Alternative Coffee-Based Products Market Size, Share, Trends, Industry Analysis Report: By Product Form (Gummies, Snack Bars, Jellies, Ready-to-Drink (RTD) Beverages, Instant Coffee Blends, Capsules & Tablets, Powders & Sachets, Others), Ingredient Type, Application, Distribution Channel, Consumer Demographics, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 119

- Format: PDF

- Report ID: PM5459

- Base Year: 2024

- Historical Data: 2020-2023

Alternative Coffee-Based Products Market Overview

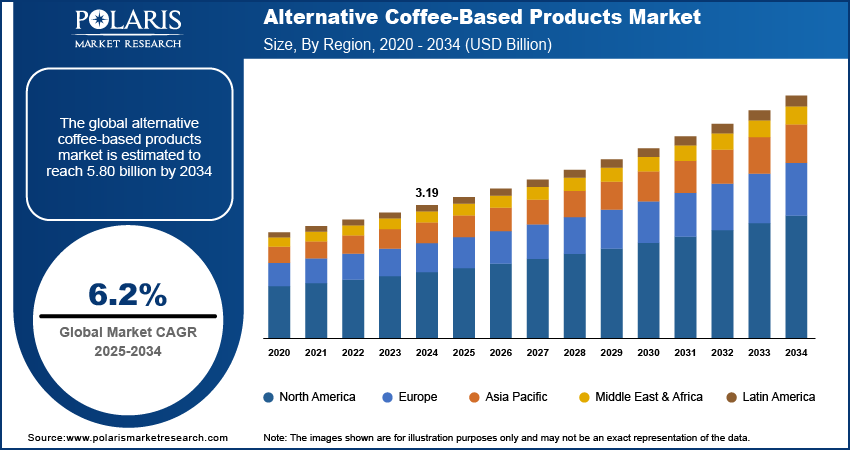

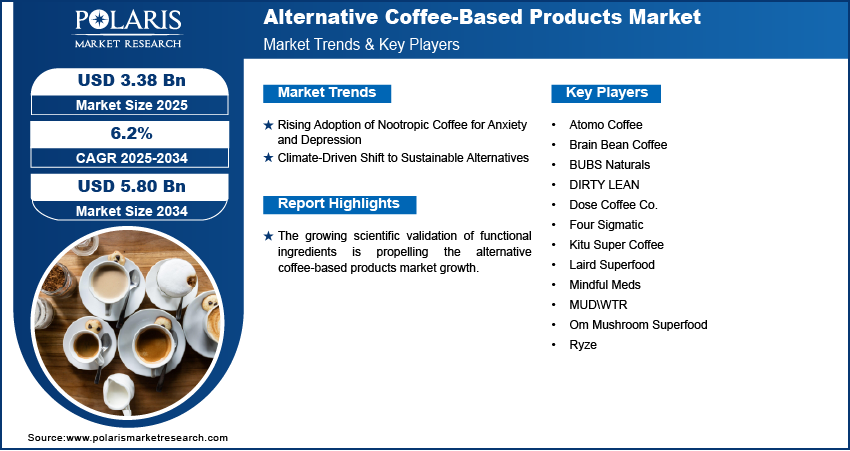

The global alternative coffee-based products market size was valued at USD 3.19 billion in 2024. The market is projected to grow from USD 3.38 billion in 2025 to USD 5.80 billion by 2034, at a CAGR of 6.2% from 2025 to 2034.

The alternative coffee-based products market encompasses coffee-based goods infused with functional, non-traditional ingredients designed to enhance physical, mental, or emotional well-being. These products blend traditional coffee with bioactive additives such as adaptogens, nootropics, functional mushrooms, herbal extracts, vitamins, or minerals to deliver targeted health benefits beyond basic caffeine stimulation. They are formulated in various forms, including ready-to-drink beverages, instant blends, capsules, powders, gummies, and snack bars, and are distributed through retail channels such as online grocery, supermarkets, specialty stores, and pharmacies. The alternative coffee-based products distinguish themselves from conventional coffee by prioritizing health-centric innovation, combining coffee’s inherent properties with scientifically backed functional ingredients to address modern consumer demands for wellness, convenience, and personalized nutrition.

To Understand More About this Research: Request a Free Sample Report

The growing scientific validation of functional ingredients is propelling the alternative coffee-based products market growth. Adaptogens such as ashwagandha and rhodiola are in high demand, backed by peer-reviewed studies. The National Institutes of Health (NIH) found that ashwagandha coffee has seen a sales increase in 2020 due to chronic stress and sleeplessness. The rising awareness regarding health and wellness is further fueling the adoption of alternative coffee-based products as these products reduce stress and anxiety levels. In 2023, the National Institutes of Health (NIH) stated that 33% of US consumers prioritize products with proven health benefits. Regulatory support is also accelerating alternative coffee-based products market revenue, expediting market entry for functional coffee brands. Companies such as Four Sigmatic, a major player in mushroom-infused coffee, have capitalized on this trend, expanding their market share.

The rising clinical credibility regarding alternative coffee-based products has reshaped consumer purchasing decisions, with wellness-conscious buyers favoring coffee blends that promise tangible benefits. Retailers have responded by increasing shelf space for functional coffee, thereby boosting alternative coffee-based products market expansion.

Global Alternative Coffee-Based Products Market Dynamics

Rising Adoption of Nootropic Coffee for Anxiety and Depression

Various countries across the world are reporting a rising number of anxiety and depression cases. For instance, according to the Centers for Disease Control and Prevention (CDC), in 2022, about 18.2% of adults in the US reported experiencing symptoms of anxiety, and 21.4% of depression. Alternative coffee-based products, including nootropic coffee and functional blends with L-theanine, lion’s mane, and bacopa monnieri, can stimulate dopamine. Dopamine helps reduce stress levels and depression. Hence, the growing incidence of anxiety and depression worldwide drives the alternative coffee-based products market demand.

Climate-Driven Shift to Sustainable Alternatives

Conventional coffee farming contributes to 1.5% of global deforestation, pushing consumers toward sustainable alternatives such as lab-grown, deforestation-free coffee. Consumers are now prioritizing eco-friendly choices, leading to rising demand for cascara-based blends and regeneratively farmed beans. Major retailers are expanding sustainable coffee selections, reflecting growing environmental awareness. Companies integrating carbon-neutral production and ethical sourcing are outperforming competitors, thereby expanding their market presence. Therefore, as climate concerns intensify, innovation in coffee production is estimated to continue, reshaping the alternative coffee-based products market.

Alternative Coffee-Based Products Market Segment Insights

Alternative Coffee-Based Products Market Assessment by Product Form

Based on product form, the alternative coffee-based products market is segregated into gummies, snack bars, jellies, ready-to-drink (RTD) beverages, instant coffee blends, capsules & tablets, powders & sachets, and others. The RTD beverages segment dominated the product form segment in 2024, fueled by urbanization, convenience-driven consumption, and changing breakfast habits. Athletes, professionals, and busy consumers prefer RTD beverage options that deliver energy, cognitive benefits, and functional health support in a single serving. Brands such as Koia, Kitu Super Coffee, and Suntory’s Boss Functional Coffee have pioneered RTD functional coffee, integrating ingredients like protein, collagen, and nootropics to create performance-enhancing beverages. The growing adoption of refrigerated plant-based coffee drinks has also fueled segment growth. Additionally, e-commerce platforms and direct-store distribution models have enabled rapid consumer adoption, propelling segment expansion.

Alternative Coffee-Based Products Market Assessment by Ingredient Type

In terms of ingredient type, the alternative coffee-based products market is categorized into coffee with adaptogens, coffee with nootropics, coffee with functional mushrooms, coffee with herbal extracts, and others. The coffee with adaptogens segment held the largest share in 2024 due to the rising consumer awareness of stress management and hormonal balance. Adaptogens like ashwagandha, Rhodiola, and holy basil have been extensively researched for their ability to lower cortisol levels, support adrenal health, and enhance resilience to stress. The segment also benefits from regulatory flexibility, as many adaptogens are classified as dietary supplements rather than pharmaceuticals, easing market entry. Additionally, modern lifestyles characterized by high stress and sleep deprivation have pushed consumers toward products that offer calm energy without caffeine jitters. Millennials and Gen Z, the largest functional coffee consumers, prefer science-backed wellness solutions, making adaptogen-infused blends an attractive option. Major brands like Ryze and Moon Juice have capitalized on this demand through D2C models and social media-driven marketing, increasing accessibility and consumer education.

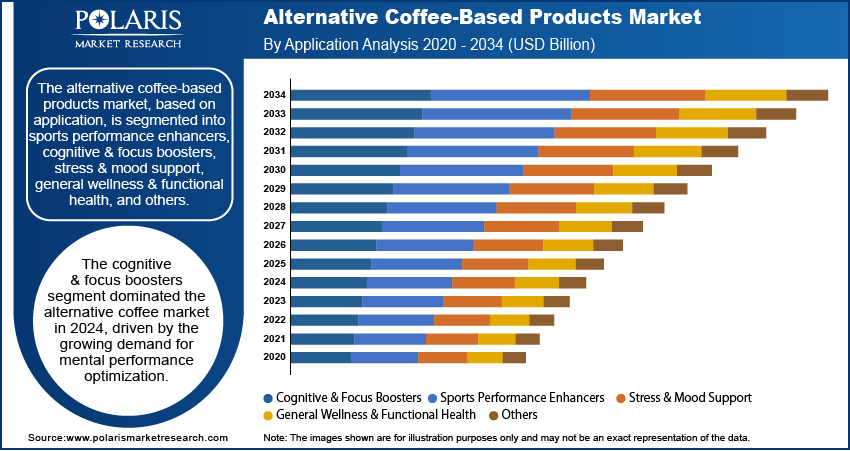

Alternative Coffee-Based Products Market Evaluation by Application

Based on application, the alternative coffee-based products market is divided into sports performance enhancers, cognitive & focus boosters, stress & mood support, general wellness & functional health, and others. The cognitive & focus boosters segment dominated the alternative coffee-based products market share in 2024, driven by the growing demand for mental performance optimization. Consumers are increasingly turning to nootropic-infused coffee for improved concentration, memory, and productivity. Functional ingredients such as L-theanine, lion’s mane mushroom, and ginseng are gaining traction due to their ability to reduce stress and boost mental health. Furthermore, regulatory approvals from the FDA and EFSA have eased market entry for alternative coffee-based product brands, fueling the adoption of cognitive & focus boosters applications. The rise of biohacking culture and evidence-backed brain-boosting formulations have further contributed to the cognitive & focus boosters segment.

Alternative Coffee-Based Products Market Insight by Distirbution Channel

Based on distribution channel, the alternative coffee-based products market is categorized into online retail, supermarkets & hypermarkets, specialty stores, convenience stores, pharmacies & drugstores, and others. Online retail is the dominant distribution channel in 2024 due to the rise of D2C brands, personalized marketing, and AI-driven recommendations. Additionally, social media and influencer marketing play a crucial role in online sales growth, allowing brands to educate consumers and build brand loyalty more effectively than offline stores. The rise of AI-powered personalization, where consumers receive tailored product recommendations based on preferences and purchase history, has further accelerated the adoption of alternative coffee-based products through online retail platforms.

Alternative Coffee-Based Products Market Evaluation by Consumer Demograhics

In terms of consumer demographics, the alternative coffee-based products market is divided into athletes & fitness enthusiasts, professionals & students, general health-conscious consumers, aging population, and others. The professionals & students represent the largest share of the consumer demographic segment in 2024, driven by the need for sustained focus, cognitive enhancement, and stress reduction. The popularity of biohacking culture and the increased adoption of personalized wellness solutions further drive demand for alternative coffee-based products among professionals & students. Brands such as MUD\WTR and Peak Performance specifically target this demographic through social media, podcasts, and influencer marketing, positioning their products as healthy alternatives to traditional caffeine-loaded energy drinks. The segment is also fueled by remote work, digital learning, and gig economy growth, where individuals seek enhanced mental clarity and sustained energy throughout the day.

Alternative Coffee-Based Products Market Regional Analysis

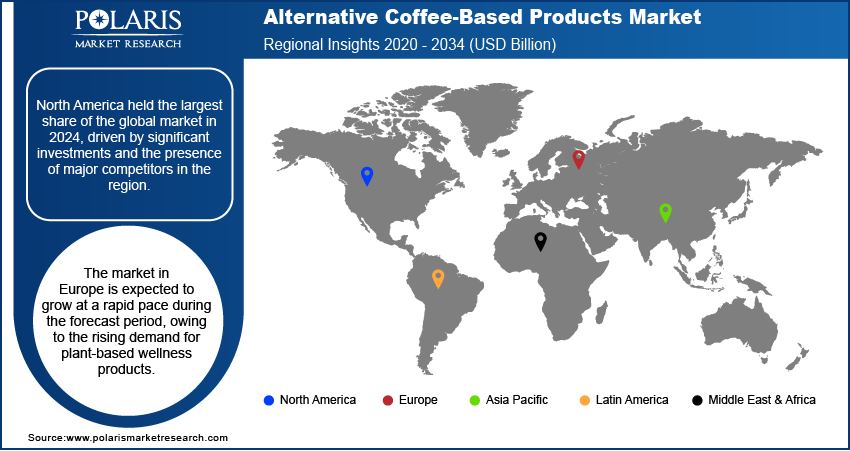

By region, the alternative coffee-based products market report offers insights into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America dominated the alternative coffee-based products market share in 2024 due to regulatory ease and high disposable income. Online retail plays a crucial role in the region, with Amazon and Shopify-powered D2C brands dominating sales. Nootropic-infused blends, particularly lion’s mane coffee, are growing in tech hubs such as Silicon Valley, where work-related stress fuels consumption. Urban centers such as Vancouver and Toronto, known for health-conscious consumers, further driven alternative coffee-based products market growth. The country’s preference for organic and clean-label products aligns with the rise of mushroom coffee brands like Four Sigmatic, expanding market presence. North America remains the largest and most lucrative market for alternative coffee-based products, with increasing regulatory support and consumer interest.

The market in Europe is expected to grow at a rapid pace during the forecast period, owing to the rising demand for plant-based wellness products. Alternative coffee-based products such as functional coffee have gained adoption, with 6.62 million people vegan in the European Union (EU) in 2023. Sustainability initiatives, such as the EU’s carbon tax incentives, have also fueled interest in upcycled coffee products like cascara blends. Workplace stress in the region is another driver for the alternative coffee-based products market growth. The UK, with a 10% market share, has witnessed rapid adoption of mushroom coffee. The market growth in the region is further supported by e-commerce dominance, with Amazon and Tmall expanding distribution. Europe’s strict quality regulations ensure credibility, making it a lucrative market for alternative coffee-based products.

Alternative Coffee-Based Products Market–Key Players and Competitive Insights

The alternative coffee-based products market is highly competitive, with established beverage giants, specialty wellness brands, and emerging startups competing for market share. Companies are leveraging scientific research, clean-label formulations, and digital-first strategies to capture consumers seeking functional benefits. Leading players like Four Sigmatic, Ryze, and MUD\WTR have built strong brand loyalty through direct-to-consumer (D2C) models, influencer marketing, and subscription-based services. Major coffee chains, including Starbucks and Nestlé, have entered the space with functional offerings such as reishi-infused cold brews and adaptogen-enhanced blends. Regulatory approvals in the US, European Union (EU), and APAC markets are further accelerating product expansion, particularly in nootropic, protein, and adaptogen coffee categories. The rise of private-label functional coffee from retailers like Whole Foods and Target is increasing price competition. Companies with strong supply chains, sustainable sourcing, and regulatory compliance are positioned for long-term success. Innovation in RTD formats, mushroom-infused coffee, and biohacking beverages is reshaping the competitive landscape. The market is expected to witness continued mergers, acquisitions, and venture capital investments, with brands focusing on premiumization, eco-friendly production, and AI-driven personalization to gain a competitive edge.

Major players in the alternative coffee-based products market include Atomo Coffee, Brain Bean Coffee, BUBS Naturals, DIRTY LEAN, Dose Coffee Co., Four Sigmatic, Kitu Super Coffee, Laird Superfood, Mindful Meds, MUD\WTR, Om Mushroom Superfood, and Ryze.

Four Sigmatic, founded in 2012 and headquartered in Los Angeles, California, is a pioneer in the functional coffee and adaptogen-infused beverage market. The company specializes in mushroom-based coffee alternatives, blending organic coffee with medicinal mushrooms like lion’s mane, Chaga, and reishi, to create products that cater to health-conscious consumers seeking cognitive enhancement, immune support, and reduced caffeine jitters. Its flagship offerings include instant mushroom coffee packets, ready-to-drink (RTD) mushroom elixirs, and mushroom-infused creamers. Four Sigmatic positions itself at the intersection of wellness and convenience, targeting urban professionals, biohackers, and holistic health enthusiasts. The brand has expanded its retail footprint in major US chains like Whole Foods while emphasizing sustainability through compostable packaging and partnerships with regenerative farming initiatives.

RYZE, a rising player in the alternative coffee market, focuses on mushroom-based blends that replace traditional coffee with a caffeine-free, adaptogen-rich formula. Founded in 2020, RYZE combines organic mushrooms with herbs like cinnamon and coconut milk powder to create a smooth, earthy beverage marketed as a gentler alternative to conventional coffee. The brand targets health-focused millennials and Gen Z consumers seeking energy without crashes or acidity. RYZE operates primarily via a direct-to-consumer (DTC) model, leveraging social media campaigns and subscription services to build a loyal community. The company emphasizes sustainability through recyclable packaging and ethically sourced ingredients.

List of Alternative Coffee-Based Products Market Key Players

- Atomo Coffee

- Brain Bean Coffee

- BUBS Naturals

- DIRTY LEAN

- Dose Coffee Co.

- Four Sigmatic

- Kitu Super Coffee

- Laird Superfood

- Mindful Meds

- MUD\WTR

- Om Mushroom Superfood

- Ryze

Alternative Coffee-Based Products Industry Developments

January 2024: JDE Peet’s, the world’s major pure-play coffee and tea company by revenue, announced that it has successfully completed the acquisition of the Brazilian coffee & tea business from JAV Group to expand its market reach.

February 2023: Starbucks unveiled a transformational innovation in coffee, Oleato, a line of coffee beverages infused with a spoonful of Partanna cold-pressed, extra virgin olive oil.

Alternative Coffee-Based Products Market Segmentation

By Application Outlook (Revenue, USD Billion, 2020-2034)

- Sports Performance Enhancers

- Cognitive & Focus Boosters

- Stress & Mood Support

- General Wellness & Functional Health

- Others

By Ingredient Type Outlook (Revenue, USD Billion, 2020-2034)

- Coffee with Adaptogens

- Coffee with Nootropics

- Coffee with Functional Mushrooms

- Coffee with Herbal Extracts

- Others

By Product Outlook (Revenue, USD Billion, 2020-2034)

- Gummies

- Snack Bars

- Jellies

- Ready-to-Drink (RTD) Beverages

- Instant Coffee Blends

- Capsules & Tablets

- Powders & Sachets

- Others

By Distribution Channel Outlook (Revenue, USD Billion, 2020-2034)

- Online Retail

- Supermarkets & Hypermarkets

- Specialty Stores

- Convenience Stores

- Pharmacies & Drugstores

- Others

By Consumer Demographics Outlook (Revenue, USD Billion, 2020-2034)

- Athletes & Fitness Enthusiasts

- Professionals & Students

- General Health-Conscious Consumers

- Aging Population

- Others

By Regional Outlook (Revenue, USD Billion, 2020-2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Alternative Coffee-Based Products Market Report Scope

|

Report Attributes |

Details |

|

Alternative Coffee-Based Products Market Size in 2024 |

USD 3.19 billion |

|

Alternative Coffee-Based Products Market Value in 2025 |

USD 3.38 billion |

|

Revenue Forecast by 2034 |

USD 5.80 billion |

|

CAGR |

6.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The alternative coffee-based products market was valued at USD 3.19 billion in 2024 and is projected to grow to USD 5.80 billion by 2034.

The market is projected to register a CAGR of 6.2% between 2025–2034.

North America held the largest market share in 2024.

Atomo Coffee, Brain Bean Coffee, BUBS Naturals, DIRTY LEAN, Dose Coffee Co., Four Sigmatic, Kitu Super Coffee, Laird Superfood, Mindful Meds, MUD\WTR, Om Mushroom Superfood, Ryze are a few of the key players in the market.

The cognitive & focus boosters segment dominated the market revenue in 2024

The coffee with adaptogens segment dominated the market in 2024.