Animal Feed Market Size, Share, Trends, Industry Analysis Report: By Type (Antibiotic, Antioxidants, Amino Acids, Feed Enzymes, Feed Acidifiers, Vitamin, and Others), Livestock, Form, Composition, and Region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 118

- Format: PDF

- Report ID: PM1133

- Base Year: 2024

- Historical Data: 2020-2023

Animal Feed Market Overview

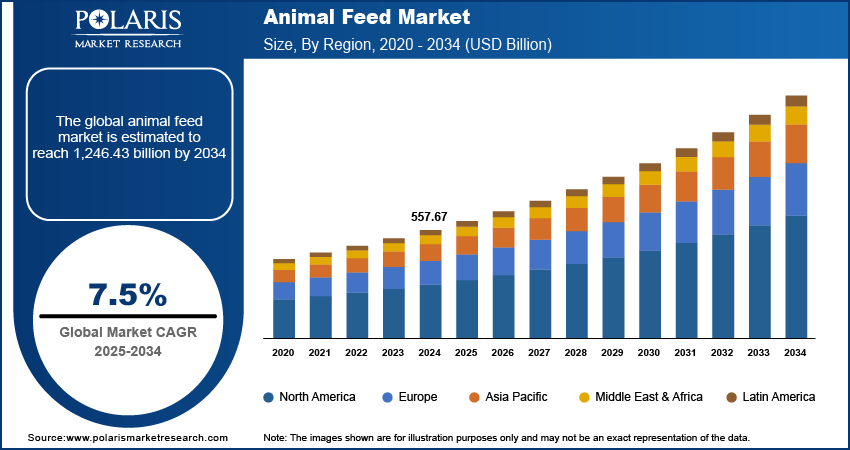

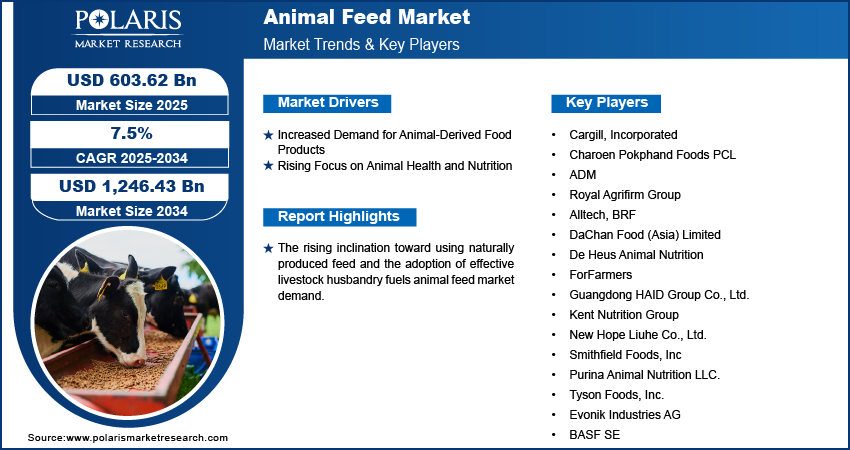

The global animal feed market was valued at USD 557.67 billion in 2024. The market is projected to grow from USD 603.62 billion in 2025 to USD 1,246.43 billion by 2034. It is projected to exhibit a CAGR of 7.5% from 2025 to 2034.

Animal feed is a type of food given to animals to provide them nutrients they need for growth, health, and productivity. The feed can be made with various ingredients, including grains, protein meals, fats, and minerals. There are many different types of animal feed, each designed for a specific kind of animal and purpose. For example, poultry feed is formulated specifically for chickens and other poultry and contains the nutrients needed for egg production and growth. Cattle feed, on the other hand, is designed for cows and other ruminants and has high levels of fiber to aid in digestion.

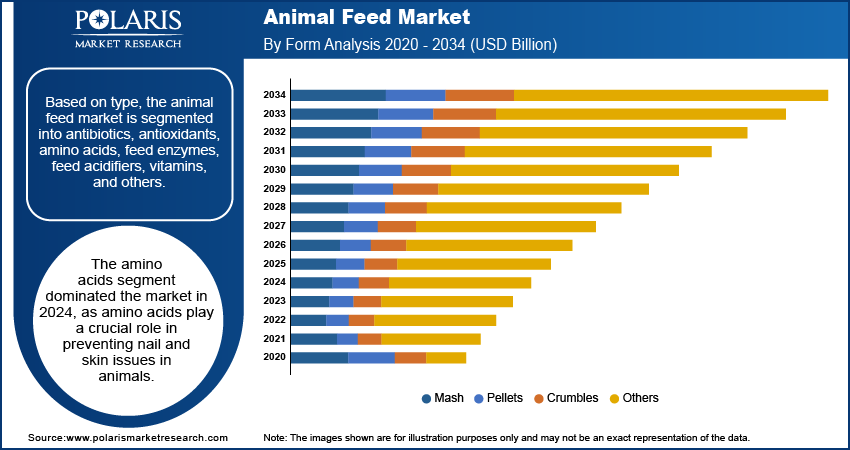

To Understand More About this Research: Request a Free Sample Report

Animal feed can be produced in different forms, including pellets, crumbles, and powders. Pelleted feed is one of the most common forms of animal feed, as it is easy to store, transport, and feed to animals. Crumbled feed is often used for young or small animals, as it is easier for them to consume. Powdered feed is used in some cases, such as for feeding young animals that cannot yet consume solid food.

The high demand for animal-derived food products such as meat, dairy, and eggs and the increasing focus on animal health and nutrition drive the animal feed market growth. Technological advancements in feed production, the rising number of feed mills, and consolidation of the industry are other factors supporting the animal feed market development.

Growing disposable income, changing lifestyles, and increasing awareness regarding health and nutrition have resulted in increased demand for high-quality meat and meat-based products. This, in turn, has boosted the demand for animal feed. The rising inclination toward using naturally produced feed and the adoption of effective livestock husbandry further fuels animal feed market demand. New product launches and strategic developments, such as mergers and acquisitions, by major players are expected to offer numerous animal feed market opportunities during the forecast period.

Rising concerns about the environmental impact of animal agriculture and the fluctuating cost of ingredients used in animal feeds hinder the animal feed market growth. The environmental impact of livestock farming, including greenhouse gas emissions and water use, is a growing concern for many consumers and policymakers. As a result, there may be increased pressure for the adoption of more sustainable practices, which could impact the demand for animal feed and its composition. Further, the cost of ingredients used in animal feed, including corn and soybean meal, often fluctuates due to factors such as weather patterns and supply and demand, making it difficult for feed manufacturers to maintain stable pricing and margins.

Animal Feed Market Dynamics

Increased Demand for Animal-Derived Food Products

With the rising global population, there is increased demand for protein-rich foods. This has led to a significant increase in livestock production, thereby fueling the demand for animal feed. In addition, rising disposable incomes in developing countries have led to a shift in dietary habits, with consumers increasingly opting for meat and dairy products. For instance, the United Nations Food and Agriculture Organization (FAO) has estimated that by 2050, the demand for food will grow by 60%. Specifically, between 2010 and 2050, meat production is projected to rise by 70%, dairy by 55%, and aquaculture by 90%. Thus, the increased demand for animal derived food products is one of the major factors driving the animal feed market expansion.

Rising Focus on Animal Health and Nutrition

The increased focus on animal health and nutrition is another major animal feed market revenue contributor. With rising consumer awareness, consumers are seeking products that are nutrient-dense and free from antibiotics and other harmful chemicals. This trend has shifted the focus from treating animals to preventing illness and promoting their overall wellness. Livestock producers are increasingly using natural and organic animal feed, which is perceived as healthier and safer for animals and humans. Also, they are enriching animal feeds with supplements such as B12 and salt-based additives to ensure animals get all the essential vitamins and minerals they need.

Animal Feed Market Segment Insights

Animal Feed Market Outlook Based on Type

The animal feed market, based on type, is segmented into antibiotics, antioxidants, amino acids, feed enzymes, feed acidifiers, vitamins, and others. The amino acids segment dominated the market with a revenue share of 33.6% in 2024. Amino acids play a crucial role in preventing nail and skin issues in animals. Also, they regulate metabolic pathways that improve health, growth, development, and reproduction. The growing demand for meat and dairy products, the need to improve feed efficiency and reduce feed cost, and the rising focus on sustainability and environmental responsibility in animal agriculture contribute to the dominant position of the segment in the market.

Animal Feed Market Assessment Based on Livestock

The animal feed market, based on livestock, is segmented into cattle, poultry, swine, aquaculture, and others. The poultry segment held the largest revenue share of 39.0% in 2024. Poultry, which is focused on the production of ducks, turkeys, and chicken for meat, is a vital source of animal protein worldwide. Poultry feed manufacturers use a combination of several ingredients, including vitamins, minerals, oilseeds, and grains, to prepare balanced diets for various poultry growth stages. With the rising global population, there has been a significant increase in poultry farms and the amount of poultry feed produced. Further, the shift toward more intensive farming methods, which require high-quality feed specifically formulated to meet the birds' nutritional needs, is another factor driving growth in the poultry feed market.

Animal Feed Market Evaluation Based on Form

The animal feed market, based on form, is segmented into mash, pellets, crumbles, and others. The pellets segment is anticipated to register a significant CAGR from 2025 to 2034. The increased demand for efficient and convenient feed options is a key driver of the segment in the animal feed market. Pelleted feed is easier to handle and store than loose feed and is less likely to spoil or attract pests. This makes it an attractive option for farmers and feed manufacturers looking to improve their operational efficiency. Pelleted feed also offers several benefits for animal health and performance. The pelleting process can improve the digestibility and bioavailability of nutrients in the feed, leading to better feed conversion rates and improved animal growth and development.

Animal Feed Market Regional Analysis

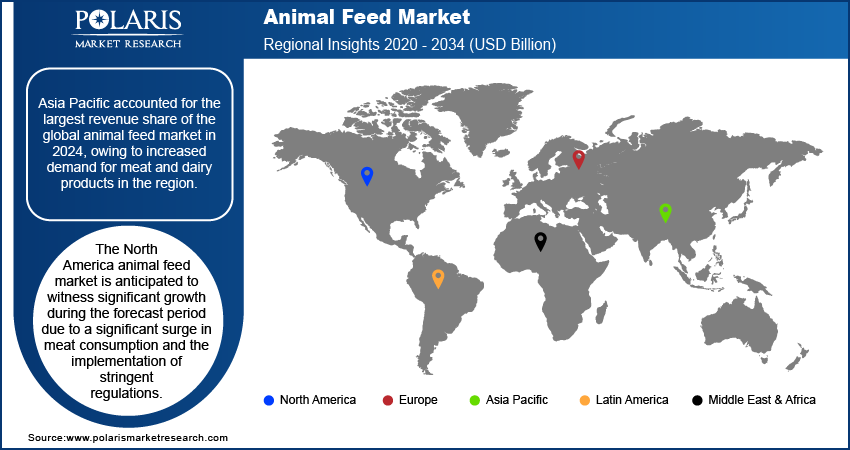

The market report offers animal feed market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific accounted for the largest revenue share of 39.9% in 2024. The increasing demand for meat and dairy products is one of the major market growth drivers in the region. With rising income and changing dietary preferences, consumers in Asia Pacific are consuming more animal protein, driving up demand for animal feed. In addition, the region is home to some of the largest meat producers in the world, such as China, India, and Indonesia, which are also the major consumers of animal feed.

The North America animal feed market is anticipated to witness significant growth during the forecast period. A significant surge in meat consumption across North America and the implementation of stringent regulations are anticipated to propel the market growth in the region. The rising health awareness among consumers and the presence of well-established players are also projected to boost the demand for animal feed in North America.

Animal Feed Market – Key Players and Competitive Insights

The key players in the animal feed market are focusing on research and development to enhance their products and services offerings and drive market demand. Also, they are adopting various strategic initiatives, including collaborations, new product launches, and increased investments, to improve their global footprint. To expand and survive in a more competitive environment, the animal feed market players must offer high-quality animal feeds.

In recent years, the animal feed market has witnessed several innovations, with key players seeking to provide specially formulated animal feeds that help meet sustainability goals. The research report offers a market assessment of all the key players, including Cargill, Incorporated; Charoen Pokphand Foods PCL; ADM; Royal Agrifirm Group; Alltech; BRF; DaChan Food (Asia) Limited; De Heus Animal Nutrition; ForFarmers; Guangdong HAID Group Co., Ltd.; Kent Nutrition Group; New Hope Liuhe Co., Ltd.; Smithfield Foods, Inc; Purina Animal Nutrition LLC.; Tyson Foods, Inc.; Evonik Industries AG; and BASF SE.

List of Key Companies in Animal Feed Market

- Cargill, Incorporated

- Charoen Pokphand Foods PCL

- ADM

- Royal Agrifirm Group

- Alltech

- BRF

- DaChan Food (Asia) Limited

- De Heus Animal Nutrition

- ForFarmers

- Guangdong HAID Group Co., Ltd.

- Kent Nutrition Group

- New Hope Liuhe Co., Ltd.

- Smithfield Foods, Inc

- Purina Animal Nutrition LLC.

- Tyson Foods, Inc.

- Evonik Industries AG

- BASF SE

Animal Feed Industry Developments

May 2023: Evonik introduced the next generation of Biolys, a proven source of lysine. The company stated that the new version of Biolys will enable customers to cater to their animals’ requirements for amino acid L-lysine more effectively.

January 2023: BASF SE and Cargill, Incorporated expanded their feed enzymes development and distribution agreement in the US. According to BASF, the strategic move will enable the companies to bring high-performance enzyme solutions for animal feed customers in the US.

Animal Feed Market Segmentation

By Type Outlook

- Antibiotic

- Antioxidants

- Amino Acids

- Feed Enzymes

- Feed Acidifiers

- Vitamin

- Others

By Livestock Outlook

- Cattle

- Poultry

- Swine

- Aquaculture

- Others

By Form Outlook

- Mash

- Pellets

- Crumbles

- Others

By Composition Outlook

- Cereal-Based Feed

- Soy-Based Feed

- Fish-Based Feed

- Oilseed-Based Feed

- Other Animal-Based Feed

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Animal Feed Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 557.67 billion |

|

Market Size Value in 2025 |

USD 603.62 billion |

|

Revenue Forecast by 2034 |

USD 1,246.43 billion |

|

CAGR |

7.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 557.67 billion in 2024 and is projected to grow to USD 1,246.43 billion by 2034.

The market is projected to register a CAGR of 7.5% from 2025 to 2034.

Asia Pacific accounted for the largest region-wise market share in 2024.

Cargill, Incorporated; Charoen Pokphand Foods PCL; ADM; Royal Agrifirm Group; Alltech; BRF; DaChan Food (Asia) Limited; De Heus Animal Nutrition; ForFarmers; Guangdong HAID Group Co., Ltd.; Kent Nutrition Group; New Hope Liuhe Co., Ltd.; Smithfield Foods, Inc; Purina Animal Nutrition LLC.; Tyson Foods, Inc.; Evonik Industries AG; and BASF SE are a few key players in the market.

The amino acids segment accounted for the largest market share in 2024.

The pellets segment is anticipated to witness a significant CAGR in the market for animal feeds during the forecast period.