Anti-fatigue Cosmetics Market Share, Size, Trends, Industry Analysis Report, By Product (Cream, Oil, Lotion, Serum, Gel); By Distribution Channel (Offline, Online); By Region; Segment Forecast, 2021 - 2028

- Published Date:Sep-2021

- Pages: 111

- Format: PDF

- Report ID: PM1957

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

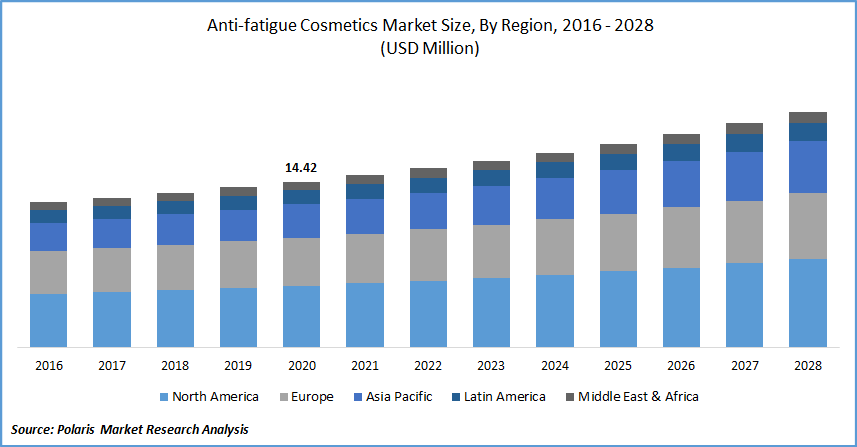

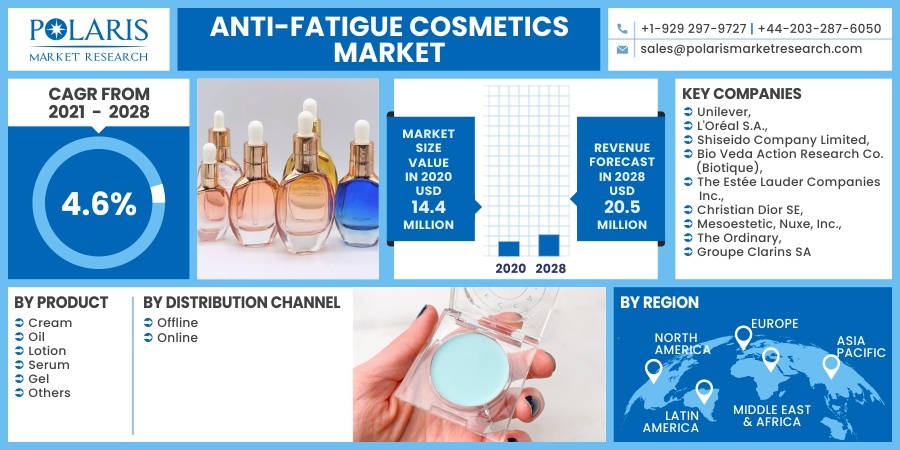

The global anti-fatigue cosmetics market was valued at USD 14.4 million in 2020 and is expected to grow at a CAGR of 4.6% during the forecast period. Hectic lifestyles, increasing stress, inconsistent sleeping patterns, and bad eating habits have harmed people's skin around the globe.

Furthermore, the skin becomes dull and lackluster due to harmful solar rays and dangerous levels of pollution. This increases the need for rejuvenating, anti-fatigue cosmetics. The increasing number of skincare awareness initiatives by significant personal care market companies is expected to broaden the range.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Rapid urbanization has resulted in a change in lifestyle and sleeping patterns that have increased stress and anxiety levels among people. Globally, it is estimated that nearly 300 million people suffer from some stress and anxiety. Skin fatigue is also caused due to increase in the prevalence of smoking, increased pollution, and lack of exercise.

There are nearly 1.3 billion smokers across the globe, and almost 80% of them live in developing and low-income countries. The increased use of the internet and rapid increase in the economic status of the people in growing regions will cumulatively drive the market growth for anti-fatigue cosmetics.

The developing e-commerce industry and expanding customer demand for purchasing anti-fatigue cosmetics and other personal care goods online have significantly fueled the market growth. Social media also plays a crucial role in branding such commodities, targeting a surging millennial and young customer base.

Many countries are under lockdown to control the spread of the virus, and hence companies are increasingly selling personal care products through e-commerce platforms. Companies are making sure there is minimal disruption in the supply chain. All these factors are expected to negate the negative impact of COVID-19 on the growth of the anti-fatigue cosmetics market.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The global anti-fatigue cosmetics market is driven by the factors such as increasing stress among people and unhealthy sleep patterns and food habits. The rapid urbanization in many parts of the world has resulted in higher levels of pollutions, which are expected to propel the market growth for anti-fatigue cosmetics. Consumers across the globe increasingly prefer organic personal care products made of natural ingredients in recent years.

Certain synthetic products used in anti-fatigue cosmetics are toxic and accumulate in the body, resulting in allergies and irritations of the skin. Hence companies are focusing on developing products made of natural and organic ingredients such as herbs, cucumber, citrus fruit, pomegranate, and seaweed. This is expected to accelerate the market growth of anti-fatigue cosmetics.

The key players across the globe are launching new products owing to the popularity of anti-fatigue cosmetics. For instance, Pure nutritional launched three skin creams for the Indian market in 2020 to capitalize on the booming personal care market in the country. Nuxe launched a new generation of multi-corrective skincare named Creme Prodigieuse Boost range in March 2019. The new product is expected to improve the condition of damaged and stressed skin.

Anti-fatigue Cosmetics Market Report Scope

The market is primarily segmented on the basis of product, distribution channel, and region.

|

By Product |

By Distribution Channel |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Product

Creams segment dominated the market for anti-fatigue cosmetics and generated the highest revenue in 2020. Under-eye creams, night moisturizers, and under-eye primers are critical products under this segment, which help hydrate the skin and reduce dullness, dark circles, puffiness, and spores. Several companies have introduced products with novel and combination ingredients to make efficient products and keep ahead of the market.

Gel-based anti-fatigue cosmetics are increasingly used among consumers with oily skin. The segment is the second-largest revenue holder in 2020 and is predicted to rise steadily over the next few years. However, the lotions segment of the anti-fatigue cosmetics industry is expected to have a high growth rate during the forecast period.

Insight by Distribution Channel

The offline distribution channel dominated the market for anti-fatigue cosmetics and generated the highest revenue in 2020. Many consumers still tend to shop at physical businesses, such as health and beauty stores and supermarkets. This growth is fueled by an increase in the number of hypermarkets and supermarkets in emerging countries like India, Bangladesh, China, and Brazil, which has boosted the product sales offline.

Several health and beauty products merchants and company-owned stores offer expert advice for each skin type, providing suggestions on using products, ingredients, and other product benefits. Some retailers also offer trial samples to help customers choose the suitable product best suited to their needs. All these features will continue to drive the market segment of the anti-fatigue cosmetics industry.

The online distribution channel of the anti-fatigue cosmetics industry is anticipated to have a high growth rate during the projected period. The continuing surge in the e-commerce industry has significantly influenced the purchasing behavior of customers. Buyers prefer this retail channel as it provides a broader range of product variants, convenience, discounts, choices, and numerous payment options.

Geographic Overview

North America anti-fatigue cosmetics industry is the most significant region for the global market regarding revenue share during the forecast period. Chronic fatigue syndrome affects large portions of the U.S. Women are more likely than men to suffer from this condition. It causes the skin to appear dry, dull, and wrinkled prematurely. It is caused by insufficient sleep, excessive stress, and a poor diet.

According to Global Emotions Report by Gallup Inc., the U.S. is one of the top ten most stressed nations in the globe, according to Gallup Inc.'s "Global Emotions Report." Insomnia affects nearly 30% of the adult population in the country, resulting in dark circles and puffy eyes. As a result, the products have become very popular in this region. In addition, the availability of advanced cosmetic products and unhealthy lifestyle due to the busy schedule has resulted in stress and anxiety level among people in the region.

Asia Pacific anti-fatigue cosmetics industry is expected to have the fastest growth rate during the forecast period due to the rapid urbanization in many parts of this region, resulting in increased awareness among people for anti-fatigue cosmetics. The improved per capita income among people in countries like China, India, and Bangladesh has made consumers in this region opt for branded skincare and cosmetic products.

Competitive Insight

Companies across the world are investing in R&D to introduce novel products such as organic and natural cosmetic products due to the inclination of consumers towards such products. Companies are also developing strategies and mergers to increase the range of product portfolio and foothold in the market for anti-fatigue cosmetics.

Some of the major players operating in the market for anti-fatigue cosmetics include Unilever, L'Oréal S.A., Shiseido Company, Limited, Bio Veda Action Research Co. (Biotique), The Estée Lauder Companies Inc., Christian Dior SE, Mesoestetic, Nuxe, Inc., The Ordinary, and Groupe Clarins SA.

Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 14.4 million |

|

Revenue forecast in 2028 |

USD 20.5 million |

|

CAGR |

4.6% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million and CAGR from 2021 to 2028 |

|

Segments covered |

By Product, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies |

Unilever, L'Oréal S.A., Shiseido Company, Limited, Bio Veda Action Research Co. (Biotique), The Estée Lauder Companies Inc., Christian Dior SE, Mesoestetic, Nuxe, Inc., The Ordinary, and Groupe Clarins SA |