Alpha-Cellulose Market Size, Share, Trends, Industry Analysis Report: By Type (Food Grade, Medicine Grade, and Others), Application (Food Products, Pharmaceuticals, Textiles, Packaging, and Others), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 116

- Format: PDF

- Report ID: PM5258

- Base Year: 2024

- Historical Data: 2020-2023

Alpha-Cellulose Market Overview

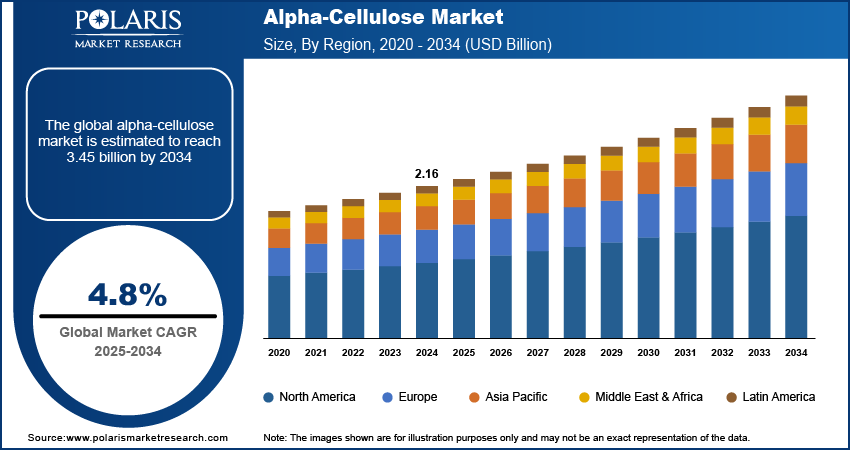

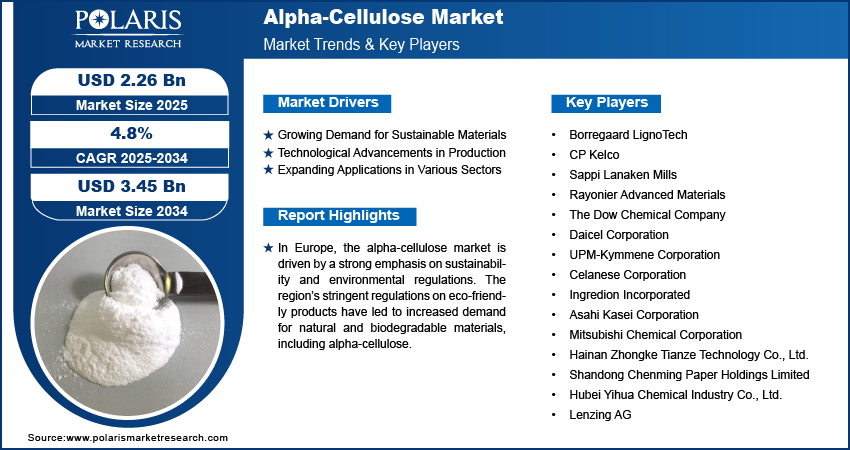

The global alpha-cellulose market size was valued at USD 2.16 billion in 2024. The market is projected to grow from USD 2.26 billion in 2025 to USD 3.45 billion by 2034, exhibiting a CAGR of 4.8% during 2025–2034.

Alpha-cellulose, being the most stable form of cellulose, is primarily used in the manufacturing of paper and textiles. It is also used as a food additive. The global alpha-cellulose market focuses on the production and utilization of alpha-cellulose. Increasing demand in the paper & pulp industry, rising applications in the textile sector, and growing awareness of sustainable and biodegradable materials drive the market growth.

To Understand More About this Research: Request a Free Sample Report

Alpha-Cellulose Market Drivers Analysis

Growing Demand for Sustainable Materials

There is an increasing demand for sustainable and biodegradable materials across industries. As environmental concerns become more prominent, industries are seeking alternatives to synthetic and nonrenewable resources. Alpha-cellulose, being a natural and eco-friendly material, fits well into this paradigm. The global paper industry, a significant consumer of alpha-cellulose, is transitioning toward sustainable practices. This shift reduces environmental impact and aligns with the growing consumer preference for products made from renewable resources.

Technological Advancements in Production

Technological advancements in the production of alpha-cellulose, mostly in extraction and purification processes, have improved the efficiency and quality of alpha-cellulose. Recent developments in enzymatic treatments and advanced bleaching techniques have enhanced the yield and purity of alpha-cellulose, making it more suitable for high-quality applications. The adoption of these technologies is reflected in the increasing use of alpha-cellulose in high-end products, including specialty papers and premium textiles. In 2023, a study by the Forest Products Laboratory highlighted that the adoption of new processing technologies has increased alpha-cellulose purity by up to 10% over the past decade.

Expanding Applications in Various Sectors

The expansion of alpha-cellulose applications is increasing across various sectors. Beyond its traditional use in paper and textiles, alpha-cellulose is finding new roles in the pharmaceutical and food industries. In pharmaceuticals, it is used as an excipient in drug formulations due to its excellent binding properties. In the food industry, it serves as a dietary fiber and a thickening agent.

Alpha-Cellulose Market Segment Analysis

Alpha-Cellulose Market Breakdown Assessment by Type

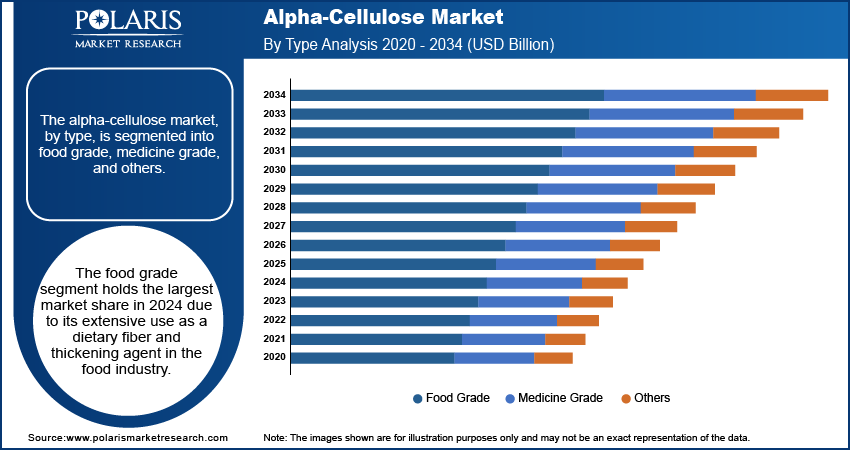

The alpha-cellulose market, by type, is segmented into food grade, medicine grade, and others. The food grade segment holds the largest market share due to its extensive use as a dietary fiber and thickening agent in the food industry. This segment is also experiencing significant growth, driven by the increasing consumer preference for natural and health-oriented food products. The food grade alpha-cellulose is in high demand due to its functional benefits and natural origin, aligning with the broader trend toward healthier and more sustainable food options.

The medicine grade segment is expected to register the highest growth rate during the forecast period, attributed to its application as an excipient in drug formulations in the pharmaceutical industry. The demand for medicine grade alpha-cellulose is expanding due to the increasing use of natural and nontoxic materials in drug manufacturing, ongoing advancements in pharmaceutical technology, and the rising focus on biocompatible materials.

Alpha-Cellulose Market Breakdown by Application

The alpha-cellulose market, by application, is segmented into food products, pharmaceuticals, textiles, packaging, and others. The food products segment holds the largest market share, owing to the extensive use of alpha-cellulose as a dietary fiber and thickening agent in various food applications. The high demand for natural and health-oriented ingredients in the food industry continues to drive this segment's dominance. Additionally, the pharmaceutical segment is experiencing the highest growth rate, largely due to the increasing use of alpha-cellulose as an excipient in drug formulations. The expanding pharmaceutical industry and the rising preference for natural excipients in medication propel the market growth for the segment.

The textiles segment plays a significant role in the market, utilizing alpha-cellulose to enhance fabric quality and performance. The packaging segment and other niche applications contribute to the market by addressing specific needs in packaging materials and industrial uses.

Alpha-Cellulose Market Share by Region

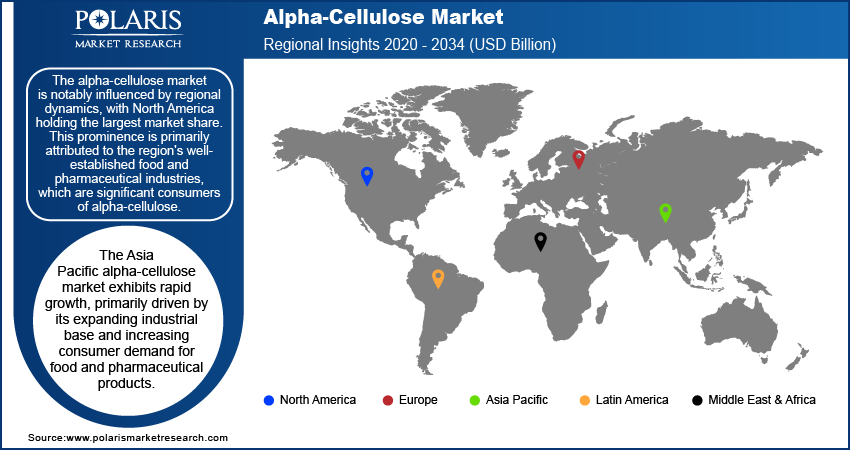

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The alpha-cellulose market is notably influenced by regional dynamics, with North America holding the largest market share. This prominence is primarily attributed to the region's well-established food and pharmaceutical industries, which are significant consumers of alpha-cellulose. The high demand for natural and functional ingredients in food products, combined with the extensive use of alpha-cellulose as an excipient in pharmaceutical formulations, contributes to North America's leading position. Additionally, the region benefits from advanced production technologies and a strong focus on research and development, further bolstering its market share. Thus, North America's combination of industrial strength and technological advancement makes it the dominant player in the global alpha-cellulose market.

In Europe, the alpha-cellulose market is driven by a strong emphasis on sustainability and environmental regulations. The region’s stringent regulations on eco-friendly products have led to increased demand for natural and biodegradable materials, including alpha-cellulose. The food and pharmaceutical industries are major contributors to the market in Europe, with growing consumer awareness about natural ingredients fueling demand. Additionally, Europe's well-established infrastructure for research and development supports innovation in alpha-cellulose production and applications. The market in Europe is characterized by a focus on high-quality and specialized applications, which aligns with the region's trend toward premium and sustainable products.

The Asia Pacific alpha-cellulose market exhibits rapid growth, primarily driven by its expanding industrial base and increasing consumer demand for food and pharmaceutical products. Countries such as China and India are significant contributors due to their large-scale food processing and pharmaceutical industries. The rising middle-class population and changing dietary preferences are boosting the demand for natural food additives and excipients, including alpha-cellulose. Moreover, rising advancements in production technologies and infrastructure development and growing focus on sustainable and cost-effective materials support the expansion of the alpha-cellulose market in Asia Pacific.

Alpha-Cellulose Market – Key Market Players and Competitive Insights

Borregaard LignoTech, CP Kelco, Sappi Lanaken Mills, Rayonier Advanced Materials, and The Dow Chemical Companyare a few key players in the alpha-cellulose market. Other notable players are Daicel Corporation, UPM-Kymmene Corporation, Celanese Corporation, Ingredion Incorporated, and Asahi Kasei Corporation. Additional significant players are Mitsubishi Chemical Corporation; Hainan Zhongke Tianze Technology Co., Ltd.; Shandong Chenming Paper Holdings Limited; and Hubei Yihua Chemical Industry Co., Ltd. These companies are actively involved in the production and supply of alpha-cellulose and have established themselves within the market.

The competitive landscape of the alpha-cellulose market is characterized by a focus on technological advancements and product innovation. Companies are investing in research and development to enhance the purity and application range of alpha-cellulose. The emphasis on sustainable and eco-friendly products is also a key factor, with many firms striving to meet increasing consumer and regulatory demands for natural ingredients. Market players are also expanding their production capabilities and geographic reach to cater to growing global demand.

In terms of competitive positioning, firms such as Borregaard LignoTech and Rayonier Advanced Materials are known for their extensive research and development efforts, which help them maintain a strong presence in the market. CP Kelco and Celanese Corporation are leveraging their broad product portfolios and technological expertise to cater to diverse industrial applications. The market dynamics are influenced by these companies' ability to adapt to evolving consumer preferences and regulatory standards, ensuring their ongoing relevance and competitiveness in the alpha-cellulose sector.

Borregaard LignoTech is a notable player in the alpha-cellulose market, specializing in the production of high-quality lignin-based products. The company, based in Norway, focuses on sustainable and innovative solutions for various applications, including alpha-cellulose. Borregaard LignoTech is known for its commitment to environmental sustainability and has established a strong presence in the global market through its advanced production techniques.

Rayonier Advanced Materials, headquartered in the US, is another key player in the alpha-cellulose market. The company is involved in producing a range of cellulose products, including alpha-cellulose, for diverse applications. Rayonier Advanced Materials emphasizes innovation and efficiency in its production processes.

Key Companies in the Alpha-Cellulose Market

- Borregaard LignoTech

- CP Kelco

- Sappi Lanaken Mills

- Rayonier Advanced Materials (RYAM)

- The Dow Chemical Company

- Daicel Corporation

- UPM-Kymmene Corporation

- Celanese Corporation

- Ingredion Incorporated

- Asahi Kasei Corporation

- Mitsubishi Chemical Corporation

- Hainan Zhongke Tianze Technology Co., Ltd.

- Shandong Chenming Paper Holdings Limited

- Hubei Yihua Chemical Industry Co., Ltd.

- Lenzing AG

Alpha-Cellulose Market Developments

- In June 2024, Rayonier Advanced Materials reported the successful completion of a major upgrade to its production facility aimed at enhancing its operational efficiency and increasing its alpha-cellulose production capacity. This upgrade reflects the company's ongoing efforts to improve its market offerings and respond to rising global demand.

- In August 2023, Borregaard LignoTech announced a significant investment in expanding its production capacity to meet the growing demand for sustainable materials, highlighting its strategic move to boost its market position.

Alpha-Cellulose Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Food Grade

- Medicine Grade

- Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Food Products

- Pharmaceutical

- Textiles

- Packaging

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Alpha-Cellulose Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2.16 billion |

|

Market Size Value in 2025 |

USD 2.26 billion |

|

Revenue Forecast in 2034 |

USD 3.45 billion |

|

CAGR |

4.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 2.16 billion in 2024 and is projected to grow to USD 3.45 billion by 2034.

The global market is projected to register a CAGR of 4.8% during 2025–2034.

North America accounted for the largest market share.

Key players in the alpha-cellulose market are Borregaard LignoTech, CP Kelco, Sappi Lanaken Mills, Rayonier Advanced Materials, and The Dow Chemical Company. Other notable players are Daicel Corporation, UPM-Kymmene Corporation, Celanese Corporation, Ingredion Incorporated, and Asahi Kasei Corporation. Additional significant players are Mitsubishi Chemical Corporation, Hainan Zhongke Tianze Technology Co., Ltd.; Shandong Chenming Paper Holdings Limited, and Hubei Yihua Chemical Industry Co., Ltd.

The food grade segment accounted for the largest share of the global market.

The food products segment accounted for the largest share of the global market