance, in May 2024, Armor Kovico from South Korea presented different models of the KMPV armored personnel carrier (APC) during the DSA 2024 expo held in Malaysia.

Major Players Operating in Market

- BAE Systems plc

- General Dynamics Corporation

- Rheinmetall AG

- Oshkosh Corporation

- Lockheed Martin Corporation

- Thales Group

- Navistar International Corporation

- ST Engineering

- Textron Inc.

- Leonardo S.p.A.

Recent Developments in Industry

- February 2023: Lockheed Martin signed the Long-Range Hypersonic Weapon (LRHW) system contract worth USD 756 million with the US Army. The contract features extra LRHW battery equipment, systems, and software engineering support and the provision of logistical solutions.

- March 2024: During 2024 AUSA Global Force Symposium, BAE Systems displayed the Armored Multi-Purpose Vehicle (AMPV) with an External Mission Equipment Package (ExMEP).

Report Coverage

The armored vehicles market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, platform, mobility, system, mode of operation, type, point of sale, and futuristic growth opportunities.

Armored Vehicles Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 51.54 billion |

|

Revenue Forecast in 2032 |

USD 66.62 billion |

|

CAGR |

3.3% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global armored vehicles market size was valued at USD 49.96 billion in 2023 and is projected to grow to USD 66.62 billion by 2032.

The global market registers a CAGR of 3.3% during the forecast period.

North America had the largest share of the global market due to increasing defense expenditure, and technological advancements propelled the demand for armored vehicles in the region

The key players in the market are BAE Systems plc.; General Dynamics Corporation; Rheinmetall AG; Oshkosh Corporation; Lockheed Martin Corporation; Thales Group; Navistar International Corporation; ST Engineering; Textron Inc. Leonardo S.p.A.

The combat vehicles category dominated the market in 2023 due to widespread use in military forces for defense.

The tracked vehicles category had the largest share due to technological advancements and military modernization programs.