Alternative Data Market Share, Size, Trends, Industry Analysis Report, By Industry; By Data Type; By End User (Investment Institutions, Retail Companies, Hedge Fund Operators, Other End-Users); By Region; Segment Forecast, 2024 - 2032

- Published Date:Apr-2024

- Pages: 117

- Format: PDF

- Report ID: PM4838

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

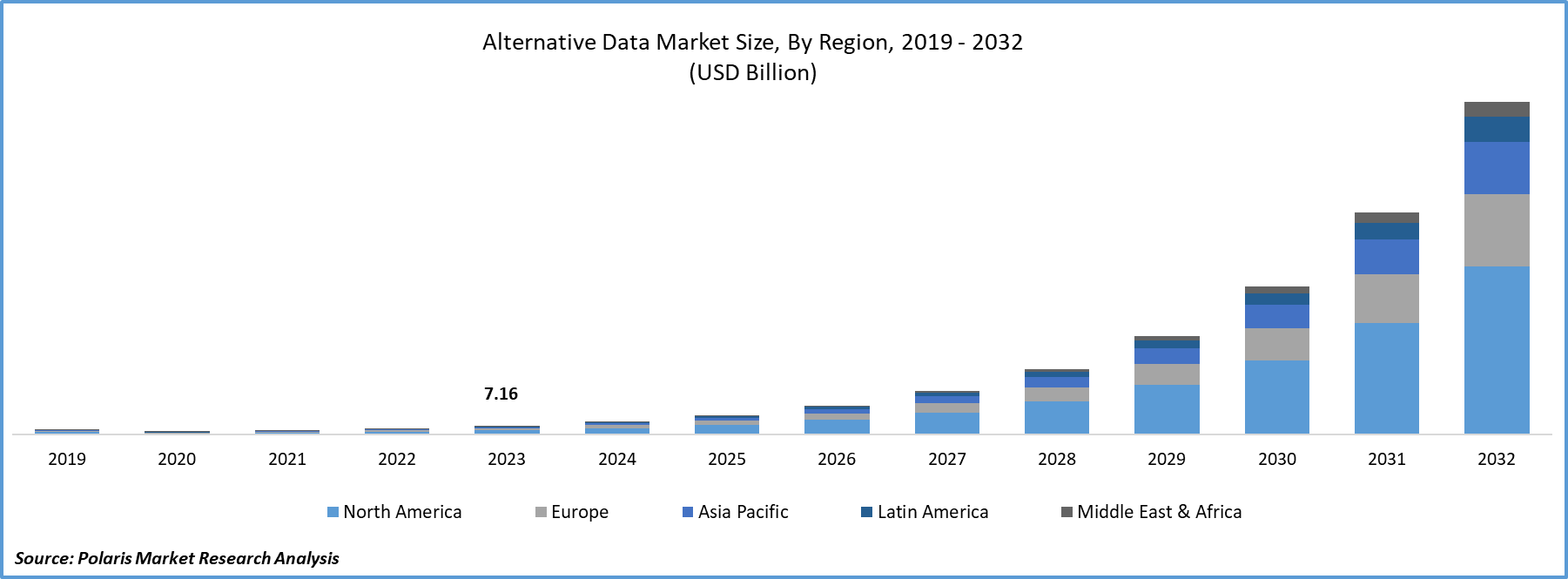

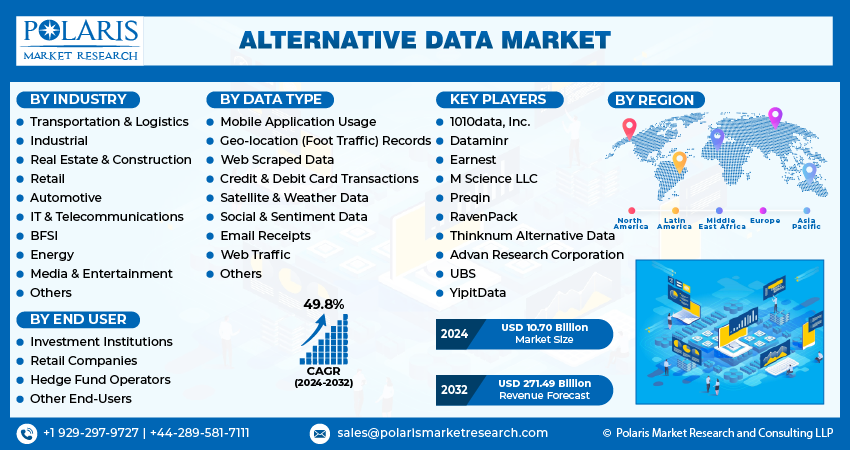

Global alternative data market size was valued at USD 7.16 billion in 2023. The market is anticipated to grow from USD 10.70 billion in 2024 to USD 271.49 billion by 2032, exhibiting a CAGR of 49.8% during the forecast period

Alternative Data Market Overview

Alternative data refers to non-traditional sources of information that analysts and investors use to gain insights into various aspects of businesses, industries, or markets. This data often includes unconventional sources such as sensor data, satellite imagery, credit card transactions, web scraping, and social media posts, among others. Unlike traditional financial data such as earnings reports or balance sheets, alternative data offers a more dynamic and granular view, providing unique insights into consumer behavior, supply chain dynamics, economic trends, and more.

The alternative data market has witnessed significant growth in recent years, driven by the increasing demand for unique insights and competitive advantages in various industries. One prominent trend is the proliferation of non-traditional data sources, ranging from social media sentiment analysis to satellite imagery and IoT sensor data. This diversification reflects the growing recognition among businesses and investors of the limitations of traditional financial data and the need for more comprehensive and dynamic datasets to make informed decisions. As a result, alternative data providers are continuously expanding their offerings to cater to this demand, fueling alternative data market size growth.

To Understand More About this Research:Request a Free Sample Report

Also, the key driving factors behind the expansion of the alternative data market are the rise of big data analytics and artificial intelligence (AI) technologies. The ability to process and analyze vast amounts of unstructured data has unlocked new possibilities for extracting actionable insights and predicting alternative data market trends with greater accuracy. Businesses across sectors, from finance to retail to healthcare, are leveraging these advanced analytics tools to gain a competitive edge and optimize their operations. Additionally, regulatory developments such as GDPR and increased data privacy concerns have prompted organizations to explore alternative data sources that comply with evolving regulations while still delivering valuable insights.

Another driving force shaping the alternative data market is the growing emphasis on ESG (Environmental, Social, and Governance) factors in investment decision-making. Investors are increasingly integrating ESG criteria into their portfolio strategies to mitigate risks, align with their values, and capitalize on emerging opportunities in sustainable industries. Alternative data providers are responding to this trend by offering datasets that enable investors to evaluate companies' ESG performance and assess their long-term sustainability prospects. As ESG considerations continue to gain prominence in the investment landscape, the demand for alternative data solutions tailored to these needs is expected to drive further alternative data market growth.

Alternative Data Market Dynamics

Market Drivers

Growth of Big Data bolstering the growth of the Alternative Data market share.

The exponential growth of big data originating from diverse sources such as IoT devices, sensors, and social media sites is a primary driver behind the expansion of the alternative data market. These sources collectively generate massive volumes of data at an unprecedented rate, offering a wealth of information for analysis. IoT devices, for instance, continuously collect data on various aspects of our physical environment, ranging from temperature and humidity to motion and sound, providing insights into consumer behavior, supply chain efficiency, and operational performance. Similarly, social media sites produce vast amounts of user-generated content, including posts, comments, and interactions, which can offer valuable understandings of consumer preferences, sentiment trends, and market dynamics.

The availability of such diverse and abundant data sources fuels the demand for alternative data as businesses and investors seek to extract actionable insights and gain competitive advantages. Traditional datasets often need to catch up on capturing the complexities and nuances of rapidly evolving markets and consumer behaviors. Alternative data, leveraging big data analytics and machine learning techniques, enables deeper analysis and predictive modeling, empowering organizations to make knowledgeable conclusions in real time. As the volume and variety of big data continue to expand, the alternative data market is poised for further growth, with innovative solutions emerging to meet the evolving needs of businesses and investors in an increasingly data-driven world.

Market Restraints

Technical Complexity is likely to hamper the growth of the market.

The processing and analysis of alternative data pose significant challenges due to their inherent complexity, particularly when dealing with unstructured or semi-structured data obtained from sources such as social media sites and satellite imagery. Extracting meaningful insights from these diverse datasets demands specialized expertise and infrastructure in data science, machine learning, and big data analytics. Many organizations need help with effectively harnessing alternative data for decision-making due to the complexity of data integration, cleaning, and modeling processes. With sufficient resources and capabilities in data engineering and advanced analytics, organizations may be able to derive actionable insights from alternative data sources, limiting their ability to leverage this valuable resource for informed decision-making across various domains.

Report Segmentation

The market is primarily segmented based on industry, data type, end user, and region.

|

By Industry |

By Data Type |

By End User |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Alternative Data Market Segmental Analysis

By Data Type Analysis

- In 2023, the Credit and Debit Card Transaction segment holds the largest share in the global Alternative Data market. This dominance can be attributed to the extensive usage of credit and debit cards in various economic activities, providing a rich source of transactional data that offers valuable insights into consumer behavior, spending patterns, and economic trends. The widespread adoption of digital payment methods, coupled with the convenience and accessibility of credit and debit cards, has resulted in a vast volume of transaction data being generated daily. Analyzing this data enables businesses and investors to make informed decisions regarding alternative data market trends, customer preferences, and investment opportunities. Additionally, advancements in data analytics and machine learning techniques have enhanced the ability to derive actionable insights from credit and debit card transaction data, further solidifying its position as a leading segment in the alternative data landscape.

- The Social & Sentiment Data segment is poised for significant growth over the forecast period in the Alternative Data market. This anticipation is primarily driven by the increasing reliance on social media sites as channels for communication, expression, and information sharing. Social media sites generate vast amounts of user-generated content, including posts, comments, likes, and shares, which collectively provide valuable insights into consumer sentiments, preferences, and trends. Businesses and investors recognize the importance of tapping into this rich source of data to gauge public opinion, track brand sentiment, and identify emerging alternative data market trends. Additionally, advancements in natural language processing (NLP) and sentiment analysis techniques empower organizations to extract actionable insights from social media data with greater accuracy and efficiency. As a result, the Social & Sentiment Data segment is expected to experience significant growth as more businesses and investors leverage this alternative data source to gain competitive advantages and drive informed decision-making strategies.

By End User Analysis

- In 2023, the hedge fund operators segment emerged as the leading contributor to the global alternative data market revenue. This substantial share can be attributed to the heightened demand from hedge fund companies seeking alternative data. Hedge fund operators such as QR Capital Management, Blackrock Advisors, and Bridgewater Associates extensively leverage alternative data to enhance their investment strategies and generate alpha. Moreover, this segment is anticipated to maintain a steady growth trajectory throughout the forecast period, driven by the escalating requirement for diverse data sources to analyze industries and uncover lucrative investment opportunities.

- The retail companies segment is projected to experience the fastest-growing CAGR. This surge is credited to innovative applications of alternative data, including social media, sentiment analysis, geo-location, and satellite imagery, employed by retail companies to inform strategic decision-making. For instance, retail companies like Gap, Walmart, and Target extensively utilize geo-location data. Amidst the burgeoning dominance of online shopping, this data aids major retailers and shopping malls in correlating foot traffic with actual sales figures. Moreover, it assists stores in determining optimal locations for new outlets.

Alternative Data Market Regional Insights

The North American region dominated the global market with the largest alternative data market share in 2023

This can be attributed to several factors, including the region's robust technological infrastructure, extensive adoption of data analytics and artificial intelligence (AI) technologies, and a high concentration of leading alternative data providers and users. North America hosts several major financial centers, including New York City and Silicon Valley, which serve as hubs for innovation and investment in alternative data solutions. Moreover, the region's regulatory environment, while stringent, also fosters innovation and compliance in data privacy and security, enhancing investor confidence and market stability. Additionally, North America's diverse and dynamic economy, coupled with its large consumer base and mature financial markets, creates ample opportunities for leveraging alternative data across various industries, further solidifying its dominance in the global Alternative Data market.

The European region is poised to witness significant growth in the global Alternative Data market. This anticipation includes the region's increasing adoption of data analytics and digital transformation initiatives across various industries. Europe boasts a diverse and sophisticated financial services sector, with major financial hubs such as Zurich, London, and Frankfurt, which are driving demand for alternative data solutions among investment firms, asset managers, and hedge funds. Moreover, the European Union's stringent data privacy regulations, such as the General Data Protection Regulation (GDPR), have fostered a culture of compliance and data protection, instilling trust and confidence in alternative data sources. Furthermore, the region's vibrant startup ecosystem and growing investment in technology and innovation are fueling the development of novel alternative data sources and analytics platforms.

Competitive Landscape

The alternative data market is characterized by a diverse array of players ranging from established data providers to emerging startups, each vying for market share and differentiation. Major financial data vendors have expanded their offerings to include alternative datasets, leveraging their extensive networks and infrastructure to cater to institutional clients' growing demand for non-traditional data sources. Additionally, technology giants are actively entering the alternative data space, leveraging their cloud computing and AI capabilities to offer innovative solutions for data collection, analysis, and visualization. With the market witnessing continuous innovation and consolidation, competition intensifies as players strive to differentiate themselves through data quality, breadth of coverage, technological prowess, and value-added services, driving continuous evolution and growth in the alternative data landscape.

Some of the major players operating in the global market include:

- 1010data, Inc.

- Advan Research Corporation

- Dataminr

- Earnest

- M Science LLC

- Preqin

- RavenPack

- Thinknum Alternative Data

- UBS

- YipitData

Recent Developments

- In April 2023, Thinknum Alternative Data added to its employee sentiment datasets the supplementary data fields, empowering both investors and people analytics teams to leverage them as a stand-in for 'employee NPS' (Net Promoter Score). This improvement streamlines the process for highly rated employers to organize interviews via employee referrals, thereby bolstering their recruitment endeavors.

- In May 2022, M Science LLC unveiled a trend of spending by consumer platform, providing comprehensive visibility into competitive benchmarking and consumer behaviors on a semi-annual, daily, monthly, and weekly basis. This platform offered real-time insights into consumer spending patterns specific to Australian brands and delivered unparalleled analysis of business performance.

Report Coverage

The Alternative Data market report emphasizes key regions worldwide to help users better understand the product. It also provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis of various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market, focusing on various key aspects such as industry, data type, end user, and futuristic growth opportunities.

Alternative Data Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 10.70 billion |

|

Revenue Forecast in 2032 |

USD 271.49 billion |

|

CAGR |

49.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Industry, By Data Type, By End User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

key companies in Alternative Data Market are 1010data, Inc., Advan Research Corporation, Dataminr, Earnest, M Science LLC

Alternative Data Market exhibiting a CAGR of 49.8% during the forecast period

The Alternative Data Market report covering key segments are industry, data type, end user, and region.

key driving factors in Alternative Data Market are Increasing investment in smart city initiatives

The global alternative data market size is expected to reach USD 271.49 billion by 2032