Antifreeze Proteins Market Share, Size, Trends, Industry Analysis Report, By Form (Liquid, Solid); By Source (Plants, Fish, Insects, Others); By End-Use (Food & Beverage, Pharmaceutical & Medical, Cosmetics, Others); By Region; Segment Forecast, 2023 - 2032

- Published Date:May-2023

- Pages: 116

- Format: PDF

- Report ID: PM1978

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

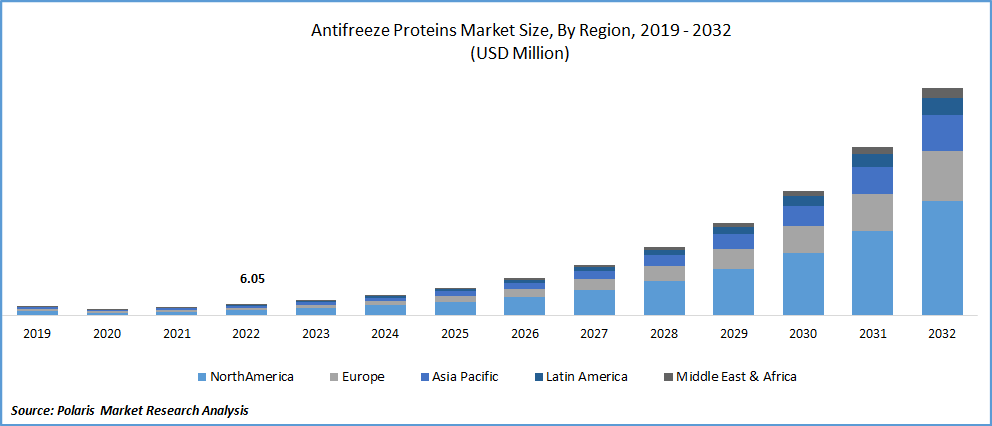

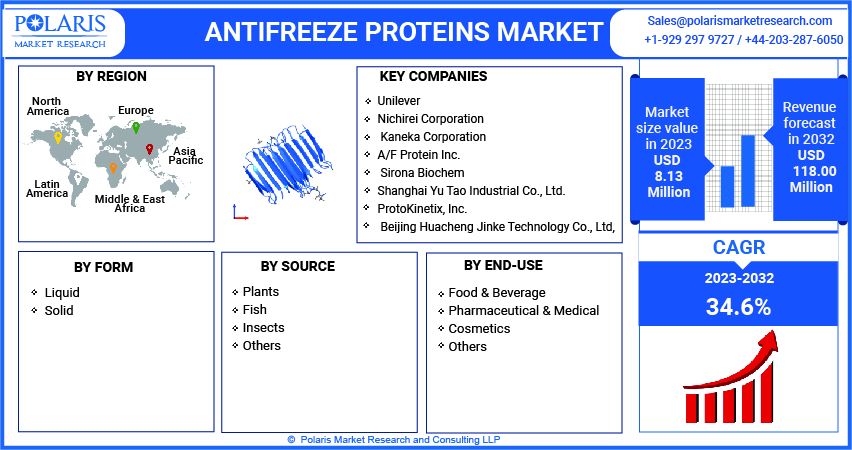

The global antifreeze proteins market was valued at USD 6.05 million in 2022 and is expected to grow at a CAGR of 34.6% during the forecast period. The market growth is expected to be driven by various factors, such as the improvement of aquaculture practices in cold regions, the refinement of freeze tolerance and development of plants, the extension of the harvest season in cold climates, and the enhancement of cryosurgery procedures.

Know more about this report: Request for sample pages

Additionally, the utilization of antifreeze proteins in yogurts and ice creams will soon contribute to the market's growth. Moreover, the launch of new frozen goods by major companies in the food sector through increased investments is anticipated to boost antifreeze proteins market growth even further.

The increasing R&D expenditure and rising demand for proteins across various sectors drive anticipated antifreeze protein industry market growth. Additionally, the prevalence of chronic and acute diseases due to changing lifestyles is expected to fuel demand for disease treatment, further contributing to market growth. Furthermore, the application of molecular biology research in various operations such as cryosurgery, immunization, transplantation, and hypothermia has been improved due to advancements in this field.

Furthermore, the growing demand for frozen food products, which are highly convenient in today's fast-paced lifestyle, is expected to be a major driving force behind the expansion of the market. However, the market's growth is likely to be hampered by the high costs associated with manufacturing and research and development, as well as the barriers to entry posed by the antifreeze proteins market association. When producing any product, research, and development expenses are a high direct cost for businesses, including labor, utilities, electricity, consumables, and other charges. Extracting antifreeze proteins from fish is a complex process requiring significant research and development effort.

The market has been impacted by the COVID-19 pandemic, with disruptions in the supply chain and manufacturing processes affecting the production and distribution of antifreeze protein products. Additionally, the closure of borders and restrictions on travel have hindered the import and export of necessary raw materials. However, due to a heightened focus on health and hygiene, the pandemic has also increased demand for frozen food items, considered safer than fresh food products. This surge in demand may indirectly benefit the Antifreeze Proteins Market by driving a need for antifreeze proteins to ensure the quality and safety of frozen food products.

For Specific Research Requirements, Request Customized Research Report

Industry Dynamics

Growth Drivers

There is an increasing demand for frozen food products, which require antifreeze proteins to maintain their quality during freezing and thawing. Additionally, there is a growing demand for eco-friendly and sustainable products, which are expected to boost the demand for antifreeze proteins due to their biodegradable and natural properties.

The expanding use of antifreeze proteins in medical and cosmetic applications. These proteins have cryoprotective properties that make them useful in preserving cells, tissues, and organs for medical purposes. They are also used in cosmetic products to prevent skin damage caused by freezing temperatures. For instance, the cosmetics industry is using antifreeze proteins in products like moisturizers, sunscreens, and anti-aging creams due to their natural and sustainable properties.

Moreover, technological advancements and research developments are expected to fuel market growth by enabling the creation of innovative applications for antifreeze proteins. Collaborations and partnerships between industry players and research institutions are also likely to drive growth by facilitating the development of new products and expanding the market's reach.

Report Segmentation

The market is primarily segmented based on form, source, end-use, and region.

|

By Form |

By Source |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Solid segment accounted for the largest market share in 2022

The solid segment accounted for the largest share in 2022, and will likely to continue its dominance over the projected period, owing to the ease of availability of antifreeze proteins in solid form the source of origin. Due to its longer shelf life, the solid form of antifreeze proteins is widely used in the food industry, including frozen foods, ice cream, frozen fish, and meats. Moreover, the solid form offers better stability and ease of handling, making it ideal for various frozen food applications.

However, the liquid segment is expected to witness significant growth during the forecast period, driven by rising demand from the food and pharmaceutical sectors. Liquid antifreeze proteins have several advantages over solid proteins, including ease of application and enhanced solubility, making them ideal for products such as functional beverages and dietary supplements. Furthermore, the increasing use of liquid antifreeze proteins in the pharmaceutical industry for storing and transporting vaccines and other biological materials is further expected to drive market growth.

The fish segment dominated the market in 2022

The fish segment dominated the market in 2022. This can be attributed to the easy availability of fish as a source for extracting antifreeze proteins, as well as the simplicity of the extraction procedure. Furthermore, fish antifreeze proteins are 300 times more efficient than other chemical anti-freezing agents, making them highly desirable in various applications. These factors are expected to continue driving the growth of the Fish segment in the forecast period.

Meanwhile, the Insect segment is anticipated to witness lucrative growth due to the ability of insect antifreeze proteins to withstand more earthly temperatures than fish proteins. Insects, being cold-blooded creatures, have evolved unique mechanisms to survive cold temperatures, including producing antifreeze proteins. These proteins have the potential to be used in a variety of applications, including food and medical industries.

Pharmaceutical and medical segment holds the highest shares of the market

The pharmaceutical and medical segment holds the highest share of the market. This can be attributed to extensive research undertaken by biotechnology and pharmaceutical companies to explore the potential applications of antifreeze proteins in the pharmaceutical and medical sectors. The proteins are used as cryoprotectants to preserve human tissues and cells, which is crucial for various medical procedures such as organ transplantation and fertility treatments. The cryoprotective properties of antifreeze proteins have also led to their increasing use in the development of vaccines, including the COVID-19 vaccine, which requires ultra-low temperature storage.

Meanwhile, the cosmetics segment is expected to witness lucrative growth in the coming years. This is due to the increasing applications of antifreeze proteins in the cosmetic sector, particularly in European and Asian countries. The proteins are known to prevent damage to the skin caused by freezing temperatures, making them a valuable ingredient in cold-weather skincare products. Moreover, the rising demand for natural and sustainable ingredients in cosmetic products is expected to drive the adoption of antifreeze proteins in the cosmetics industry.

Asia Pacific dominated the global market in 2022

The Asia Pacific dominated the market in 2022, owing to the region's high production of marine catch and aquaculture, leading to the easy availability of antifreeze proteins. The surging demand for these proteins in various industries, such as food, pharmaceuticals, and cosmetics, drives the market. The pharmaceutical industry uses antifreeze proteins for cryopreservation vaccines and other biological materials. The cosmetics industry increasingly uses these proteins in products to protect the skin from damage caused by cold temperatures. Additionally, the growing consumption of sashimi and other smoked fish products in China is further propelling the market's growth in the region.

Competitive Insight

Some of the major players operating in the global market include Unilever, Nichirei Corporation, Kaneka Corporation, A/F Protein Inc., Sirona Biochem, Shanghai Yu Tao Industrial Co., Ltd., ProtoKinetix, Inc., Beijing Huacheng Jinke Technology Co., Ltd, and Kodera Herb Garden Co., Ltd.

Recent Developments

- In October 2021, Nichirei Holding Holland B.V. successfully acquired Norish (N.I.) Limited from Norish Plc. This acquisition is expected to facilitate Nichirei Holding Holland B.V. in expanding its temperature-controlled logistics operations in the United Kingdom.

Antifreeze Proteins Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 8.13 million |

|

Revenue forecast in 2032 |

USD 118.00 million |

|

CAGR |

34.6% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments Covered |

By Form, By Source, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Unilever, Nichirei Corporation, Kaneka Corporation, A/F Protein Inc., Sirona Biochem, Shanghai Yu Tao Industrial Co., Ltd., ProtoKinetix, Inc., Beijing Huacheng Jinke Technology Co., Ltd, and Kodera Herb Garden Co., Ltd. |

FAQ's

Key companies in antifreeze proteins market are Unilever, Nichirei Corporation, Kaneka Corporation, A/F Protein Inc., Sirona Biochem, Shanghai Yu Tao Industrial Co., Ltd., ProtoKinetix, Inc.

The global antifreeze proteins market expected to grow at a CAGR of 34.6% during the forecast period.

The antifreeze proteins market report covering key segments are form, source, end-use, and region.

Key driving factors in antifreeze proteins market are increasing understanding of the advantages of antifreeze proteins.

The global antifreeze proteins market size is expected to reach USD 118.00 million by 2032.