Anorexiants Market Share, Size, Trends, Industry Analysis Report, By Drug Class (Catecholamines, Serotonin); By Route of Administration; By End User; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 118

- Format: PDF

- Report ID: PM4793

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

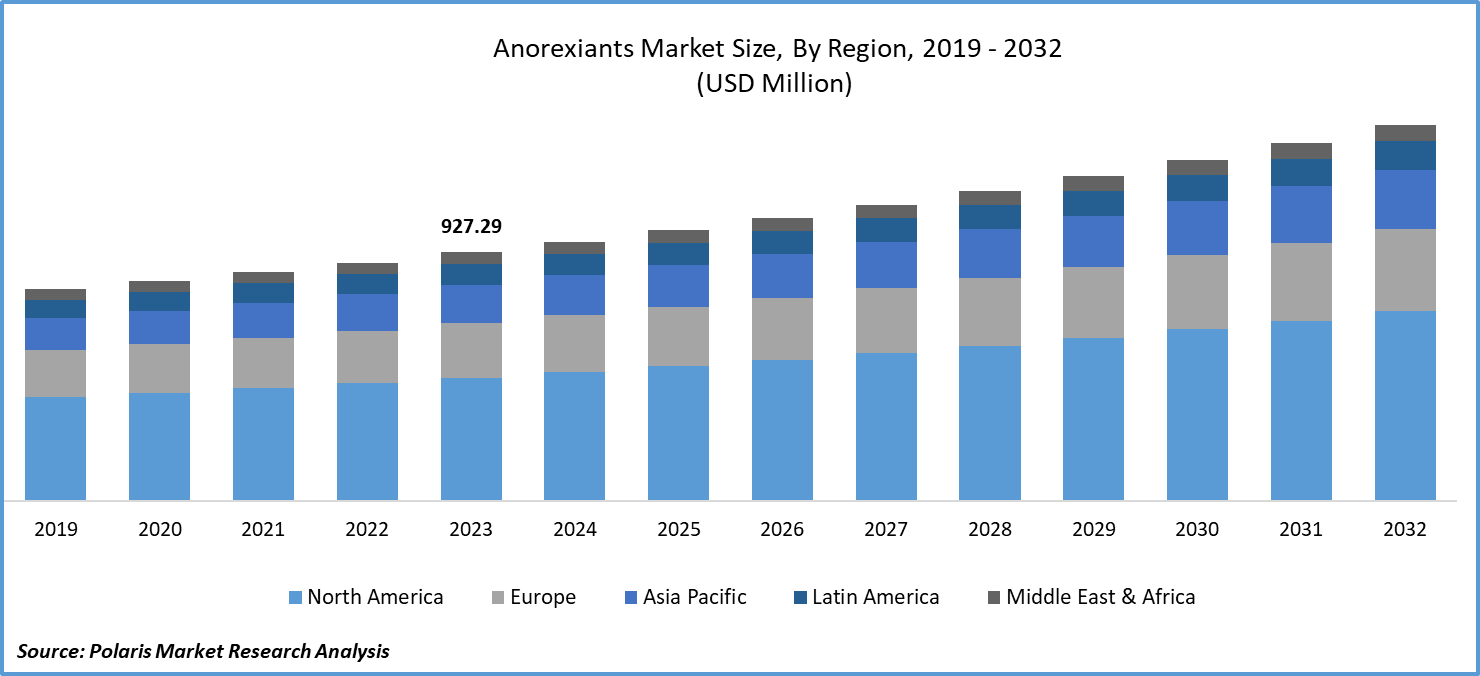

Global anorexiants market size was valued at USD 927.29 million in 2023. The market is anticipated to grow from USD 967.62 million in 2024 to USD 1,403.13 million by 2032, exhibiting the CAGR of 4.8% during the forecast period.

Market Overview

Appetite-suppressant drugs are gaining importance in the global market with the rising obesity cases, which are mostly caused by the intake of foods with a higher rate of calories. Based on the data from the Centres for Disease Control and Prevention, around 70% of the adults in the United States are suffering from obesity or overweight.

The rising need for medications that can limit appetite is expected to grow significantly in the coming years. Increased awareness about the causes and solutions of obesity, coupled with the internet's accessibility to a wider consumer base, is likely to fuel the adoption of weight management drugs. Furthermore, the increasing collaborative initiatives and expansion activities of the key players are projected to stimulate growth opportunities for the global anorexiant market in the long run.

To Understand More About this Research: Request a Free Sample Report

- For instance, in November 2023, Novo Nordisk, a pharmaceutical company, announced the acquisition of Inversago, an obesity drug producer, for $1.07 billion with the agreement to develop an appetite regulator.

Moreover, pharmaceutical companies are witnessing a surge in the consumption of obesity-medicinal drugs, showing a positive outlook for the growth of the anorexiant market in the long run. For instance, Novo Nordisk witnessed a 174% rise in sales of obesity care drugs in the initial three quarters of 2023.

However, the higher cost of obesity drugs and the lower availability of these drugs in the National Health Scheme are major factors contributing to the limited demand for anorexiants in the global market.

Growth Drivers

The presence of lower physical activity in the population

The world population is registering a rapid transformation in employment opportunities, from traditional agricultural farming, which involves higher physical activity, to modern technology-based jobs. The increased compensation for sedentary jobs in relation to agriculture is facilitating the large shift to those jobs, leading to overweight and obesity among the employees. Physical inactivity is the fourth major cause of death in the world. According to a recent study conducted by The Hindu, a news agency, around half a billion people are expected to witness chronic cases due to physical inactivity by 2030. The shift towards a sedentary lifestyle is likely to create new demand for anorexiants in the foreseeable future.

Increase in the demand for weight-loss drugs

The worldwide nations are experiencing a significant rise in the demand for weight management drugs on the market, with the growing consciousness of the professional look stimulating the need for medication to assist in controlling appetite. Pharmaceutical companies are working to increase production of anti-obesity drugs with the increasing demand in the supply shortage. For instance, in November 2023, Eli Lilly and Company announced the construction of a new production facility in Germany with $2.5 billion to meet the ongoing demand for its medicines, including its portfolio of diabetes and obesity.

Restraining Factors

Regulatory hurdles and side effects associated with the anorexiants

The existence of stringent regulations among obesity drugs and the prevalence of negative impacts on consumers, such as the risk of pulmonary hypertension and cardiovascular events, led to lower adoption in the market. For instance, in February 2020, the U.S. Food and Drug Administration announced the voluntary removal of Belviq from Esai, Inc., after the release of clinical trial results that showed the potential risk of cancer among consumers.

Report Segmentation

The market is primarily segmented based on drug class, route of administration, end user and region.

|

By Drug Class |

By Route of Admission |

By End User |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Drug Class Analysis

Catecholamines segment is expected to witness the highest growth during the forecast period

The catecholamines segment will grow at a rapid pace, mainly driven by their effectiveness in fueling energy spending. Rising research studies exploring the properties of anorexiants in the catecholamine drug class are likely to propel awareness about these drugs in the long run. For instance, a 2021 study published in PubMed Central focused on determining the treatment duration and dose of phentermine in weight management and found that 30 mg is more effective than 15 mg over 3 months.

The serotonin segment led the market with a substantial revenue share in 2023, largely attributable to the ability of anorexiants to store nutrients by increasing serotonin levels, causing a feeling of fullness among consumers. The potential of serotonin-based anorexiants in limiting the intake of carbohydrates with moderate consumption of protein is expected to gain utility in the long run as it assists in having a balanced diet.

By Route of Admission Analysis

Oral segment accounted for the largest market share in 2023

The oral segment accounted for the largest share in 2023. This growth is highly influenced by the lower side effects related to medication intake, as subcutaneous intake can create pain, swelling, and other external effects. The higher convenience in consumption of oral anorexiants due to their noninvasiveness and the increased availability of anorexiant capsules or tablets are optimally driving market growth.

The subcutaneous segment is expected to grow at the fastest rate over the next few years on account of the growing research studies revealing a positive impact of subcutaneous intake to some extent. For instance, a 2021 study published in PubMed Central focused on evaluating the effectiveness of Semaglutide, weight loss, and type 2 diabetes-control drugs in subcutaneous and oral consumption and found that subcutaneous Semaglutide has the potential to lower HbA1c and body weight in line with oral intake.

By End User Analysis

Hospitals segment held the significant market revenue share in 2023

The hospitals segment held a significant market share in revenue in 2023, which was highly accelerated over the study period due to the continuous rise in the number of hospitals offering treatment for multiple diseases. The rising incidence of obesity is bolstering the need for treatment in healthcare settings, contributing to the rise in demand for anorexiants from health providers.

The clinics segment accounted for the significant growth in the global anorexiants market in 2023 and is anticipated to boost its growth trajectory over the study period. This is due to the growing establishment of clinics providing healthcare services to obese people. For instance, in June 2023, the National Health Service (NHS) announced its plan to introduce 10 new specialty clinics offering services to obese children in England. These government initiatives are likely to create significant growth potential for the anorexiant market in the coming years.

Regional Insights

North America region registered the largest share of the global market in 2023

The North America region held the dominant share in 2023 and is expected to continue its dominance over the study period. This can be largely attributed to the growing prevalence of obesity among the people in the region and the presence of prominent market players engaged in research activities, primarily in the United States and Canada. For instance, in February 2024, BioAge Labs, a US-based research institute, entered a collaboration with a pharmaceutical company, Eli Lilly, for the testing of its obesity therapy and raised $170 million in the funding round.

According to the World Obesity Organization, over 10 million adults (34% of people older than 18) are projected to register obesity by 2025, while around 108 million people will be obese in the United States.

The Asia Pacific region is expected to be the fastest-growing region with a healthy CAGR during the projected period, owing to the presence of a larger proportion of the population facing obesity, primarily in India. According to the National Family Health Survey-5 (2019–21) data, around 40% of women and around 12% of men are abdominally obese in India. This is showcasing the need for weight management medication, including anorexiants, in the region.

The companies in the region are enhancing their potential with collaboration agreements to meet surging demand for weight management drugs, due to increasing obesity cases. In November 2023, AstraZeneca entered a deal with Eccogene, a Chinese company, for the weight-loss pill trial with an upfront transaction of $185 million. It received the right for global development and production other than China.

Key Market Players & Competitive Insights

Research developments to drive the competition

The anorexiants market is anticipated to register competition with the existence of several major players in the anorexiants market. The ongoing initiatives by the global anorexiant market players on collaborations, research innovations, partnerships, and acquisitions are projected to boost market expansion during the assessment period. For instance, in January 2024, Cipla announced its plan to develop obesity and diabetes drugs.

Some of the major players operating in the global market include:

- AstraZeneca (UK)

- Aurobindo Pharma (India)

- Bausch Health Companies Inc. (Canada)

- Cipla Inc. (US)

- Currax Pharmaceuticals LLC (US)

- Eisai Co., Ltd. (Japan)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- GlaxoSmithKline plc (UK)

- Johnson & Johnson Private Limited (US)

- Lannett (US)

- Merck & Co., Inc. (US)

- Mylan N.V. (US)

- Novartis AG (Switzerland)

Recent Developments in the Industry

- In November 2023, Zydus Lifesciences, a pharmaceutical firm, completed the acquisition of a UK-based biotechnology company, LiqMeds Group, with a starting payment of GBP 68 million. This development is likely to expand the distribution network of oral liquid products.

Report Coverage

The anorexiants market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, drug class, route of administration, end user, and their futuristic growth opportunities.

Anorexiants Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 967.62 million |

|

Revenue forecast in 2032 |

USD 1,403.13 million |

|

CAGR |

4.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in Anorexiants Market are AstraZeneca, Aurobindo Pharma, Bausch Health Companies Inc., Cipla Inc

Anorexiants Market exhibiting the CAGR of 4.8% during the forecast period.

The Anorexiants Market report covering key segments are drug class, route of administration, end user and region.

key driving factors in Anorexiants Market are Increase in the demand for weight-loss drugs

The global anorexiants market size is expected to reach USD 1,403.13 million by 2032