Anti-acne Cosmetics Market Share, Size, Trends, Industry Analysis Report, By Product Type (Mask, Creams & Lotions, Cleaners & Toners, Others); By End-Use (Women, Men); By; Segment Forecast, 2021 - 2028

- Published Date:Aug-2021

- Pages: 112

- Format: PDF

- Report ID: PM1940

- Base Year: 2020

- Historical Data: 2016-2019

Report Outlook

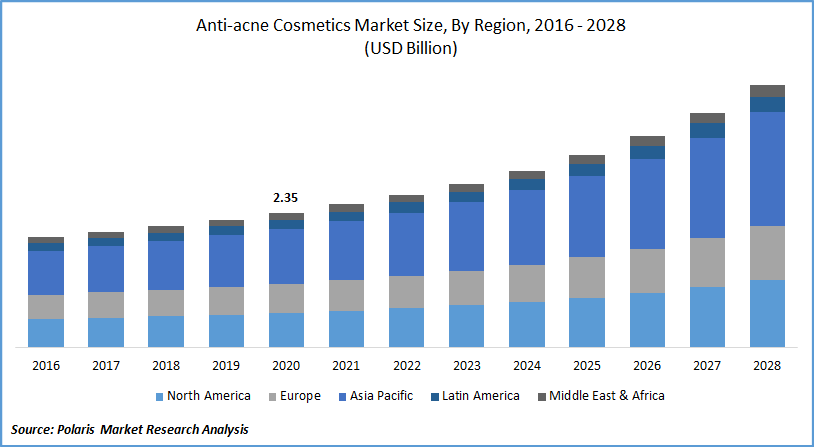

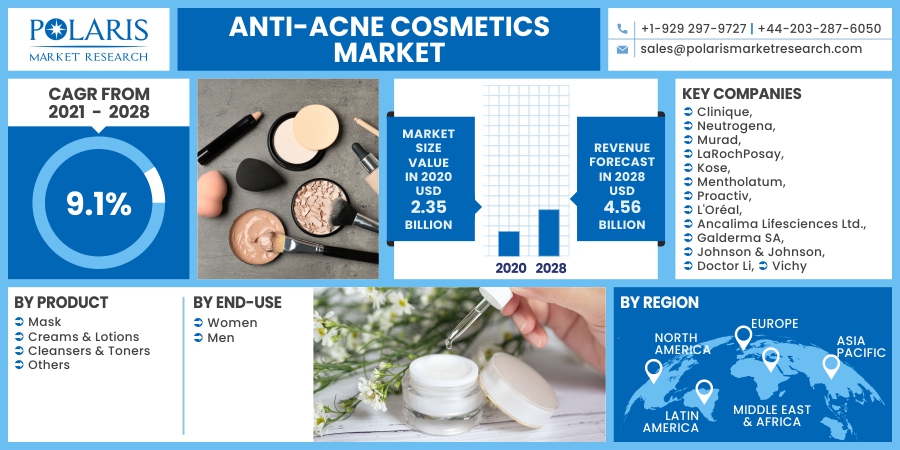

The global anti-acne cosmetics market was valued at USD 2.3 billion in 2020 and is expected to grow at a CAGR of 9.1% during the forecast period. The market is driven by the harmful psychological stress attached to acne and the increasing use of cosmetics by men and women, especially in emerging economies.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Moreover, rising internet penetration, the number of e-commerce platforms selling these goods, and urbanization are expected to raise awareness among the target audience, specifically in developing countries, which will drive the growth of the global anti-acne cosmetics market during the forecasted period.

Furthermore, the increased availability of anti-acne cosmetics through a variety of offline and online stores is expected to fuel the market development. The introduction of new products, the use of organic ingredients, and the growing popularity of social media apps would provide opportunities for market players in the industry.

Industry Dynamics

Growth Drivers

Acne is one of the most common dermatological disorders affecting both men and women globally. Anti-acne cosmetics are used to clear the pimples, and lesions form due to acne. The use of anti-acne cosmetics has increased in recent years due to the increasing number of people with acne globally and increased beauty awareness and urbanization in many parts of the world.

Globally, acne is the eighth most prevalent disease, and acne vulgaris affects nearly 700 million people worldwide and is approximately 10% of the world population. Even though acne will not have any life-threatening effects on the health of a person, but it will lead to various psychological problems such as depression and anxiety among people.

In recent years, men's use of anti-acne cosmetics has increased due to increased awareness of cosmetic products among men. Many companies are also producing anti-acne cosmetics specifically for men. The increasing popularity of anti-acne products has led to the introduction of many new innovative products in the anti-acne cosmetics market.

In December 2019, CeraVe Acne introduced Resurfacing Retinol Serum and Foaming Cream Cleanser with Benzoyl Peroxide therapeutic skincare products. Both the products are produced by combining the three essential ceramides that include 1, 3, and 6-II to manage acne-prone skin.

Perricone MD introduced a new Acne Relief Prebiotic Acne Therapy line based on prebiotics in October 2019. The new product will treat acne by targeting acne-causing bacteria, inflammation, and excess oil. In August 2020, Moia Elixirs launched an advanced skincare Cannabidiol-infused nanofiber face mask for acne prevention.

The COVID-19 pandemic is expected to have a negligible effect on the growth of the global market for anti-acne cosmetics during the forecast period, as most treatments do not require hospitalization or visiting hospitals frequently. The products are used at home for the proper management of skin.

Know more about this report: request for sample pages

Anti-acne Cosmetics Market Research Scope

The market is primarily segmented on the basis of product, end-use, and region.

|

By Product |

By End-User |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Product

The creams & lotions segment generated the highest revenue in 2020 and is expected to have its dominance during the forecast period due to high market demand for these items, as it offers protection from bacteria and skin ailments such as eczema and psoriasis.

The others segment is expected to grow at the fastest pace in the market for anti-acne cosmetics over the forecast period. The segment's growth is driven by high market demand, as these products are designed to be compatible with different skin types.

Insight by End-Use

In 2020, the women end-user segment dominated the industry, accounting for more than half of all revenue produced globally. From 2021 - 2028, the women end-user segment is projected to grow at the fastest pace. The high prevalence of skin disorders among females can be attributed to the increase in revenue.

Acne is more common in females than males due to hormonal fluctuations, such as those that occur during the menstrual cycle. According to a survey, 62.2% of pre-menopausal women said their acne got worse during their menstrual cycle.

Geographic Overview

The Asia Pacific market for anti-acne cosmetics is expected to be the largest region for the market in terms of revenue in 2020. Over the forecast period, the regional market is expected to grow at the fastest pace. China and India are expected to emerge as the biggest market for anti-acne products in the coming years owing to their population size and booming economy.

Acne affects nearly 80% of people in India and China. In the past few decades, the improved economic condition in these countries has increased awareness of high-end cosmetics brands among the public. In addition, Malaysia, Vietnam, and Indonesia are a few other countries where the anti-acne cosmetics demand is expected to be strong over the forecast period.

Competitive Landscape

Cosmetics companies across the globe are increasingly coming with new anti-acne products due to increased awareness among people for these products, which has led to increased consumption globally. High-end cosmetic brands are being launched in many developing economies owing to the increased expenditure among the public for cosmetic-related products.

Some of the major players operating in the market for anti-acne cosmetics include Clinique, Neutrogena, Murad, LaRochPosay, Kose, Mentholatum, Proactiv, L'Oréal, Ancalima Lifesciences Ltd., Galderma SA, Johnson & Johnson, Doctor Li, and Vichy.

Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 2.35 billion |

|

Revenue forecast in 2028 |

USD 4.56 billion |

|

CAGR |

9.1% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Product, By End-User, By Region |

|

Regional scope |

North America Europe Asia Pacific Latin America; Middle East & Africa |

|

Key Companies |

Clinique, Neutrogena, Murad, LaRochPosay, Kose, Mentholatum, Proactiv, L'Oréal, Ancalima Lifesciences Ltd., Galderma SA, Johnson & Johnson, Doctor Li, and Vichy |