Aluminum Foam Market Share, Size, Trends, Industry Analysis Report, By Material (Copper, Aluminum, Titanium, Nickel, Zinc); By Product; By Application; By End-Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Apr-2024

- Pages: 120

- Format: PDF

- Report ID: PM4742

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

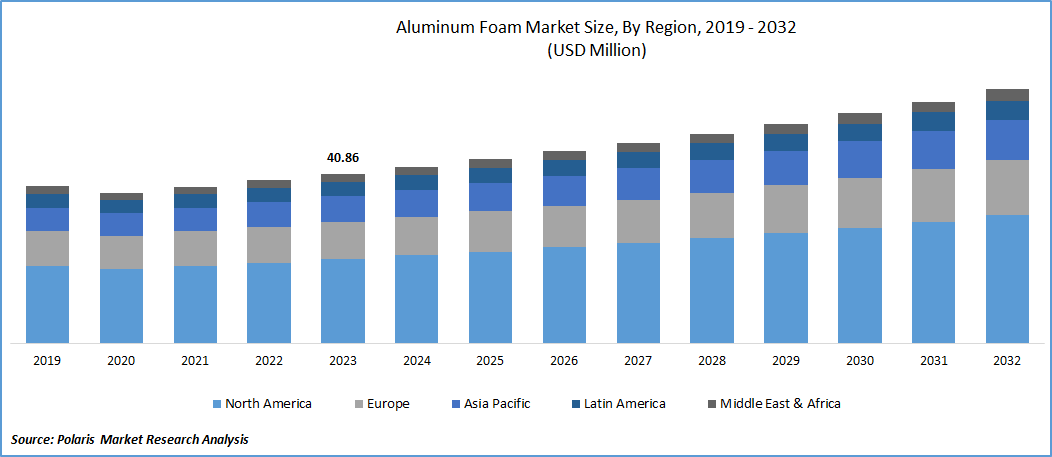

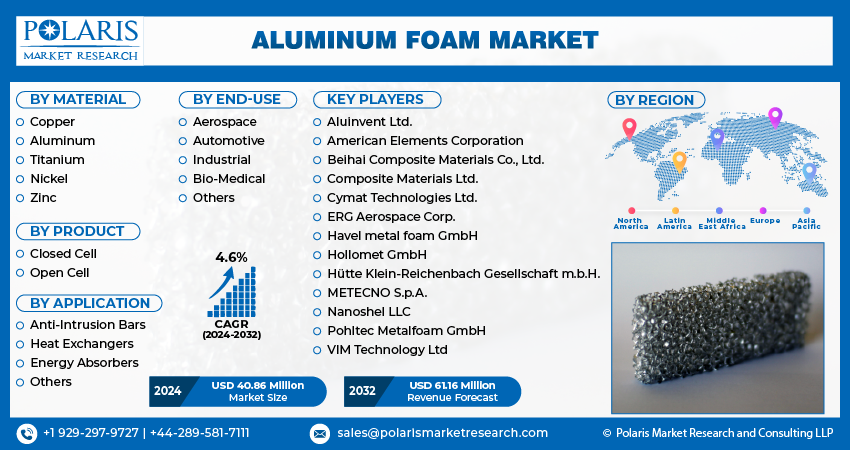

Aluminum Foam Market size was valued at USD 40.86 million in 2023. The market is anticipated to grow from USD 42.55 million in 2024 to USD 61.16 million by 2032, exhibiting a CAGR of 4.6% during the forecast period.

Industry Overview

Aluminum foam, characterized by its cellular structure comprising solid aluminum and gas-filled voids, distinguishes itself from solid aluminum in its metallic state. Renowned for its exceptional properties, including thermal conductivity, crush resistance, and lightweight, corrosion-resistant nature, aluminum foam is garnering increasing attention. Its recyclability further adds to its appeal in production processes. The automotive sector, grappling with stringent fuel efficiency and emissions standards globally, has embraced lightweight vehicles as a solution. This emphasis on weight reduction has propelled the demand for lightweight materials like metal foam, offering significant competitive advantages in vehicle efficiency and performance. Consequently, the surge in lightweight vehicle adoption is anticipated to drive the expansion of the metal foam market.

To Understand More About this Research:Request a Free Sample Report

As regulations targeting plastic polymers tighten, consumers are actively seeking sustainable alternatives. Aluminum foam emerges as a notable option due to its eco-friendly and recyclable properties, thus playing a pivotal role in stimulating market growth. Moreover, the expansion of the aluminum foam market is fueled by factors such as increased automotive production and heightened construction activities. Furthermore, ongoing research and development initiatives, coupled with advancements in technology and production techniques, are unlocking new opportunities for the aluminum foam market in the forecast period. This dynamic landscape positions aluminum foam as a key player in meeting the evolving demands of various industries and markets.

The innovation for the aluminum foam market is characterized by ongoing research and development efforts aimed at improving the properties, manufacturing processes, and applications of aluminum foam. Innovations in manufacturing processes such as powder metallurgy, foaming agents, and casting methods are enhancing the efficiency and scalability of aluminum foam production. Techniques, like melt foaming and powder metallurgy, are being refined to achieve better foam properties and cost-effectiveness.

- For instance, In September 2023, Beihai Composite Materials Co., Ltd introduced a range of innovative solutions aimed at addressing urban noise pollution. Among these solutions are cooling tower sound insulation, spot highway sound barriers, and noise reduction technologies, along with community sound-absorbing walls. Additionally, the company has developed specialized products designed to mitigate noise disturbances associated with cooling towers. These advancements are particularly crucial in enhancing the quality of life for residents living in areas impacted by noise pollution.

As the global economy recovers and industries adapt to the "new normal," the aluminum foam market is expected to regain its momentum. It has potential for growth in various applications, including aerospace, automotive, and renewable energy sectors, as the emphasis on lightweight and sustainable materials continues.

Key Takeaway

- North America dominated the largest market and contributed to more than 38% of the share in 2023.

- Asia Pacific accounted for the market to be the fastest growing CAGR during the forecast period.

- By product category, the closed cell segment accounted for the largest market share in 2023.

- By material category, the aluminium segment is projected to grow at a high CAGR during the projected period.

What are the market drivers driving the demand for the Aluminum Foam Market?

- Increase in the sales of Lightweight vehicles will Facilitate the Market Growth

The increase in sales of lightweight vehicles primarily drives the market growth of aluminum foam during the forecast period. Lightweight vehicles demand reduced energy for their journeys, resulting in heightened fuel efficiency. This holds immense significance for car manufacturers aiming to comply with rigorous fuel economy and environmental standards. Governments worldwide are implementing more stringent regulations concerning vehicle emissions and fuel efficiency. To adhere to these mandates, automakers must incorporate lightweight materials in their vehicles.

Furthermore, the successful integration of lightweight solutions gives automakers a significant competitive advantage, improving both the efficiency and performance of their vehicles. To stay competitive in the market, it is highly recommended that other manufacturers consider using lightweight materials, such as foam metal. As a result, the increase in sales of lightweight vehicles in the automotive industry is expected to drive the growth of the global metal foam market in the forecast period.

Which factor is restraining the demand for Aluminum Foam?

- The high initial cost involved in Aluminum Foam material is expected to hamper the global aluminum foam market growth.

The aluminum foam market lies in its relatively high production costs compared to traditional materials. Despite advancements in manufacturing techniques, aluminum foam production still involves complex processes and specialized equipment, leading to elevated manufacturing expenses. These higher costs can limit the widespread adoption of aluminum foam in certain applications, especially in price-sensitive industries such as construction and consumer goods. Additionally, the limited availability of raw materials and the energy-intensive nature of the foaming process contribute to cost challenges. Moreover, the market may need more support related to the perception of aluminum foam as a niche material, which could hinder its acceptance as a mainstream alternative to conventional materials like steel or plastics. Addressing these cost-related barriers through technological innovations, process optimization, and economies of scale will be crucial for unlocking the full potential of the aluminum foam market across various industries.

Report Segmentation

The market is primarily segmented based on material, product, application, end-use, and region

|

By Material |

By Product |

By Application |

By End-Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Material Insights

Based on material analysis, the market is segmented into copper, aluminum, titanium, nickel, and zinc. The Aluminum segment is expected to grow at the fastest CAGR during the forecast period. The aerospace and automotive industries are experiencing a notable increase in the utilization of aluminum foam. In space applications, aluminum metal foam sheets and sandwich panels show promise as alternatives to conventional honeycomb structures. Aluminum foams, due to their reduced weight, contribute to the production of lighter vehicles and find applications in boats and ships as well. Moreover, aluminum metal foams have the potential to bring about a transformation in the household furniture industry, allowing for the creation of unique designs for items like lamps, tables, and other furnishings. The lightweight, recyclable nature and outstanding damping properties of aluminum foam are anticipated to drive its continued adoption in the years ahead.

By Product Analysis

Based on the analysis of the product, the market has been segmented into two categories: closed-cell and open-cell. In the year 2023, the closed-cell segment accounted for the largest market share. Closed-cell foams have permeability to both air and liquid, which is why their demand is expected to increase during the forecasted period. This is mainly due to their superior tear resistance, high strength, and enhanced coefficient of friction. Closed-cell foams offer a wide variety of capabilities compared to open-cell foams. They provide greater durability and the ability to withstand higher pressures, which is driving the adoption of closed-cell foams.

Regional Insights

North America

North America accounted for the largest revenue share in 2023. North America emerged as the leading revenue contributor to the aluminum foam market, primarily due to several key factors. First and foremost, the region benefits from a robust industrial sector, particularly in sectors such as automotive, aerospace, and construction, which are significant consumers of aluminum foam products. These industries drive demand for lightweight materials with high strength-to-weight ratios, making aluminum foam an attractive choice for various applications ranging from structural components to energy absorption systems.

Furthermore, North America is home to several leading manufacturers and suppliers of aluminum foam products, providing a diverse range of solutions tailored to the needs of different industries. This strong presence of suppliers, coupled with established distribution networks and technical expertise, facilitates the widespread adoption of aluminum foam across various sectors. Moreover, stringent regulations and standards regarding safety, environmental sustainability, and fuel efficiency in North America incentivize the adoption of lightweight materials like aluminum foam.

Asia-Pacific

Asia-Pacific (APAC) region is expected to be the fastest growing CAGR in the forecast period. APAC is witnessing rapid industrialization and urbanization, driving demand for lightweight materials across various industries such as automotive, construction, and electronics. Aluminum foam, with its exceptional strength-to-weight ratio and versatility, is increasingly being sought after as a viable alternative to traditional materials in these sectors. The automotive industry in APAC is experiencing robust growth, fueled by rising disposable incomes, expanding middle-class populations, and government initiatives promoting electric vehicles (EVs) and fuel-efficient automobiles. Aluminum foam finds applications in lightweight structural components, crash management systems, and battery enclosures for EVs, thus aligning with the evolving trends in the automotive sector.

Competitive Landscape

The aluminum foam market is characterized by fragmentation, featuring competition from numerous players. Leading service providers in this sector consistently upgrade their technologies to retain a competitive advantage, prioritizing efficiency, reliability, and safety. In pursuit of a significant market share, these entities underscore the importance of strategic partnerships, continuous product improvements, and collaborative initiatives to outperform industry peers.

Some of the major players operating in the global market include:

- Aluinvent Ltd.

- American Elements Corporation

- Beihai Composite Materials Co., Ltd.

- Composite Materials Ltd.

- Cymat Technologies Ltd.

- ERG Aerospace Corp.

- Havel metal foam GmbH

- Hollomet GmbH

- Hütte Klein-Reichenbach Gesellschaft m.b.H.

- METECNO S.p.A.

- Nanoshel LLC

- Pohltec Metalfoam GmbH

- VIM Technology Ltd

Recent Developments

- In April 2022, CYMAT Technologies announced plans to increase production capacity and implement advanced technology deployment and automation processes to enhance manufacturing efficiency.

- In July 2021, Cymat Technologies made a significant announcement regarding its partnership with ADI Technologies Incorporated, which aimed to expand its presence in the U.S. defense market. Under this agreement, ADI Technologies would actively seek contracts within the U.S. Military for Cymat's stabilized aluminum foam products.

- In March 2021, Banner Industries partnered with Mott. Mott specializes in filtration and flow control solutions for semiconductors, industrial applications, and medical environments. Their partnership offers high-performance filters and fluid control devices with gas diffusers, purifiers, and flow restrictors to eliminate contaminants from process gases.

Report Coverage

The aluminum foam market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, material, product, application, end-use, and their futuristic growth opportunities.

Aluminum Foam Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 40.86 million |

|

Revenue forecast in 2032 |

USD 61.16 million |

|

CAGR |

4.6% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments Covered |

By Material, By Product, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The key companies in Aluminum Foam Market Aluinvent Ltd., American Elements Corporation, Beihai Composite Materials Co., Ltd., Composite Materials Ltd

Aluminum Foam Market exhibiting a CAGR of 4.6% during the forecast period.

Aluminum Foam Market report covering key segments are material, product, application, end-use, and region

The key driving factors in Aluminum Foam Market are Increase in the sales of Lightweight vehicles will Facilitate the Market Growth

Aluminum Foam Market Size Worth $ 61.16 Million By 2032