Apoptosis Assay Market Share, Size, Trends, Industry Analysis Report

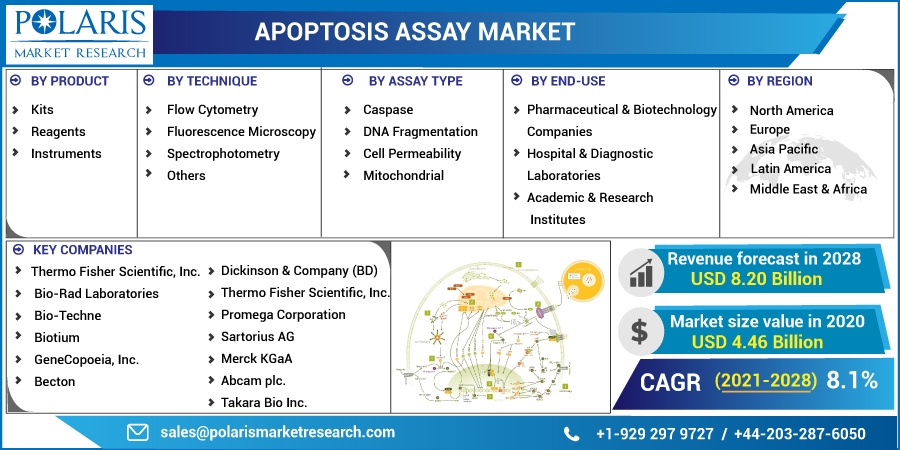

By Product (Kits, Reagents, Instruments); By Technique (Flow Cytometry, Fluorescence Microscopy, Spectrophotometry, Others); By Assay Type; By End-Use; By Regions; Segment Forecast, 2021 - 2028

- Published Date:Jan-2021

- Pages: 103

- Format: PDF

- Report ID: PM1780

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

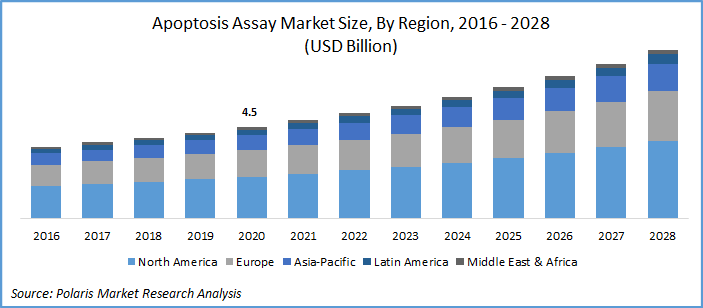

The global apoptosis assay market was valued at USD 4.46 billion in 2020 and is expected to grow at a CAGR of 8.1% during the forecast period. Factors contributing to market growth include the rising prevalence of chronic and infectious diseases, increased investments and funding on cancer and cell-based research, and innovations in apoptosis modulation drugs.

Apoptosis is a programmed cell death if it does not receive any signal to perform any function. The cell’s contents are packaged into small membrane sacs for so-called “garbage collection” by the immune cells. The whole mechanism removes cancerous and virus-infected cells and facilitates the proper functioning of the body. These events lead to cell shrinkage, chromatin condensation, mRNA decay, and nuclear fragmentation.

The cell death mechanism plays important role in the progression of many chronic conditions, in which cell death tests are regarded as potential candidates in designing disease strategies. Strategies are often targeted towards modulating apoptosis pathways. Moreover, the acceptance of cytotoxic and cytoprotective agents used in the treatment of cancer, and other neuro-degenerative diseases, driving the market for apoptosis assay forward.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The market demand for apoptosis assay is considerably driven by the advent of radionuclide tracers such as caspase inhibitors, and radio-labeled annexin V to increase real monitoring of cell death. For instance, ANNEXIN V kits have already seen a transition shift to the preference of researchers towards radiolabeled ANNEXIN V kits. Steps of the apoptosis mechanism are crucial to implementing them into new drug discoveries, so there is a strong need to understand controlling pathways. Thereby, the high demand in the market for the caspase assays along with Bcl-2 protein families in the pharmaceutical industry has boosted the market growth.

The study of apoptosis was more on focused cell membrane changes, particularly, the phospholipid phosphatidylserine (PS). PS molecules in healthy cells are present inside the cell membrane, while, when a cell undergoes programmed cell death (apoptosis), the enzyme flippases and scramblases mediates the flip of PS on the exterior side of the cell membrane, signaling macrophages to engulf apoptotic cells.

Know more about this report: request for sample pages

Extensive research has been carried out to provide a significant push to create demand for these assays, according to the claims of the Pharmaceutical Research and Manufacturers of America (PhRMA). Moreover, market participants are focused on implementing multiple focal points for confirmation to aid in the epidemiological studies to develop different product lines for apoptosis assays.

Apoptosis Assay Market Report Scope

The market is primarily segmented on the basis of product, technique, assay type, end-use, and region.

|

By Product |

By Technique |

By Assay Type |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Product

Based on the product, the global apoptosis assay market is categorized into kits, reagents, and instruments. In 2020, the kits segment accounted for the largest share and is also anticipated to register the highest market growth rate over the study timeframe. This high segment share is due to its increased adoption in drug designing and its repeated usage in various apoptosis procedures. The required need to increase the efficiency of such assays led to a significant increase in manufacturers, wherein more focus was towards expanding the portfolio of offerings including assay kits.

Moreover, substantial investments by manufacturers for developing affordable assay kits, and the rising preference of apoptosis kits among the end-use industry has also contributed to the segment’s dominance. The reagents market segment is expected to exhibit the highest market growth rate over the study period. This is owing to the fact that reagents are an integral part of assay protocols.

Insight by Assay Type

Based on the assay type, the global apoptosis assay market is categorized into caspase, DNA fragmentation, cell permeability, and mitochondrial. In 2020, the caspase segment accounted for the largest share in the global market. Caspase-based assay systems have gained immense attention among researchers and healthcare professionals over the past few years. This is owing to a large number of research activities on the significance of caspase in programmed cell death. Some of the important hallmarks of apoptosis include chromatin condensation, caspase activation, and DNA fragmentation.

Insight by Technique

Based on the technique, the global apoptosis assay industry is categorized into flow cytometry, fluorescence microscopy, spectrophotometry, and other techniques. In 2020, the flow cytometry segment accounted for the largest market revenue share. This high market share is due to the researcher’s inclination towards flow cytometry mitochondrial assays. Also, this technique helps in the distinction between intact mitochondria and the cell undergoing cell death. The market segment is likely to maintain its dominance, as it is regarded as the gold standard in assay detection technology. The fluorescence microscopy segment is expected to show a lucrative growth rate over the study period.

Geographic Overview

Geographically, the global market is bifurcated into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa (MEA). North America region dominated among all and accounted for a revenue share of over 45% in 2020 and is anticipated to remain dominant over the study period, with the U.S. being the largest revenue-generating country. Manufacturers, wholesalers, and distributors are well equipped to manufacture and distribute varied assay products customized according to the needs of the life sciences industry. Moreover, the region has a substantial number of universities and clinical research organizations engaged in apoptosis research findings.

Competitive Insight

The global apoptosis assay industry is flooded with small and big market players. Some of the key players operating in the market are Thermo Fisher Scientific, Inc., Bio-Rad Laboratories, Bio-Techne, Biotium, GeneCopoeia, Inc., Becton, Dickinson & Company (BD), Thermo Fisher Scientific, Inc., Promega Corporation, Sartorius AG, Merck KGaA, Abcam plc., and Takara Bio Inc.