Anti-Biofilm Wound Dressing Market Size, Share, Trends, Industry Analysis Report: By Type (Foam Dressings, Alginate Dressings, Hydrogel Dressings, and Others), Material, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 118

- Format: PDF

- Report ID: PM1736

- Base Year: 2024

- Historical Data: 2020-2023

Anti-Biofilm Wound Dressing Market Overview

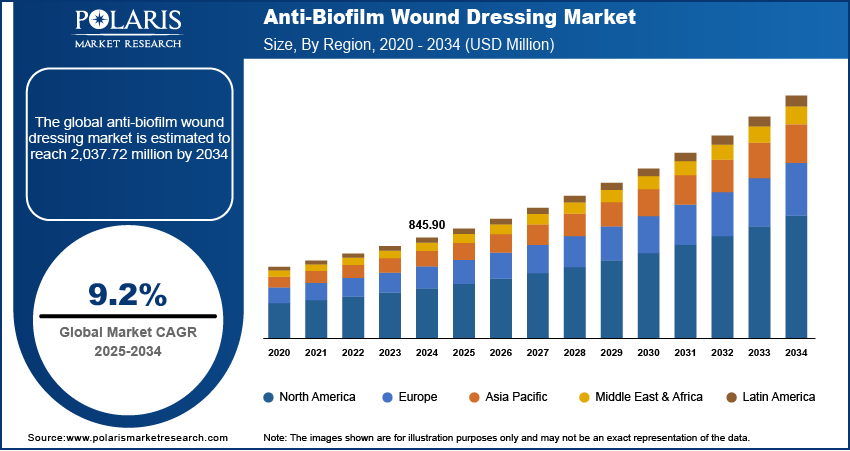

The global anti-biofilm wound dressing market size was valued at USD 845.90 million in 2024. The market is projected to grow from USD 922.12 million in 2025 to USD 2,037.72 million by 2034, exhibiting a CAGR of 9.2% from 2025 to 2034.

The anti-biofilm wound dressing market involves the development and use of advanced dressings designed to prevent or eliminate biofilm formation in chronic and acute wounds. Biofilms, which are clusters of bacteria that form protective layers, can delay healing and increase the risk of infection. Anti-biofilm wound dressings incorporate antimicrobial agents or materials that disrupt biofilm formation and promote faster wound healing.

To Understand More About this Research: Request a Free Sample Report

The anti-biofilm wound dressing market growth is being driven by the rising prevalence of chronic wounds, such as diabetic foot ulcers, and the growing awareness of the need for advanced wound care. Trends such as the increasing adoption of nanotechnology in wound care products and the demand for more effective and specialized treatments are expected to propel market expansion. Additionally, innovations in materials, such as silver-based and hydrocolloid dressings, are enhancing the efficacy of anti-biofilm wound dressings in managing complex wounds.

Anti-Biofilm Wound Dressing Market Dynamics

Increasing Adoption of Nanotechnology in Wound Care

Nanotechnology enables better penetration into the wound site and allows for a sustained release of antimicrobial agents, which is critical in preventing biofilm formation and promoting faster healing. The use of nanomaterials, such as nanoparticles and nanofibers, enhances the antimicrobial properties of wound dressings. According to a study published in Wound Repair and Regeneration (2020), nanomaterials like silver nanoparticles have shown superior antimicrobial activity, which is vital for treating chronic wounds. The use of these advanced materials also reduces the risk of resistance development, making them more effective in long-term treatment scenarios. Thus, the rising adoption of nanotechnology in wound care is expected to boost the anti-biofilm wound dressing market development.

Rising Prevalence of Chronic Wounds and Diabetes-Related Complications

Chronic conditions, such as diabetic foot ulcers, are becoming increasingly common worldwide, creating a need for specialized treatments. According to the International Diabetes Federation (IDF), approximately 463 million adults were living with diabetes globally in 2019, and this number is expected to rise to 700 million by 2045. Diabetes significantly increases the risk of wound infections and delayed healing due to impaired circulation and immune response, making biofilm formation a significant concern. The need for dressings that can combat biofilms and promote quicker healing is critical in addressing these complications and improving patient outcomes. As a result, the growing prevalence of chronic wounds, particularly those related to diabetes, is driving the anti-biofilm wound dressing market demand.

Advancements in Biocompatible and Silver-Based Dressings

Silver-based wound dressings are widely recognized for their antimicrobial properties, and their use in anti-biofilm wound care is increasing. Silver ions are effective in disrupting bacterial cell walls and preventing biofilm formation, which is particularly beneficial for treating infected or chronic wounds. Recent advancements in silver-based dressing formulations have focused on improving biocompatibility and reducing cytotoxicity, ensuring that the dressings are safe for long-term use. A study in the Journal of Applied Microbiology (2020) highlighted that silver-based dressings reduced bacterial load and promoted faster wound healing, making them a preferred option in treating biofilm-associated wounds. These innovations are driving the anti-biofilm wound dressing market revenue by providing more effective, long-lasting solutions to complex wound care.

Anti-Biofilm Wound Dressing Market Segment Insights

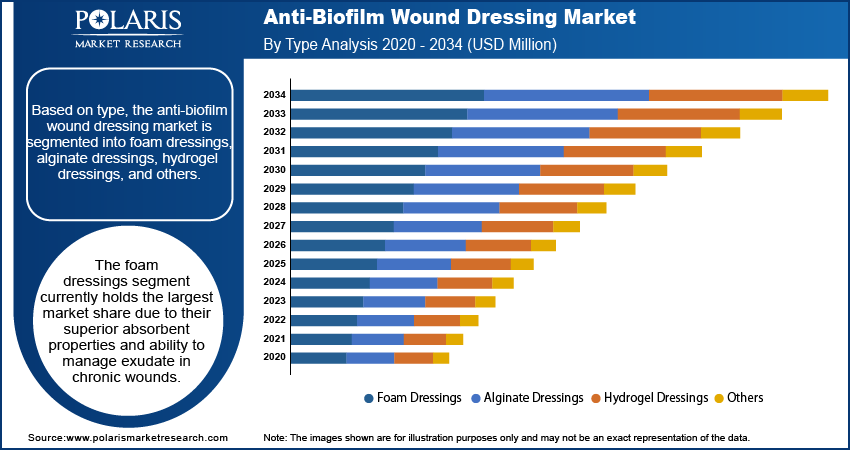

Anti-Biofilm Wound Dressing Market Assessment Based on Type

The anti-biofilm wound dressing market, by type, is segmented into foam dressings, alginate dressings, hydrogel dressings, and others. Foam dressings hold the largest anti-biofilm wound dressing market share due to their superior absorbent properties and ability to manage exudate in chronic wounds. These dressings form a protective barrier against external contaminants while maintaining a moist wound environment, which is crucial for biofilm disruption and promoting faster healing. The demand for foam dressings is also driven by their versatility in treating various wound types, including diabetic foot ulcers and pressure ulcers. This has now become a preferred choice among healthcare professionals, particularly in the treatment of complex and exudative wounds.

Among the other types, alginate dressings are registering the highest CAGR due to their unique ability to absorb large amounts of exudate while facilitating a moist environment that supports tissue regeneration. Alginate dressings, made from seaweed derivatives, are particularly effective in managing moderate to heavily exuding wounds and have gained traction in clinical settings for their ease of use and rapid hemostatic properties. The increasing focus on advanced wound care solutions and the rising incidence of chronic wounds are also contributing to the growing preference for alginate-based products.

Anti-Biofilm Wound Dressing Market Evaluation Based on Material

The anti-biofilm wound dressing market, based on material, is segmented into collagen, gelatin, hyaluronic acid, polyurethane, and others. The polyurethane segment dominates the market in terms of market share due to its durability, flexibility, and excellent barrier properties. Polyurethane-based dressings are widely used in wound care because they provide a moist healing environment while being impermeable to bacteria and other contaminants. Polyurethane's ability to manage exudate and prevent infection makes it a preferred material in treating a wide range of wound types, including chronic and surgical wounds. Its combination of protection, comfort, and high adhesion without causing irritation has contributed to its widespread adoption, particularly in clinical settings.

The hyaluronic acid segment is experiencing the fastest growth due to its exceptional regenerative and moisturizing properties, which are critical in supporting wound healing and reducing biofilm formation. Hyaluronic acid promotes cell proliferation and tissue regeneration, making it a valuable material in advanced wound care. As the demand for more effective and biocompatible wound healing solutions increases, hyaluronic acid-based dressings are gaining popularity for their ability to enhance the healing process, especially in chronic and infected wounds. The growing preference for natural and biocompatible materials in wound care products is further driving the rapid expansion of the hyaluronic acid segment.

Anti-Biofilm Wound Dressing Market Outlook Based on Application

The anti-biofilm wound dressing market, based on application, is segmented into chronic wounds, acute wounds, surgical wounds, and others. The chronic wounds segment holds the largest market share due to the increasing prevalence of conditions such as diabetic foot ulcers, venous ulcers, and pressure ulcers, which require long-term, specialized care. Chronic wounds are characterized by persistent infection and delayed healing, making them particularly susceptible to biofilm formation. Anti-biofilm wound dressings are essential in managing these types of wounds, as they help prevent infection and support the healing process. The rising incidence of diabetes and an aging population are major factors driving the demand for advanced dressings tailored for chronic wound care.

The surgical wounds segment is experiencing the fastest growth due to the increasing number of surgeries performed globally and the need for effective wound management to prevent complications such as infections and delayed healing. Surgical wounds are particularly vulnerable to biofilm formation because of the presence of surgical instruments, foreign materials, and external contaminants. The growing focus on post-operative care and infection prevention is propelling the demand for anti-biofilm dressings that promote faster recovery and reduce the risk of surgical site infections. As the healthcare sector continues to expand, particularly in developing regions, the adoption of advanced wound care products for surgical wounds is expected to grow significantly.

Anti-Biofilm Wound Dressing Market Regional Analysis

By region, the study provides the anti-biofilm wound dressing market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, driven by the high prevalence of chronic wounds, an advanced healthcare infrastructure, and increasing healthcare expenditure. The region benefits from a well-established network of hospitals and clinics that adopt advanced wound care technologies, including anti-biofilm dressings, to treat conditions such as diabetic foot ulcers and pressure ulcers. Additionally, favorable government initiatives and the growing demand for more effective and specialized wound care products contribute to the regional market dominance. The presence of key market players and the region's focus on innovation and research in wound care technologies also play a significant role in maintaining its leadership in the market.

Europe is a significant market for anti-biofilm wound dressings, driven by the increasing aging population and the high incidence of chronic wounds such as diabetic foot ulcers and venous ulcers. The region's healthcare systems are well-established, and there is a growing demand for advanced wound care solutions to address the challenges posed by chronic and infected wounds. Additionally, the regulatory environment in Europe supports innovation, with several key manufacturers focusing on improving the effectiveness of anti-biofilm dressings. The rising focus on healthcare quality, coupled with the increasing awareness of biofilm-related wound complications, is contributing to the steady growth of the market in Europe. Furthermore, the growing number of outpatient surgeries and post-operative wound care treatments are propelling the adoption of these advanced dressings in the region.

The Asia Pacific anti-biofilm wound dressing market is experiencing rapid growth, driven by improving healthcare infrastructure, increasing healthcare access, and rising awareness of advanced wound care technologies. Countries such as China, India, and Japan are seeing a rise in chronic diseases like diabetes, which is fueling the demand for specialized wound care products. In addition, the region’s expanding geriatric population is contributing to the market growth. As healthcare systems in developing countries continue to modernize and shift towards more advanced medical treatments, the adoption of anti-biofilm dressings is increasing. The rise in surgical procedures and the increasing burden of non-communicable diseases are also influencing market growth in Asia Pacific, along with growing support for advanced wound management in both public and private healthcare sectors.

Anti-Biofilm Wound Dressing Market – Key Players and Competitive Insights

Key players in the anti-biofilm wound dressing market include companies such as 3M, Smith & Nephew, Mölnlycke Health Care, Coloplast, and ConvaTec, all of which offer a range of wound care solutions targeting biofilm disruption. Other notable players are Hartmann Group, and Medtronic, which provide advanced wound care products, including antimicrobial and anti-biofilm dressings. Companies like HARTMANN, and BSN Medical also play significant roles with their advanced technologies for biofilm management in chronic and acute wound care. Further contributors to the market are companies such as Advancis Medical, Urgo Medical, and Integra LifeSciences, which focus on developing biofilm-targeting wound care solutions. Additionally, smaller but growing players such as Tielle and KCI are introducing innovative materials to enhance wound healing and infection prevention.

The competitive landscape of the anti-biofilm wound dressing market is characterized by a mix of established medical device companies and specialized firms focused on wound care innovation. Companies are increasingly concentrating on developing antimicrobial, biocompatible, and cost-effective solutions to manage biofilm-related wounds. These players often differentiate themselves through their product portfolios, clinical efficacy, and regulatory approvals. Many are also expanding their presence in emerging markets where the demand for advanced wound care solutions is growing. For example, 3M and Medtronic leverage their extensive distribution networks and healthcare collaborations to maintain strong market positions globally, while regional players like Urgo Medical and Advancis Medical capitalize on their specialized technologies and niche offerings.

Competitive strategies in the anti-biofilm wound dressing market include product innovation, mergers and acquisitions, and regional market expansion. Companies are investing heavily in research and development to create next-generation dressings that are more effective in treating biofilm-related infections while improving patient comfort and healing times. There is also a strong focus on regulatory approvals to enter new markets, especially in developing regions. As the market grows, there is a noticeable shift towards partnerships and collaborations aimed at advancing wound care technologies, with companies joining forces to enhance product offerings and increase their market footprint.

3M is a multinational company known for its diverse product offerings, which include healthcare solutions like wound care products. In the anti-biofilm wound dressing market, 3M is recognized for its advanced wound care dressings that help manage infections and promote healing. The company integrates technology and research into its products, ensuring that they are designed to address challenges like biofilm formation in chronic and surgical wounds.

Smith & Nephew is another key player in the anti-biofilm wound dressing market, focusing on advanced wound management products. The company offers a range of dressings and wound care solutions that target biofilm and infection, helping to speed up the healing process in both acute and chronic wounds.

List of Key Companies in Anti-Biofilm Wound Dressing Market

- 3M

- Smith & Nephew

- Mölnlycke Health Care

- Coloplast

- ConvaTec

- Hartmann Group

- Medtronic

- HARTMANN

- BSN Medical

- Advancis Medical

- Urgo Medical

- Integra LifeSciences

Anti-Biofilm Wound Dressing Industry Developments

- In December 2023, Smith & Nephew launched a new line of antimicrobial dressings designed to reduce biofilm-related complications in surgical wounds. The company stated that the product development aligns with its commitment to improving patient outcomes through innovative wound care solutions that address the challenges posed by biofilm in wound healing.

- In November 2023, 3M announced a collaboration with a Smart Reporting, a German technology provider in radiology and pathology provider to improve wound care outcomes through the introduction of its new antimicrobial dressings designed for patients with complex wounds.

Anti-Biofilm Wound Dressing Market Segmentation

By Type Outlook

- Foam Dressings

- Alginate Dressings

- Hydrogel Dressings

- Others

By Material Outlook

- Collagen

- Gelatin

- Hyaluronic Acid

- Polyurethane

- Others

By Application Outlook

- Chronic Wounds

- Acute Wounds

- Surgical Wounds

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Anti-Biofilm Wound Dressing Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 845.90 million |

|

Market Size Value in 2025 |

USD 922.12 million |

|

Revenue Forecast by 2034 |

USD 2,037.72 million |

|

CAGR |

9.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The anti-biofilm wound dressing market has been segmented into detailed segments of type, material, and application. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: The growth strategy in the anti-biofilm wound dressing market focuses on innovation, product differentiation, and expanding geographical reach. Companies are investing in research and development to introduce new antimicrobial technologies and advanced materials that enhance the effectiveness of wound healing. Collaborations and partnerships with healthcare providers and hospitals are also key to expanding market access, particularly in emerging markets. Additionally, firms are increasingly focusing on educating healthcare professionals and patients about the benefits of advanced wound care products, driving adoption. A focus on regulatory approvals and compliance ensures that companies can reach global markets while meeting local healthcare standards.

FAQ's

The anti-biofilm wound dressing market size was valued at USD 0.85 million in 2024 and is projected to grow to USD 2,037.72 million by 2034

The market is projected to register a CAGR of 9.2% from 2025 to 2034.

North America had the largest share of the market in 2024.

A few of the key players in the market are 3M, Smith & Nephew, Mölnlycke Health Care, Coloplast, and ConvaTec, all of which offer a range of wound care solutions targeting biofilm disruption. Other notable players are Hartmann Group, and Medtronic, which provide advanced wound care products, including antimicrobial and anti-biofilm dressings.

The foam dressings segment accounted for the largest market share in 2024.

The polyurethane segment held the largest share in 2024.

Anti-biofilm wound dressing refers to specialized wound care products designed to prevent or disrupt the formation of biofilms in chronic or infected wounds. Biofilms are clusters of bacteria that form protective layers, making them more resistant to treatment and hindering the healing process. These dressings incorporate antimicrobial agents or advanced materials that actively target and break down biofilms, helping to reduce infection, promote faster healing, and improve overall wound management. They are commonly used in the treatment of chronic wounds such as diabetic foot ulcers, pressure ulcers, and surgical wounds, where biofilm formation is a significant barrier to recovery.

A few key trends in the anti-biofilm wound dressing market are described below: Adoption of Nanotechnology: Increasing use of nanomaterials, such as nanoparticles, to enhance antimicrobial properties and improve wound healing. Rising Prevalence of Chronic Wounds: Growing number of chronic conditions, particularly diabetes, driving demand for advanced wound care solutions. Innovation in Biocompatible Materials: Development of dressings with biocompatible materials, like silver and hydrocolloids, to ensure effective biofilm disruption and better patient outcomes. Shift Towards Natural and Sustainable Materials: Growing preference for wound dressings made from natural and eco-friendly materials, such as collagen and hyaluronic acid, which also support healing.

A new company entering the anti-biofilm wound dressing market could focus on developing innovative products with enhanced antimicrobial properties and faster healing capabilities, leveraging advanced technologies such as nanomaterials or smart dressings. Focusing on biocompatible and sustainable materials, such as collagen or hyaluronic acid, could meet the growing demand for natural wound care solutions. Additionally, establishing partnerships with hospitals and healthcare providers to promote product adoption and gaining regulatory approvals for quick market entry would be crucial. Targeting emerging markets with tailored solutions for chronic wounds could also provide a competitive edge in regions where advanced wound care products are in increasing demand

Companies manufacturing, distributing, or purchasing anti-biofilm wound dressing and related products, and other consulting firms must buy the report.