Anticoagulant Reversal Drugs Market Share, Size, Trends, Industry Analysis Report – By Product (Prothrombin Complex Concentrates, Phytonadione, Andexanet Alfa, Idarucizumab, Protamine, and Others), Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 116

- Format: PDF

- Report ID: PM1869

- Base Year: 2024

- Historical Data: 2020-2023

Anticoagulant Reversal Drugs Market Overview

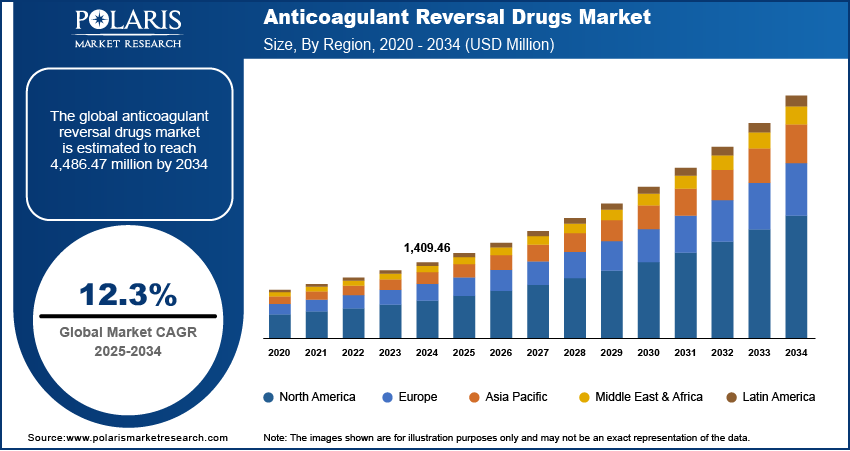

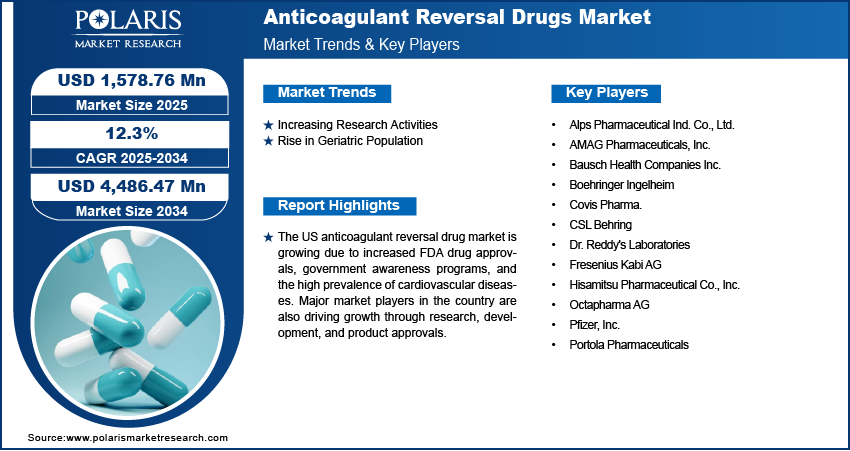

The global anticoagulant reversal drugs market size was valued at USD 1,409.46 million in 2024. The market is projected to grow from USD 1,578.76 million in 2025 to USD 4,486.47 million by 2034, exhibiting a CAGR of 12.3% during 2025–2034.

Anticoagulant reversal drugs are medications used to counteract the effects of anticoagulants (blood thinners) when there is a need to stop excessive bleeding or prevent hemorrhage. They work by directly neutralizing the anticoagulant or promoting blood clotting to restore normal coagulation.

The increasing prevalence of cardiovascular diseases and surgeries is expected to boost the anticoagulant reversal drugs market development during the forecast period. The growing number of surgeries, both electoral and emergency, is further driving the demand for anticoagulant reversal agents to manage bleeding risks during and after operations, fueling the anticoagulant reversal drugs market growth. Additionally, the anticoagulant reversal drugs market is expected to grow expeditiously during the forecast period due to a rise in product approvals, awards, and innovation. Governments and private players are engrossing in capitalizing on interesting and new products to address disorders related to medical devices, thereby driving the anticoagulant reversal drug market demand.

To Understand More About this Research: Request a Free Sample Report

An increase in the number of hospital readmissions due to bleeding disorders and the high pervasiveness of atrial fibrillation among the aged population are driving the anticoagulant reversal drugs market growth. Moreover, the increasing research activities for the development of new products by major players are expected to drive the market growth during the forecast period.

Anticoagulant Reversal Drugs Market Dynamics

Increasing Research Activities

The anticoagulant reversal drugs market is being driven by the rapidly progressing research activities in drug development of novel therapeutics worldwide to counter the growing prevalence of cardiovascular diseases. This growth of the research and development activities is driven by growth in government and private investment. Governments are investing in the research and development sector, due to which the demand for anticoagulant reversal drug agents is growing. Additionally, rising awareness among healthcare professionals and patients about the importance of prompt reversal of anticoagulant effects is further fueling the demand for anticoagulant reversal drugs, thereby driving the anticoagulant reversal drugs market growth.

Rise in Geriatric Population

The anticoagulant reversal drugs market is experiencing significant growth, driven by the increasing elderly population. The rising elderly population has heightened the chances of getting affected by cardiovascular diseases, due to which the demand for anticoagulant reversal drugs agents is rising. For instance, according to the reports of the Centers for Disease Control and Prevention (CDC), 9% of the world's population is above 65 years of age, consisting of atrial fibrillation, showcasing the large volume of the elderly population having cardiovascular disease.

Anticoagulant Reversal Drugs Market Segment Analysis

Anticoagulant Reversal Drugs Market Assessment by Product Type Insights

The anticoagulant reversal drugs market segmentation, based on product type, includes prothrombin complex concentrates, phytonadione, andexanet alfa, idarucizumab, protamine, and others. The idarucizumab dominated the anticoagulant reversal drugs market share in 2024 due to its high efficacy and specificity in reversing the effects of dabigatran, a common blood thinner. This drug is highly preferred because it works quickly and safely to counteract bleeding risks in patients using dabigatran. The adoption of idarucizumab is further rising, driven by its effectiveness in emergencies and its ability to improve patient outcomes, thereby driving segmental growth.

Anticoagulant Reversal Drugs Market Evaluation by Distribution Channel Insights

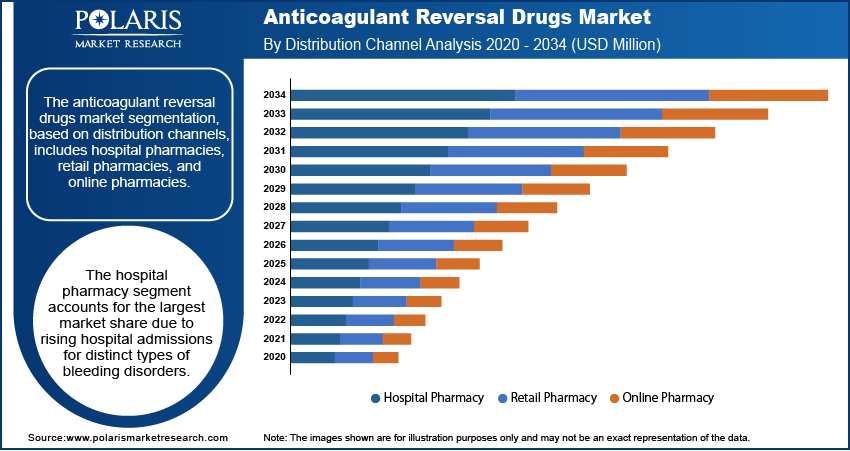

The anticoagulant reversal drugs market segmentation, based on distribution channels, includes hospital pharmacies, retail pharmacies, online pharmacies, and others. The hospital pharmacy segment accounts for the largest market share. Hospitals are the prime centers for diagnosis and medications of distinct types of bleeding disorders, driving the demand for anticoagulant reversal drug agents. Additionally, the rise in the usage of anticoagulant drugs during surgical procedures to regulate excessive bleeding during surgical procedures is further driving the segmental growth in the global anticoagulant reversal drug market share.

Anticoagulant Reversal Drugs Market Regional Analysis

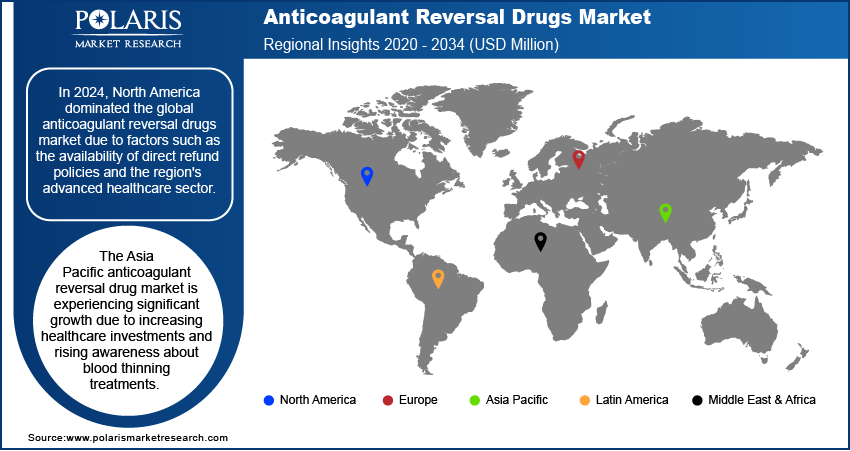

By region, the study provides the anticoagulant reversal drugs market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the overall anticoagulant reversal drugs market revenue share in 2024. The high growth of the market in North America is attributed to factors such as the availability of direct refund policies and the region's advanced healthcare sector. The easy availability of these reversal drugs during emergency conditions is further driving the regional market growth.

The anticoagulant reversal drug market in the US is growing significantly due to the increased drug approval initiative by the US FDA and the inception of various prevention programs and awareness workshops for blood disorders by government bodies. The high prevalence of cardiovascular diseases in the US is further driving the market growth in the country. Additionally, major players in the anticoagulant reversal drugs market have a base in the US and are engaged in research and development activities and product approvals, driving the market growth in the region.

The Asia Pacific anticoagulant reversal drug market expansion is driven by the increasing healthcare investments and rising awareness about blood thinning treatments. Countries such as Japan, China, and India are seeing higher demand for these drugs, driven by a growing aging population and the rising prevalence of conditions requiring anticoagulant therapy. Additionally, improvements in healthcare infrastructure and access to advanced medical treatments are contributing to market growth. The availability of effective reversal drugs such as Idarucizumab is improving patient outcomes and boosting the adoption of these therapies, thereby driving the anticoagulant reversal drug market growth in Asia Pacific.

Anticoagulant Reversal Drugs Market – Key Players and Competitive Trend

The anticoagulant reversal drugs market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative formulations to meet the demand of specific market sectors. This competitive environment is amplified by continuous progress in product offerings. A few major players in the anticoagulant reversal drugs market include Alps Pharmaceutical Ind. Co., Ltd.; AMAG Pharmaceuticals, Inc.; Bausch Health Companies Inc.; Boehringer Ingelheim; CSL Behring; Dr. Reddy's Laboratories; Fresenius Kabi AG; Octapharma AG; Pfizer, Inc.; Portola Pharmaceuticals; Covis Pharma.; and Hisamitsu Pharmaceutical Co., Inc.

Pfizer Inc. is a global biopharmaceutical company founded in 1849 in New York by Charles Pfizer and Charles Erhart. The company focuses on the discovery, development, manufacturing, and marketing of medicines and vaccines across various therapeutic areas, including oncology, immunology, cardiology, and rare diseases. Pfizer operates through two main segments, which include pharmaceuticals and consumer healthcare, with a portfolio that includes over 150 products across 16 therapeutic areas. Pfizer offers Eliquis (apixaban), a Factor Xa inhibitor anticoagulant. For reversal, Andexanet alfa (Andexxa) counteracts Eliquis's effects during emergencies. In addition to its pharmaceutical products, Pfizer engages in contract manufacturing services, producing sterile injectable pharmaceuticals and biosimilars to meet various healthcare needs. Pfizer operates in more than 125 countries worldwide, with significant manufacturing facilities located in India, China, Japan, Ireland, Italy, Belgium, Germany, Singapore, and the US.

Dr. Reddy's Laboratories Ltd. is an Indian multinational pharmaceutical company established in 1984, with its headquarters in Hyderabad. The company engages in the development, manufacture, and marketing of a wide range of pharmaceutical products, including generic formulations, anticoagulant reversal drugs, active pharmaceutical ingredients (APIs), biosimilars, and proprietary products. Dr. Reddy's offers more than 200 medications across various therapeutic areas such as gastroenterology, oncology, cardiovascular diseases, diabetology, pain management, and dermatology. The company is also involved in developing new chemical entities (NCEs) aimed at addressing metabolic disorders and bacterial infections. In the biosimilar market, Dr. Reddy's has launched several products since 2007 to meet the demand for biologic treatments. The company emphasizes research and development, with a robust pipeline and investments in new technologies and processes. It operates over 15 manufacturing facilities that are inspected by the US Food and Drug Administration (FDA). Dr. Reddy's operates in several key markets, including the US, Europe, India, Russia, CIS countries, and Latin America.

List of Key Companies in Anticoagulant Reversal Drugs Market

- Alps Pharmaceutical Ind. Co., Ltd.

- AMAG Pharmaceuticals, Inc.

- Bausch Health Companies Inc.

- Boehringer Ingelheim

- Covis Pharma.

- CSL Behring

- Dr. Reddy's Laboratories

- Fresenius Kabi AG

- Hisamitsu Pharmaceutical Co., Inc.

- Octapharma AG

- Pfizer, Inc.

- Portola Pharmaceuticals

Anticoagulant Reversal Drugs Industry Developments

October 2023: Alveron Pharma announced the completion of Phase 1 clinical study for OKL-1111, a new drug for the immediate treatment of Intracranial Haemorrhage (ICH) and other life-threatening bleeding disorders associated with the use of anticoagulants or platelet inhibitors.

July 2020: AMAG Pharmaceuticals, Inc. and Norgine B.V., a European Specialist Pharmaceutical Industries, announced entrance into an exclusive licensing agreement to develop and commercialize ciraparantag in Europe, Australia, and New Zealand.

July 2020: Alexion Pharmaceuticals, Inc. announced the acquisition of Portola Pharmaceuticals, Inc. The acquisition adds Factor Xa inhibitor reversal agent Andexxa, which is marketed as Ondexxya in Europe, to Alexion’s commercial portfolio.

Anticoagulant Reversal Drugs Market Segmentation

By Product Outlook (USD Million, 2020–2034)

- Prothrombin Complex Concentrates

- Phytonadione

- Andexanet Alfa

- Idarucizumab

- Protamine

By Distribution Channel Outlook (USD Million, 2020–2034)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By Regional Outlook (USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Anticoagulant Reversal Drugs Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1,409.46 million |

|

Market size value in 2025 |

USD 1,578.76 million |

|

Revenue Forecast by 2034 |

USD 4,486.47 million |

|

CAGR |

12.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global anticoagulant reversal drugs market size was valued at USD 1,409.46 million in 2024 and is expected to grow to USD 4,486.47 million by 2034.

The global market is projected to register a CAGR of 12.3% during 2025–2034.

North America held the largest share of the global market in 2024.

A few key players in the market are Alps Pharmaceutical Ind. Co., Ltd.; AMAG Pharmaceuticals, Inc.; Bausch Health Companies Inc.; Boehringer Ingelheim; CSL Behring; Dr. Reddy's Laboratories; Fresenius Kabi AG; Octapharma AG; Pfizer, Inc.; Portola Pharmaceuticals; Covis Pharma.; and Hisamitsu Pharmaceutical Co., Inc.

The Idarucizumab segment dominated the market in 2024.

The hospital pharmacy segment held the largest share of the global market in 2024.