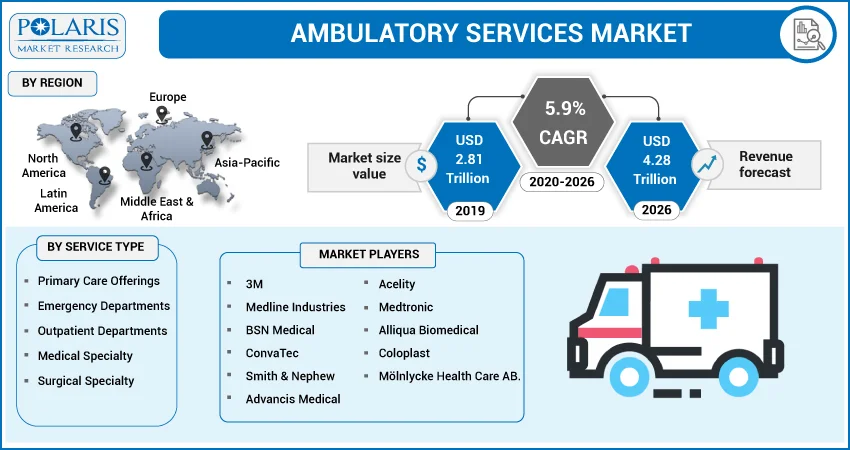

Ambulatory Services Market Share, Size, Trend, Industry Analysis Report By Service Type (Primary Care Offerings, Emergency Departments, Outpatient Departments, Medical Specialty, Surgical Specialty); By Regions - Segment Forecast, 2020 – 2026

- Published Date:Jan-2020

- Pages: 120

- Format: PDF

- Report ID: PM1016

- Base Year: 2019

- Historical Data: 2015-2018

Report Outlook

The global ambulatory services market was valued at USD 2.81 trillion in 2019 and is anticipated to grow at a CAGR of 5.9% during the forecast period. Ambulatory services are a set of a therapeutic and diagnostic service area that provide patient care, community support, and education. Ambulatory care includes structural, clinical, and specialized activities performed by a registered nurse and health experts. The ambulatory services comprise processes and application of advanced medical technologies that are provided without visiting the diagnostic centers or hospital, thus avoiding hospital stays.

The factors contributing to the growth of these ambulatory service centers include growing expenditure in healthcare, rising chronic diseases requiring hospital and ambulatory care, and increasing government expenditure for ambulatory care amenities coupled with government initiatives to reach the medical requirements. There are different benefits which are associated with ambulatory service centers (ASCs) which include low costs of operations and lower hospital bills, reduced patient stay in the hospitals, along with faster turnaround time due to technological advancements.

In addition, growing geriatric population suffering specific diseases who require ambulatory services; rise in government expenditure on ambulatory care facilities, and high unmet medical needs globally are another factors driving the global market. Moreover, the market is driven by benefits, such as ease-in-access, reduced hospital stay, flexible timings, cost savings processes accessible by ambulatory services, and high costs of other alternative treatments.

Governments across the globe are constantly working towards increasing their budget on healthcare services, with some countries increasing their spending as a percent of GDP. For instance, the Government of India announced its plans to increase their healthcare spending to almost 2.5% of the GDP. Similarly, health expenditure by the U.S. government was around USD 3.2 trillion in 2015 which the highest among other countries of the world. This expenditure by both the developed and the developing countries is estimated to increase in the coming years. With the existence of ambulatory service centers, the government is able to treat more people, thus significantly improving the healthcare services.

Segment Analysis

The Ambulatory Services market is segmented by service type which include primary care offerings, emergency departments, outpatient departments, medical specialty, and surgical specialty. In 2019, the primary care offerings accounted for the majority share and dominated the market. This was followed by the surgical specialty segment which gained traction due to the technological advancements of the same-day surgeries for cataract and orthopedic issues.

Regional Analysis

The market is further segmented by regions which include North America, Europe, Asia-Pacific, Latin America and Middle East and Africa. Among these regions, countries such as U.S. and Canada have dominated the market. However, developing countries such as China and India are contributing to the high growth rate of the Asia-Pacific region followed by the Middle East and Africa region. The major reason for the growth in the APAC region is due to the changing lifestyle of the population like the developed nations, and growing medical tourism, particularly in countries such as India and Singapore

Competitive Landscape

Key players in the ambulatory services market include companies such as 3M, Medline Industries, BSN Medical, ConvaTec, Smith & Nephew, Advancis Medical, Acelity, Medtronic, Alliqua Biomedical, Coloplast, and Mölnlycke Health Care AB.