Anti-Vascular Endothelial Growth Factor Therapeutics Market Share, Size, Trends, Industry Analysis Report, By Product (Eylea, Lucentis, Beovu); By Disease (Macular Edema, Diabetic Retinopathy, Retinal Vein Occlusion, Age-related Macular Degeneration); By Region; Segment Forecast, 2022 - 2030

- Published Date:Feb-2022

- Pages: 112

- Format: PDF

- Report ID: PM2270

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

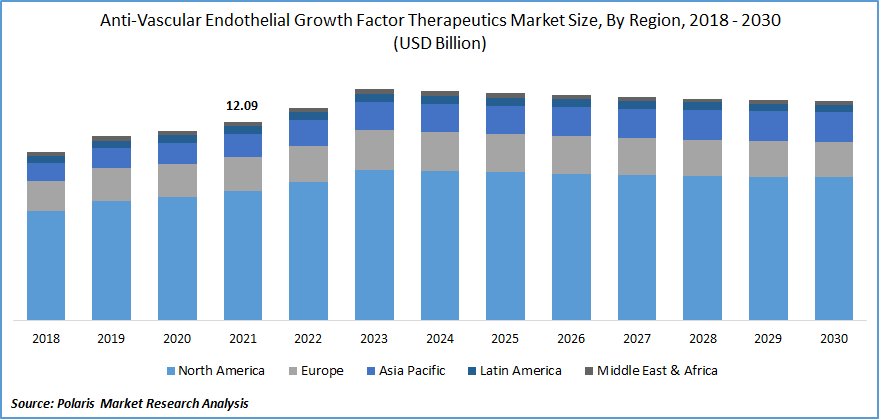

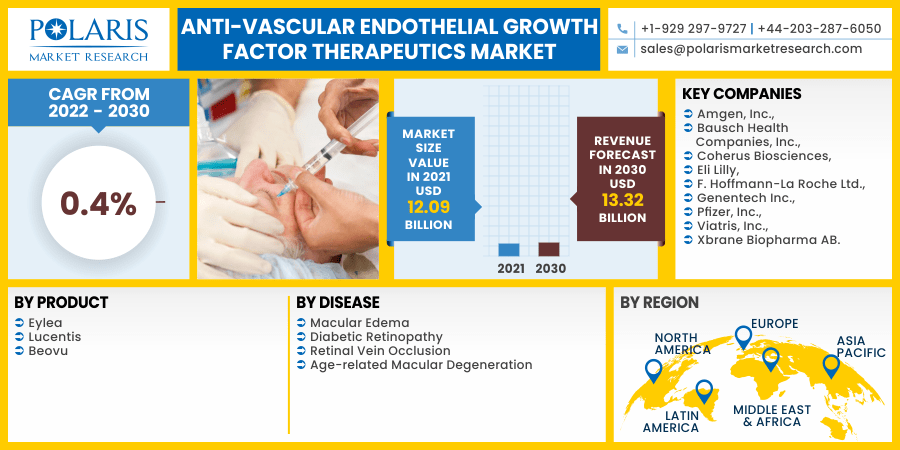

The global anti-vascular endothelial growth factor therapeutics market was valued at USD 12.09 billion in 2021 and is expected to grow at a CAGR of 0.4% during the forecast period. The firms are working on various formulations and drug delivery technologies that could boost the uptake of these therapies, such as AMD, macular edema, diabetic retinopathy, and others.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Anti-vascular endothelial growth factor therapeutics medicines, provided through frequent office-based intravitreal injections, are currently the primary therapy for neovascular age-related macular degeneration. Although regular injections impose a burden on individuals, family members, and specialists, this treatment is often quite effective in stabilizing or enhancing vision. In addition, the quantity of injections increases the risk of endophthalmitis and other problems. The relative efficacies of the three leading anti-VEGF therapeutics drugs (bevacizumab, ranibizumab, and aflibercept), as well as the most common re-injection regimens, are receiving more and more attention in the clinic.

In theory, intravitreal anti-VEGF drug delivery with sustained-release systems would provide comparable visual results with minimal injections. Noninvasive treatments, intraocular implants, colloidal carriers such as liposomes, microparticles, and nanoparticles have been investigated.

Furthermore, for diseases such as AMD, Macular Edema, and Others, industry players focus on longer-acting VEGF medicines and treatments, which boosts the anti-vascular endothelial growth factor therapeutics market development during the forecast period. For instance, in January 2021, EyePoint Pharmaceuticals, Inc. confirmed that the first participant in their Phase I trial of EYP-1901 had been dosed. EYP-1901 is a bi-annually sustained administration of intravitreal anti-VEGF treatment (wAMD) for wet age-related macular degeneration.

It's the newest of several continuous delivery medications in growth, with this one promising to prolong the period between injections to six months. It's being researched primarily as a treatment for wAMD, but researchers are hopeful that it could also be used to treat eye diseases and retinal vein occlusion. However, low screening and diagnostic rates of diabetic retinopathy in emerging countries hurt anti-vascular endothelial growth factor therapeutics market growth. Another anti-vascular endothelial development factor therapeutics market limitation is the increased risk of intraocular damage associated with anti-VEGF medication.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The anti-vascular endothelial development factor therapeutics market has seen significant growth in recent decades, owing to factors such as an increase in the prevalence of ophthalmic diseases such as macular edoema, diabetic retinopathy, retinal vein occlusion, and Age-related Macular Degeneration (AMD), as well as an aging population that is at risk of developing the condition. According to the Bright Focus Foundation, Age-related macular degeneration affects up to 11 million people in the U.S. By 2050, this is predicted to be nearly 22 million. Macular degeneration will affect around 196 million people globally by 2020, rising to about 288 million by 2040.

A substantial risk aspect for age-related macular degeneration is age. The chance of developing advanced age-related macular degeneration rises from 2% in those aged 50 to 59 to about 30% in those aged 75 and up. The cost of vision loss due to age-related macular degeneration (AMD) is estimated to be around $343 billion, with $255 billion in direct healthcare expenses. Thus, the rising prevalence of AMD disease and the cost for its treatment, along with the increasing geriatric population, are the factors that boost the anti-vascular endothelial development factor therapeutics market development during the forecast period.

Report Segmentation

The market is primarily segmented based on product, disease, and region.

|

By Product |

By Disease |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Disease

Based on the disease segment, the AMD segment is expected to be the most significant revenue contributor in the global anti-vascular endothelial development factor therapeutics market in 2021 and is projected to retain its dominance in the foreseen period. This is primarily due to the rise in old age population, long list product pipeline, and significant investments. According to the National Institute of Health, the number of people living with AMD is anticipated to double, by 2050, from 2.07 million to 5.44 million. The bulk of cases will continue to be influenced by white Americans.

Geographic Overview

In terms of geography, North America had the largest anti-vascular endothelial development factor therapeutics market share in 2021. Over the projection period, the regional industry is projected to increase significantly. This is primarily due to the rise in consumer awareness, government-sponsored actions, and clinical advancements in the concerned sector. The market would also benefit due to the presence of important players in North America.

In October 2021, the FDA approved Susvimo, one first port delivery system (PDS) with ranibizumab, for the management of patients with moist or neovascular age-related macular degeneration (AMD) who've already previously reacted to at least two anti-vascular endothelial growth features treatments. The procedure is the first and only FDA-approved therapy for wet AMD that requires only two treatments per year. It delivers 100 mg/ML ranibizumab injections intravenously via an ocular implant. The implant is surgically implanted into the eye during a one-time outpatient procedure and replenished every six months. Such delivery techniques, combined with technical improvements and new product launches, are likely to impact the region's anti-vascular endothelial growth factor therapeutics market growth positively.

Moreover, Asia Pacific is expected to witness a high CAGR in the global anti-vascular endothelial growth factor therapeutics market over the forecast period. The primary drivers projected to fuel regional anti-vascular endothelial growth aspect therapeutics industry growth include increased anti-VEGF product penetration, increased disposable income, and expanding consumer awareness. Furthermore, a growing number of government programs to improve population health, such as improving access to anti-VEGF pharmaceuticals through favorable reimbursement policies, may stimulate product adoption, boosting the regional anti-vascular endothelial development factor therapeutics market development.

Competitive Insight

Some of the major players operating in the global anti-vascular endothelial growth factor therapeutics market include Amgen, Inc., Bausch Health Companies, Inc., Coherus Biosciences, Eli Lilly, F. Hoffmann-La Roche Ltd., Genentech Inc., Pfizer, Inc., Viatris, Inc., and Xbrane Biopharma AB.

Anti-Vascular Endothelial Growth Factor Therapeutics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 12.09 billion |

|

Revenue forecast in 2030 |

USD 13.32 billion |

|

CAGR |

0.4% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Disease, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Amgen, Inc., Bausch Health Companies, Inc., Coherus Biosciences, Eli Lilly, F. Hoffmann-La Roche Ltd., Genentech Inc., Pfizer, Inc., Viatris, Inc., and Xbrane Biopharma AB. |