Aluminum Composite Panel Market Size, Share, Trends, Industry Analysis Report: By Applications (Building & Construction, Transportation, Automotive, and Advertising), Coating, Composition, Vehicle, Product, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 116

- Format: PDF

- Report ID: PM1195

- Base Year: 2024

- Historical Data: 2020-2023

Aluminum Composite Panel Market Overview

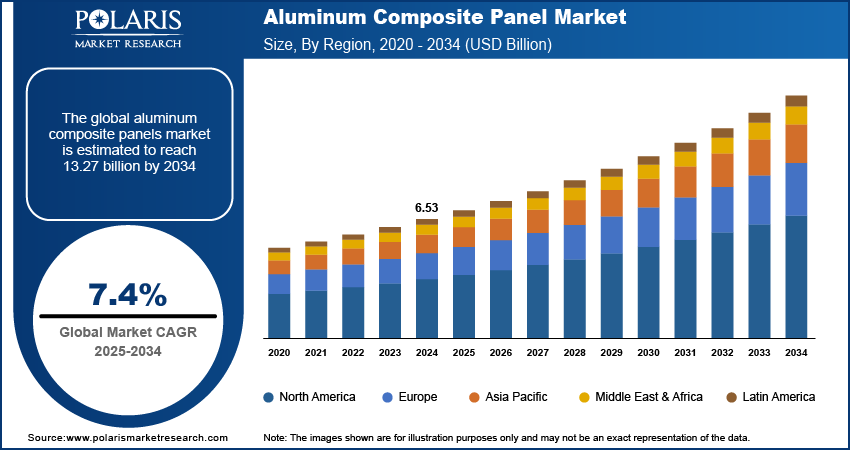

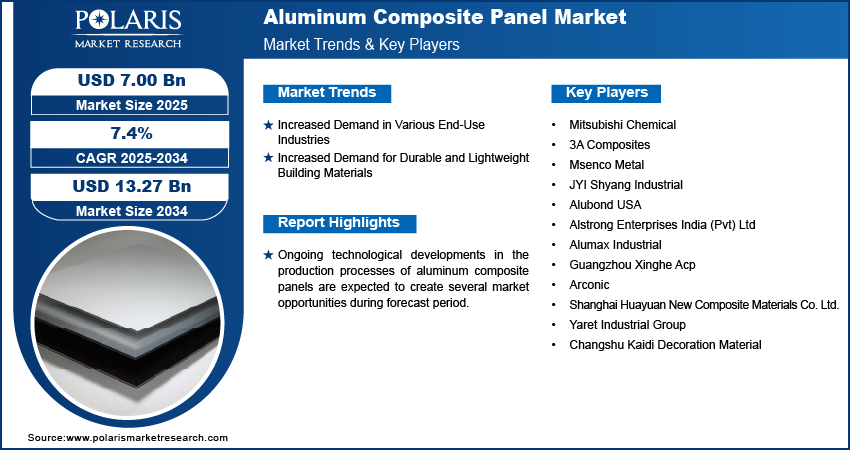

The aluminum composite panel market size was valued at USD 6.53 billion in 2024. The market is projected to grow from USD 7.00 billion in 2025 to USD 13.27 billion by 2034, at a CAGR of 7.4% from 2025 to 2034.

An aluminum composite panel (ACP) is a flat panel made of a couple of thin aluminum sheets joined to a foundation of polyethylene or fire-resistant mineral filler. Owing to its sandwich-like structure, the panel is also referred to as an aluminum sandwich panel. ACPs have several advantages, including stability, large formability, fire retardancy or resistance, and recycling. They have numerous applications in various industries, including construction, modern vehicles, and sustainable architecture. To meet the transitional energy and building needs, the construction industry is growing, and more panels are being used for cladding and decorative applications.

To Understand More About this Research: Request a Free Sample Report

As lightweight aluminum composite panel are increasingly being used to improve building thermal insulation in the construction industry, the aluminum composite panel (ACP) market demand is anticipated to rise during the forecast period. The reduced thickness, better insulation, and enhanced sealing that these composite panels provide are critical for building structures. ACPs also offer superior air and water barriers, flexibility, high load performance, and durability, all of which are expected to positively impact the ACP market expansion during the forecast period. It is also projected that the rising demand for green buildings will boost product demand due to the environmentally friendly characteristics of these materials. ACPs are a viable material for the modern construction industry as they reduce the overall weight of the building structure and have a high tensile strength.

Aluminum composite panel are typically utilized for wallboards, advertisement boards, commercial display platforms and signboards, tunnel ceilings, curtain walls, and decorative renovations for older buildings with stories added. A number of macroeconomic variables, including GDP growth, employment rates, and living standards, influence this aluminum composite panel industry’s expansion. Economic growth combined with easy access to raw materials and labor sandwich panels is primarily used to lower the structural weight of transportation systems, including high-speed trains, satellites, missiles, and airplanes. Sandwich panels are made from aluminum composites, which will fuel the aluminum composite panel market expansion during the forecast period. Additionally, it is anticipated that technological developments in the production of ACP sheets and panels will significantly boost the market growth during the forecast period.

Aluminum Composite Panel Market Dynamics

Increased Demand in Various End-Use Industries

Aluminum composite panel are used in numerous applications across various industries such as advertising boards, building and construction, and transportation. These panels are used extensively in transportation owing to their many qualities, including lightweight, fire resistance, compression resistance, non-flammability, nontoxic fumes, ease of assembly, cost and time effectiveness, and acoustic insulation. Aluminum composite panel's ideal fire, weather, and chemical resistance, as well as their lightweight nature, along with new international building codes that have forced the construction industry to focus on sustainable and energy-efficient design, propel the aluminum composite panel market demand.

Increased Demand for Durable and Lightweight Building Materials

The main effect of aluminum composite panel is to reduce the structural weight of building elements. Owing to their remarkable strength-to-weight ratio and low weight, ACPs are highly sought-after as building materials. The panels offer numerous properties such as improved resistance to weather and UV rays; increased insulation against heat and sound; and resistance to harsh environments such as pollutants, acids, and alkali salts. They also provide increased durability and stiffness. Aluminum composite panel are also used as exterior and interior components of vehicles, such as passenger cars, trucks, and ships. Technological developments in the production of aluminum composite panel and sheets are anticipated to have a big impact on the sector as a whole. Given how environmentally friendly these products are, it is anticipated that the rising demand for green buildings will increase demand for the products.

Aluminum Composite Panel Market Segment Insights

Aluminum Composite Panel Market Outlook by Coating Type

Aluminum composite panel market segmentation based on coating type is made as oxide films, polyvinylidene difluoride (PVDF), laminating coating, polyester, and polyethylene. In 2024, the polyvinylidene difluoride (PVDF) segment held the largest revenue share of 38.2% due to its many uses, including advertising boards, high-speed trains, and lightweight construction. Additionally, the segment growth is anticipated to be aided by their attributes, such as durability and resistance to corrosion and wear. It is anticipated to grow significantly in the future owing to its advantages such as simple processing and fabrication. Laminating coating ACPs are mainly utilized for lamination applications in the construction sector and are produced using multi-layer extrusion lamination. Oxide film offers a number of benefits when used to produce ACPs, including resistance to acid, corrosion, and UV light, as well as fire protection. As a result, this is also segment is expected to grow at a significant CAGR over the forecast period.

Aluminum Composite Panel Market Assessment by Applications Type

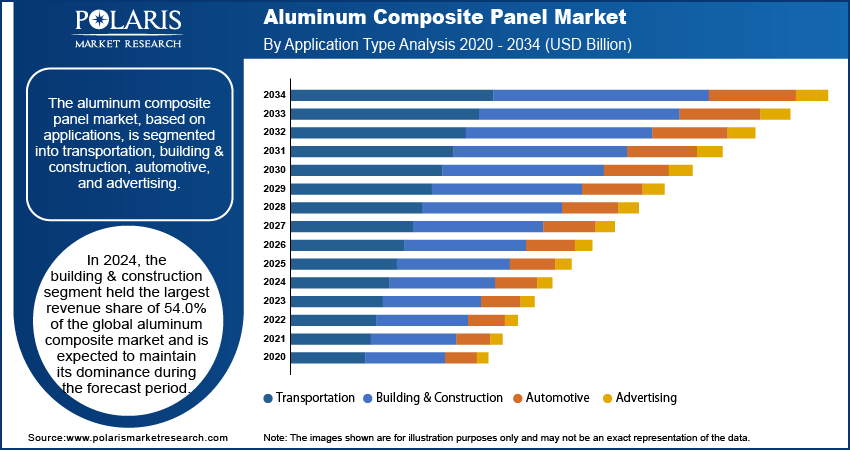

Based on application, the market for aluminum composite panel is segmented as transportation, building & construction, automotive, and advertising. In 2024, the building & construction segment held the largest revenue share of 54.0%. The environmentally friendly features of aluminum composite panel are anticipated to boost their demand for green buildings. Benefits such as the product's corrosion resistance and thermal and acoustic insulation are also anticipated to increase demand for it in the contemporary construction sector. Significant growth is also anticipated in the railway application segment. Additionally, these composites aid in lowering the trains' total weight, which increases speed and lowers power usage.

Aluminum Composite Panel Market Regional Insights

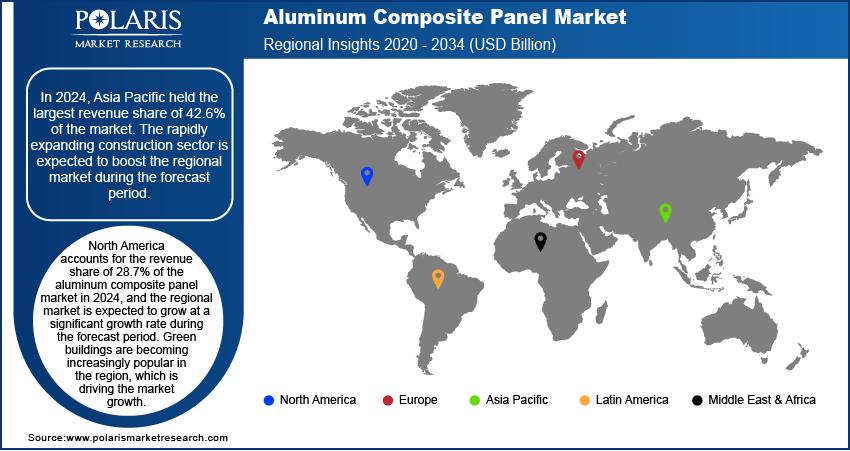

The study offers regional insight into the aluminum composite panel market in North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa.

In 2024, Asia Pacific held the largest revenue share of 42.6% and dominated the aluminum composite panel market value. It is expected that the rapidly expanding construction sector will benefit the regional market growth. The growing population, government initiatives to provide basic amenities, and the strong demand for reasonably priced housing drive the Asia Pacific aluminum composite panel market expansion. China and Japan are the two biggest consumers of aluminum composite panel in the region. The Asia Pacific market is also anticipated to be driven by the region's expanding building and construction sector and consumers' growing preference for easy-to-use and secure building materials.

North America accounts for the revenue share of 28.7% of the aluminum composite panel market in 2024, and the regional market is expected to grow at a significant growth rate during the forecast period. The rising popularity of green buildings in the region and the increasing governmental initiatives and programs to promote better infrastructure propel the market expansion. Additionally, the market growth will be positively impacted by increased production of electric and hybrid vehicles in North America.

Aluminum Composite Panel Market – Key Players and Competitive Insights

Since major companies concentrate on creating innovative products with exceptional qualities and also showcase their brand strength through well-known trademarked products, the global aluminum composite panel market is extremely competitive. Expansion of production capacity and customization of products are anticipated to be two of the main strategic initiatives that these businesses implement to obtain a competitive edge.

Mitsubishi Chemical, 3A Composites, Msenco Metal, JYI Shyang Industrial, Alubond USA, Alstrong Enterprises India (Pvt) Ltd, Alumax Industrial, Guangzhou Xinghe Acp, Arconic, and Shanghai Huayuan New Composite Materials Co. Ltd. are among the top companies in the aluminum composite panel market.

List of Key Players

- Mitsubishi Chemical

- 3A Composites

- Msenco Metal

- JYI Shyang Industrial

- Alubond USA

- Alstrong Enterprises India (Pvt) Ltd

- Alumax Industrial

- Guangzhou Xinghe Acp

- Arconic

- Shanghai Huayuan New Composite Materials Co. Ltd.

- Yaret Industrial Group

- Changshu Kaidi Decoration Material

Aluminum Composite Panel Industry Developments

In October 2024, Viva and Aloxide introduced the 'Pure Aura' line of anodized aluminum panels in India. This product's incorporation of German technology offers improved durability, corrosion resistance, and aesthetic appeal, representing a major advancement in the market for aluminum composite panels (ACPs).

In December 2024, The Swiss company 3A Composites’ flagship brand, ALUCOBOND, unveiled “ALUCODUAL circular,” an aluminum composite panel that is continuously committed to sustainability. It exemplifies the “Reduce, Reuse, Recycle” philosophy and is composed of 89% recycled aluminum.

Aluminum Composite Panel Market Segmentation

By Application Outlook

- Transportation

- Building & Construction

- Automotive

- Advertising

By Coating Outlook

- Oxide Film

- Polyvinylidene Difluoride

- Laminating Coating

- Polyester

- Polyethylene

By Vehicle Outlook

- Light Commercial Vehicles

- Passenger Cars

By Composition Outlook

- Rear Skin

- Core Material

- Metal Skin

- Surface Coating

By Product Outlook

- Antistatic

- Antibacterial

- Fire-Resistant

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Aluminum Composite Panel Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.53 billion |

|

Market Size Value in 2025 |

USD 7.00 billion |

|

Revenue Forecast by 2034 |

USD 13.27 billion |

|

CAGR |

7.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The aluminum composite panel market size is expected to grow from USD 7.0 billion in 2025 to USD 13.27 billion by 2034.

The market is expected to register the highest CAGR of 7.4% during the forecast period.

In 2024, Asia Pacific held the largest revenue share of 42.6% and dominated the global aluminum composite panel market revenue.

Alubond USA, Alstrong Enterprises India (Pvt) Ltd, Alumax Industrial, Mitsubishi Chemical, Shanghai Huayuan New Composite Materials Co. Ltd., 3A Composites, Msenco Metal, and JYI Shyang Industrial are among the key players influencing the aluminum composite panel market growth.

The building & construction segment held the largest revenue share of 54.0% of the aluminum composite market in 2024.

In 2024, the polyvinylidene difluoride (PVDF) segment held the largest revenue share of 38.2% in the market.