Antiscalants Market Size, Share, Trends, Industry Analysis Report: by Type, Application, Process Type (Threshold Inhibitors, Crystal Modification, Dispersion, and Other Process Types), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast 2025–2034

- Published Date:Nov-2024

- Pages: 128

- Format: PDF

- Report ID: PM5237

- Base Year: 2024

- Historical Data: 2020-2023

Antiscalants Market Overview

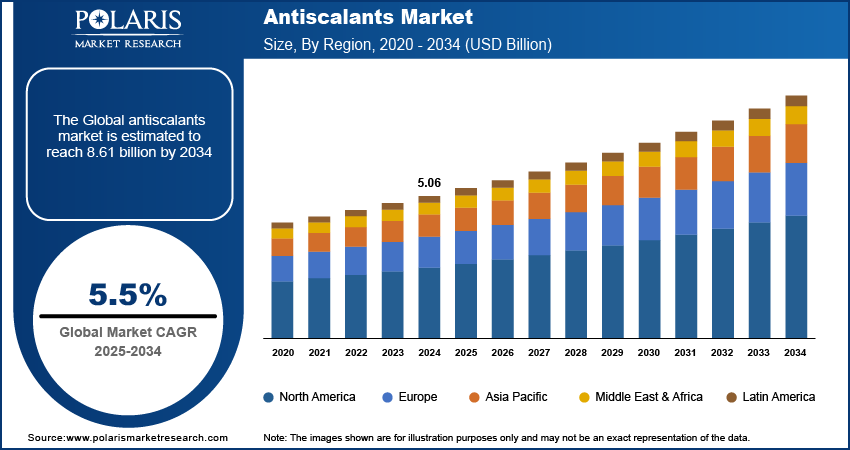

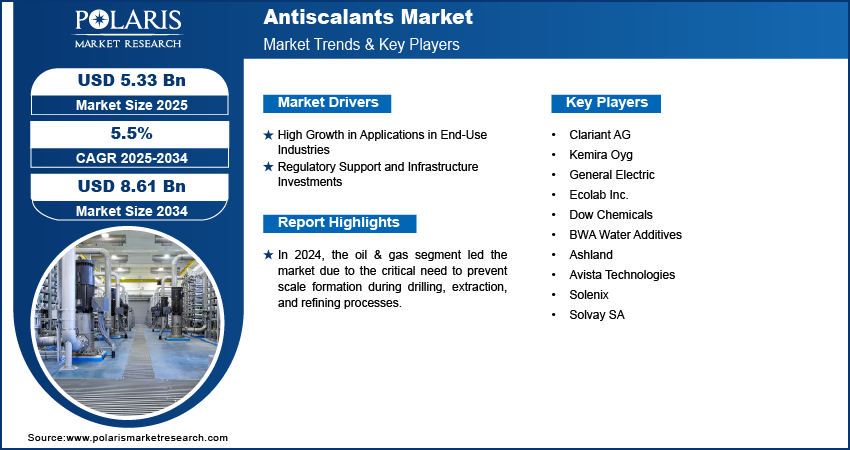

The antiscalants market size was valued at USD 5.06 billion in 2024. The market is projected to grow from USD 5.33 billion in 2025 to USD 8.61 billion by 2034, exhibiting a CAGR of 5.5% during 2025–2034.

The antiscalants market is experiencing robust growth due to increasing demand across various industries, including oil & gas, power generation, and water treatment.

Antiscalants are crucial in preventing scale formation in processes where water with high mineral content is utilized, thus ensuring operational efficiency and reducing maintenance costs. The market is supported by significant investments in infrastructure, especially in desalination and water treatment facilities, driven by regulatory initiatives aimed at improving water quality and availability.

Additionally, in regions such as the Middle East, where water scarcity is a pressing issue, countries are investing heavily in desalination technologies that rely on antiscalants to enhance the efficiency of seawater conversion into potable water. For instance, Saudi Arabia has implemented large-scale desalination projects, integrating advanced antiscalant solutions to manage scaling problems effectively. As industries increasingly prioritize sustainability and operational efficiency, the antiscalants market is set to continue its growth. Also, regulatory support and technological advancements drive market growth.

To Understand More About this Research: Request a Free Sample Report

Antiscalants Market Dynamics

Antiscalants Market Driver Analysis

High Growth in Applications in End-Use Industries

Antiscalants are increasingly used in applications across various end-use industries, particularly in oil & gas, power generation, and water treatment. In the oil & gas sector, antiscalants are essential for preventing scale formation caused by the high mineral content in water, which can lead to blockages and damage to equipment. In power plants, antiscalants help maintain operational efficiency by preventing scale buildup in cooling systems and boilers.

The demand for antiscalants is rising in the water treatment industry, especially with the growing need for desalination technologies in arid regions. As countries aim to secure freshwater resources, antiscalants are crucial in ensuring the efficient conversion of seawater into potable water. For instance, desalination projects in countries such as Saudi Arabia and the UAE heavily rely on antiscalants to convert seawater into potable water. The projects are essential in dried-up regions facing water scarcity, and the application of antiscalants has been crucial in maintaining the efficiency and effectiveness of desalination processes. The trend is supported by increased infrastructure investments and regulatory efforts to improve water quality, particularly in developing regions. Overall, the emphasis on operational efficiency, cost reduction, and sustainability across oil & gas, power plants, and other sectors would drive the growth of the antiscalants market in the coming years as companies seek innovative solutions to combat scale formation.

Regulatory Support and Infrastructure Investments

Regulatory support and infrastructure investments are expected to fuel the antiscalant demand during the forecast period, particularly in the water treatment and desalination sectors. Governments are implementing strict regulations to enhance water quality, which necessitates effective solutions such as antiscalants to prevent scale formation. For instance, the U.S. EPA has set drinking water standards that encourage the use of such chemicals in treatment facilities.

Significant investments in water infrastructure are underway globally. In India, the government announced its plans to invest over USD 3.5 billion to improve water supply and sanitation, including desalination projects that rely on antiscalants to ensure efficient operations. The Middle East, with countries such as Saudi Arabia, is investing heavily in desalination technologies across plants, such as the King Abdulaziz Sea Water Desalination Plant, which uses advanced antiscalants to optimize its processes. These regulatory frameworks and infrastructure initiatives underline the growing need for antiscalants in sustainable water management solutions.

Antiscalants Market Segment Analysis

Antiscalants Market Breakdown by Type Outlook

The global antiscalants market segmentation, based on type, includes phosphonates, carboxylates/carbonates, sulfonates, fluorides, and other types. In 2024, the sulfonates segment dominated the market due to their superior performance in preventing scale formation in industrial environments. Antiscalants are effective at holding back hard-to-treat scales commonly encountered in sectors such as oil & gas, desalination, and power generation. Sulfonates offer excellent thermal stability, making them reliable in high-temperature and high-pressure environments. Moreover, their ability to function effectively in acidic and alkaline conditions provides a versatile solution across a wide range of industrial applications, positioning them as a leading choice in the antiscalants market.

The phosphonates segment is projected to grow rapidly during the forecast period. Phosphonates are highly effective at holding mineral scales in water treatment systems, reverse osmosis membranes, and cooling towers, which makes them a popular choice in industries such as desalination, power generation, and oil & gas. Thus, phosphonate's efficiency in maintaining system performance by preventing scale buildup is critical to their increasing demand across these sectors.

Antiscalants Market Evaluation by Application Outlook

The global antiscalants market, based on application, is segmented into power & construction, oil & gas, mining, municipal water treatment & desalination, food & beverage, chemical & pharmaceutical, pulp & paper, and other applications. In 2024, the oil & gas segment led the market due to the critical need to prevent scale formation during drilling, extraction, and refining processes. Antiscalants are vital for preserving equipment, minimizing downtime, and extending the lifespan of machinery. Additionally, the industry faces demanding operational conditions, frequent scaling issues, and high water consumption, all of which contribute to significant demand for antiscalants. The necessity for maintaining equipment efficiency and reducing maintenance costs has solidified the oil and gas sector’s leading position in the market.

The power & construction segment holds a significant share of the antiscalant market due to widespread mineral scaling issues. Antiscalants are crucial in preventing mineral accumulation, particularly in cooling systems, boilers, and heat exchangers, where scale buildup can reduce efficiency and lead to costly maintenance. By effectively managing scale formation, antiscalants enhance operational efficiency and extend equipment life in the power & construction industries.

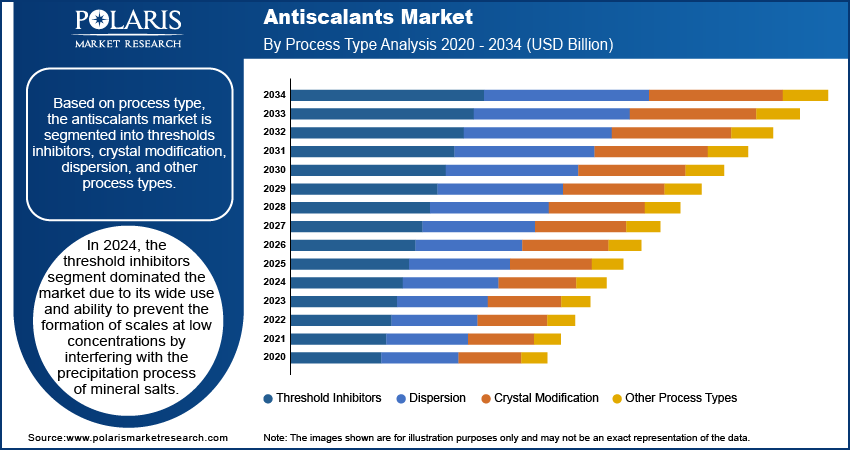

Antiscalants Market Assessment by Process Type Outlook

The antiscalants market segmentation, based on process type, includes threshold inhibitors, crystal modification, dispersion, and other process types. In 2024, the threshold inhibitors segment dominated the market due to its wide use and ability to prevent the formation of scales at low concentrations by interfering with the precipitation process of mineral salts. The threshold inhibitors are highly effective in managing scaling issues across various industries, including oil & gas, power generation, and water treatment. Also, their versatility and cost-effectiveness have contributed to the dominant position of the segment, as they can delay the onset of crystallization, maintaining equipment efficiency and reducing maintenance costs.

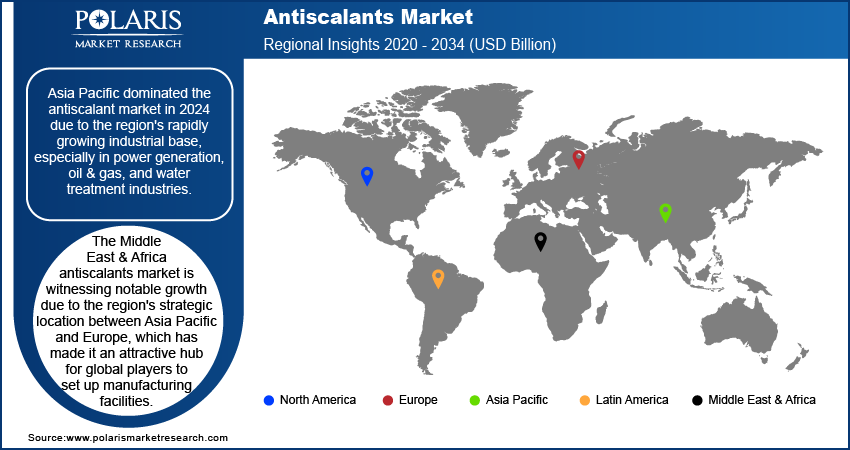

Antiscalants Market Share by Region

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific dominated the antiscalant market due to the region's rapidly growing industrial base, especially in industries such as power generation, oil & gas, and water treatment. Countries such as China and India have been focusing on expanding their energy and infrastructure sectors, leading to significant investments in desalination plants, thermal power plants, and mining operations, where antiscalants are essential in preventing scale buildup and enhancing operational efficiency.

The increasing water scarcity across the Asia Pacific pushes the need for advanced water treatment solutions, where antiscalants play a crucial role. The surge in population and urbanization across the region also contributes to the rising demand for clean water and the maintenance of industrial equipment, further supporting the use of antiscalants. Government initiatives such as goods and service tax, FDI policy reforms, measures for reduction in compliance, phased manufacturing programs, and others aimed at improving industrial efficiency and environmental regulations have increased the adoption of chemicals in the region, making it dominant in the market.

The Middle East & Africa antiscalants market is witnessing notable growth due to the region's strategic location between Asia Pacific and Europe, which has made it an attractive hub for global players to set up manufacturing facilities. The power and construction sectors are particularly active, with large-scale projects that increase the demand for antiscalants to prevent scale formation, improving equipment efficiency and operational durability. As a result, antiscalants play a crucial role in addressing the region’s water scarcity challenges while supporting its rapidly growing population and expanding industrial base.

Antiscalants Market – Key Players and Competitive Analysis Report

The competitive landscape is characterized by a diverse range of regional and global players striving to capture market share through innovation, strategic partnerships, and geographic expansion. Leading companies in the sector leverage their robust R&D capabilities and extensive distribution networks to offer advanced antiscalant solutions tailored for various applications, including oil & gas, power generation, and water treatment.

The industry leaders focus on product innovation, enhancing safety, functionality, and cost-effectiveness to meet the evolving demands of end users. Smaller regional companies are also emerging, introducing specialized products that cater to market needs or local demands. Common competitive strategies in this market include mergers and acquisitions, collaborations with industrial partners, and investments in emerging markets, all aimed at strengthening market presence and expanding product offerings. A few major market players are Clariant AG, Kemira Oyg, Dow Chemicals, BWA Water Additives, Ashland, Avista Technologies, Solenix, and Solvay SA.

Kemira specializes in sustainable chemical solutions for water-intensive industries. The company is based in Helsinki, Finland. In July 2024, Kemira completed the acquisition of Norit’s UK reactivation business, Purton Carbons Limited, entering the activated carbon market for micropollutant removal. The deal included a reactivation facility in Purton, UK, which restores used activated carbons for reuse. The facility produces two types of reactivated carbon: Green reactivation, used for drinking water and food-related purposes, and Amber reactivation for non-food applications with the goal of expanding its water treatment solutions.

Ecolab Inc., based in Saint Paul, Minnesota, specializes in the treatment, purification, cleaning, and hygiene of water across various applications. In July 2021, Ecolab announced the launch of a new business unit, Global Chemicals, under its water and process management division, Nalco Water. The company aimed to provide a broad range of solutions managing water, carbon, and energy challenges through antiscalants for the chemicals industry, with further expansion of Ecolab’s commitment to sustainable practices and complete management of environmental resources.

List of Key Companies in the Antiscalants Industry Outlook

- Clariant AG

- Kemira Oyg

- Italmatch Chemicals

- Ecolab Inc.

- Dow Chemicals

- BWA Water Additives

- Ashland

- Avista Technologies

- Solenix

- Solvay SA

Antiscalants Industry Developments

In March 2024, H2O Innovation Inc. reported that since 2021, the company had successfully supplied its super-concentrated antiscalants with a reduced CO2 footprint to over 25 desalination plants worldwide, including seven major facilities. The advanced antiscalants demonstrate superior scale inhibition performance and require lower dosage levels than conventional products, reflecting the commitment to sustainability and operational efficiency in large-scale water treatment operations.

In April 2024, Italmatch Chemicals launched Dequest PB, a new sustainable range of Carboxy Methyl Inulin (CMI)-based antiscalants and dispersants for homecare, industrial, and institutional applications.

In October 2023, Solenis completed the acquisition of Cedarchem with an aim to improve its direct-to-market strategy. The acquisition allowed Solenis to expand its offerings of improved chemical solutions and wastewater treatment products and services by integrating Cedarchem's expertise. The strategy would enable better service and innovation for Solenis customers in sectors reliant on advanced water and wastewater treatment technologies.

Antiscalants Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Phosphonates

- Carboxylates/Carbonates

- Sulfonates

- Fluorides

- Other Types

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Power & Construction

- Oil & Gas

- Mining

- Municipal Water Treatment & Desalination

- Food & Beverage

- Chemical & Pharmaceutical

- Pulp & Paper

- Other Applications

By Process Type Outlook (Revenue, USD Billion, 2020–2034)

- Threshold Inhibitors

- Crystal Modification

- Dispersion

- Other Process Types

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Antiscalants Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 5.06 billion |

|

Market Size Value in 2025 |

USD 5.33 billion |

|

Revenue Forecast by 2034 |

USD 8.61 billion |

|

CAGR |

5.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global antiscalants market size was valued at USD 5.06 billion in 2024 and is projected to grow to USD 8.61 billion by 2034.

The global market is projected to register a CAGR of 5.5% during the forecast period

Asia Pacific dominated the antiscalants market in 2024 due to the region's rapidly growing industrial base, especially in power generation, oil & gas, and water treatment industries.

A few key players in the market are Clariant AG, Kemira Oyg, Dow Chemicals, BWA Water Additives, Ashland, Avista Technologies, Solenix, and Solvay SA.

The oil & gas segment led the market in 2024 due to its critical need to prevent scale formation during drilling, extraction, and refining.

The sulfonates segment dominated the market in 2024 due to their superior performance in preventing scale formation in industrial environments.