Application Delivery Controller Market Share, Size, Trends, Industry Analysis Report, By Product (Dry, Fresh), By Seasoning (Unflavored, Paprika), By End-use, By Distribution Channel (Food Service, Retail), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3778

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

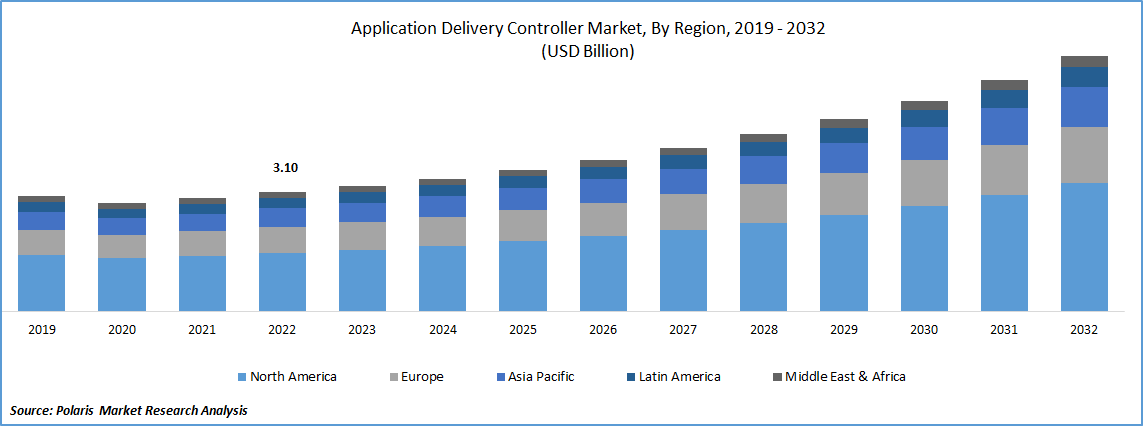

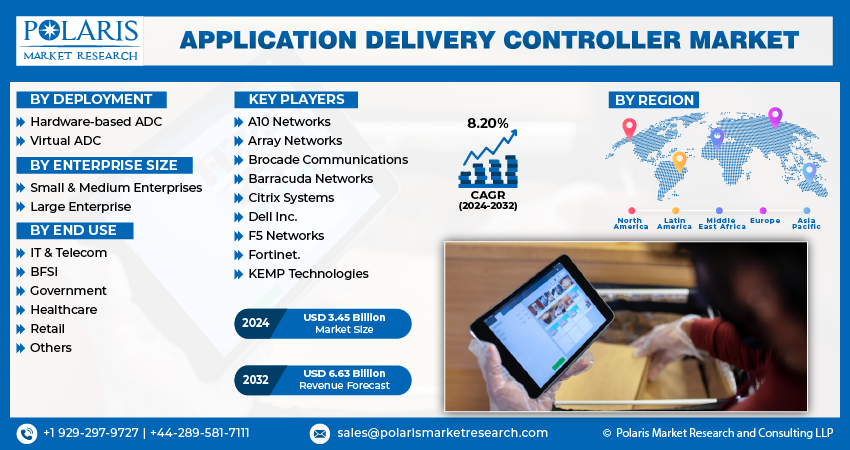

The global application delivery controller (ADC) market was valued at USD 3.26 billion in 2023 and is expected to grow at a CAGR of 8.20% during the forecast period.

An application delivery controller (ADC) is a specialized device typically positioned in a data center, functioning as an intermediary between one or more applications and the server's firewall. Over the past decade, ADCs have garnered increasing attention, primarily driven by the demand to enhance the performance of legacy load balancing appliances and meet the advanced requirements associated with application delivery. Designed specifically for networking purposes, ADCs play a crucial role in enhancing the security, resiliency, and overall performance of web-delivered applications. They serve as purpose-built networking appliances aimed at optimizing the delivery of applications over the internet.

To Understand More About this Research: Request a Free Sample Report

Market is projected to experience significant growth due to the rising demand for cloud computing, big data, and virtualization. These technologies have led to an increased need for effective and reliable webbing solutions. Additionally, the adoption of emerging technologies like software-defined storage and software-defined networking is expected to drive the demand for application delivery controllers in the coming years. These advancements are likely to play a crucial role in shaping the market's growth trajectory during the forecast period.

In countries such as the U.S., UK, and Germany, there is a growing demand for application delivery controllers (ADCs), which is expected to create opportunities for application delivery controller (ADC) market growth in the next eight years. Similarly, the Asia Pacific region is projected to experience a significant growth rate during the same period, driven by factors like increasing globalization, the adoption of distributed enterprise architecture, heightened awareness about security, and rapid population growth, particularly in countries like China and India.

Industry Dynamics

Growth Drivers

Increasing prevalence of end-user mobility

The increasing prevalence of end-user mobility is expanding the connectivity needs for corporate IT resources. This surge in mobile device connections is amplifying the complexity of challenges faced by organizations. Moreover, as companies adopt policies like "Bring Your Own Device" (BYOD), additional endpoints such as laptops, tablets, and smartphones are introduced into the network environment, leading to heightened network complexities.

Governments worldwide are recognizing the escalating significance of the internet, especially in relation to the growing importance of IT across various sectors. Consequently, there has been an increased focus on implementing regulations and legislations aimed at exerting control over business operations. Notable examples of these regulations include the Payment Card Industry Data Security Standard (PCI DSS), Health Insurance Privacy and Accountability Act (HIPAA), Communications Assistance for Law Enforcement Act (CALEA), and Gramm-Leach-Bliley Act, among others. These measures are part of the government's efforts to address the evolving landscape of information technology and its impact on various industries.

Report Segmentation

The market is primarily segmented based on deployment, enterprise size, end use, and region.

|

By Deployment |

By Enterprise Size |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Deployment Analysis

Hardware segment accounted for the largest share in 2022

Hardware segment accounted for major global share. Anticipated developments in the IT & telecom sector, such as the rise of Bring Your Own Device (BYOD) and Choose Your Own Device (CYOD) approaches, are set to have a favorable effect on the industry's growth in the upcoming years. Moreover, the establishment of new businesses in emerging economies is expected to drive the demand for cloud-based solutions.

In addition, the virtual application delivery controller is becoming increasingly attractive due to its cost-effectiveness compared to hardware-based ADCs. The virtual solution offers superior scalability, IT agility, and flexibility, catering to the evolving customer demands, which is further boosting the demand for these solutions. As a result, these factors are poised to positively impact the growth of the industry.

By Enterprise size analysis

SME segment expected to hold substantial market share in 2022

SME segment is projected to hold significant market share. This growth can be attributed to the widespread adoption of ADC in server firewalls and network security systems within the SME segment. Small and medium-sized businesses (SMBs) are increasingly dependent on web-enabled services and applications to conduct their operations. They utilize e-commerce transactions and Customer Relationship Management (CRM) both remotely and locally, even beyond their physical business facilities. However, this reliance on web-based apps exposes them to potential risks, such as Denial of Service (DoS) attacks, intrusions, and viruses, as traffic enters the network through various firewalls and ports without proper inspection.

In this context, Application Delivery Controllers (ADCs) play a crucial role in mitigating IT security risks. They help reduce the vulnerabilities associated with web-enabled applications and ensure compliance with data security and privacy regulations, providing SMBs with a more secure and protected environment for their digital operations.

By End-Use Analysis

IT & telecom segment is anticipated to witness highest growth during forecast period

IT & telecom segment is expected to grow at highest CAGR One of the key factors contributing to this growth is the adoption of Application Delivery Controllers (ADCs) by the IT & telecom industry. These solutions empower the industry to have greater control over their infrastructure, optimizing existing data center resources to meet the dynamic demands of current business and operational requirements. By implementing ADCs, the IT industry can effectively preempt issues before they arise, leading to increased productivity, reduced stress, and significant cost and time savings. This ability to proactively manage their infrastructure enables IT & telecom companies to operate more efficiently and effectively in today's fast-paced and demanding business landscape.

BFSI segment garnered the largest share. The rising number of cyber-attacks and the constantly evolving security landscape emphasize the need for safeguarding sensitive financial data from breaches with minimal risk and optimal returns. As banking institutions increasingly embrace cloud technology, the BFSI segment presents considerable potential for the adoption of Application Delivery Controllers (ADCs). These controllers play a vital role in ensuring the secure and efficient delivery of financial services in the cloud environment, enhancing the overall performance and security of the BFSI sector.

Regional Insights

North America region dominated the global market in 2022

North America region dominated the global market. This substantial share can be attributed to the well-developed IT & telecom sector in the region. This can be attributed to the presence of numerous enterprises that heavily rely on application delivery controllers for enhancing performance and effectively managing network traffic. Looking ahead, several trends are expected to drive growth in the market over the forecast period. These trends include the increasing adoption of virtualization, cloud computing, software-defined networking (SDN) devices, and heightened focus on network security. As these advancements gain momentum in the region, the application delivery controller market is likely to experience further growth and development.

APAC is likely to emerge as fastest growing region. Growth can be attributed to the region's increasing internet penetration rate. Moreover, various government initiatives, such as the Chinese government's OpenNet initiative and the Indian government's Make in India program, aimed at enhancing the performance of web applications and services, are expected to significantly impact the industry's expansion in the upcoming years. These initiatives are likely to create a conducive environment for the adoption of application delivery controllers, thereby driving the market's growth in the region.

Key Market Players & Competitive Insights

The application delivery controller market is fragmented and is anticipated to witness competition due to several players’ presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- A10 Networks

- Array Networks

- Brocade Communications

- Barracuda Networks

- Citrix Systems

- Dell Inc.

- F5 Networks

- Fortinet.

- KEMP Technologies

Recent Developments

- In May 2023, F5 has introduced Distributed Cloud Services, a comprehensive solution that offers security and connectivity solutions at both the network and application levels. These services facilitate seamless connections for APIs and applications across various environments, including cloud, hybrid, and edge setups.

- In April 2023, A10 Networks recently solution that integrates the Thunder Application Delivery Controller (ADC) & A10 Next-Generation Web Application Firewall (WAF). This comprehensive solution is designed to provide enhanced security & resilience specifically tailored for hybrid cloud environments.

Application Delivery Controller Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.45 billion |

|

Revenue forecast in 2032 |

USD 6.63 billion |

|

CAGR |

8.20% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Deployment, By Enterprise Sze, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

F5 Networks, A10 Networks, Array Networks, Citrix Systems, Brocade Communications, Dell Inc., Fortinet., Barracuda Networks, & KEMP Technologies. |

FAQ's

The application delivery controller market report covering key segments are deployment, enterprise size, end use, and region.

Application Delivery Controller Market Size Worth $6.63 Billion by 2032.

The global application delivery controller (ADC) market is expected to grow at a CAGR of 8.20% during the forecast period.

North America is leading the global market.

key driving factors in application delivery controller market are Increasing prevalence of end-user mobility