Animal Feed Acidifiers Market Size, Share, Trends, Industry Analysis Report: By Type (Propionic Acid, Fumaric Acid, Formic Acid, Lactic Acid, Citric Acid, and Others), Application, and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 113

- Format: PDF

- Report ID: PM5549

- Base Year: 2024

- Historical Data: 2020-2023

Animal Feed Acidifiers Market Overview

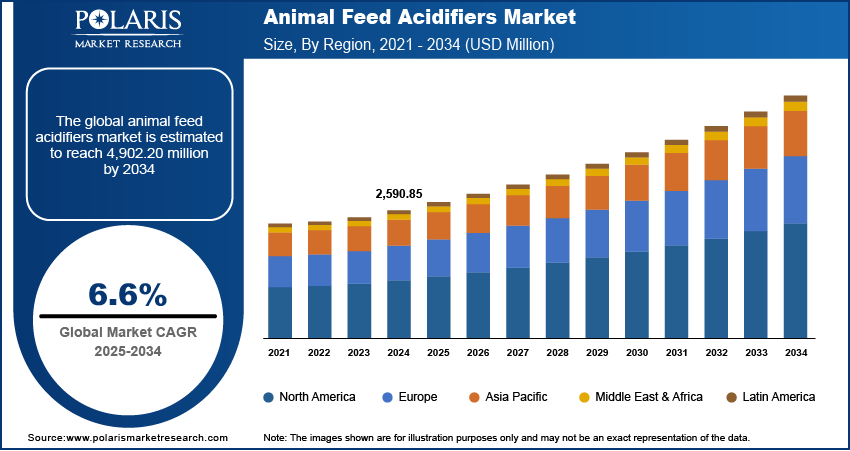

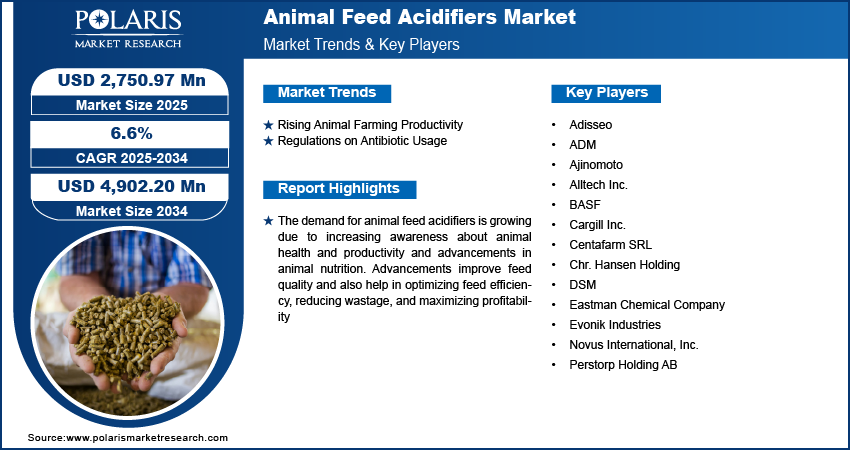

The global animal feed acidifiers market size was valued at USD 2,590.85 million in 2024. The market is projected to grow from USD 2,750.97 million in 2025 to USD 4,902.20 million by 2034, exhibiting a CAGR of 6.6% during 2025–2034.

Animal feed acidifiers are substances added to livestock feed to lower the pH and improve the overall quality and digestibility of the feed. These acidifiers help maintain a healthy gut environment for animals, enhance nutrient absorption, and prevent the growth of harmful pathogens. Common types of acidifiers used in animal feed include organic acids such as citric acid, formic acid, and propionic acid. Their primary role is to promote better feed conversion rates and improve the health and productivity of livestock, making them a vital component in modern animal nutrition.

The rising animal feed acidifiers market demand is attributed to the increasing awareness about animal health and productivity. The need for high-quality feed that enhances animal performance has risen as livestock production intensifies globally. Acidifiers help optimize gut health, which supports better digestion and nutrient absorption, leading to improved growth rates, weight gain, and overall efficiency in livestock production. Consequently, the growing demand for efficient and high-quality feed solutions is driving the animal feed acidifiers market expansion.

Acidifiers play a vital role in enhancing feed utilization, which reduces the overall feed cost per unit of livestock production. Livestock producers are increasingly adopting acidifiers as a means to achieve better feed conversion ratios, ensuring that animals derive more nutrition from the same amount of feed. This leads to cost savings, increased productivity, and more sustainable operations, thus driving the animal feed acidifiers market expansion.

Animal Feed Acidifiers Market Dynamics

Rising Animal Farming Productivity

The livestock sector is experiencing rapid growth, driven by increased demand for animal products worldwide. This surge in productivity, particularly in developing countries such as Bangladesh, is catalyzing a shift toward more advanced farming practices. According to the World Bank, the Livestock and Dairy Development Project in Bangladesh focuses on enhancing livestock productivity and market access while promoting climate-smart practices. The project aims to improve productivity by 35% and increase market access by 50%, which has a direct impact on the demand for efficient farming solutions.

There is a rising need for specialized animal feed additives, such as acidifiers, as farmers adopt modern techniques to improve yields and manage livestock health more effectively. These feed acidifiers are essential in improving animal digestion and overall health, which boosts productivity. The rising focus on optimizing livestock performance through better nutrition and feed efficiency has significantly increased the demand for these additives. Enhanced feed additives help reduce microbial growth, stabilize the pH of animal digestive systems, and improve feed conversion rates, making them an essential tool in high-productivity animal farming systems. The increasing focus on sustainable animal farming practices fuels the demand for feed solutions that support environmental and economic objectives. Acidifiers help minimize the environmental impact of animal farming by reducing methane emissions and promoting more sustainable feed usage. These acidifiers are crucial for enhancing efficiency and sustainability as livestock farms expand to meet the demand for animal products. Thus, the rising animal farming productivity is driving the animal feed acidifiers market growth.

Regulations on Antibiotic Usage and Consumer Demands for Antibiotic-Free Food Products

Antibiotics have long been used in animal production to promote growth and prevent diseases. However, growing concerns over antibiotic resistance have led to the imposition of stricter regulations globally. For instance, in November 2024, the FSSAI's 2024 amendment banned antibiotics in the production of milk, meat, poultry, and aquaculture, effective April 2025. It prohibits specific antibiotics such as colistin, streptomycin, and chloramphenicol, expanding earlier regulations that only applied to processing stages. Hence, it has become necessary for producers to find ways to maintain animal health and productivity without relying on antibiotics. Further, these regulations have reshaped the way animal feed is formulated, driving demand for alternative solutions such as animal feed acidifiers. Acidifiers, which help maintain the proper pH balance in animals' gastrointestinal systems, are becoming essential in livestock nutrition. They enhance digestion, nutrient absorption, and overall health, making them an appealing option for producers aiming to comply with strict regulations. These acidifiers support gut health, prevent infections, and reduce the need for antimicrobial treatments. Thus, the rising imposition of regulations on antibiotic usage propels the animal feed acidifiers market demand.

Consumer awareness of food safety has played a crucial role in the rising use of feed acidifiers. Antibiotic residues in food products have been a point of concern, especially following reports by organizations such as the Centre for Science and Environment (CSE), which highlighted antibiotic residues in products such as chicken, meat, and honey. As consumers increasingly demand antibiotic-free food, farmers and producers must adopt practices that align with these expectations. The use of feed acidifiers helps in regulatory compliance and also supports the production of cleaner, healthier animal products that appeal to health-conscious consumers. This shift toward non-antibiotic alternatives is expected to provide lucrative animal feed acidifiers market opportunities as producers seek to comply with new regulations and fulfill consumer demands for safer food products.

Animal Feed Acidifiers Market Segment Insights

Animal Feed Acidifiers Market Outlook by Type Insights

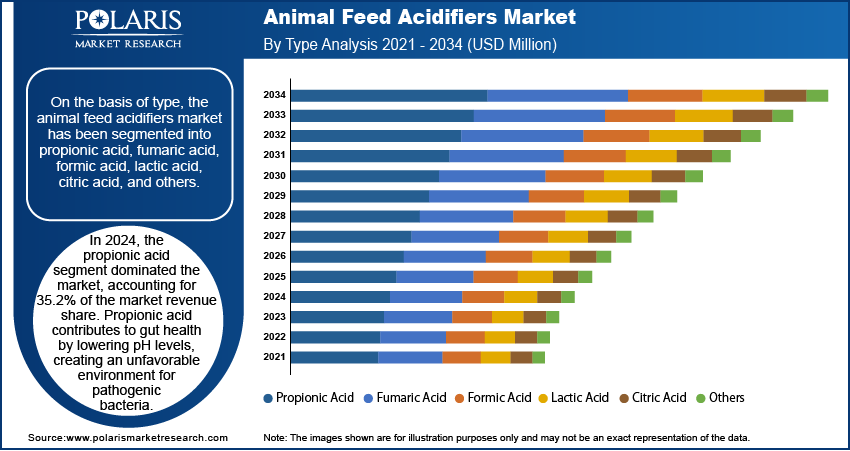

On the basis of type, the animal feed acidifiers market is segmented into propionic acid, fumaric acid, formic acid, lactic acid, citric acid, and others. In 2024, the propionic acid segment dominated the animal feed acidifiers market share, accounting for 35.2% of market revenue. This dominance is attributed to its antimicrobial properties that inhibit mold and bacterial growth in feed. It is particularly effective in preserving feed ingredients, ensuring longer shelf life, and reducing feed spoilage. Therefore, propionic acid is commonly applied in poultry, swine, and cattle feed to maintain feed quality during storage and transportation.

In livestock, propionic acid improves gut health by lowering pH levels, creating an unfavorable environment for pathogenic bacteria. Moreover, it also supports better feed conversion rates by improving digestion efficiency. In poultry and swine, propionic acid prevents digestive disorders, leading to better growth performance. For ruminants, propionic acid supplementation enhances energy metabolism by promoting propionate production during fermentation.

Animal Feed Acidifiers Market Assessment by Application Insights

By application, the animal feed acidifiers market is segmented into vitamins & minerals, probiotics, enzymes, prebiotics, amino acids, and herbal supplements. The vitamins & minerals segment accounted for the largest share in 2024 and is expected to register a CAGR of 7.4% during the forecast period. Vitamins and minerals are fundamental to maintaining optimal livestock health, ensuring efficient metabolic functions and resistance to diseases. Acidifiers prevent nutrient losses during feed storage, especially in humid conditions, by inhibiting microbial growth. They also optimize gut pH, creating an environment conducive to nutrient absorption, which is particularly beneficial for aquaculture species such as fish and shrimp, which improves their skeletal health and survival rates in intensive farming systems.

The presence of acidifiers in feed formulations containing vitamins and minerals contributes to better feed conversion ratios (FCR) across species, which reduces production costs and improves profitability for farmers. Moreover, in equines, proper nutrient assimilation supported by acidifiers ensures stronger hooves and higher stamina, while in cattle, it enhances milk yield. Therefore, the synergistic role highlights acidifiers’ importance in meeting the nutritional demands of modern livestock farming.

The probiotics segment is projected to grow fastest during the forecast period as it enhances gut health and immunity in livestock. Acidifiers lower the gastrointestinal pH, creating an environment favorable for beneficial probiotic bacteria such as Lactobacillus and Bifidobacterium to grow. Therefore, healthy bacterial growth ensures effective colonization of probiotics, which aid in pathogen inhibition, digestion improvement, and nutrient utilization. In poultry, this combination reduces the risk of enteric diseases, enhancing growth rates and egg quality.

Probiotics are essential in feed for maintaining a balanced gut microbiome, which directly impacts the health and productivity of livestock. Acidifiers amplify the benefits of probiotics by controlling harmful bacteria such as Salmonella and E. coli. Moreover, acidifiers are particularly crucial for aquaculture species, where maintaining water and gut microbiota balance reduces phosphorus discharge in water. Swine also benefits from enhanced gut health, leading to fewer cases of post-discouraging diarrhea and better weight gain. The integration of acidifiers with probiotics supports sustainable farming practices by reducing the reliance on antibiotics. Therefore, this process contributes to higher productivity and better-quality meat, milk, or eggs, aligning with consumer demands for natural and antibiotic-free animal products. For equines, this combination promotes better digestion and overall vitality, enhancing their performance.

Animal Feed Acidifiers Market Regional Analysis

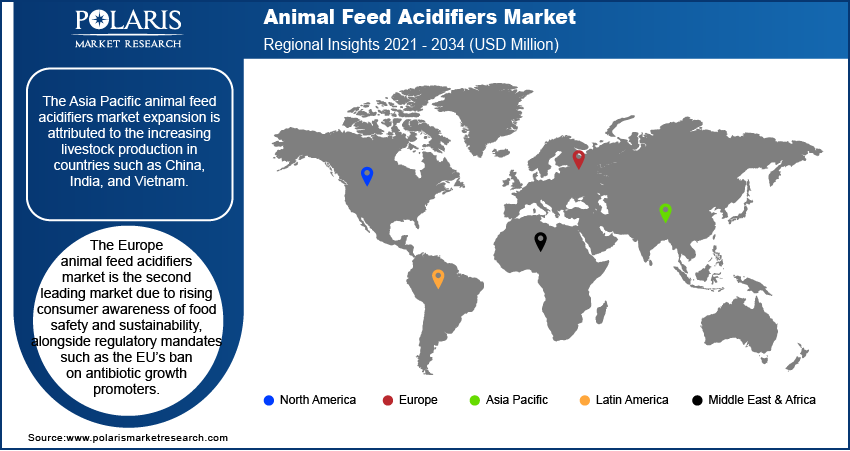

By region, the study provides animal feed acidifiers market insights into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. The Asia Pacific animal feed acidifiers market size reached USD 1,175.99 million in 2024 and is estimated to register a CAGR of 7.1% during the forecast period. The growth is driven by increasing livestock production in countries such as China, India, and Vietnam. Factors such as rising meat consumption due to economic growth, urbanization, and dietary changes have led to the widespread implementation of acidifiers to enhance livestock productivity and health. The region’s poultry and aquaculture sectors are major users of acidifiers, ensuring optimal growth and disease prevention.

The Europe animal feed acidifiers market expansion is mainly attributed to rising consumer awareness of food safety and sustainability, alongside regulatory mandates such as the EU’s ban on antibiotic growth promoters. Countries such as Germany, France, and the Netherlands have strong livestock sectors, emphasizing sustainable and efficient farming practices. Acidifiers play a critical role in maintaining animal health and enhancing feed efficiency, aligning with the EU's commitment to producing antibiotic-free meat based on guidelines approved by the World Health Organization in 2006. Moreover, the demand for acidifiers is particularly strong in the poultry and dairy industries, reflecting the region's high per capita meat and dairy consumption.

The North America animal feed acidifiers market is expected to register a significant CAGR from 2025 to 2034. In regional market growth is driven by the increasing livestock farming and heightened awareness about animal health. The region’s large-scale meat production industry, particularly in the US and Canada, focuses on improving feed quality to meet rising consumer demand for safe, antibiotic-free meat products. Acidifiers are widely adopted as an alternative to antibiotics that help increase the absorption of minerals and fight pathogenic bacteria, thereby improving gut health and feed conversion efficiency in livestock. Acidifier implementation is particularly dominant in poultry and swine industries, where maintaining health and productivity is important. The region’s geographical diversity supports various livestock farming practices, from intensive farming in the US to mixed farming systems in Canada. Furthermore, North America animal feed acidifiers market opportunities lie in exploring organic acidifiers tailored to niche markets, such as grass-fed or free-range livestock producers. Also, with the growing consumer awareness of sustainable agriculture and animal welfare, the demand for feed acidifiers will grow in North America during the forecast period.

Animal Feed Acidifiers Market – Key Players & Competitive Insights

Major market players are investing heavily in research and development to expand their product lines, which will boost the animal feed acidifiers market development during the forecast period. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments such as new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in competition, the animal feed acidifiers market players must offer cost-effective items.

A few major players in the animal feed acidifiers market include Adisseo; ADM; Ajinomoto; Alltech Inc.; BASF; Cargill Inc.; Centafarm SRL; Chr. Hansen Holding; DSM; Evonik Industries; Novus International, Inc.; Perstorp Holding AB; and Eastman Chemical Company.

Novus International, Inc. is a company operating in animal health and nutrition solutions for the animal agriculture sector. The product offerings of Novus are categorized into several segments, including organic trace minerals, enzymes, organic acids, essential oils, and methionine. These products are designed for use in various livestock sectors such as poultry, swine, ruminants, aquaculture, and companion animals.

Novus International provides ALIMET, a feed supplement that supplies methionine. Another key product is MINTREX, which consists of chelated trace minerals for nutrient absorption. CIBENZA is a range of enzyme feed additives that improve feed efficiency and digestion in livestock. Additionally, NEXT ENHANCE is a feed additive designed to promote gut health and overall performance in animals. ACTIVATE serves as a nutritional feed acid that helps create a healthy gut environment through organic acids and HMTBa. In terms of regional operations, Novus International has a global presence, serving customers across North America, Europe, Asia Pacific, Latin America, and the Middle East.

Adisseo is a global company involved in animal nutrition, focusing on the production of feed additives. It operates as a subsidiary of Sinochem Holdings Corp, a Chinese conglomerate. The company’s main product is methionine, an essential amino acid used in animal feed. Adisseo produces both liquid and solid forms of methionine, with manufacturing facilities in Nanjing, China. A new powder methionine plant is currently under construction in Quanzhou, set to begin operations in 2027. Besides methionine, Adisseo also produces various specialty feed additives aimed at improving nutrient absorption and livestock health. The company operates primarily in three regions, including Asia, Europe, and North America. It serves over 4,200 customers across more than 110 countries.

List of Key Companies in Animal Feed Acidifiers Market

- Adisseo

- ADM

- Ajinomoto

- Alltech Inc.

- BASF

- Cargill Inc.

- Centafarm SRL

- Chr. Hansen Holding

- DSM

- Eastman Chemical Company

- Evonik Industries

- Novus International, Inc.

- Perstorp Holding AB

Animal Feed Acidifiers Industry Developments

September 2024: Novus International and Ginkgo Bioworks announced a partnership to develop advanced feed additives using Ginkgo’s enzyme services, aiming to enhance efficiency, sustainability, and performance in the animal agriculture industry.

August 2024: A strategic partnership was announced between Allozymes and Adisseo to develop innovative bioprocesses for animal feed ingredient production. This collaboration aimed to create sustainable, environmentally friendly solutions for the industry.

September 2020: BASF produced Amasil formic acid, which was launched as a feed hygiene enhancer to improve animal performance by controlling pathogens such as salmonella without the safety concerns associated with formaldehyde.

Animal Feed Acidifiers Market Segmentation

By Type Outlook (Revenue, USD Million, 2021–2034)

- Propionic Acid

- Fumaric Acid

- Formic Acid

- Formic Acid

- Sodium Formate

- Others

- Lactic Acid

- Citric Acid

- Others

By Application Outlook (Revenue, USD Million, 2021–2034)

- Vitamins & Minerals

- Probiotics

- Enzymes

- Prebiotics

- Amino Acids

- Herbal Supplements

By Regional Outlook (Revenue, USD Million, 2021–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Animal Feed Acidifiers Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,590.85 Million |

|

Market Size Value in 2025 |

USD 2,750.97 Million |

|

Revenue Forecast by 2034 |

USD 4,902.20 Million |

|

CAGR |

6.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2024–2034 |

|

Quantitative Units |

Revenue in USD million, Volume in Kilotons, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global animal feed acidifiers market size was valued at USD 2,590.85 million in 2024 and is projected to grow to USD 4,902.20 million by 2034.

The global market is expected to register a CAGR of 6.6% during the forecast period.

Asia Pacific held the largest share of the global market in 2024.

A few key players in the market are Adisseo; ADM; Ajinomoto; Alltech Inc.; BASF; Cargill Inc.; Centafarm SRL; Chr. Hansen Holding; DSM; Evonik Industries; Novus International, Inc.; Perstorp Holding AB; and Eastman Chemical Company.

The propionic acid segment dominated the market in 2024.

The vitamins & minerals segment held the largest share of the global market in 2024.