Animal Intestinal Health Market Share, Size, Trends, Industry Analysis Report

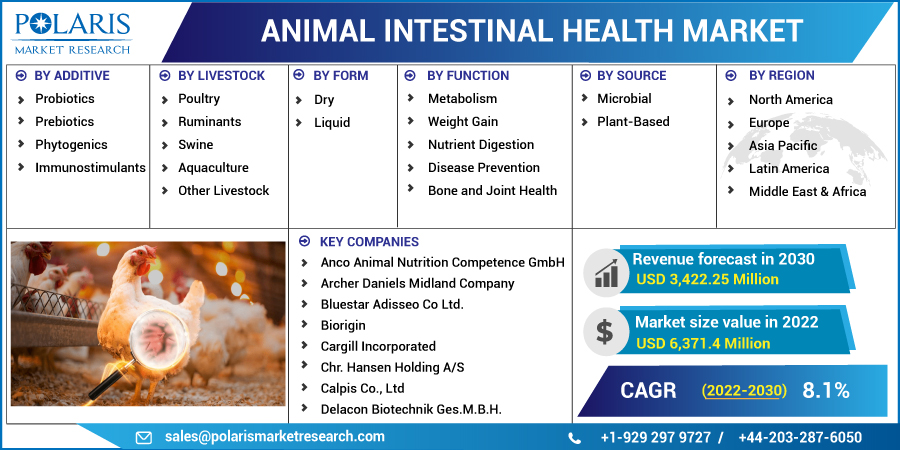

By Additive (Probiotics, Prebiotics, Phytogenics, and Immuno-stimulants); By Livestock; By Form; By Function; By Source; By Region; Segment Forecast, 2022-2030

- Published Date:Nov-2022

- Pages: 115

- Format: PDF

- Report ID: PM2847

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

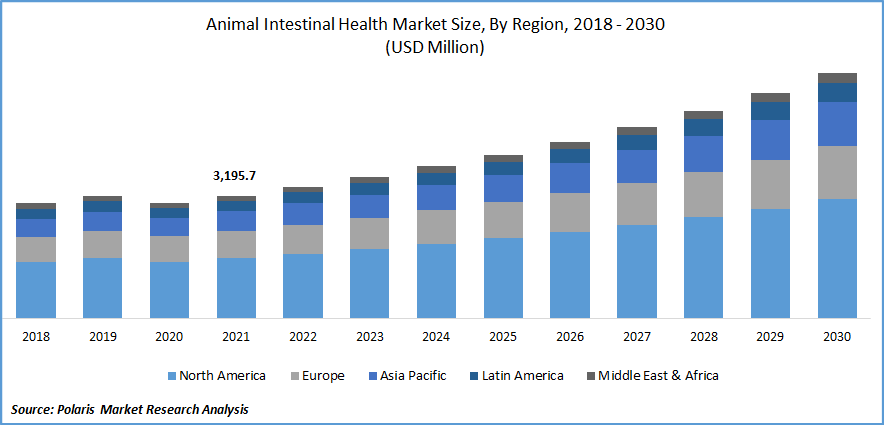

The global animal intestinal health market was valued at USD 3,195.7 million in 2021 and is expected to grow at a CAGR of 8.1% during the forecast period.

The rising benefits of animal intestinal ingredients in feed products are the major factor boosting the market growth over the forecast period. Since, gut microbiota ferments intricate dietary macronutrients and performs a wide range of bodily functions, including the production of nutrients and vitamins, defense against pathogens, and maintenance of immune system balance, it has long been understood that prebiotics may play a role in the gut ecosystem. Dietary components and commensal bacteria are just two of the many factors that can have an impact on the gut ecosystem.

Know more about this report: Request for sample pages

The main driver of the growth of the global market for animal intestinal health is the increase in the production of meat and eggs. The rising disposable income in developing nations is driving up demand for meat and egg products. Products made from meat and eggs are a great source of proteins, calcium, vitamin B12, iron, and other nutrients that support healthy bones, muscles, and brain function. Over the past three decades, meat consumption has increased threefold in developing nations. Due to an increase in consumer demand, meat production is rising quickly. Thus, maintaining animal intestinal health has become more important.

Due to transportation limitations and other socially isolating circumstances during the COVID-19 epidemic, animal output and supply fell sharply. The supply of goods, however, was reduced as a result of the chain of distribution for cattle products being disrupted and the closure of restaurants and schools. The market is anticipated to resume its upward trend with the decline in COVID-19 instances and the lifting of limitations globally.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Animal intestinal health market growth has been fueled by an increase in foods derived from animals and growing public concern for animal health. It is important to develop and then uses a better understanding of protein nutrition for the formulation of suitable protein feed for livestock. A high energy-to-protein ratio is required to maximize the use of protein, underscoring the significance of an adequate available energy supply in a balanced diet for livestock. Different species have different protein needs, and age and animal growth stages have an impact as well. Hence, maintaining the health of animals is a great concern that boost the market.

Report Segmentation

The market is primarily segmented based on additives, livestock, form, function, source, and region.

|

By Additive |

By Livestock |

By Form |

By Function |

By Source |

By Region |

|

|

|

|

|

|

Know more about this report: Request for sample pages

The probiotics segment is expected to witness the fastest growth

Probiotics are being used more frequently as a secure and effective substitute for antibiotics to boost livestock performance. They demonstrated that numerous health organizations from around the world have established and documented suitable safety protocols for the development of probiotics.

The Poultry segment is expected to hold the significant revenue share

The three main variables that have contributed to the unprecedented expansion of the industry are population growth, income growth, and urbanization. As a result, there has been an increase in the consumption of food items like milk, eggs, and meat. Increased production of lean, nutritious poultry meat in response to anticipated growth in demand will fuel market expansion.

The frequency of diarrhea is decreased with the help of intestinal health products for animals. They also help a variety of poultry species digest food more efficiently and absorb nutrients by maintaining healthy gut flora. These products promote a higher feed conversion ratio and help different types of poultry gain weight. Due to the anticipated increase in the population of these species, there will likely be an increase in the demand for compound feed products for poultry.

The demand in North America is expected to witness significant growth

North America will continue to increase steadily. It is anticipated to take second place as a result of growing government activities to ensure the welfare and safety of animals. Chemicals known as animal feed additives are used to raise the caliber of feed supplies to improve the health and performance of livestock. The demand for various feed additives, like probiotics, antioxidants, enzymes, flavors, and sweeteners, among others, should increase as there is an increasing need to improve the digestibility of feed materials.

Livestock is used in a variety of industries, including agriculture, dairy, and the production of meat. Growing consumer demand for meat from various livestock species, including broilers, turkeys, beef, and pigs, among others, should promote market expansion in the area. The demand for meat is projected to rise as a result of an expanding working population, expanding food and beverage industry, and expanding foodservice sector, which will in turn spur expansion of the North American market over the forecast period.

Asia-Pacific is anticipated to grow the fastest in terms of market share throughout the projection period. The region is predicted to have a high demand for chicken goods, which is predicted to increase the demand for feed products for broilers and layers. The demand for beef and pork meat is anticipated to rise as a result of the westernization of diets in the developing nations of the Asia Pacific area, which will also promote market expansion in that sector. Due to growing disposable income and urbanization in Saudi Arabia and Turkey, the Middle East and Africa are expected to grow over the projection period. The government's initiatives to promote the development of goods for improving animal intestinal health and reducing disease transmission are advancing this industry even further.

Competitive Insight

Key players in the market include Anco Animal Nutrition, Archer Daniels Midland, Bluestar Adisseo, Biorigin, Cargill Incorporated, Chr. Hansen Holding, Calpis, Delacon Biotechnik., DuPont, Dr. Eckel Animal Nutrition, Evonik Industries, Koninklijke, Kemin Industries, Lallemand, Nutreco., Phytobiotics Futterzusatzstoffe, and SunTech Medical.

Recent Developments

In May 2021, Evonik launched probiotics, protein diets, & consulting for the intestinal health of laying hens, broiler chickens & pigs. These products will help to maintain animal health without the use of antibiotics and will increase production and profitability.

In September 2021, ADM Animal introduced Forage First as a premium gastrointestinal health nutritional supplement. Its special combination of ingredients promotes a healthy gastric pH while defending and bolstering the horse's stomach lining.

In September 2020, DuPont Animal Nutrition & Proteon Pharma have joined forces to bring poultry producers cutting-edge bacteriophage technology that will improve intestinal health solutions and reduce antimicrobial resistance in poultry animals.

Animal Intestinal Health Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 3,422.25 million |

|

Revenue forecast in 2030 |

USD 6,371.4 million |

|

CAGR |

8.1% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments Covered |

By Additive, By Livestock, By Form, By Function, By Source, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Anco Animal Nutrition Competence GmbH, Archer Daniels Midland Company, Bluestar Adisseo Co Ltd., Biorigin, Cargill Incorporated, Chr. Hansen Holding A/S, Calpis Co., Ltd, Delacon Biotechnik Ges.M.B.H., DuPont de Nemours, Inc., Dr. Eckel Animal Nutrition GmbH & Co., Evonik Industries, Koninklijke DSM N.V., Kemin Industries, Inc., Lallemand, Inc., Nutreco N.V., Phytobiotics Futterzusatzstoffe GmbH, and SunTech Medical, Inc. |