Aluminum Curtain Wall Market Size, Share, Trends, Industry Analysis Report

: By Type (Stick-Built, Semi-Unitized, and Unitized), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025– 2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM1066

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

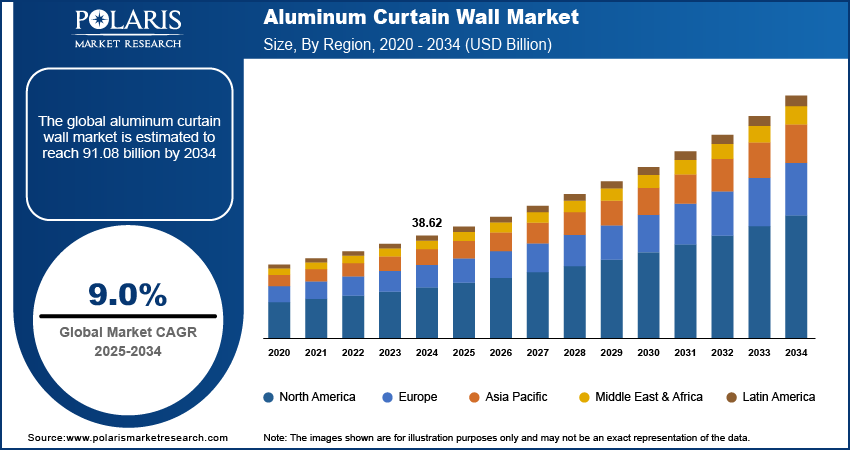

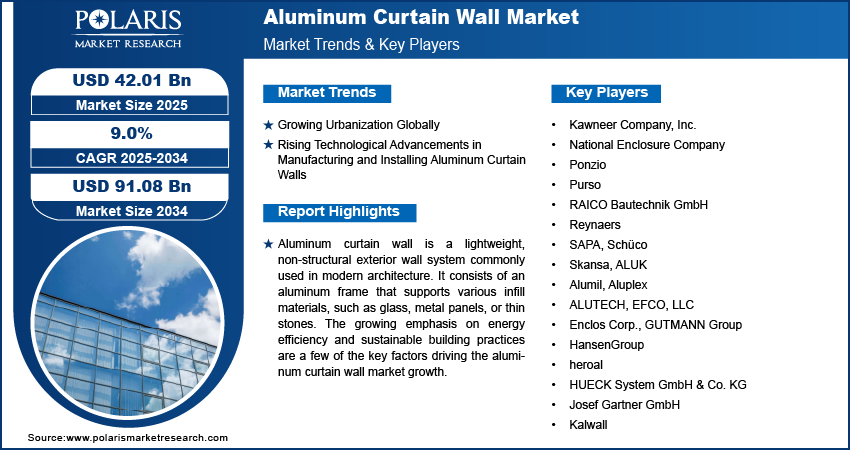

The global aluminum curtain wall market size was valued at USD 38.62 billion in 2024. The market is projected to grow from USD 42.01 billion in 2025 to USD 91.08 billion by 2034. It is projected to exhibit a CAGR of 9.0% from 2025 to 2034. Market growth is driven by rising demand for energy-efficient buildings, rapid urbanization, sustainable construction practices, and advancements in manufacturing and installation technologies.

Key Insights

- The unitized segment accounted for the largest market share in 2024.

- The commercial segment had a maximum share in 2024 because of extensive acquisition of aluminum curtain walls in office buildings, shopping malls, and soaring commercial networks.

- Asia Pacific aluminum curtain wall market peaked the global market in 2024

- China witnessed a steep growth due to its outstanding manufacturing potential together with economic labor and material adding to its leadership position.

- North America witnessed a notable CAGR during the forecast period.

- The US propels growth because of its entrenched construction sector and growing concentration on retrofitting ancient buildings with contemporary curtain wall systems.

Industry Dynamics

- Urban regions need productive, sturdy, and aesthetically attractive construction solutions to assist population growth and developing infrastructure requirements which is driving the market forward.

- Inventions in production procedures such as mechanized machining and 3D modelling permit for advancement of intricate, superior aluminum wall designs with decreased material waste and speedier turnaround times.

- The growing awareness of energy efficient and green building practices speed up the market growth momentum.

Market Statistics

2024 Market Size: USD 38.62 billion

2034 Projected Market Size: USD 91.08 billion

CAGR (2025-2034): 9.0%

Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Aluminum curtain wall is a lightweight, non-structural exterior wall system commonly used in modern architecture. It consists of an aluminum frame that supports various infill materials, such as glass, metal panels, or thin stones. Aluminum curtain walls are particularly valued for their thermal efficiency and durability.

The growing emphasis on energy efficiency and sustainable building practices are a few of the key factors driving the aluminum curtain wall market growth. Aluminum curtain walls are lightweight, durable, and highly recyclable, making them ideal for eco-conscious designs. Their ability to integrate advanced glazing systems enhances building thermal insulation, reduces energy consumption, and improves building performance, aligning with green building standards such as Leadership in Energy and Environmental Design (LEED) and Building Research Establishment Environmental Assessment Method (BREEAM). Additionally, their adaptability to innovative designs allows architects to create energy-efficient facades that maximize natural light while minimizing heat gain, contributing to reduced carbon footprints. This combination of sustainability, functionality, and aesthetic appeal has made aluminum curtain walls increasingly popular in both commercial and residential construction projects.

Aluminum Curtain Wall Market Dynamics

Growing Urbanization Globally

Urban areas require efficient, durable, and aesthetically appealing construction solutions to accommodate population growth and evolving infrastructure needs. Aluminum curtain walls meet these demands by offering lightweight, versatile, and visually striking facades that are ideal for skyscrapers, commercial complexes, and residential towers. The ability of aluminum curtain walls to support large glass panels promotes natural lighting and energy efficiency, aligning with modern urban design priorities. Additionally, as urbanization drives the need for sustainable and resilient structures, aluminum curtain walls stand out for their recyclability, durability, and compatibility with energy efficinent building technologies, making them a preferred choice in urban construction projects worldwide. For instance, according to the United Nations, the urban population is set to increase by almost 600 million by the year 2030, reaching a total of 5.2 billion.

Rising Technological Advancements in Manufacturing and Installing Aluminum Curtain Walls

Innovations in production processes, such as automated machining and 3D modeling, allow for the development of complex, high-quality aluminum wall designs with reduced material waste and faster turnaround times. Advanced installation techniques, including prefabricated systems and modular construction, streamline the building process, reduce labor costs, and ensure higher accuracy in assembly. This has led to the broader adoption of aluminum curtain walls in new constructions and renovation projects across various regions. Thus, technological advancements in manufacturing and installation are driving the aluminum curtain walls market demand.

Aluminum Curtain Wall Market Segment Insights

Assessment Based on Type

The aluminum curtain wall market, based on type, is segmented into stick-built, semi-unitized, and unitized. The unitized segment accounted for a larger aluminum curtain wall market share in 2024 due to its superior efficiency, performance, and ease of installation. Unitized systems, which involve pre-assembled panels fabricated off-site, have gained significant traction as they minimize on-site labor and reduce construction timelines. These systems offer enhanced quality control during manufacturing, leading to better precision and durability in the final installation. Unitized curtain walls also perform exceptionally well in terms of thermal insulation and weather resistance, making them a preferred choice for large-scale commercial projects and high-rise buildings where performance and speed are critical. The growing trend of modular construction and the rising demand for sustainable and energy-efficient buildings further contribute to the dominance of the segment.

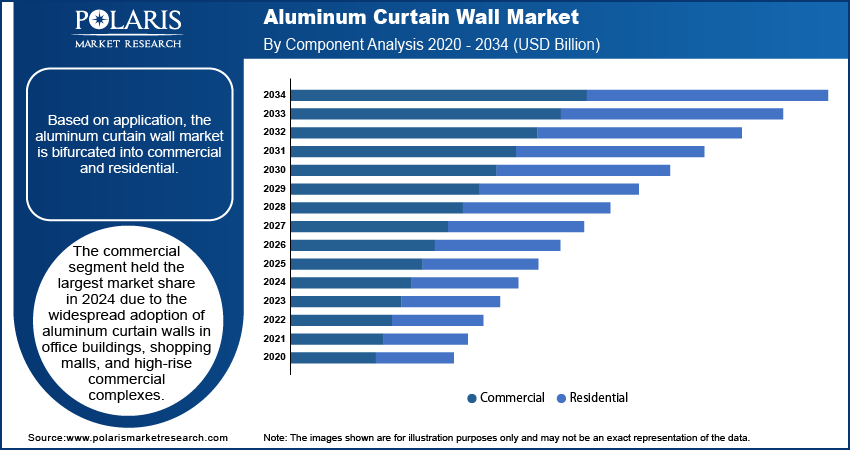

Evaluation Based on Application

The aluminum curtain wall market, based on application, is bifurcated into commercial and residential. The commercial segment held the largest market share in 2024 due to the widespread adoption of aluminum curtain walls in office buildings, shopping malls, and high-rise commercial complexes. The demand for energy-efficient and aesthetically appealing facades drives their extensive use in commercial applications. Aluminum curtain walls provide superior insulation, natural ambient lighting, and modern design flexibility, which are crucial for meeting the needs of commercial developers aiming to create iconic structures that align with sustainability goals. Rapid urbanization, particularly in emerging economies, and the increasing prevalence of green building certifications like LEED and BREEAM have further fueled the growth of the segment.

The residential segment is expected to grow at a rapid pace from 2025 to 2034, owing to the growing urbanization and rising disposable incomes. Aluminum curtain walls offer homeowners and developers modern design solutions that enhance energy efficiency, durability, and aesthetic appeal. High-rise residential towers, particularly in densely populated cities, benefit from the lightweight properties and structural adaptability of these systems. The growing emphasis on energy-efficient buildings by governments worldwide and the increasing popularity of luxurious, sustainable living spaces contribute to the rising adoption of aluminum curtain walls in residential construction.

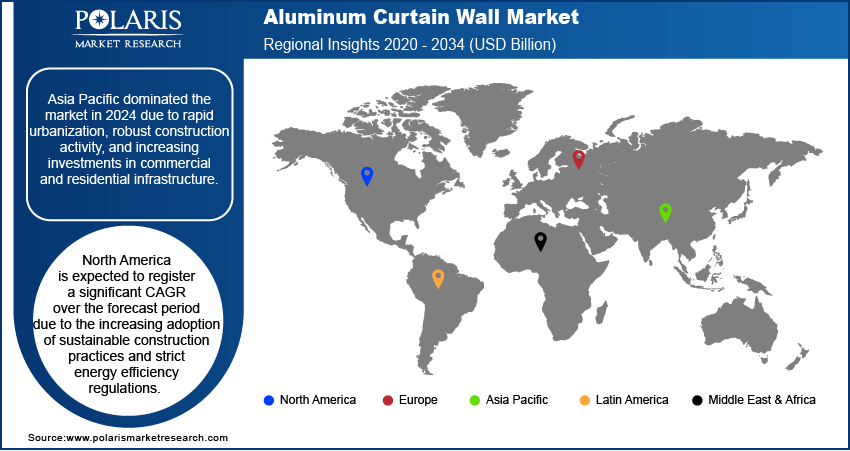

Regional Analysis

By region, the study provides the aluminum curtain wall market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the global market in 2024 due to rapid urbanization, robust construction activity, and increasing investments in commercial and residential infrastructure. Countries like China and India have been at the forefront of this growth, with China dominating the region. China's massive manufacturing capabilities, combined with cost-efficient labor and materials, contribute to its leadership position. Additionally, the growing adoption of green building certifications and advancements in curtain wall technologies are driving demand in Asia Pacific, as developers increasingly prioritize modern, durable, and energy-efficient building solutions.

The North America aluminum curtain wall market is expected to witness a significant CAGR during the forecast period due to the increasing adoption of sustainable construction practices and strict energy efficiency regulations. The US, as the largest contributor in this region, drives growth with its well-established construction sector and a rising focus on retrofitting older buildings with modern curtain wall systems. Additionally, advancements in technology and innovation in materials enhance the appeal of aluminum curtain walls, supporting their growing use across various architectural designs in the region.

Key Players and Competitive Analysis

Major market players are investing heavily in research and development in order to expand their offerings, which will help the aluminum curtain wall market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The aluminum curtain wall market is fragmented, with the presence of numerous global and regional market players. Major players in the aluminum curtain wall market include Kawneer Company, Inc.; National Enclosure Company; Ponzio; Purso; RAICO Bautechnik GmbH; Reynaers; SAPA; Schüco; Skansa; ALUK; Alumil; Aluplex; ALUTECH; EFCO, LLC; Enclos Corp.; GUTMANN Group; HansenGroup; heroal; HUECK System GmbH & Co. KG; Josef Gartner GmbH; and Kalwall.

ALUK is a prominent global leader in the design, engineering, and distribution of high-quality aluminum construction systems, particularly known for its windows, doors, and curtain walling solutions. With over 70 years of experience in the fenestration industry, ALUK has established a strong reputation for delivering innovative and reliable products that meet the diverse needs of modern architecture. The company operates in ten countries and serves more than 50 markets worldwide. ALUK's product offerings include various curtain wall systems tailored for specific applications. For instance, the SG50 Curtain Walling System is designed as a structurally glazed solution that provides high performance while allowing for expansive glass facades. Similarly, the SL60 system features external mechanical retainers and customizable options for enhanced thermal insulation, making it suitable for commercial buildings such as offices, hospitals, and educational institutions.

EFCO, LLC is a well-established company in the fenestration industry, with a legacy that spans over 65 years. Headquartered in Monett, Missouri, EFCO specializes in the design, manufacture, and distribution of a wide range of architectural products, including aluminum windows, curtain walls, storefront systems, and entrance solutions. One of EFCO's flagship offerings is its aluminum curtain wall systems, which have become increasingly popular in contemporary architecture due to their ability to create expansive glass facades that maximize natural light while providing structural integrity.

List of Key Companies

- Kawneer Company, Inc.

- National Enclosure Company

- Ponzio

- Purso

- RAICO Bautechnik GmbH

- Reynaers

- SAPA

- Schüco

- Skansa

- ALUK

- Alumil

- Aluplex

- ALUTECH

- EFCO, LLC

- Enclos Corp.

- GUTMANN Group

- HansenGroup

- heroal

- HUECK System GmbH & Co. KG

- Josef Gartner GmbH

- Kalwall

Aluminum Curtain Wall Industry Developments

November 2024: ALUK, a global company that designs, engineers, and distributes aluminum windows, doors, and facade systems, announced the launch of its W75U Unitised Curtain Walling System in India.

October 2023: METRA SpA, a producer of aluminum sheets, completed the acquisition of Belding Machinery and Equipment Leasing, LLC and its subsidiaries to accelerate its geographic expansion within North America

September 2020: Vaisala, a Finland-based global provider of weather, environmental, and industrial measurements, opened its new North American headquarters in Louisville, Colorado. The company stated that it chose to use aluminum curtain walls in many of the buildings to achieve net-zero environmental impact.

Aluminum Curtain Wall Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Stick-Built

- Semi-Unitized

- Unitized

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Commercial

- Residential

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Aluminum Curtain Wall Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 38.62 billion |

|

Market Size Value in 2025 |

USD 42.01 billion |

|

Revenue Forecast by 2034 |

USD 91.08 billion |

|

CAGR |

9.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global aluminum curtain wall market size was valued at USD 38.62 billion in 2024 and is projected to grow to USD 91.08 billion by 2034.

The global market is projected to register a CAGR of 9.0% from 2025 to 2034.

Asia Pacific had the largest share of the global market in 2024.

Some of the key players in the market are Kawneer Company, Inc.; National Enclosure Company; Ponzio; Purso; RAICO Bautechnik GmbH; Reynaers; SAPA; Schüco; Skansa; Alumil; Aluplex; ALUTECH; EFCO, LLC; Enclos Corp.; GUTMANN Group; HansenGroup; heroal; HUECK System GmbH & Co. KG; Josef Gartner GmbH; and Kalwall.

The residential segment is projected to grow at a rapid pace during the forecast period.

The unitized segment accounted for a larger market share in 2024.