Angina Pectoris Drugs Market Size, Share, Trends, Industry Analysis Report: By Type (Stable Angina, Unstable Angina, and Others), Drug Class, Route of Administration, End Users, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 119

- Format: PDF

- Report ID: PM5279

- Base Year: 2024

- Historical Data: 2020-2023

Angina Pectoris Drugs Market Overview

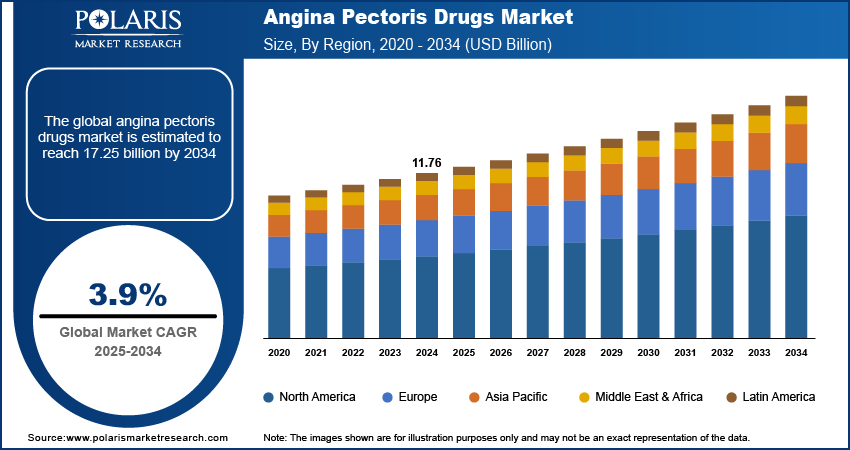

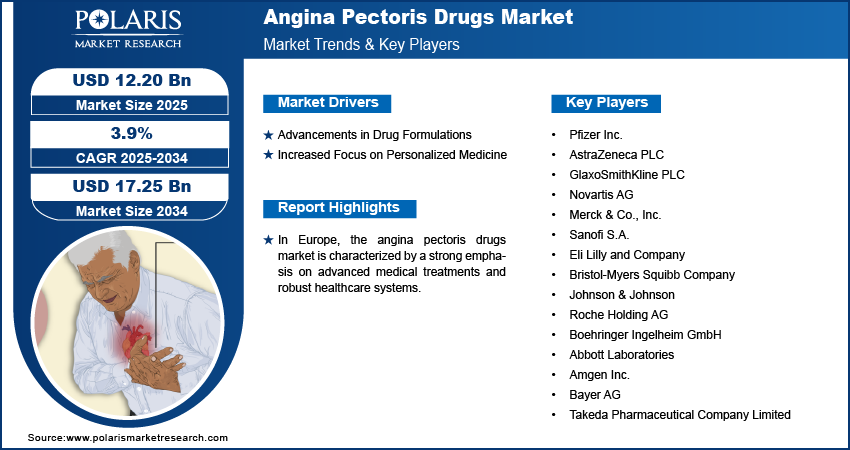

The global angina pectoris drugs market size was valued at USD 11.76 billion in 2024. The market is projected to grow from USD 12.20 billion in 2025 to USD 17.25 billion by 2034, exhibiting a CAGR of 3.9% during 2025–2034.

The global angina pectoris drugs market encompasses the development, production, and distribution of pharmaceutical treatments for angina pectoris, a condition characterized by chest pain due to inadequate blood flow to the heart.

This market is driven by several factors such as the increasing prevalence of cardiovascular diseases, surging geriatric population, and the rising awareness and diagnosis of angina pectoris. Key future trends that influence the market include the advancements in drug formulations and delivery systems, such as extended-release formulations, and the growing emphasis on personalized medicine tailored to individual patient needs. Additionally, ongoing research and development efforts are focused on improving drug efficacy and safety profiles, which is expected to support market growth in the coming years.

To Understand More About this Research: Request a Free Sample Report

Angina Pectoris Drugs Market Drivers and Trends Analysis

Advancements in Drug Formulations

Recent developments in drug formulations are significantly impacting the angina pectoris drugs market. Extended-release formulations are becoming increasingly popular, offering improved patient compliance and more stable drug levels in the bloodstream. For instance, new formulations of nitrates and beta-blockers have been introduced to provide prolonged therapeutic effects, reducing the frequency of doses and improving patient adherence. According to a study published in the Journal of Clinical Medicine (2023), extended-release formulations of nitrates showed a 20% improvement in patient compliance compared to immediate-release versions. Such advancements in drug formulations enhance treatment efficacy and contribute to the angina pectoris drugs market growth.

Increased Focus on Personalized Medicine

The rising shift towards personalized medicine is shaping the angina pectoris drugs market by tailoring treatments to individual patient profiles. The growing understanding of genetic and molecular factors influencing drug response is expected to boost the demand for personalized medicines. Personalized approaches are being developed to optimize therapeutic outcomes and minimize adverse effects. A report from Pharmacogenomics Journal published in 2022 highlights that personalized drug regimens based on genetic testing can improve treatment response rates by up to 30% in patients suffering from angina pectoris. This trend is supported by increasing investments in genetic research and advancements in diagnostic technologies, which are driving the development of tailored therapies.

Expansion of Combination Therapies

Combination therapies are gaining traction in the treatment of angina pectoris, as they address multiple pathways involved in the condition. Combining different classes of drugs, such as nitrates, beta-blockers, and calcium channel blockers, can provide a more comprehensive approach to manage angina symptoms. Combination therapy enhances therapeutic efficacy and reduces the likelihood of drug resistance. According to research published in Circulation Research in 2024, combination therapy can lead to a 25% reduction in angina episodes compared to monotherapy. The growing preference for combination therapies is leading to increased research and development in this area, which is expected to propel the market growth during the forecast period.

Angina Pectoris Drugs Market Segment Insights

Angina Pectoris Drugs Market Breakdown by Type Insights

Based on type, the angina pectoris drugs market is segmented into stable angina, unstable angina, and others. The stable angina segment holds the largest market share in 2024. Stable angina, characterized by predictable chest pain triggered by physical exertion or stress, can be treated by well-established treatment protocols and a broad range of available medications. The dominance of this segment is supported by a significant patient population and widespread usage of long-acting nitrates, beta-blockers, and calcium channel blockers. The increasing prevalence of cardiovascular conditions related to lifestyle factors and the rising geriatric population contribute to the sustained demand for treatments for stable angina.

Unstable angina, marked by unexpected chest pain that occurs at rest or with minimal exertion, is experiencing notable growth due to its acute nature and the need for rapid intervention. Advances in drug therapies and the introduction of novel medications tailored to manage unstable angina are driving this segment’s expansion.

Angina Pectoris Drugs Market Breakdown by Drug Class Insights

The angina pectoris drugs market, by drug class, is segmented into beta blockers, anticoagulants, and others. The beta blockers segment holds the largest market share and is registering the highest growth among drug classes. Beta blockers such as metoprolol and atenolol are widely prescribed due to their efficacy in reducing heart rate and blood pressure, thereby alleviating angina symptoms. Their established role in the long-term management of angina pectoris and the increasing prevalence of cardiovascular conditions contribute to their dominant market position. The sustained demand for beta blockers is driven by their well-documented benefits in improving patient outcomes and their extensive clinical use.

Anticoagulants, which are used to prevent blood clots and reduce the risk of heart attacks, are also experiencing significant growth in demand. The rise in their use is attributed to advancements in anticoagulant therapies and an increasing patient population at risk for thrombotic events.

Angina Pectoris Drugs Market Breakdown by Route of Administration Insights

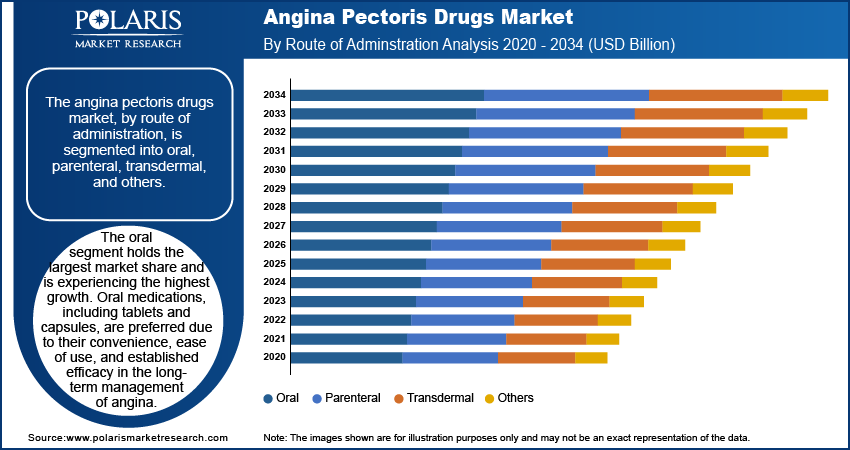

The angina pectoris drugs market, by route of administration, is segmented into oral, parenteral, transdermal, and others. The oral segment holds the largest market share and is experiencing the highest growth. Oral medications, including tablets and capsules, are preferred due to their convenience, ease of use, and established efficacy in the long-term management of angina. The widespread adoption of oral therapies such as beta blockers, nitrates, and calcium channel blockers drives this segment's dominance. The segment benefits from its cost-effectiveness and the extensive range of available oral drugs that cater to various patient needs.

The parenteral route segment, which includes intravenous and intramuscular administration, is also growing. Parenteral drugs are typically used in acute settings for rapid relief of angina symptoms, contributing to their steady growth. The transdermal route, offering medications via skin patches, is gaining traction due to its convenience and ability to provide a steady release of medication over time.

Angina Pectoris Drugs Market Breakdown by End Users Insights

The angina pectoris drugs market, based on end users, is segmented into hospitals, homecare, specialty clinics, and others. The hospitals segment holds the largest market share and is experiencing the highest growth rate. Hospitals are the primary setting for the management and treatment of acute angina pectoris, particularly for patients suffering from severe symptoms or complications. The high volume of patients receiving inpatient care and the comprehensive range of treatment options available in hospital settings contribute to this segment's dominance. The expansion of hospital infrastructure and advancements in cardiovascular care further drive this growth.

The homecare segment is seeing notable growth due to the increasing preference for managing chronic conditions such as angina pectoris in a home setting. Advances in home healthcare and monitoring technologies and the growing availability of oral and transdermal medications facilitate effective home-based management. The specialty clinics segment focuses on providing specialized care and treatment for cardiovascular conditions, and its growth rate is not as pronounced as that of hospitals and homecare settings.

Angina Pectoris Drugs Market Share by Region

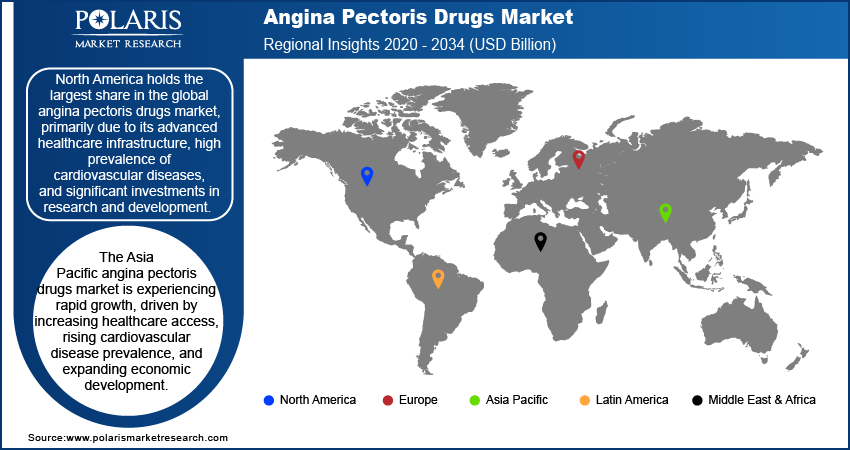

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share in the global angina pectoris drugs market, primarily due to its advanced healthcare infrastructure, high prevalence of cardiovascular diseases, and significant investments in research and development. The regional market also benefits from well-established medical facilities, a strong focus on innovative treatments, and the widespread availability of advanced medications for angina pectoris. Additionally, the presence of major pharmaceutical companies and a high rate of diagnosis and treatment contribute to North America's dominance. While Europe and Asia Pacific also show substantial market activity, North America's leadership is supported by its comprehensive healthcare system and substantial patient base.

In Europe, the angina pectoris drugs market is characterized by a strong emphasis on advanced medical treatments and robust healthcare systems. High healthcare expenditure and well-established regulatory frameworks that facilitate the approval and distribution of new medications also drive the regional market growth. Countries such as Germany, France, and the UK are key contributors to market growth due to their extensive healthcare infrastructure and high prevalence of cardiovascular diseases. Europe also sees significant research and development activities focused on improving angina pectoris treatments, driven by public and private sector investments. Despite facing challenges such as varying healthcare policies across countries, Europe's market remains substantial due to its advanced medical capabilities and comprehensive patient care.

The Asia Pacific angina pectoris drugs market is experiencing rapid growth, driven by increasing healthcare access, rising cardiovascular disease prevalence, and expanding economic development. Countries such as China and India are significant contributors, benefiting from large populations and growing healthcare infrastructure. The rising prevalence of lifestyle-related cardiovascular conditions and the adoption of advanced medical technologies are major factors driving market expansion. However, the region faces challenges such as disparities in healthcare quality and access across different countries. Despite these challenges, the growing focus on improving healthcare services and increasing patient awareness are contributing to the robust growth of the market in Asia Pacific.

Angina Pectoris Drugs Market – Key Players and Competitive Analysis Report

Key players in the angina pectoris drugs market include major pharmaceutical companies such as Pfizer Inc.; AstraZeneca PLC; GlaxoSmithKline PLC; Novartis AG; and Merck & Co., Inc. Other notable companies are Sanofi S.A., Eli Lilly and Company, Bristol-Myers Squibb Company, Johnson & Johnson, and Roche Holding AG. Additionally, firms such as Boehringer Ingelheim GmbH, Abbott Laboratories, Amgen Inc., Bayer AG, and Takeda Pharmaceutical Company Limited are active in this space. These companies are engaged in developing, manufacturing, and distributing various treatments for angina pectoris, encompassing beta blockers, nitrates, and other cardiovascular drugs.

In terms of competitive positioning, market players leverage their extensive research and development capabilities to innovate and enhance their drug offerings. They focus on improving drug efficacy, reducing side effects, and advancing drug delivery systems. Pfizer and AstraZeneca, for instance, are investing heavily in novel formulations and combination therapies to address unmet needs in angina management. Their substantial financial resources and research expertise enable them to lead in drug development and clinical trials, contributing to their competitive edge in the market.

The market landscape reflects ongoing collaboration and strategic partnerships among players to advance treatment options. Companies are increasingly entering into alliances for co-development and co-marketing of new therapies, aiming to enhance their market presence and reach. Additionally, regulatory approvals and market access strategies play a crucial role in shaping competitive dynamics. As the market evolves, these key players continue to adapt their strategies to maintain their positions and meet the growing demand for effective angina pectoris treatments.

Pfizer Inc. is a global player in the angina pectoris drugs market, known for its extensive portfolio of cardiovascular treatments. The company's products include various beta blockers and nitrate medications used to manage angina symptoms. Pfizer's significant presence in the market is supported by its strong research and development capabilities, aimed at advancing treatment options and improving patient outcomes.

AstraZeneca PLC, another key company in the market, offers a range of cardiovascular drugs, including those used for angina pectoris. The company focuses on developing innovative therapies to address cardiovascular conditions and improve treatment standards.

Key Companies in Angina Pectoris Drugs Market

- Pfizer Inc.

- AstraZeneca PLC

- GlaxoSmithKline PLC

- Novartis AG

- Merck & Co., Inc.

- Sanofi S.A.

- Eli Lilly and Company

- Bristol-Myers Squibb Company

- Johnson & Johnson

- Roche Holding AG

- Boehringer Ingelheim GmbH

- Abbott Laboratories

- Amgen Inc.

- Bayer AG

- Takeda Pharmaceutical Company Limited

Angina Pectoris Drugs Market Developments

- In August 2024, AstraZeneca reported positive results from a Phase II study of a new angina treatment, demonstrating promising efficacy and safety profiles.

- In July 2024, Pfizer announced the initiation of a Phase III clinical trial for a new extended-release formulation of one of its angina medications, which aims to enhance patient adherence and treatment efficacy.

Angina Pectoris Drugs Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Stable Angina

- Unstable Angina

- Others

By Drug Class Outlook (Revenue – USD Billion, 2020–2034)

- Beta Blockers

- Anticoagulants

- Others

By Route of Administration Outlook (Revenue – USD Billion, 2020–2034)

- Oral

- Parenteral

- Transdermal

- Others

By End Users Outlook (Revenue – USD Billion, 2020–2034)

- Hospitals

- Homecare

- Specialty Clinics

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Angina Pectoris Drugs Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 101.76 billion |

|

Market Size Value in 2025 |

USD 12.20 billion |

|

Revenue Forecast by 2034 |

USD 17.25 billion |

|

CAGR |

3.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global angina pectoris drugs market size was valued at USD 11.76 billion in 2024 and is projected to grow to USD 17.25 billion by 2034.

The global market is projected to register a CAGR of 3.9% during the forecast period.

North America accounted for the largest share of the global market.

Key players in the angina pectoris drugs market include major pharmaceutical companies such as Pfizer Inc.; AstraZeneca PLC: GlaxoSmithKline PLC: Novartis AG; and Merck & Co., Inc. Other notable companies are Sanofi S.A., Eli Lilly and Company, Bristol-Myers Squibb Company, Johnson & Johnson, and Roche Holding AG. Additionally, firms such as Boehringer Ingelheim GmbH, Abbott Laboratories, Amgen Inc., Bayer AG, and Takeda Pharmaceutical Company Limited are active in this space.

The stable angina segment accounted for the largest share of the global market.

The oral administration segment accounted for the largest market share.