Anhydrous Hydrogen Fluoride Market Size, Share, Trends, Industry Analysis Report: By Application (Fluoropolymers, Fluorogases, Pesticides, and Others) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 125

- Format: PDF

- Report ID: PM5331

- Base Year: 2024

- Historical Data: 2020-2023

Anhydrous Hydrogen Fluoride Market Overview

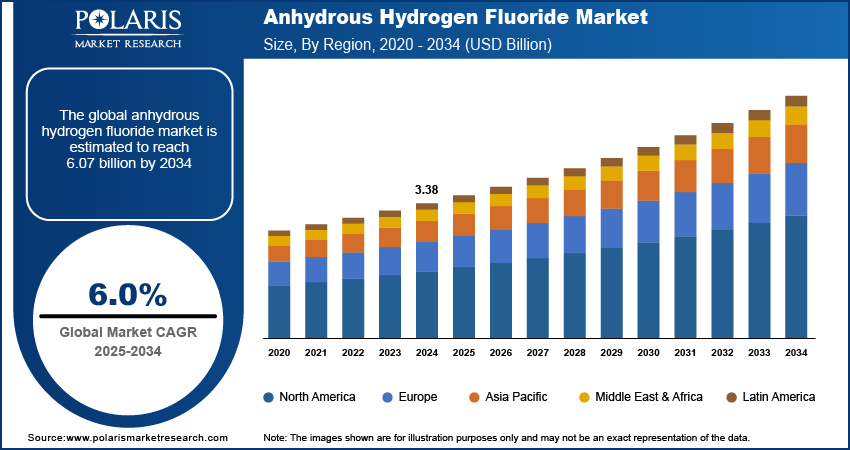

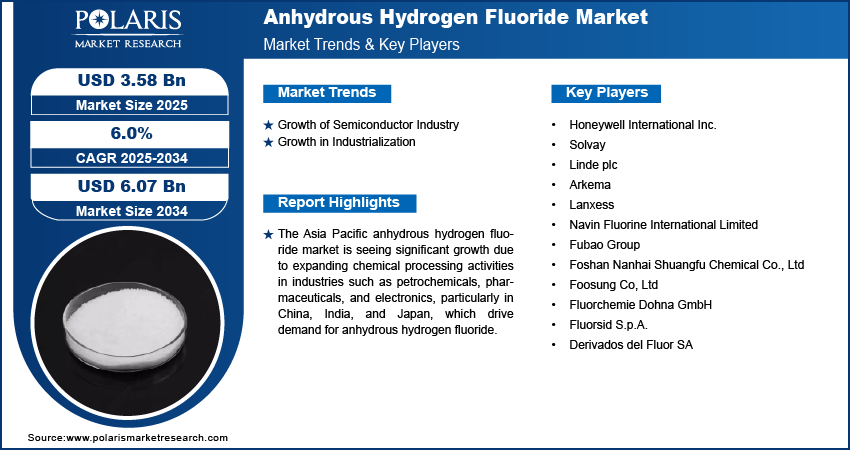

The global anhydrous hydrogen fluoride market size was valued at USD 3.38 billion in 2024. The market is projected to grow from USD 3.58 billion in 2025 to USD 6.07 billion by 2034, exhibiting a CAGR of 6.0% during 2025–2034.

Anhydrous hydrogen fluoride is a highly reactive, colorless, and corrosive gas or liquid that contains hydrogen and fluorine. It is commonly used in various industrial applications such as aluminum production, petrochemical refining, and various fluorine-containing compound synthesis.

The expansion of petroleum refining capacity is boosting the anhydrous hydrogen fluoride market demand. Private and public sector refineries are expanding their refining capacities, due to which the demand for anhydrous hydrogen fluoride is rising. According to the Indian Ministry of Petroleum & Natural Gas, petroleum refining capacity in India rose by 41.7 million metric tons per annum (MMTPA) in a decade, showcasing the expansion of refining capacities. Anhydrous hydrogen fluoride is used to produce alkylates, which are important for improving fuel quality.

To Understand More About this Research: Request a Free Sample Report

The anhydrous hydrogen fluoride market development is driven by technological advancements in its formulations. Advanced formulations of anhydrous hydrogen fluoride are anticipated to be used in a wider range of applications, from electronics to clean energy technologies, by reducing costs and improving safety, leading to increased demand and anhydrous hydrogen fluoride market expansion in the forecast years.

Anhydrous Hydrogen Fluoride Market Driver Analysis

Growth of Semiconductor Industry

Semiconductor manufacturers are expanding their operations to meet high market demand. According to the United States Semiconductor Industry Association, in the US alone, the semiconductor industry employs over 280,000 people, showcasing the growth of the industry. Additionally, growing government incentives are driving the growth of the semiconductor industry. In semiconductor manufacturing, anhydrous hydrogen fluoride is used for essential processes such as cleaning and etching. Therefore, the growth of the semiconductor industry is driving the anhydrous fluoride market expansion.

Growth in Industrialization

Industries such as manufacturing, electronics, and automotive are expanding across the world. Thus, the demand for anhydrous hydrogen fluoride for processes such as the creation of fluorochemicals is rising. According to the United Nations Industry Development Organization, the industrial sector grew by 2.3% in 2023, showcasing the growth in industrialization. Industrial growth leads to higher production of goods and technology, increasing the need for specialized chemicals such as anhydrous hydrogen fluoride. Thereby, rising industrialization, especially in emerging regions, is driving the anhydrous hydrogen fluoride market growth.

Anhydrous Hydrogen Fluoride Market Segment Analysis

Anhydrous Hydrogen Fluoride Market Assessment – by Application Outlook

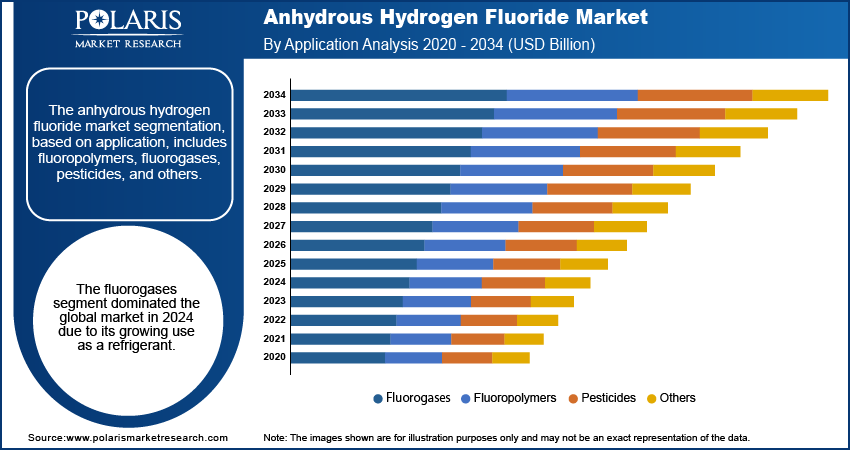

The anhydrous hydrogen fluoride market segmentation, based on application, includes fluoropolymers, fluorogases, pesticides, and others. The fluorogases segment dominated the global market in 2024 due to its growing use as a refrigerant. Anhydrous hydrogen fluoride is essential in the production of fluorinated gases, which are widely used in refrigeration and air conditioning systems. These gases offer high efficiency and low environmental impact, driving their adoption in various industries. The increasing demand for energy-efficient and eco-friendly cooling solutions contributes significantly to segmental dominance.

The fluoropolymers segment is expected to experience significant CAGR in the global market during the forecast period due to its increasing application in industries such as automotive, aerospace, electronics, and healthcare. Fluoropolymers are known for their high resistance to heat, chemicals, and wear, making them ideal for a wide range of applications. The increasing demand for advanced materials in these industries, particularly for components that require durability and reliability, is driving the growth of the fluoropolymers segment.

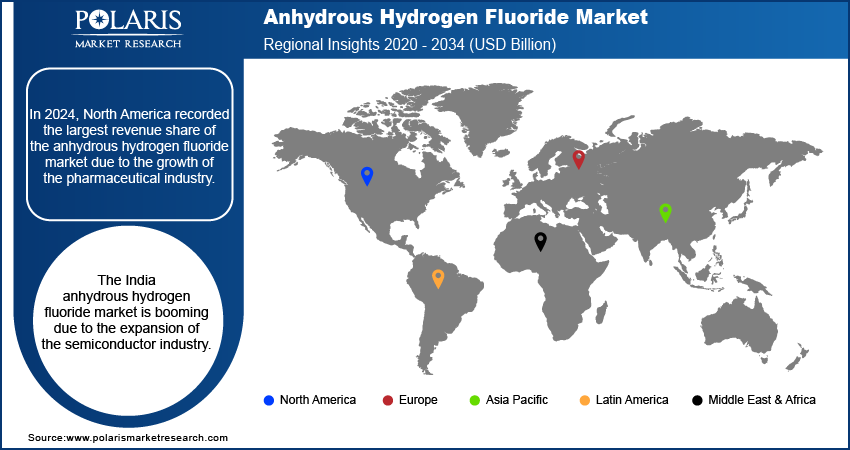

Anhydrous Hydrogen Fluoride Market Regional Analysis

By region, the study provides the anhydrous hydrogen fluoride market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest revenue share of the market due to the growth of the pharmaceutical industry. Pharmaceutical industries in North America are expanding their operations to fulfil the demand from consumers, due to which the demand for anhydrous hydrogen fluoride is growing. According to the Pharmaceutical Research and Manufacturers of America, the pharmaceutical industry in the US employs over 4.9 million people, highlighting the industry growth. Anhydrous hydrogen fluoride is primarily employed for the synthesis of various active pharmaceutical ingredients (APIs) and specialized chemicals. Therefore, the growth of the pharmaceutical industry is driving the anhydrous hydrogen fluoride market development in North America.

The Asia Pacific anhydrous hydrogen fluoride market is experiencing significant growth due to the expansion of chemical processing activities. Countries such as China, India, and Japan are seeing significant growth in industries such as petrochemicals, pharmaceuticals, and electronics, all of which require anhydrous hydrogen fluoride in their production processes. This chemical is used in manufacturing a variety of products, including fluoropolymers, refrigerants, and semiconductors. Additionally, the region is home to many large-scale chemical production facilities, which further drives the market growth. Thus, the expansion of chemical processing activities is driving the anhydrous hydrogen fluoride market growth in Asia Pacific.

The anhydrous hydrogen fluoride market in India is experiencing substantial growth due to the rapid expansion of the semiconductor manufacturing industry. India has become a significant hub for semiconductor production, driven by increasing demand for electronic devices and advancements in technology. Anhydrous hydrogen fluoride is a critical material in the production of semiconductors, where it is used in etching and cleaning processes during chip fabrication, leading to the anhydrous hydrogen fluoride market expansion in India.

Anhydrous Hydrogen Fluoride Market – Key Players and Competitive Analysis

The anhydrous hydrogen fluoride market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific sectors. This competitive environment is amplified by continuous progress in product offerings. A few major players in the anhydrous hydrogen fluoride market are Honeywell International Inc.; Solvay; Linde plc; Arkema; Lanxess; Navin Fluorine International Limited; Fubao Group; Foshan Nanhai Shuangfu Chemical Co., Ltd; Foosung Co, Ltd; Fluorchemie Dohna GmbH; Fluorsid S.p.A.; and Derivados del Fluor SA.

Honeywell International Inc. is a multinational conglomerate corporation headquartered in Charlotte, North Carolina. The company offers products in four areas, including building technologies, aerospace, safety & productivity solutions (SPS), and performance materials and technologies (PMT). The Home and Building Technologies segment offers products, solutions, software, and technologies that help homeowners stay in control and connected to their comfort, energy, and security. The Performance Materials and Technologies segment manufactures and develops process technologies, materials, and automation solutions. Moreover, the Safety and Productivity Solutions segment provides software, products, and connected solutions, including footwear and personal protection equipment designed for play, work, and outdoor activities. Honeywell Aerospace provides aircraft engines, avionics, flight management systems, and services to airlines, airports, manufacturers, space programs, and militaries. Honeywell International Inc. operates for various industries such as aerospace and travel, commercial real estate, energy, healthcare, life sciences, logistics & warehouse, retail, and utilities.

Linde plc, a global industrial gases and engineering company, is headquartered in Dublin, Ireland and serves customers across various industries. The company was formed in October 2018 through the merger of Linde AG and Praxair Inc., and it has since become one of the largest industrial gas companies in the world, with a presence in over 100 countries. Linde offers a wide range of products and services, including gases, equipment, and technology solutions for various industries such as healthcare, food & beverage, energy, and manufacturing. Its portfolio of products includes atmospheric gases, such as nitrogen, oxygen, and argon, as well as specialty gases, including hydrogen, helium, and acetylene. It also provides a range of gas-handling equipment, including cylinders, valves, regulators, and cryogenic equipment, such as tanks and refrigeration systems. One of Linde's core strengths is its expertise in air separation technology, which involves separating atmospheric air into its constituent gases. The company has a long history of developing and manufacturing air separation plants, which produce large amounts of gases, including oxygen, nitrogen, and argon, used in a wide range of industries. Linde also offers various engineering and consulting services to help customers improve their productivity, efficiency, and environmental performance. The company's engineers and experts work closely with customers to identify opportunities for optimization and develop tailored solutions that meet their needs.

List of Key Companies in Anhydrous Hydrogen Fluoride Market

- Honeywell International Inc.

- Solvay

- Linde plc

- Arkema

- Lanxess

- Navin Fluorine International Limited

- Fubao Group

- Foshan Nanhai Shuangfu Chemical Co., Ltd

- Foosung Co, Ltd

- Fluorchemie Dohna GmbH

- Fluorsid S.p.A.

- Derivados del Fluor SA

Anhydrous Hydrogen Fluoride Market Developments

In June 2020, Arkema and Nutrien Ltd signed a long-term supply agreement for anhydrous hydrogen fluoride (AHF) to support production at Arkema's Calvert City site. A USD 150 million AHF production plant was established at Nutrien’s Aurora site in 2022.

In September 2023, SOJITZ selected Buss ChemTech's hydrogen fluoride (HF) technology for a new HF plant in Japan for emphasizing the importance of Buss ChemTech's reliable HF technology.

Anhydrous Hydrogen Fluoride Market Segmentation

By Application Outlook (Volume, Kilotons, Revenue USD Billion, 2020–2034)

- Fluoropolymers

- Fluorogases

- Pesticides

- Others

By Regional Outlook (Volume, Kilotons, Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Anhydrous Hydrogen Fluoride Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3.38 billion |

|

Market Size Value in 2025 |

USD 3.58 billion |

|

Revenue Forecast by 2034 |

USD 6.07 billion |

|

CAGR |

6.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Kilotons, Revenue in USD billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Volume Forecast, Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report End User |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The anhydrous hydrogen fluoride market size was valued at USD 3.38 billion in 2024 and is projected to grow to USD 6.07 billion by 2034.

The global market is projected to register a CAGR of 6.0% during 2025–2034.

North America accounted for the largest share of the global market in 2024.

A few key players in the market are Honeywell International Inc.; Solvay; Linde plc; Arkema; Lanxess; Navin Fluorine International Limited; Fubao Group; Foshan Nanhai Shuangfu Chemical Co., Ltd; Foosung Co, Ltd; Fluorchemie Dohna GmbH; Fluorsid S.p.A.; and Derivados del Fluor SA.

The fluorogases segment dominated the global market in 2024 due to its growing use as a refrigerant.