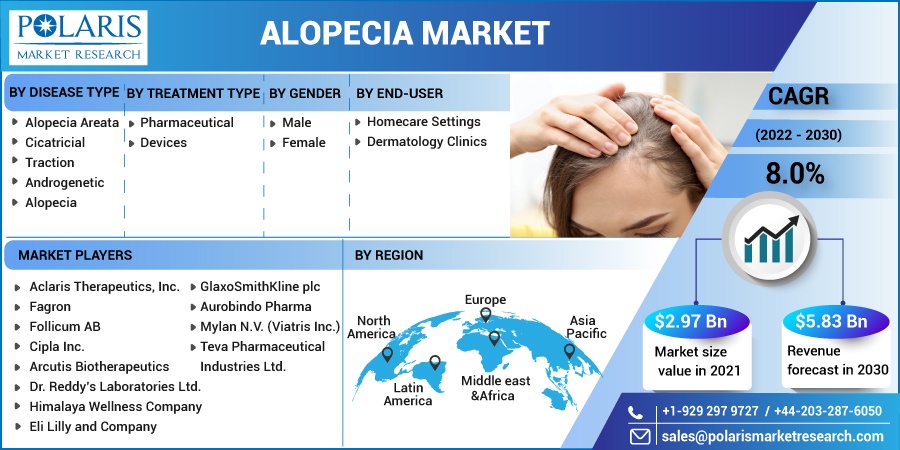

Alopecia Market Share, Size, Trends, Industry Analysis Report, By Treatment Type (Pharmaceutical, Devices); By Disease Type (Alopecia Areata, Cicatricial, Traction, Androgenetic Alopecia); By Gender: By End-Use; By Region; Segment Forecast 2022 - 2030

- Published Date:Aug-2022

- Pages: 118

- Format: PDF

- Report ID: PM1248

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

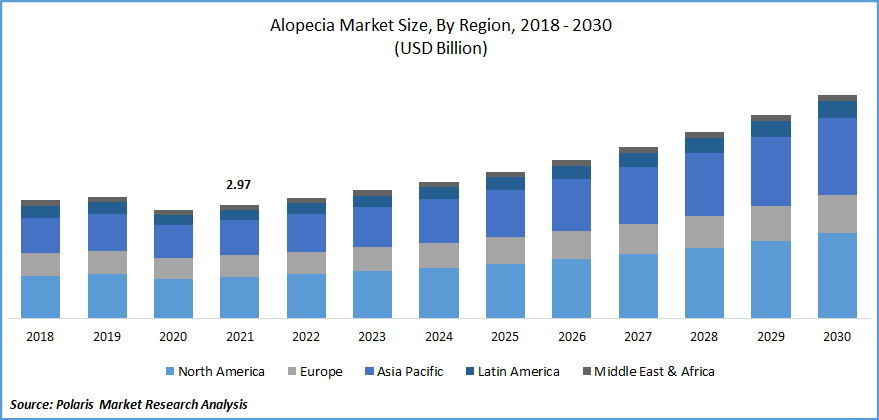

The global alopecia market was valued at USD 2.97 billion in 2021 and is expected to grow at a CAGR of 8.0% during the forecast period. Primary drivers anticipated to propel market revenue growth over the forecast period include increasing emphasis and focus on advancing the study of alopecia to deduce standard of care, rising cases of primary and secondary alopecia, potential pipeline products, and promising research grants to evaluate potential molecular pathways through industry-academia collaboration.

Know more about this report: Request for sample pages

Another important aspect anticipated to contribute to the alopecia market's revenue growth is the greater understanding of the molecular mechanisms underlying the mechanism of molecular pathways as a result of recent research. This, in turn, has enhanced the possibility of developing novel therapies.

It is the medical term for hair loss caused by either damaged hair follicles or abnormalities in the hair cycle. According to a data study, approximately 147 million individuals worldwide have alopecia or are at risk of developing it in the future. The prevalence rate is around 1.7–2 % worldwide. Alopecia, which can leave scars or not, has been linked to serious negative effects on a person's self-esteem, mental health, and perception of their body.

The need for well-designed clinical studies and licensed therapies is increasing in response to the growing need for effective treatments for hair loss. Over 95.0 % of male pattern baldness is commonly due to androgenic alopecia, as per the American Hair Loss Association (AHLA).

In a similar vein, research by the International Society of Hair Restoration Surgery found that around 35 of age, close to 40 percent of males have some form of hair loss, increasing to 60% at 60 and rising consequently with advancing age. The outbreak of the COVID-19 pandemic has significantly impacted the growth of the alopecia market.

For instance, the COVID-19 pandemic reportedly caused a decline in outpatient dermatology and hair care services and appointments in England in 2020, according to research published in the journal Clinical and Experimental Dermatology 2020. Total dermatology appointments dropped to 58 %, first attendances to 43 %, follow-ups to 51 %, and day cases to 37 % of pre-lockdown levels during the COVID-19 lockdown, according to reports. Only 75% of pre-lockdown numbers were represented in total appointments following the lockdown. There were 484,415 (17%) fewer appointments overall between April and October of 2020 than there were during the same time period in 2019.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Growth is primarily due to a robust product pipeline and the rising adoption of laser-based therapy for hair loss cases. Significant government efforts with favorable legislation and advancements in hair loss treatment also favor the industry's growth.

The primary factors driving this industry are technological progress in the treatment. Rogaine and Propecia are two FDA-approved therapies for hair loss treatment. After patents expired, generic medication became more widely available. In the coming years, drug candidates like Xeljanz, Breezula, Jakafi, SM04554, and Lumigan, are expected to increase competition in the marketplace.

Moreover, the introduction of low levels of laser treatment therapies has increased the volume of the treatment procedures, significantly supported by laser combs, hats, helmets, and bands. For instance, the alopecia market is flooded with branded products such as iGrow helmets, hair growth supplements, laser devices, and growth systems.

Report Segmentation

The market is primarily segmented based on disease type, treatment type, gender, end-user, and region.

|

By Disease Type |

By Treatment Type |

By Gender |

By End-user |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Alopecia Areata Segment is Expected to Witness the Fastest Growth

The industry is primarily driven by the alopecia areata segment, which had the highest revenue share in 2021 due to the disease's high prevalence and patients' increasing consumer awareness. Around 6.8 million of the approximately 147.0 million persons affected by AA live in the United States alone, according to the National Alopecia Areata Foundation.

Due to a rise in the discovery of innovative therapies and supportive measures in the approval process, the alopecia market is predicted to grow significantly during the projected period. For instance, the U.S. FDA granted baricitinib's Breakthrough Therapy Designation for the treatment of AA in March 2020 to Incyte Corporation and Eli Lilly and Company. The designation as a "breakthrough therapy" will speed up the approval process.

Androgenetic alopecia held the second-largest revenue share. Growing public awareness of these disorders is being fueled by proactive activities from groups like the American Hair Loss Association, Alopecia World, and Hairmax (Lexington International), which created National Hair Loss Awareness Month.

Additionally, the market expansion during the anticipated period is being fueled by the use of laser-based treatment options for AGA. Companies like Lexington Intl., LLC. (Hairmax), iRestore Hair Growth System (Freedom Laser Therapy) and LUTRONIC are demonstrating cutting-edge and painless therapy solutions for treating AGA.

Pharmaceutical Segment Accounted for the Second-Largest Market Share in 2021

In 2021, the pharmaceutical industry controlled the market and generated the highest revenue share. The category is primarily driven by the low cost of pharmaceutical items and increased consumption of prescription and over-the-counter medications. The most popular medications used to treat any kind of hair loss are finasteride and minoxidil.

The only medications in the United States that are licensed for the treatment of both Male Pattern Hair Loss (MPHL) and Female Pattern Hair Loss (FPHL) are finasteride and minoxidil (MPHL). Major pharmaceutical firms are also actively engaged in the discovery of innovative medications for hair loss treatment, which is predicted to boost the industry throughout the projection period. Examples include Lilly, Pfizer Inc., and Concert Pharmaceuticals.

Male Segment is Expected to Hold the Significant Revenue Share

Due to the high prevalence of hair loss in the male population globally, the male alopecia segment led the market and contributed the biggest revenue share in 2021. The most typical kind of hair loss in males is Androgenetic. At the average age of 50, over 50% of males report having some degree of hair loss, with the Androgenetic variety accounting for more than 95% of these occurrences.

Additionally, the market is anticipated to be further driven by elements including men's increased cigarette consumption and a growing elderly population throughout the projected period. During the projected period, the market is predicted to expand at the fastest rate. The market is anticipated to develop as a result of greater awareness, lifestyle changes, rising PCOS rates, and a rising trend in cosmetic operations.

The Demand in North America is Expected to Witness Significant Growth

In 2021, North America dominated the market and generated the highest portion of revenue. High disease prevalence, increased consumer awareness, proactive government action, technological advancements, and improvements to the healthcare system's infrastructure all contribute to the rise. A major driver of the market's expansion is the existence of important companies in this area. Additionally, the region is seeing an increase in the number of people receiving laser-based treatments.

The market is anticipated to grow at the highest CAGR in the Asia Pacific during the projected period as a result of increased consumer awareness, disposable income, and product penetration in the region. Additionally, it is anticipated that enhancing the healthcare regulatory environment in emerging nations would draw in foreign investors and open up new business possibilities.

Europe is expected to grow significantly. Many things, including technology developments and awareness programs run by both governmental and commercial organizations, might be blamed for this surge. The European Hair Research Society plays a significant role in organizing initiatives to raise knowledge of the best ways to treat and prevent hair.

Competitive Insight

Key players operating in the global market include Aclaris Therapeutics, Fagron, Follicum, Cipla Inc., Arcutis Biotherapeutics, Dr. Reddy’s Laboratories, Himalaya Wellness, Eli Lilly and Company, GlaxoSmithKline; Aurobindo Pharma; Mylan, Concert Pharmaceuticals, and Teva Pharmaceutical.

Alopecia Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 2.97 billion |

|

Revenue forecast in 2030 |

USD 5.83 billion |

|

CAGR |

8.0% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Disease Type, By Treatment Type, By Gender, By End-user, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Aclaris Therapeutics, Inc., Fagron, Follicum AB, Cipla Inc., Arcutis Biotherapeutics, Dr. Reddy’s Laboratories Ltd., Himalaya Wellness Company, Eli Lilly and Company, GlaxoSmithKline plc; Aurobindo Pharma; Mylan N.V. (Viatris Inc.), Concert Pharmaceuticals Inc., and Teva Pharmaceutical Industries Ltd. |