Application Modernization Services Market Size, Share, Trends, Industry Analysis Report: By Service Type, Enterprise Size (Large Enterprise and SMEs), Deployment, Industry Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5482

- Base Year: 2024

- Historical Data: 2020-2023

Application Modernization Services Market Overview

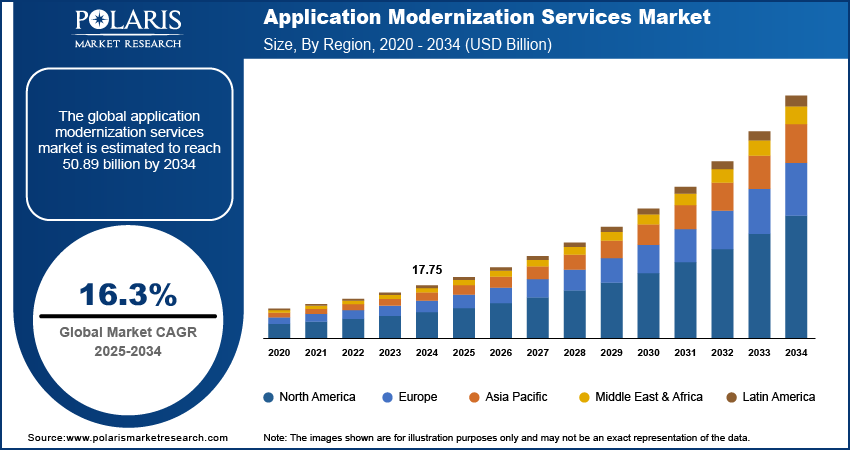

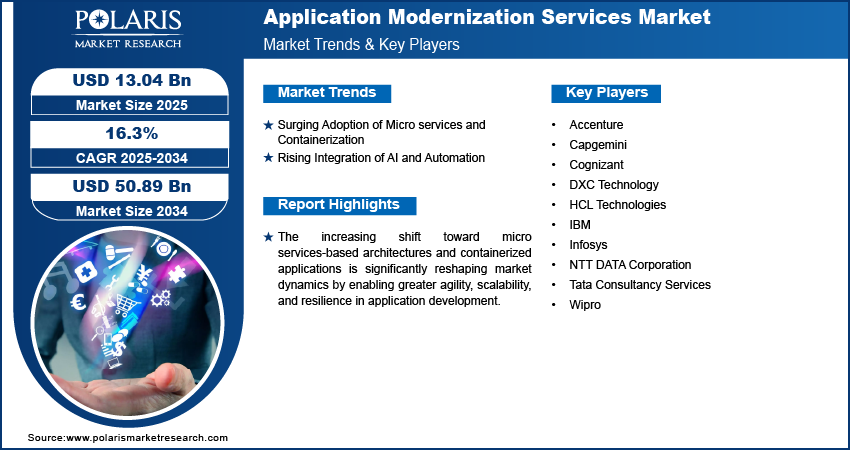

The global application modernization services market size was valued at USD 17.75 billion in 2024. The market is projected to grow from USD 20.55 billion in 2025 to USD 81.24 billion by 2034, exhibiting a CAGR of 16.5% during 2025–2034.

The application modernization services market provides solutions for upgrading legacy applications to modern, cloud-native, and scalable architectures. These services help businesses enhance operational efficiency, improve agility, and reduce maintenance costs by leveraging technologies such as cloud migration, micro services, containerization, DevOps, and AI-driven automation.

The increasing adoption of cloud computing is significantly fueling the demand for application modernization services. Organizations are prioritizing the transition of legacy systems to hybrid, public, and multi-cloud environments to enhance scalability, flexibility, and operational efficiency. They require modernization strategies such as re-platforming, re-hosting, and re-architecting to ensure seamless integration with cloud services as enterprises shift towards cloud-native architectures. The need to improve agility, reduce infrastructure costs, and enhance security is further accelerating this trend. Businesses are leveraging modernization services to optimize performance, ensure compliance, and stay competitive in a rapidly evolving digital landscape. This growing reliance on cloud-based solutions is expected to drive substantial growth in the application modernization services market in the coming years.

To Understand More About this Research: Request a Free Sample Report

Enterprises are investing in modernization strategies to improve time-to-market, enhance operational efficiency, and support real-time decision-making, contributing to application modernization services market growth. Furthermore, the high cost of maintaining outdated applications and security vulnerabilities in legacy infrastructure is accelerating market expansion, driving businesses to invest in modernization services.

Application Modernization Services Market Dynamics

Surging Adoption of Micro Services and Containerization

The increasing shift toward micro services-based architectures and containerized applications is significantly reshaping market dynamics by enabling greater agility, scalability, and resilience in application development. For instance, in April 2024, the Department of Veterans Affairs introduced VA Platform One (VAPO), a platform standardizing the use of containers and micro services to optimize cloud operations. This initiative has led to significant improvements in application development timelines, exemplifying the benefits of micro services in streamlining processes. Businesses are adopting containerization technologies such as Docker and Kubernetes to facilitate seamless deployment, reducing downtime and operational complexities. The rising preference for cloud-native solutions is further driving demand, as organizations seek to enhance efficiency and performance. The ability of micro services to support continuous integration and continuous delivery (CI/CD) is also contributing to market growth, allowing enterprises to quickly adapt to changing requirements. This transition is accelerating application modernization services market expansion, with vendors investing in advanced container orchestration and management solutions to strengthen their position and increase their reach.

Rising Integration of AI and Automation

The integration of AI-driven automation, low-code/no-code development platforms, and DevOps is transforming the application modernization services market, enhancing efficiency and reducing time-to-market. Businesses are increasingly leveraging AI-powered tools to automate application transformation processes, minimizing manual intervention and improving accuracy. The demand for low-code/no-code platforms is surging as enterprises prioritize rapid development and scalability, significantly contributing to market growth. The role of DevOps practices in boosting seamless collaboration and accelerating modernization efforts is further driving demand. The combination of AI and automation is not only streamlining workflows but also driving expansion, reinforcing market value and enhancing overall growth through cost-effective and intelligent modernization solutions.

Application Modernization Services Market Segment Insights

Application Modernization Services Market Assessment by Service Type Outlook

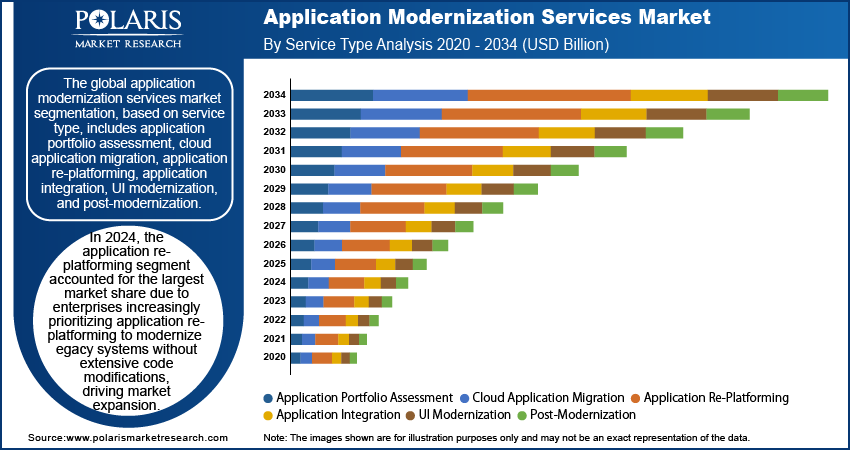

The global application modernization services market segmentation, based on service type, includes application portfolio assessment, cloud application migration, application re-platforming, application integration, UI modernization, and post-modernization. In 2024, the application re-platforming segment accounted for the largest market share due to enterprises increasingly prioritizing application re-platforming to modernize legacy systems without extensive code modifications. The demand for scalable, cloud-ready applications is pushing organizations to re-platform critical workloads, optimizing performance while reducing operational costs. The ability to leverage containerization, micro services, and server less computing within re-platformed applications enhances flexibility and security. BFSI and healthcare industries, facing regulatory pressures and rising transaction volumes, are leading adopters. The segment’s dominance is further supported by advancements in AI-driven re-platforming tools, accelerating migration while ensuring compliance with evolving cloud infrastructure standards.

The cloud application migration segment is expected to witness the highest CAGR during the forecast period due to the rapid shift toward hybrid and multi-cloud environments. Enterprises are migrating applications to public, private, and edge clouds to enhance agility, disaster recovery, and operational efficiency. The adoption of AI-driven migration solutions and automated refactoring is reducing downtime and accelerating deployment. Industries such as retail, healthcare, and telecom are embracing cloud-native frameworks to scale digital operations and enhance customer experiences. Rising investments in sovereign cloud and industry-specific cloud platforms are reinforcing segmental growth, positioning cloud migration as a key driver of market expansion.

Application Modernization Services Market Evaluation by Industry Vertical Outlook

The global application modernization services market segmentation, based on industry vertical, includes BFSI, retail & e-commerce, manufacturing, IT & telecommunication, energy and utilities, healthcare & life sciences, and other. In 2024, the BFSI segment accounted for the largest market share due to increasing regulatory compliance, cybersecurity concerns, and the need for real-time transaction processing. Financial institutions are modernizing core banking, payment gateways, and risk management systems to enhance performance and resilience. The adoption of AI-powered fraud detection, blockchain integration, and API-driven architectures is reshaping banking applications. Demand for cloud-native, scalable platforms is surging, enabling seamless integration with fintech ecosystems. The dominance of BFSI in market value is further supported by rising investments in digital transformation, Open Banking, and embedded finance, reinforcing its position as the largest revenue-generating segment.

The IT & telecommunication segment is expected to witness the highest CAGR during the forecast period due to the increasing demand for network automation, 5G-driven digital infrastructure, and cloud-native applications. The transition to software-defined networking (SDN) and edge computing is accelerating the need for legacy application transformation, optimizing network performance and operational agility. Telecom providers are leveraging AI-driven analytics, network function virtualization (NFV), and DevOps-driven modernization to enhance service delivery and cost efficiency. The shift toward hyperscale cloud environments is further fueling adoption, with enterprises focusing on multi-cloud orchestration and real-time network optimization, significantly driving the growth and expansion of the market segment.

Application Modernization Services Market Regional Analysis

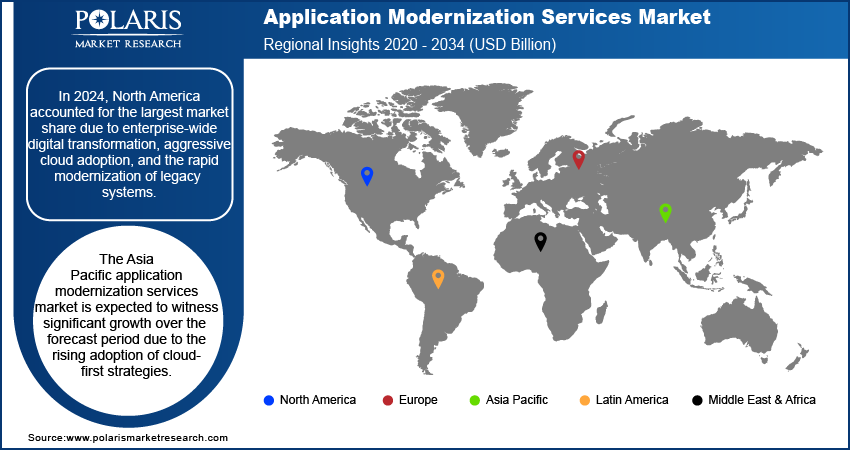

By region, the study provides the application modernization services market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest market share due to enterprise-wide digital transformation, aggressive cloud adoption, and the rapid modernization of legacy systems. The region’s well-established BFSI, healthcare, and IT & telecom sectors are investing heavily in AI-driven automation, hybrid cloud migration, and micro services architecture, fueling market value. Regulatory mandates, particularly in financial services and healthcare, are accelerating the shift toward cloud-native applications to ensure compliance, security, and operational efficiency. The presence of leading technology providers and hyperscale cloud vendors is further driving market expansion, with enterprises leveraging advanced DevOps and API-led modernization strategies to maintain competitive agility.

The Asia Pacific application modernization services market is expected to witness significant growth during the forecast period due to the rising adoption of cloud-first strategies, AI-driven analytics, and Industry 4.0 technologies. For instance, India launched the USD 1.25 billion "IndiaAI Mission" to support AI development across sectors such as healthcare and agriculture, aiming to establish a robust AI ecosystem. Enterprises across manufacturing, retail, and BFSI are investing in cloud-native solutions to enhance scalability and cost efficiency. Government-led digital transformation initiatives, particularly in China, India, and Southeast Asia, are accelerating demand for legacy system modernization to support 5G infrastructure, e-commerce expansion, and fintech innovation. The rapid growth of hyperautomation and edge computing in telecommunications and industrial applications is further strengthening market demand, positioning Asia Pacific as a key driver of future market growth.

Application Modernization Services Market – Key Players and Competitive Insights

The competitive landscape features global leaders and regional players competing for application modernization services market share through innovation, strategic alliances, and regional expansion. Global players leverage strong R&D capabilities, technological advancements, and extensive cloud infrastructure to deliver cutting-edge modernization solutions, meeting the growing market demand for cloud migration, AI-driven automation, and digital transformation. Market trends indicate a surge in low-code/no-code platforms, micro services adoption, and DevOps integration, driven by economic growth, regulatory compliance, and evolving IT architectures. Strategic investments, mergers and acquisitions, and joint ventures remain crucial for market expansion, enabling firms to enhance competitive positioning and broaden regional footprints. Post-merger integration and partnership ecosystems are key to unlocking market opportunities and addressing future-ready digital transformation needs. Regional companies focus on cost-effective modernization solutions, leveraging localized economic landscapes to cater to industry-specific demands.

Competitive benchmarking involves market entry strategies, cloud adoption trends, and scalability assessments to align with the evolving digital economy. The market is witnessing technological advancements such as AI-driven migration tools, containerization, and API-led integrations, reshaping enterprise IT ecosystems. Companies are heavily investing in supply chain modernization, cloud security enhancements, and sustainable IT frameworks to align with market growth, industry trends, and digital transformation strategies. Pricing insights, revenue growth analysis, and competitive intelligence are critical for identifying scalability opportunities and long-term profitability. In conclusion, the application modernization services market is driven by technological innovation, IT infrastructure modernization, and regional investments. Major players focus on strategic developments, cloud penetration, and competitive differentiation to navigate economic and geopolitical shifts, ensuring sustained growth in a highly dynamic global market.

Accenture is a global professional services company that provides consulting, technology, and outsourcing services to various industries worldwide. The company operates in five segments: media & technology, communications, financial services, health & public service, products, and resources. Artificial intelligence (AI) is one of the key focus areas for Accenture. The company offers various AI solutions to help clients optimize their operations, improve customer experiences, and drive business growth. These solutions include AI-powered automation, machine learning, natural language processing, and predictive analytics. Accenture delivers application modernization services through cloud-first strategies, AI-driven transformation, and DevOps integration, helping enterprises streamline legacy system re-platforming and micro services adoption. The company focuses on end-to-end modernization frameworks, including API-led integration and agile development, to optimize business continuity and IT efficiency.

International Business Machines Corporation (IBM) is an American multinational technology company operating in over 75 countries. The company mainly provides software, infrastructure services, hardware, and IT services. IBM also offers application modernization services focused on hybrid cloud migration, AI-driven automation, and containerization, enabling enterprises to transition from legacy IT systems to cloud-native architectures. The company leverages Red Hat OpenShift and AI-powered automation to enhance application performance, scalability, and integration within modern IT ecosystems.

List of Key Companies in Application Modernization Services Market

- Accenture

- Capgemini

- Cognizant

- DXC Technology

- HCL Technologies

- IBM

- Infosys

- NTT DATA Corporation

- Tata Consultancy Services

- Wipro

Application Modernization Services Industry Developments

In January 2024, AveriSource launched the enhanced AveriSource Platform 2.0, designed to streamline application modernization for mainframe and midrange systems. This updated platform utilizes advanced AI technologies to support the entire modernization lifecycle, helping organizations transform legacy applications into agile, cloud-ready solutions.

In January 2024, IBM acquired application modernization capabilities from Advanced to enhance its mainframe modernization services. This move will strengthen IBM Consulting's support for clients' modernization efforts, further advancing IBM's hybrid cloud and AI strategy.

In November 2024, Kyndryl and Microsoft launched innovative services aimed at application modernization, specifically designed for mainframe customers transitioning to the Microsoft Cloud. These services leverage generative AI technologies to enhance performance, streamline integrations, and drive efficiencies in legacy systems.

Application Modernization Services Market Segmentation

By Service Type Outlook (Revenue, USD Billion, 2020–2034)

- Application Portfolio Assessment

- Cloud Application Migration

- Application Re-Platforming

- Application Integration

- UI Modernization

- Post-Modernization

By Enterprise Size Outlook (Revenue, USD Billion, 2020–2034)

- Large Enterprise

- SMEs

By Deployment Outlook (Revenue, USD Billion, 2020–2034)

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Industry Vertical Outlook (Revenue, USD Billion, 2020–2034)

- BFSI

- Retail & E-commerce

- Manufacturing

- IT & Telecommunication

- Energy and Utilities

- Healthcare & Life Sciences

- Other

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Application Modernization Services Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 17.75 billion |

|

Market Size Value in 2025 |

USD 20.55 billion |

|

Revenue Forecast by 2034 |

USD 81.24 billion |

|

CAGR |

16.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global application modernization services market size was valued at USD 17.75 billion in 2024 and is projected to grow to USD 81.24 billion by 2034.

• The global market is projected to register a CAGR of 16.5% during the forecast period.

In 2024, North America accounted for the largest market share due to enterprise-wide digital transformation, aggressive cloud adoption, and the rapid modernization of legacy systems.

Some of the key players in the market are IBM, Accenture, Infosys, Cognizant, Capgemini, Tata Consultancy Services, DXC Technology, HCL Technologies, Wipro, and NTT DATA Corporation.

In 2024, the application re-platforming segment accounted for the largest market share due to enterprises are increasingly prioritizing application re-platforming to modernize legacy systems without extensive code modifications, driving market expansion.

In 2024, the BFSI segment accounted for the largest market share due to increasing regulatory compliance, cybersecurity concerns, and the need for real-time transaction processing.