Alzheimer’s Therapeutics Market Share, Size, Trends, Industry Analysis Report, By Drug Class (Cholinesterase Inhibitors, NMDA Receptor Antagonists, and Manufactured Combination); By Distribution Channel; By Region; Segment Forecast, 2022 - 2030

- Published Date:Aug-2022

- Pages: 115

- Format: PDF

- Report ID: PM1249

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

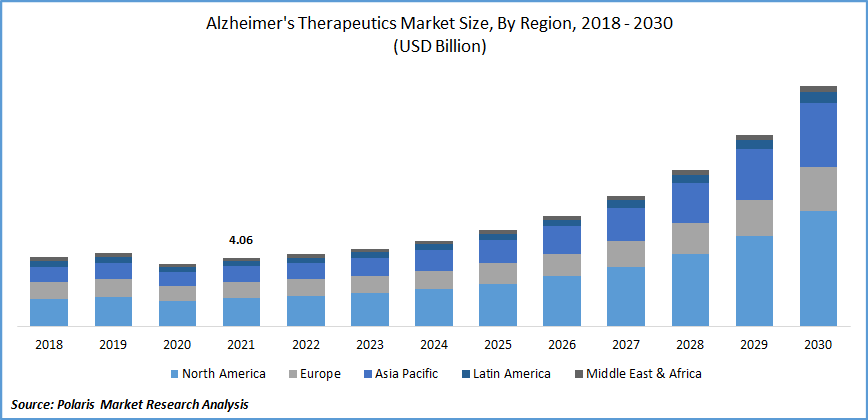

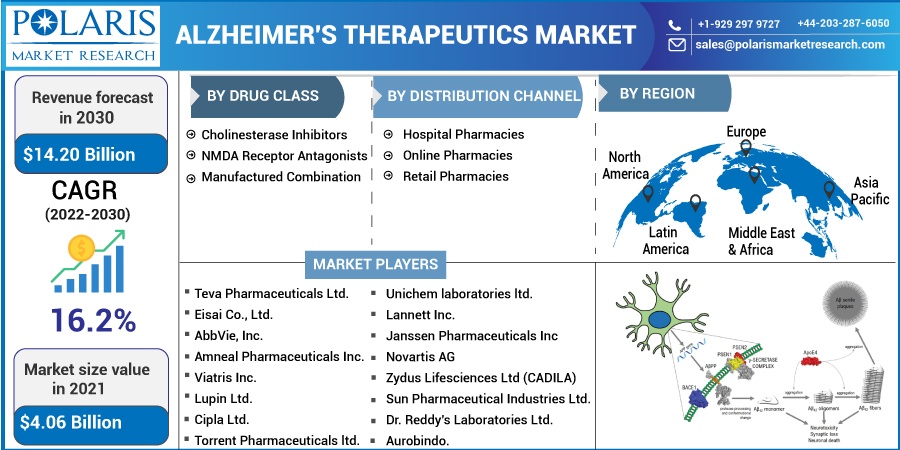

The global Alzheimer’s therapeutics market was valued at USD 4.06 billion in 2021 and is expected to grow at a CAGR of 16.2% during the forecast period. The global prevalence rate of Alzheimer's is increasing because of reasons like rising life expectancy, an aging population, and changing lifestyles, among others. This will fuel the demand for therapeutics treatment for the disorder in the upcoming years.

Know more about this report: Request for sample pages

As per the statistics published by the WHO, around 55 Mn people across the globe are suffering from this disease, and annually around 10 million cases arise, with significant advances in the diagnosis rate across different geographies.

Given the substantial risk associated with the disease medications, biomarkers have become important developments, lowering the risk and improving therapeutics results. Researchers are using biomarkers to discover important biological occurrences related to the disease and medications used to treat such diseases.

By reducing drug development risks and improving the selection of the best therapeutics candidates for large and costlier phase 3 clinical trials, the use of biomarkers enhances the drug development process. As a result, more people are using biomarkers. The market for pharmacological therapeutics for this disease is seeing increasing potential as a result of the development of novel biomarkers for therapeutics usage.

The COVID-19 pandemic's emergence had an effect on the therapeutics market for this disease treatment, and therapeutics operations everywhere were impacted by a decrease in hospital visits as a result of lockdown limitations imposed by different governments around the world.

Additionally, a number of research noted COVID-19's negative impacts on Alzheimer's patients, which is also anticipated to have an effect on the market under study. However, the studied market is anticipated to reclaim its full potential over the forecast period due to continued vaccinations and a fall in COVID-19 cases.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Major risk factors for this disorder include growing older and an aging global population, which both raise the disease's incidence and create growth potential for the market for therapeutics treatments. For instance, the World Population Prospects (WPP) report, which the UN released in 2017, estimates that of 962 million people in the world, 13% of the population are 60 years of age or older. By 2030, the population is expected to increase at a 3 % rate, reaching 1.4 billion.

Asia Pacific currently has 547 million geriatrics and is expected to reach 900 million by 2025, while Europe currently has the highest percentage of geriatrics (25 % of the population). As a result, both regions may offer opportunities for Alzheimer's therapeutics market expansion. Every year, there are around 1 million new instances of this disease in India. With an estimated 5.5 million patients in 2017, North America dominates the Alzheimer's therapeutics market demand.

Report Segmentation

The market is primarily segmented based on drug class, distribution channel, and region.

|

By Drug Class |

By Distribution Channel |

By Region |

|

|

|

Know more about this report: Request for sample pages

Cholinesterase Inhibitors Segment is Expected to Witness the Fastest Growth

Acetylcholinesterase inhibitors, commonly referred to as cholinesterase inhibitors, are a class of medicines that prevent the normal breakdown of the neurotransmitter acetylcholine. The cholinesterase inhibitors stop the enzyme's activity, which is what causes the body's cholinergic neurotransmitters to break down. Currently, Donepezil, Galantamine, Rivastigmine, and Memantine are the most popular and commonly used cholinesterase inhibitor medications on the market.

Cholinesterase inhibitors are the main medications on the current market now because the enzyme cholinesterase is a prominent therapeutics target for the disease. As a result, the industry is anticipated to expand over the next years as more pharmaceutical companies concentrate on creating cholinesterase inhibitor-based Alzheimer's therapeutics market treatment.

For instance, The USFDA gave Corium Inc. on March 11, 2022, has received once in week drug ADLARITY to treat Alzheimer's disease. In a group of Alzheimer's medications called cholinesterase inhibitors, Donepezil receives the most prescriptions. Such new advancements are additionally expected to augment the segment's growth.

Cholinesterase has also been extensively studied for its safety in Alzheimer's patients with COVID-19 infection during the COVID-19 pandemic, which is predicted to have an impact on the segment's growth since COVID-19 cases are rising globally. Acetyl cholinesterase inhibitors may be used as an additional therapy, according to the same study. Therefore, during the course of the projection period, COVID-19 is anticipated to have an impact on the growth of the cholinesterase inhibitors segment.

The Demand in North America is Expected to Witness Significant Growth

Due to the high burden of Alzheimer's disease and the region's rapidly aging population, significant investment in research and development activities, and the introduction of new products, North America held a significant share of the global market for diagnostics and therapeutics for Alzheimer's disease in recent years, and it is anticipated that it will continue to do so over the forecast period.

For instance, the Chief Science Officer of the Canadian Alzheimer Society indicated in an interview in June 2021 that "Over the next ten years, we predict that more than one million people in Canada will be living with dementia." This shows that the rising incidence of Alzheimer's in the North American area is anticipated to enhance demand for diagnostic and therapeutics for the disease, which might spur industry expansion during the forecast period.

The market is anticipated to expand in the United States over the forecast period as a result of an increase in research studies concerning the diagnosis and management of Alzheimer's disease and significant investments made in the nation by both public and private entities.

For instance, the Building Our Largest Dementia Infrastructure for Alzheimer's Act and improvements in the Improving HOPE for Alzheimer's Act were funded with USD 15 million each in December 2020 by the United States Congress, which also increased funding for Alzheimer's and dementia research at the National Institute of Health by USD 300 million. The diagnostics for Alzheimer's therapeutics market is therefore anticipated to grow in the area over the period of the forecast period.

Competitive Insight

Some of the major players operating in the global market include Teva Pharmaceuticals, Eisai Co., AbbVie, Inc., Amneal Pharmaceuticals., Macleods Pharmaceuticals, Viatris Inc., Lupin, Cipla, Torrent Pharmaceuticals, Unichem Laboratories, Lannett, Janssen Pharmaceuticals, Novartis, Zydus Lifesciences, Sun Pharmaceutical., Dr. Reddy's Laboratories, and Aurobindo.

Recent Developments

- In 2021, Kashiv Specialty Pharmaceuticals is acquired by Amneal. Amneal obtained access to the pipeline of complex generics and branded 505(b)2 medicines through this arrangement.

- In March 2022, Biogen Inc. and Eisai Co., also expanded their collaboration to find therapeutics treatments of the disease.

Alzheimer’s Therapeutics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 4.06 billion |

|

Revenue forecast in 2030 |

USD 14.20 billion |

|

CAGR |

16.2% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Drug Class, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Teva Pharmaceuticals Ltd., Eisai Co., Ltd., AbbVie, Inc., Amneal Pharmaceuticals Inc., Macleods Pharmaceuticals Ltd., Viatris Inc., Lupin Ltd., Cipla Ltd., Torrent Pharmaceuticals ltd., Unichem laboratories ltd., Lannett Inc., Janssen Pharmaceuticals, Inc. (Johnson & Johnson), Novartis AG, Zydus Lifesciences Ltd (CADILA), Sun Pharmaceutical Industries Ltd., Dr. Reddy's Laboratories Ltd., Aurobindo. |