Anti-Obesity Medication Market Share, Size, Trends, Industry Analysis Report, By Mechanism of Action (Centrally Acting Drugs, Peripherally Acting Drugs); By Product; By Distribution Channel; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 117

- Format: PDF

- Report ID: PM4814

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

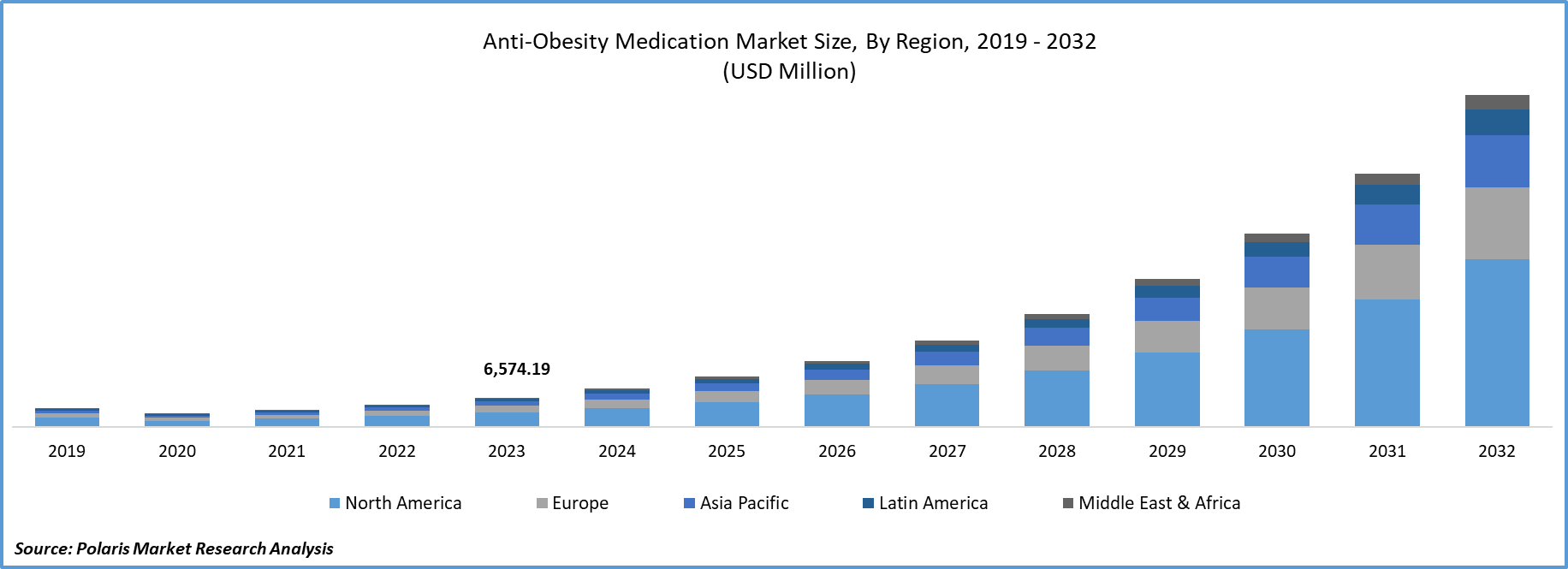

The anti-obesity medication market was valued at USD 6,574.19 million in 2023. It is anticipated to grow from USD 8,585.89 million in 2024 to USD 73,470.85 million by 2032, exhibiting a CAGR of 30.8% during the forecast period.

Anti-Obesity Medication Market Overview

Anti-obesity medications are pharmaceutical drugs specifically designed to aid in weight loss or weight management. They work through various mechanisms, including appetite suppression, inhibition of fat absorption, or modulation of metabolic processes. Common examples include appetite suppressants like phentermine, which reduces hunger signals in the brain, and lipase inhibitors such as orlistat, which block the absorption of dietary fats in the intestines. Other medications, such as GLP-1 receptor agonists like liraglutide and combination drugs like Qsymia, may also be prescribed to aid in weight loss efforts.

Furthermore, the 2022 World Obesity Atlas forecasts a dramatic surge in global obesity rates, estimating that by 2030, approximately 1 billion individuals worldwide will grapple with obesity. This forecast, notably prevalent in low- and middle-income nations, presents substantial challenges to healthcare infrastructures and global economies. The report underscores the pressing necessity for concerted efforts to address the underlying causes of obesity and alleviate its ramifications. Furthermore, the anticipated uptick in obesity prevalence directly aligns with the expansion of the overweight treatment market, presenting opportunities for pharmaceutical firms, healthcare providers, and other stakeholders. As healthcare expenses linked to obesity continue to mount, there is a growing urgency for innovative strategies and interventions to combat this epidemic and ensure sustainable containment of healthcare costs.

To Understand More About this Research:Request a Free Sample Report

Moreover, Anti-obesity medication market players are actively channeling investments into research and development endeavors aimed at spearheading innovative medications for weight management. Novo Nordisk's completion of a phase 2 clinical trial for CagriSema in August 2022 underscored its potential benefits for individuals grappling with type 2 diabetes and overweight conditions. The ongoing trials for drugs like GELA and Oral Sema Obesity, INV-202, currently in phase 3 and phase 2, respectively, offer promising prospects for further anti-obesity medication market growth.

The advent of novel medications like CagriSema, INV-202, GELA, orforglipron, and Oral Sema Obesity is driving market expansion. Committing investments to this sector allows companies to seize opportunities emerging from shifting demands and attain a competitive advantage. Taking the lead in the development and deployment of innovative medications positions these companies at the forefront, bolstering their foothold in the anti-obesity market.

Anti-Obesity Medication Market Dynamics

Market Drivers

The increasing incidence of obesity globally bolsters the growth of the Anti-Obesity Medication market share.

The increasing prevalence of obesity and overweight individuals worldwide, stemming from sedentary lifestyles and poor dietary habits, is anticipated to drive growth in the anti-obesity medication market. Major industry players are actively engaged in product development and seeking market approvals to cater to the growing global population grappling with obesity.

For instance, in 2022, Novo Nordisk collaborated with Evotec AG to explore drug molecules targeting various metabolic disorders, including obesity, diabetes, and related conditions. The escalating demand for medications offering long-term efficacy presents significant opportunities for anti-obesity market vendors to innovate and introduce new products, ultimately fostering the expansion of the anti-obesity medication market.

Furthermore, the escalating prevalence of obesity and type II diabetes has spurred numerous studies by market analysts and vendors focused on developing drugs capable of addressing both conditions simultaneously. The increasing adoption of alternative solutions such as gym memberships, exercise programs, obesity minimization treatments, and surgical interventions, coupled with patient compliance issues with dietary changes, are expected to hinder market growth further. Nonetheless, the introduction of new anti-obesity drugs and unexplored opportunities in emerging markets are projected to bolster demand for anti-obesity medication market growth in the foreseeable future.

Market Restraints

Lack of long-term effectiveness data to hamper the growth of the market.

The insufficiency of comprehensive long-term efficacy data poses a significant obstacle in the anti-obesity medications market. In the medical realm, particularly within pharmaceuticals or medical procedures, long-term efficacy data play a pivotal role in evaluating the sustained benefits and potential risks associated with interventions. With adequate long-term data, healthcare providers and regulatory bodies can make well-informed decisions regarding the suitability and safety of a treatment option for prolonged use. This lack of data introduces uncertainties regarding the intervention's ability to maintain desired outcomes over an extended period and its potential impact on patient's overall health and well-being.

The need for robust long-term efficacy data presents notable hurdles in healthcare decision-making processes. Healthcare providers may hesitate to recommend or prescribe certain treatments, especially when concerns arise regarding unknown long-term effects or limited evidence of sustained benefits. Similarly, regulatory agencies may delay granting approvals or expanding indications for interventions needing more evidence of their long-term efficacy and safety profiles. Consequently, patients may need more clarity regarding the durability of treatment effects and may have limited options for effectively managing their conditions over the long term. Therefore, efforts to generate comprehensive and reliable long-term efficacy data are indispensable for guiding clinical practice, informing regulatory decisions, and promoting patient-centered care.

Report Segmentation

The market is primarily segmented based on mechanism of action, product, distribution channel, and region.

|

By Mechanism of Action |

By Product |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Anti-Obesity Medication Market Segmental Analysis

By Mechanism of Action Analysis

- In 2023, the peripherally acting anti-obesity drugs segment accounted for the largest revenue share. This notable share is primarily ascribed to the mechanism's capability to enhance nutrient absorption and diminish hunger sensations. These medications function by impeding fat absorption in the intestines, resulting in reduced calorie intake and facilitating weight loss. The segment's dominance is further underscored by the efficacy of these drugs in fostering feelings of satiety, devoid of the common side effects associated with appetite suppressants. Additionally, their mode of operation reduces the necessity for strict calorie restriction and intensive physical activity, rendering them attractive to individuals seeking convenient and sustainable weight management solutions.

- The centrally acting drugs segment is poised to experience significant growth throughout the forecast period. These drugs, prominent in the anti-obesity sector, exert their effects by influencing the central nervous system to suppress appetite and facilitate weight loss. Examples include Bupropion (Wellbutrin) and Naltrexone, which function by targeting specific receptors to diminish hunger sensations and boost energy expenditure. The prominence of centrally acting drugs stems from their capacity to induce feelings of fullness, potentially reducing overall calorie consumption without affecting physical activity levels significantly. Moreover, their mode of action aligns with the principles of lifestyle modifications integral to effective weight management programs, rendering them a preferred option for many individuals. The recent withdrawal of certain amphetamines from the anti-obesity medication market due to adverse side effects has further fueled the shift towards safer centrally-acting drugs, reinforcing their position in the anti-obesity medication market.

By Distribution Channel Analysis

- In 2023, the retail pharmacies segment emerged as the significant revenue share. These establishments offer convenient access to medications for consumers and are typically situated in easily reachable locations within communities. Retail pharmacies serve as familiar and trusted environments for individuals seeking treatment for overweight, enabling them to conveniently fill prescriptions and receive guidance from pharmacists regarding medication usage and lifestyle adjustments.

- Hospital pharmacies also play a crucial role, especially in handling severe obesity cases or patients with comorbidities that require specialized care. These pharmacy facilities are vital for dispensing medications prescribed by healthcare providers within hospital environments, ensuring the seamless continuation of care and adherence to treatment protocols.

Analytical Standards Market Regional Insights

The North America region dominated the global market with the largest share in 2023

In 2023, the North American region dominated the largest market share due to various factors, such as the high prevalence of obesity and supportive government policies. Key players like Pfizer, Novo Nordisk, F. Hoffmann-La Roche, and Merck & Co. dominate this market and actively engage in strategic moves like mergers, acquisitions, and partnerships to strengthen their position. For example, Roche's recent acquisition of Carmot Therapeutics reflects this trend, targeting promising clinical-stage obesity drugs.

Research from the Cureus Journal of Medical Science also highlights the significant impact of obesity in rural America, which is influenced by diverse factors. While progress has been made, further exploration into genetics and focused research in rural areas is crucial for developing effective prevention and management strategies. These dynamics underline the scope and potential for growth in the North American anti-obesity market.

In Europe, the anti-obesity medication market emerges at the fastest CAGR for pharmaceutical enterprises, holding significant growth prospects within the region. Despite notable strides in acknowledging obesity as a medical condition, the accessibility of medications and treatments remains a formidable obstacle for patients. The absence of reimbursement for weight management therapies under government healthcare schemes like commercial insurance and medical providers renders these medications financially burdensome for many individuals. Presently, the European Union recognizes four drugs aimed at reducing body weight: long-acting GLP-1 analogs and orlistat, a medication comprising hydrochloride naltrexone and hydrochloride bupropion. While these treatments offer promising avenues for individuals grappling with obesity, the limited access hampers their efficacy in combatting the obesity crisis.

Competitive Landscape

The Anti-obesity medications prominent market players include. These companies employ various strategies to fortify their positions in the market. They engage in expanding their market reach by forging agreements with other players in emerging economies. Additionally, obtaining product approvals is a strategic approach undertaken by these companies. Emerging players are implementing different strategic initiatives, such as collaborations and partnerships with key stakeholders and other industry participants, to enhance their presence. They aim to capture niche segments of the supply chain, such as product distribution and delivery, to establish their foothold in the market.

Some of the major players operating in the U.S market include:

- Boehringer Ingelheim International GmbH

- Currax Pharmaceuticals

- Gelesis

- GlaxoSmithKline plc

- Kintai Therapeutics

- Novartis AG

- Novo Nordisk A/S

- Rhythm Pharmaceuticals, Inc.

- VIVUS LLC

Recent Developments

- In January 2024, Carmot Therapeutics Announces the Completion of the Acquisition by Roche. This strategic move grants Roche access to a portfolio of clinical-stage obesity drugs, notably the flagship CT-388, designed to address obesity and related ailments.

- In November 2023, Novo Nordisk's decision to expand its production facilities in Chartres, France, reflects its confidence in the market's growth prospects. This investment, exceeding USD 2.32 billion, aims to enhance capacity for treating chronic diseases, potentially encompassing anti-obesity medications.

Report Coverage

The Anti-Obesity Medication Market Report emphasizes key regions worldwide to help users better understand the product. The report also provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, it covers an in-depth qualitative analysis of various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects, such as the competitive mechanism of action, product, distribution channel, and futuristic growth opportunities.

Anti-Obesity Medication Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 8,585.89 million |

|

Revenue Forecast in 2032 |

USD 73,470.85 million |

|

CAGR |

30.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Segments Covered |

By Mechanism of Action, By Product, By Distribution Channel, By Region |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global Anti-Obesity Medication market size is expected to reach USD 73,470.85 million by 2032

Key players in the market are GmbH, Currax Pharmaceuticals, Gelesis, GlaxoSmithKline plc, Kintai Therapeutics, Novartis AG

North America contribute notably towards the global Anti-Obesity Medication Market

The Anti-Obesity Medication Market exhibiting a CAGR of 30.8% during the forecast period.

The Anti-Obesity Medication Market report covering key segments are mechanism of action, product, distribution channel, and region.