Animal Feed Additives Market Share, Size, Trends, Industry Analysis Report, By Livestock (Cattle, Poultry, Swine, Aquaculture, Others); By Type; By Form; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 118

- Format: PDF

- Report ID: PM1202

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

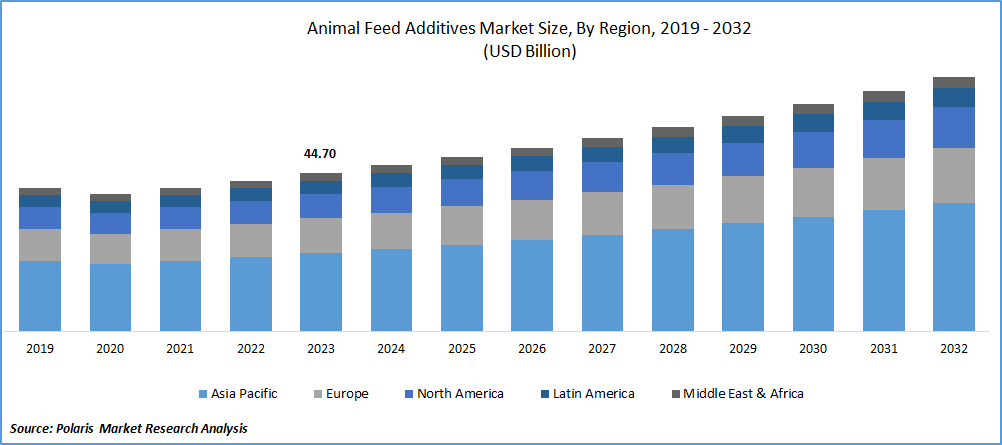

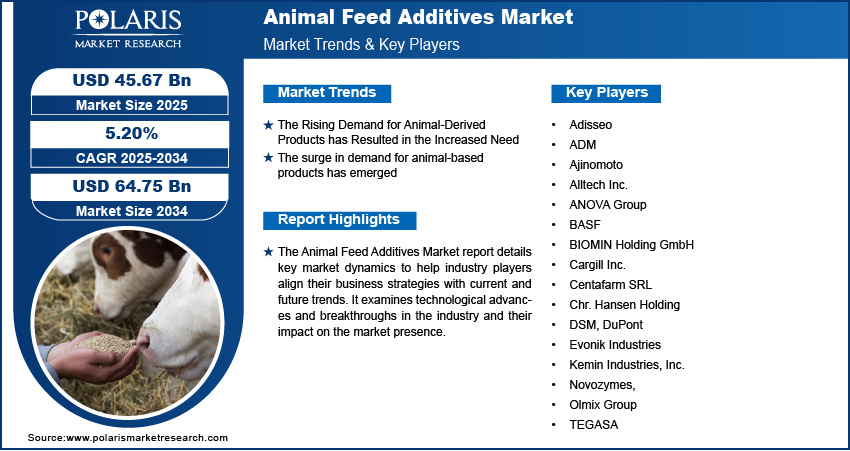

The global animal feed additives market was valued at USD 44.70 billion in 2023 and is expected to grow at a CAGR of 5.5% during the forecast period.

Animal feed additives refer to substances incorporated into animal feeds to enhance their nutritional content, improve overall animal health, and optimize performance. These additives can include vitamins, minerals, amino acids, enzymes, and other bioactive compounds. The primary goal of using these additives is to ensure the well-being of the animals, promote efficient growth, and enhance the quality of animal products such as meat, milk, and eggs.

The global increase in demand for animal-derived products, driven by population growth and rising incomes, has intensified animal farming practices. To meet the increased demand for animal products, farmers are increasingly turning to feed additives to maximize production efficiency and maintain the health of their livestock. Also, advancements in animal nutrition science and a growing awareness of the importance of balanced diets for animals contribute to the expanding market for feed additives. The animal feed additives market is expected to witness sustained growth due to ongoing research and development efforts aimed at producing innovative and sustainable feed additives. The increasing focus on organic and natural alternatives, combined with advancements in biotechnology, presents opportunities for market players to address both the growing demand for animal products and the need for environmentally friendly and ethical farming practices.

Know more about this report: Request a Free Sample Report

However, regulatory constraints and concerns regarding the environmental impact of intensive animal farming practices have led to increased scrutiny of the use of certain additives. Stricter regulations on the use of antibiotics and other chemical additives in some regions affect the market dynamics. The volatile prices of raw materials for feed additives influence the production costs, potentially impacting the overall market.

The Animal Feed Additives Market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

Growth Drivers

The Rising Demand for Animal-Derived Products has Resulted in the Increased Need for Animal Feed Additives

The surge in demand for animal-based products has emerged as an important driver for the flourishing animal feed additives market. As the world population continues to expand, followed by rising incomes and changing dietary preferences, the demand for meat, milk, and other animal-derived products has witnessed significant growth. This increased demand places greater pressure on the livestock and poultry industries to increase production efficiency and output. Animal feed additives play an important role in meeting these challenges by enhancing the nutritional content of animal feeds, promoting animal health, and ultimately boosting overall productivity.

Farmers and producers are increasingly turning to feed additives as a positive tool to address the increased demand for high-quality animal products. These additives not only contribute to improved animal growth but also play a vital role in ensuring the performance of the animals.

Report Segmentation

The market is primarily segmented based on livestock, type, form, and region.

|

By Livestock |

By Type |

By Form |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

The Amino Acids Segment Accounted for the Highest Market Share in 2023

In 2023, the amino acids segment dominated the animal feed additives market, capturing the highest market share since amino acids are the building blocks of proteins essential for the growth, development, and overall health of animals. As animals often cannot synthesize all the necessary amino acids independently, they must obtain them through their diet. In animal feed additives, amino acids are commonly included to supplement and balance the amino acid of feed, ensuring that animals receive a complete nutritional supply.

This is particularly important in intensive animal farming practices, where the demand for high-quality and nutritionally balanced feed is essential to achieve optimal growth rates and enhanced productivity. The emphasis on maximizing animal performance and improving feed efficiency has driven the demand for amino acid-based additives, making it the leading segment in the animal feed additives market.

By Form Analysis

The Dry Form of Animal Feed Additives is Estimated to Dominate the Market over the Forecasted Period

Dry animal feed additives, including powders, granules, and pellets, have gained attention primarily due to their convenience in handling, storage, and transportation. The dry form allows for easy integration into various types of animal feed, ensuring uniform distribution and accurate dosing during the feed manufacturing process. This results in enhanced accuracy in meeting the nutritional requirements of animals.

Also, the dry form of animal feed additives offers improved stability and shelf life compared to their liquid additives. This stability is important in maintaining the effectiveness of the additives over time, especially during storage and transportation, where exposure to environmental factors impacts the quality of the product. The ease of storage also causes cost savings for both manufacturers and end-users, as it reduces the need for specialized facilities and lowers the risk of spoilage or degradation.

Along with this, the dry form provides flexibility in formulation, allowing for the combination of multiple additives and active ingredients in a single blend. As the animal feed industry continues to focus on efficiency, precision, and cost-effectiveness, the dry form of animal feed additives emerges as the preferred choice, contributing to its estimated dominance in the market.

Regional Insights

Asia Pacific Region Dominated the Global Market in 2023

The Asia Pacific region emerged as the dominant region in the global animal feed additives market in 2023 because the robust agricultural sector and a significant presence of livestock farming operations played an important role. With a significant population engaged in agriculture and animal husbandry, there is a consistently high demand for animal feed additives to enhance the nutritional quality of feeds and improve overall animal health. Also, the rising population and increasing disposable incomes in many Asia Pacific countries have led to a growing demand for meat and dairy products. This surge in demand for animal-derived products has driven the need for efficient and high-quality animal nutrition, thereby boosting the adoption of feed additives.

Governments and regulatory bodies in the Asia Pacific have implemented measures to promote the use of safe and effective animal feed additives, further propelling market growth. The prevalence of intensive and industrialized farming practices in countries like China, India, and Southeast Asian nations has led to an increased dependence on scientifically formulated feeds, raising the demand for additives to gain better feed efficiency and productive.

North America is expected to grow with a significant CAGR since there is a growing awareness and emphasis on animal welfare and health. This has led to increased adoption of advanced nutritional strategies, including the incorporation of high-quality feed additives. Consumers in North America are increasingly interested in the quality and safety of animal products, driving the demand for additives that enhance the nutritional content of animal feeds. The prevalence of intensive livestock farming practices in North America, particularly in the production of poultry and swine, has created a significant market for feed additives aimed at improving feed efficiency, growth rates, and overall animal performance.

Key Market Players & Competitive Insights

The product's quality heavily influences the market’s competition, the number of manufacturers and distributors, and their geographical locations. Several participants and stakeholders are focusing on expanding their manufacturing capacities as well. Over the last five years, major market participants such as DSM, BASF, and Evonik have been very active in M&A activities. These businesses provide a diverse range of products. In addition, key companies are conducting research and development to provide customers with efficient products.

Some of the major players operating in the global market include:

- Adisseo

- ADM

- Ajinomoto

- Alltech Inc.

- ANOVA Group

- BASF

- BIOMIN Holding GmbH

- Cargill Inc.

- Centafarm SRL

- Chr. Hansen Holding

- DSM

- DuPont

- Evonik Industries

- Kemin Industries, Inc.

- Novozymes,

- Olmix Group

- TEGASA

Recent Developments

- In July 2023, Yes Sinergy was acquired by Olmix to strengthen its animal care portfolio. Through this transaction, Olmix completed international expansion and established itself as a major supplier of bio-sourced solutions for the animal feed market.

- In April 2023, BASF announced a partnership with Schothorst Feed Research to improve the environmental impact of the animal feed and protein industries. SFR used this to integrate BASF's Opteinics digital sustainability platform into its global animal nutrition consultancy services.

Animal Feed Additives Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 46.96 billion |

|

Revenue Forecast in 2032 |

USD 71.88 billion |

|

CAGR |

5.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Livestock, By Type, By Form, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements concerning countries, regions, and segmentation. |

In today’s hyper-connected world, running a business around the clock is no longer an option. And at Polaris Market Research, we get that. Our sales & analyst team is available 24x5 to assist you. Get all your queries and questions answered about the Animal Feed Additives Market report with a phone call or email, as and when needed.

Browse Our Top Selling Reports

Europe Homogeneous Precious Metal Catalyst Market Size, Share 2024 Research Report

Reciprocating Pumps Market Size, Share 2024 Research Report

Floral Tea Market Size, Share 2024 Research Report

FAQ's

The Animal Feed Additives Market covering key segments are on livestock, type, form, and region.

Animal Feed Additives Market Size Worth USD 71.88 billion By 2032 .

The global animal feed additives market is expected to grow at a CAGR of 5.5% during the forecast period.

Asia Pacific region dominated the global market in 2023.

the key driving factors in Animal Feed Additives Market are 2. Advancements in animal nutrition science and the need for balanced diets of animals expanding the market for feed additives.