Animal Vaccines Market Size, Share, Trends, Industry Analysis Report: By Type (Livestock and Companion), Product, Disease, Route of Administration, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 116

- Format: PDF

- Report ID: PM1971

- Base Year: 2024

- Historical Data: 2020-2023

Animal Vaccines Market Overview

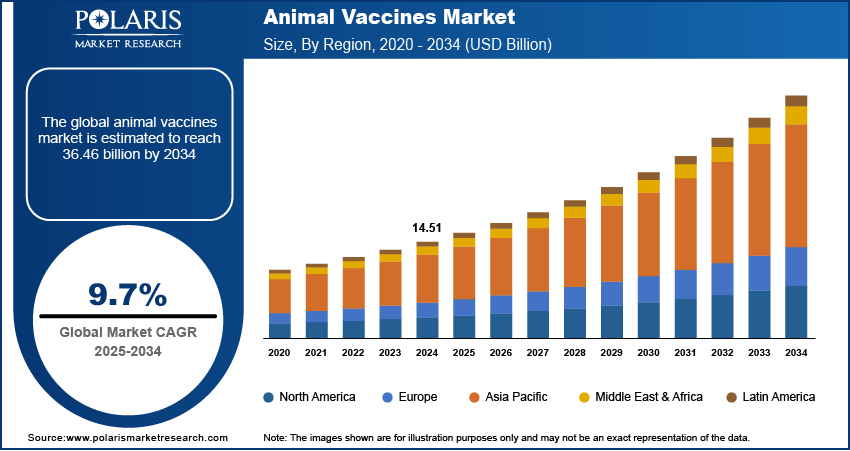

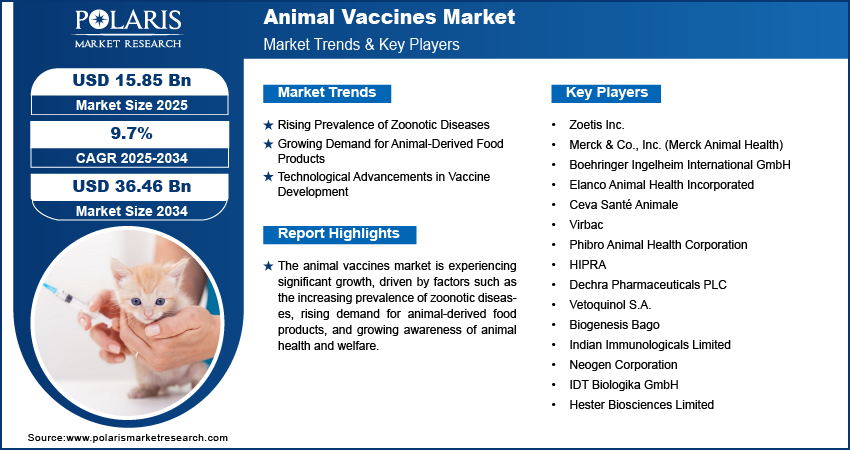

The animal vaccines market size was valued at USD 14.51 billion in 2024. The market is projected to grow from USD 15.85 billion in 2025 to USD 36.46 billion by 2034, exhibiting a CAGR of 9.7% during 2025–2034.

The animal vaccines market is involved in the development, production, and distribution of vaccines designed to prevent and control diseases in animals, including livestock identification, companion animals, and aquatic species. This market is driven by factors such as the increasing prevalence of zoonotic diseases, rising demand for animal-derived food products, and growing awareness about animal health and welfare. Technological advancements in vaccine development, such as DNA vaccines and recombinant vaccines, are also contributing to animal vaccines market growth. Key trends include the adoption of combination vaccines, government initiatives for animal disease control, and the expansion of veterinary healthcare infrastructure in emerging markets.

To Understand More About this Research: Request a Free Sample Report

Animal Vaccines Market Dynamics

Rising Prevalence of Zoonotic Diseases

The increasing prevalence of zoonotic diseases is a significant driver of the animal vaccines market. Zoonotic diseases, which are transmitted from animals to humans, have been on the rise, prompting heightened focus on preventive measures. According to the World Health Organization (WHO), approximately 60% of existing human infectious diseases are zoonotic, and 75% of emerging infectious diseases have an animal origin. Vaccination programs for animals are crucial in controlling the spread of these diseases, thereby protecting both animal and human health. This has led to increased demand for animal vaccines across various regions.

Growing Demand for Animal-Derived Food Products

The rising global demand for animal-derived food products such as meat, milk, and eggs is driving the animal vaccines market demand. The Food and Agriculture Organization (FAO) projects that global meat production will increase by nearly 15% by 2030. To meet this growing demand, ensuring the health of livestock is essential. Vaccination helps prevent disease outbreaks, reducing mortality rates, and improving the productivity of livestock, thereby supporting the supply chain of animal-derived food products. This has led to a surge in the adoption of vaccines in the livestock sector.

Technological Advancements in Vaccine Development

Technological advancements in vaccine development have significantly contributed to the animal vaccines market growth. Innovations such as recombinant vaccines, DNA vaccines, and subunit vaccines have enhanced the efficacy and safety of animal vaccines. These advancements have enabled the development of vaccines that provide long-lasting immunity and can be administered with fewer side effects. Additionally, the advent of vaccine delivery systems, such as oral and intranasal vaccines, has improved the ease of administration and compliance. These technological innovations are driving the adoption of advanced vaccines in veterinary healthcare.

Animal Vaccines Market Segment Insights

Animal Vaccines Market Assessment by Type

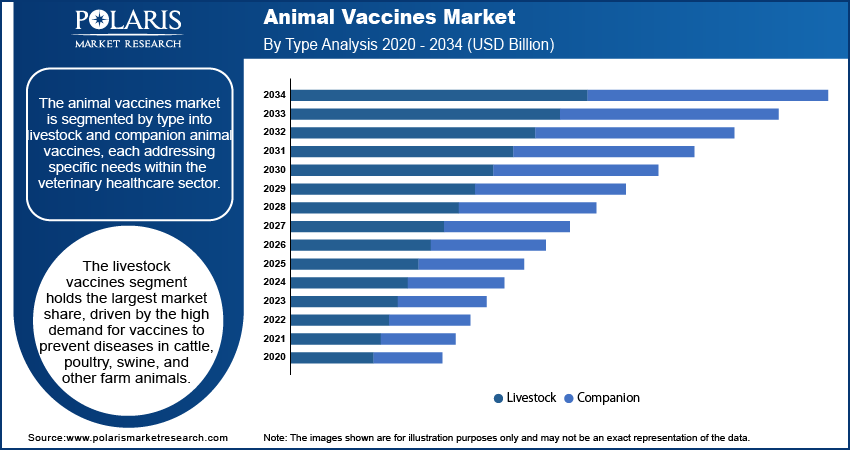

The animal vaccines market is segmented by type into livestock and companion animal vaccines, each addressing specific needs within the veterinary healthcare sector. The livestock vaccines segment holds the largest market share, driven by the high demand for vaccines to prevent diseases in cattle, poultry, swine, and other farm animals. The need to maintain herd health and productivity, especially due to the increasing demand for animal-derived food products, has led to widespread adoption of vaccines in the livestock sector. Additionally, government initiatives and mandatory vaccination programs in several countries further boost this segment's dominance.

The companion animal vaccines segment is also registering the highest growth rate, fueled by the rising adoption of pets and increasing awareness of pet health and wellness. The growing trend of pet humanization, coupled with the rise in disposable incomes, has led to higher spending on pet healthcare, including vaccinations. Vaccines for common companion animals such as dogs and cats, targeting diseases such as rabies, canine distemper, and feline leukemia, are experiencing increased demand. The development of advanced vaccines with enhanced efficacy and fewer side effects is further driving growth in this segment.

Animal Vaccines Market Evaluation by Product

The animal vaccines market is categorized by product into attenuated live vaccines, inactivated vaccines, subunit vaccines, DNA vaccines, and recombinant vaccines. Among these, the attenuated live vaccines segment holds the largest animal vaccines market share. This dominance is attributed to their ability to provide strong, long-lasting immunity with fewer doses. Attenuated live vaccines are widely used in both livestock and companion animals due to their efficacy in preventing a broad range of diseases, including highly contagious ones. Their relatively low production costs and widespread availability further support their leading position in the market.

The recombinant vaccines segment is also experiencing the highest growth rate, driven by advancements in biotechnology and the growing demand for safer and more effective vaccines. Recombinant vaccines, which use genetic engineering to improve vaccine safety and efficacy, are increasingly favored due to their ability to target specific pathogens with minimal risk of adverse reactions. The rising awareness about the benefits of these vaccines, along with increasing regulatory approvals, is contributing to their rapid adoption across various regions. This growth is further supported by ongoing research and development efforts aimed at introducing innovative recombinant vaccine solutions.

Animal Vaccines Market Assessment by Route of Administration

The animal vaccines market segmentation, based on route of administration, includes subcutaneous, intramuscular, and intranasal. The subcutaneous segment holds the largest market share, driven by its widespread use and ease of administration. Subcutaneous vaccines are favored for their ability to provide effective immune responses with minimal discomfort to the animal. This route is commonly used in both livestock and companion animals for a variety of vaccines, making it a standard practice in veterinary medicine. The simplicity of the procedure and the ability to administer vaccines without the need for specialized equipment contribute to the dominance of this segment.

The intranasal segment is also registering the highest growth rate due to its non-invasive nature and increasing adoption for respiratory disease prevention. Intranasal vaccines are particularly effective in inducing local immunity in the respiratory tract, which is crucial for protecting against respiratory infections. This method is gaining popularity, especially in companion animals, as it reduces stress and discomfort associated with traditional injection-based methods. The growing awareness of the benefits of intranasal administration, along with advancements in vaccine formulations designed for this route, is driving its rapid adoption in the animal healthcare market.

Animal Vaccines Market Evaluation by Distribution Channel

The animal vaccines market is segmented by distribution channel into e-commerce, hospital/clinic pharmacy, and others. The hospital/clinic pharmacy segment holds the largest market share, driven by the direct involvement of veterinary professionals in administering vaccines. This channel is critical for ensuring the correct storage, handling, and administration of vaccines, particularly for livestock and companion animals. Veterinary clinics and hospitals serve as primary points of care, where vaccines are often administered as part of routine health check-ups or disease prevention programs, thereby maintaining their dominance in the market.

The e-commerce segment is also registering the highest growth rate, fueled by the increasing preference for online purchasing and the convenience it offers. The growing adoption of digital platforms for veterinary products allows pet owners and livestock farmers to access a wider range of vaccines with ease. The availability of detailed product information, competitive pricing, and home delivery services are key factors driving the growth of the e-commerce segment. Additionally, the expansion of internet penetration and the rise in online veterinary consultations are further supporting the rapid adoption of this distribution channel.

Animal Vaccines Market Regional Insights

By region, the study provides animal vaccines market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, primarily due to the high prevalence of zoonotic diseases, advanced veterinary healthcare infrastructure, and substantial investment in research and development. The presence of major market players and stringent regulations promoting animal health further boost this region's dominance. Additionally, the increasing pet ownership and awareness of preventive animal healthcare contribute to the strong demand for vaccines in North America. Other regions, such as Europe and Asia Pacific, are also experiencing growth driven by rising livestock production and expanding veterinary services. However, North America remains the leading market due to its well-established healthcare systems and proactive animal health initiatives.

Europe is a significant market for animal vaccines, driven by the region’s strong emphasis on animal welfare and stringent regulatory policies. The European Union has implemented comprehensive vaccination programs to control the spread of livestock diseases, which has boosted the demand for vaccines. Additionally, rising pet ownership and increasing awareness about preventive healthcare for animals contribute to the growth of the companion animal vaccine segment. Countries such as Germany, France, and the UK are key contributors to the market, supported by advanced veterinary infrastructure and ongoing research initiatives.

Asia Pacific is experiencing rapid growth in the animal vaccines market, primarily due to the expanding livestock industry and increasing prevalence of animal diseases. Countries such as China, India, and Australia are significant contributors, with rising investments in veterinary healthcare and government-led vaccination programs for disease control. The growing awareness about animal health and the increasing adoption of pets are also driving the demand for companion animal vaccines. The region’s large agricultural base and the need to ensure food security further support the strong demand for livestock vaccines.

Animal Vaccines Market Key Players and Competitive Insights

Key players in the animal vaccines market include companies such as Zoetis Inc.; Merck & Co., Inc.; Boehringer Ingelheim; Elanco Animal Health; Bayer AG; and Virbac. Other significant players include Ceva Sante Animale, Sanofi S.A., Vetoquinol, Intervet, and Huvepharma. In addition, companies such as IDEXX Laboratories, Inc.; MSD Animal Health; and Aratana Therapeutics, Inc. continue to be active in the market. Additional participants include Agilent Technologies, Kemin Industries, and Bharat Biotech. These companies are engaged in developing a broad range of vaccines for both livestock and companion animals, targeting a variety of diseases affecting the animal population.

The competitive landscape in the animal vaccines industry is shaped by the presence of large multinational corporations and smaller specialized firms. Companies such as Zoetis and Merck dominate in terms of market presence and product offerings, consistently focusing on innovation and expanding their portfolios. Zoetis, for example, continues to lead with a comprehensive range of vaccines supported by strong research and development efforts. Merck focuses on both preventive and therapeutic vaccines, ensuring a broad application across different species. On the other hand, companies such as Virbac and Ceva are gaining traction by targeting niche markets and offering cost-effective alternatives, particularly in developing regions where price sensitivity is higher.

Smaller companies such as Huvepharma and Bharat Biotech are also making significant strides by introducing innovative solutions in the form of recombinant and DNA vaccines, which offer higher safety and efficacy profiles. The shift towards digital platforms for sales and distribution, especially in emerging markets, has opened new growth avenues for these companies. Additionally, partnerships and collaborations are becoming increasingly common, with many companies joining forces to combine expertise and resources, further intensifying the competition. These collaborations help to accelerate the development and delivery of new vaccines, creating a dynamic environment in the market.

Zoetis Inc. is a global company specializing in animal health products, including vaccines. The company has a wide range of products for livestock and companion animals, addressing various diseases and health conditions. Zoetis is known for its strong presence in the vaccine market, with a focus on both preventive and therapeutic treatments. The company operates across multiple regions, providing solutions aimed at improving animal health and productivity.

Merck Animal Health, a division of Merck & Co., Inc., is another key player in the animal vaccines market. The company offers a broad portfolio of vaccines, therapeutics, and diagnostics for both livestock and companion animals. Merck Animal Health focuses on developing solutions to prevent and treat various diseases that affect animals, contributing to improved animal welfare and farm productivity.

List of Key Companies in Animal Vaccines Market

- Zoetis Inc.

- Merck & Co., Inc. (Merck Animal Health)

- Boehringer Ingelheim International GmbH

- Elanco Animal Health Incorporated

- Ceva Santé Animale

- Virbac

- Phibro Animal Health Corporation

- HIPRA

- Dechra Pharmaceuticals PLC

- Vetoquinol S.A.

- Biogenesis Bago

- Indian Immunologicals Limited

- Neogen Corporation

- IDT Biologika GmbH

- Hester Biosciences Limited

Animal Vaccines Market Developments

- May 2024: Zoetis announced its acquisition of a portfolio of vaccines for poultry diseases from a leading veterinary biotechnology firm, further strengthening its position in the animal vaccines segment.

- April 2024: Merck Animal Health unveiled a new vaccine for bovine respiratory disease, a major issue in cattle farming. The new vaccine is part of the company's ongoing efforts to address critical health challenges in the livestock sector.

Animal Vaccines Market Segmentation

By Type Outlook (Revenue-USD Billion, 2020–2034)

- Livestock

- Companion

By Product Outlook (Revenue-USD Billion, 2020–2034)

- Attenuated Live Vaccines

- Inactivated Vaccines

- Subunit Vaccines

- DNA Vaccines

- Recombinant Vaccines

By Disease (Revenue-USD Billion, 2020–2034)

- Swine Pneumonia

- Avian Influenza

- Rabies

- Coccidiosis

- Brucellosis

- Distemper

- Canine

- Foot & Mouth

- Strangles

By Route of Administration Outlook (Revenue-USD Billion, 2020–2034)

- Subcutaneous

- Intramuscular

- Intranasal

By Distribution Channel Outlook (Revenue-USD Billion, 2020–2034)

- E-Commerce

- Hospital/Clinic Pharmacy

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Animal Vaccines Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 14.51 billion |

|

Market Size Value in 2025 |

USD 15.85 billion |

|

Revenue Forecast by 2034 |

USD 36.46 billion |

|

CAGR |

9.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The animal vaccines market has been segmented into detailed segments of type, product, disease, route of administration, and distribution channels. Moreover, the study provides the reader with a detailed understanding of the different segments at both the and regional levels.

Growth/Marketing Strategy

The growth and marketing strategies in the animal vaccines market focus on expanding product portfolios, increasing geographic reach, and enhancing engagement in the market. Companies are investing in research and development to introduce innovative vaccines that address emerging animal diseases and offer improved efficacy. Strategic partnerships, collaborations, and acquisitions are commonly used to strengthen market presence and diversify product offerings. Additionally, expanding e-commerce platforms and direct-to-consumer sales channels is becoming increasingly important for reaching a broader audience, particularly in emerging markets. Companies are also focusing on education and awareness campaigns to highlight the importance of vaccination for animal health.

FAQ's

? The animal vaccines market size was valued at USD 14.51 billion in 2024 and is projected to grow to USD 36.46 billion by 2034.

? The market is projected to register a CAGR of 9.7% during the forecast period, 2025-2034.

? North America had the largest share of the market.

? Key players in the animal vaccines market include Zoetis Inc.; Merck & Co., Inc.; Boehringer Ingelheim; Elanco Animal Health; Bayer AG; Virbac; Ceva Sante Animale; Sanofi S.A.; Vetoquinol; Intervet; Huvepharma; IDEXX Laboratories, Inc.; MSD Animal Health; and Aratana Therapeutics, Inc.

? The livestock segment accounted for the larger share of the market in 2024.

? The attenuated live vaccines segment accounted for the larger share of the market in 2024.

? Animal vaccines are biological preparations designed to prevent or control diseases in animals by stimulating their immune systems to recognize and fight specific pathogens, such as viruses, bacteria, or parasites. These vaccines are administered to both livestock and companion animals to protect them from infectious diseases, improve overall health, and enhance productivity. Animal vaccines can be made from weakened or killed forms of pathogens (attenuated or inactivated vaccines), or they may contain specific components of the pathogen, such as proteins (subunit vaccines), or genetic material (DNA and recombinant vaccines). Vaccination helps reduce the spread of diseases, ensuring better animal welfare and minimizing the economic losses associated with disease outbreaks.

? A few key trends in the market are described below: Increased Adoption of Recombinant and DNA Vaccines: Growing preference for advanced vaccine technologies that offer higher efficacy and safety. Rising Pet Ownership: The increasing number of pet owners is driving demand for vaccines in companion animals. Technological Advancements in Vaccine Development: Innovations like mRNA vaccines and new vaccine delivery methods (e.g., intranasal, oral) are gaining traction. Government Initiatives for Disease Control: Regulatory bodies are implementing stricter vaccination programs, especially for livestock diseases.

? A new company entering the Animal Vaccines market could focus on innovation by developing next-generation vaccines, such as recombinant or DNA-based vaccines, which offer improved safety and efficacy. Emphasizing sustainable and cost-effective vaccine solutions, particularly in emerging markets where veterinary infrastructure is expanding, could also provide a competitive advantage. Additionally, offering unique vaccine delivery methods, such as intranasal or oral vaccines, would appeal to both veterinary professionals and animal owners. Strategic partnerships with local governments and veterinarians for disease prevention programs, along with a strong digital presence for e-commerce and awareness campaigns, could further differentiate the company.

? Companies manufacturing, distributing, or purchasing animal vaccines and related products, and other consulting firms must buy the report.