Alkyl Polyglucosides Market Size, Share, Trends, Industry Analysis Report: By Product (Coco, Lauryl, Decyl, and Capryl), Raw Material, Functionality, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 129

- Format: PDF

- Report ID: PM1759

- Base Year: 2024

- Historical Data: 2020-2023

Alkyl Polyglucosides Market Overview

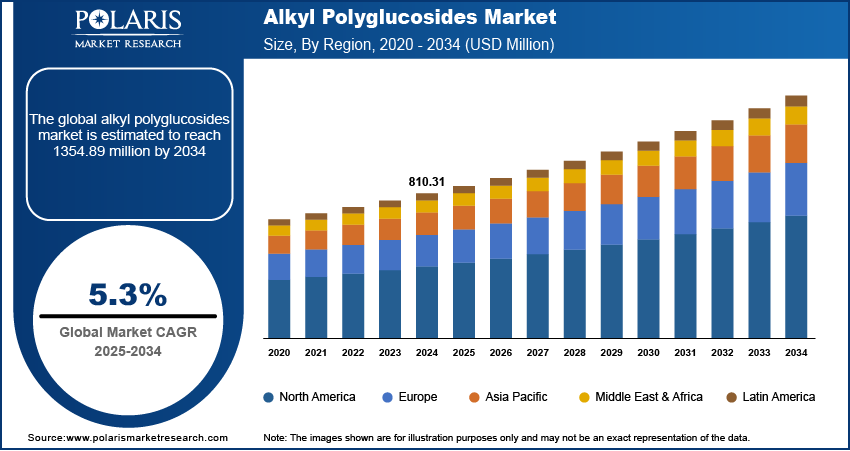

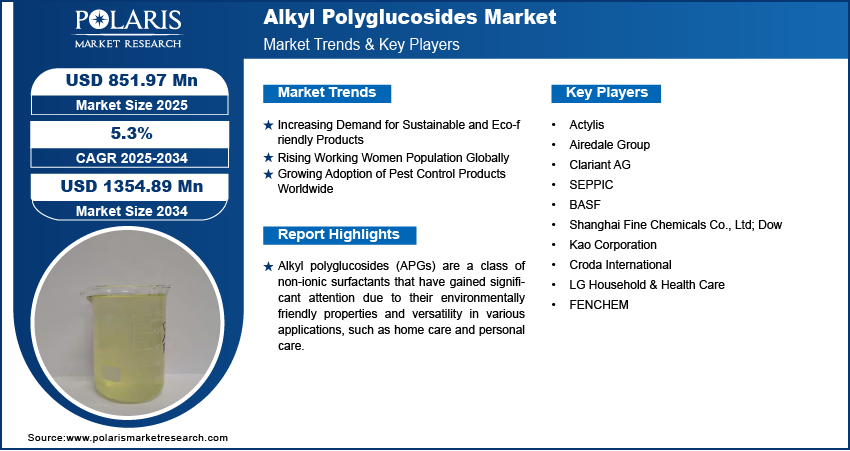

The global alkyl polyglucosides market size was valued at USD 810.31 million in 2024. The alkyl polyglucosides market is projected to grow from USD 851.97 million in 2025 to USD 1354.89 million by 2034, exhibiting a CAGR of 5.3% from 2025 to 2034.

Alkyl polyglucosides (APGs) are a class of non-ionic surfactants that have gained significant attention due to their environmentally friendly properties and versatility in various applications, such as home care and personal care. APGs are biodegradable and derived from renewable resources such as plant starch and fatty alcohols, making them suitable for sensitive skin formulations.

The increasing disposable income worldwide is propelling the global alkyl polyglucosides market growth. Higher incomes lead to greater consumption of cleaning and personal care products, which in turn boosts the demand for APGs. Derived from natural sources such as sugar and fatty alcohols, APGs are widely used in household cleaning and personal care products due to their biodegradability and gentle nature.

To Understand More About this Research: Request a Free Sample Report

The alkyl polyglucosides market demand is driven by the growing adoption of sunscreens across the globe. APGs are key ingredients in sunscreen formulations as they enhance the stability and spreadability of sunscreen products while maintaining a mild profile suitable for sensitive skin.

Alkyl Polyglucosides Market Dynamics

Increasing Demand for Sustainable and Eco-friendly Products

APGs align with the growing preference for biodegradable and non-toxic products, as they are derived from renewable resources such as plant based sugar substitutes and fatty alcohols. They are increasingly replacing conventional synthetic surfactants, which are often harsh and environmentally damaging, as consumers and industries prioritize sustainability. In addition, stringent environmental regulations and the rising emphasis on Environmental, Social, and Governance (ESG) standards are pushing businesses toward green products and biodegradable product formulations like APGs. Thus, the increasing demand for sustainable and eco-friendly products is propelling the alkyl polyglucosides market revenue.

Rising Working Women Population Globally

In recent decades, there has been a rise in the participation of women in the global workforce. According to data published by the International Labor Organization, women represent over 40% of the global labor force. As the working women population grows, so does the demand for convenient, effective, and safe personal care and household cleaning products. APGs, known for their mildness, non-toxicity, and skin-friendly properties, are highly favored in formulations for personal care products such as shampoos, body washes, and facial cleansers, catering to women seeking high-quality and safe products. Additionally, working women often value eco-friendly and sustainable products, aligning with APGs' renewable and biodegradable nature. This shift in demographics and consumer behavior drives manufacturers to incorporate APGs in a wide range of products, thereby driving the alkyl polyglucosides market development.

Growing Adoption of Pest Control Products Worldwide

APGs are used in pest control products as wetting agents, emulsifiers, and dispersants to enhance the application and performance of active ingredients. Manufacturers are turning to APGs to meet compliance standards and cater to environmentally conscious consumers as regulatory bodies impose stricter guidelines on the use of synthetic surfactants in pest control products. Additionally, APGs improve the adhesion and spreading of pest control agents on plant surfaces, maximizing efficiency while reducing environmental impact. This dual functionality of sustainability and performance makes APGs a preferred choice, driving their demand in the insect pest control industry.

Alkyl Polyglucosides Market Segment Insights

Alkyl Polyglucosides Market Assessment Based on Product

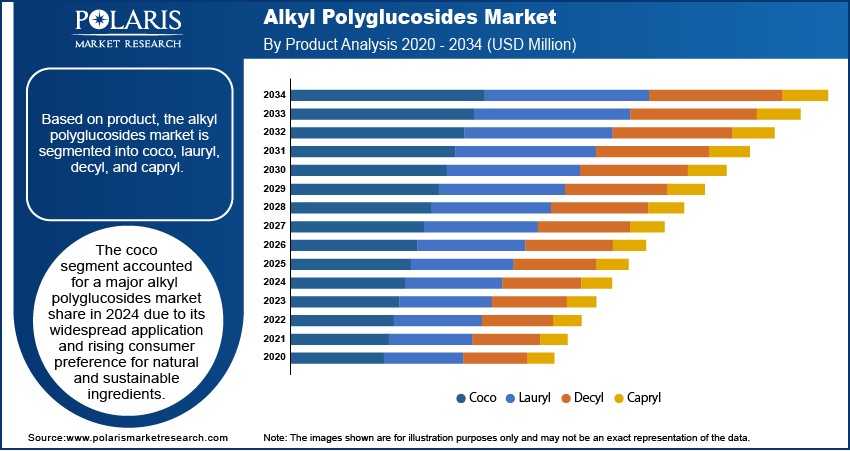

The alkyl polyglucosides market, based on product, is segmented into coco, lauryl, decyl, and capryl. The coco segment accounted for a larger market share in 2024 due to its widespread applications and rising consumer preference for natural and sustainable ingredients. Coco-derived products are sourced from coconut oil, which is renewable and eco-friendly, making them highly appealing in personal care, household, and industrial cleaning formulations. The superior foaming ability, excellent detergency, and mild nature of coco-based APGs make them ideal for use in shampoos, body washes, dishwashing liquids, and laundry detergents. Furthermore, the growing trend toward plant-based and biodegradable surfactants has led manufacturers to prioritize coco-derived formulations, which align with global sustainability goals and increasing regulatory pressures to phase out harsh synthetic chemicals. Rising consumer awareness of the environmental impact of cleaning and personal care products has further propelled the dominance of this segment.

Alkyl Polyglucosides Market Evaluation Based on Application

The alkyl polyglucosides market, based on application, is segmented into cosmetics and personal care, home care, textile, oil & gas, water treatment, and others. The home care segment held the largest market share in 2024 due to the increasing demand for eco-friendly and efficient cleaning solutions. Products in this category, such as dishwashing liquids, laundry detergents, and surface cleaners, use natural surfactants for superior cleaning performance while minimizing environmental impact. Consumers, particularly in developed and urban areas, are increasingly preferring biodegradable and non-toxic cleaning agents that align with sustainable living trends. The regulatory push toward reducing the use of harmful synthetic chemicals in household cleaning products has further driven the adoption of formulations that use renewable, plant-based ingredients such as APGs.

The cosmetics and personal care segment is expected to grow at a rapid pace from 2025 to 2034 owing to the growing consumer awareness about skin health and sustainability. The increasing preference for sulfate-free and paraben-free formulations has encouraged manufacturers to incorporate safer, plant-based ingredients such as alkyl polyglucosides in cosmetics and personal care. Furthermore, the rise in disposable income and urbanization, especially in emerging markets, is driving the demand for premium and eco-conscious personal care products.

Alkyl Polyglucosides Market Outlook Regional Analysis

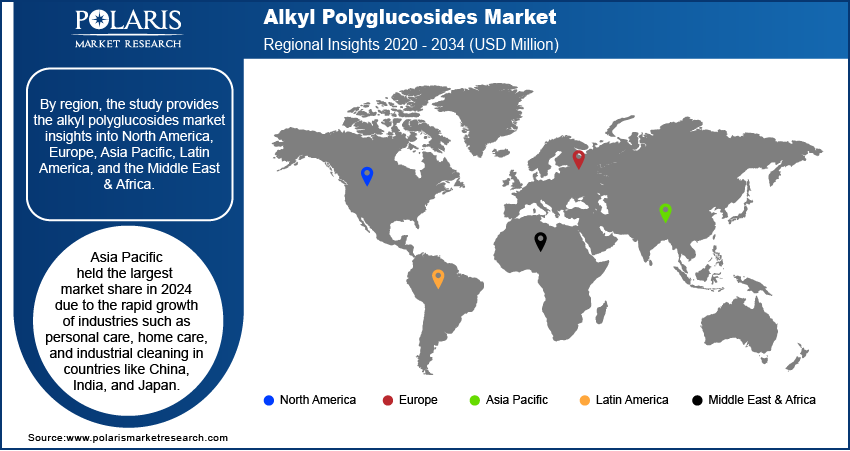

By region, the study provides the alkyl polyglucosides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific held the largest market share in 2024 due to the rapid growth of industries such as personal care, home care, and industrial cleaning in countries like China, India, and Japan. China emerged as the dominant country in the region, driven by its extensive manufacturing base, high population density, and increasing demand for eco-friendly products. The rising disposable income and growing awareness of sustainable and biodegradable products have further boosted market growth in the region. Governments in the Asia Pacific have also introduced policies encouraging the use of environmentally friendly chemicals, which has led to the widespread adoption of APGs in various applications such as personal care and home care. The increasing urbanization and expanding middle class in the region have fueled demand for products that use APGs as a key ingredient, such as premium personal care and home care products, thereby driving the regional market expansion. For instance, according to data published by the Population Reference Bureau, Asia's total urban population is estimated to exceed 2.6 billion in 2030.

The North America alkyl polyglucosides market is expected to witness a significant CAGR during the forecast period due to the rising consumer preference for natural and non-toxic ingredients in personal care and cleaning products. Stringent regulatory frameworks aimed at reducing the use of hazardous chemicals in household and industrial applications have further accelerated the adoption of APGs. In addition, growing environmental awareness and a strong emphasis on sustainability have motivated manufacturers to focus on eco-friendly formulations. The US, in particular, has witnessed an increase in demand for alkyl polyglucosides from sectors such as cosmetics, home care, and food processing, supported by technological advancements and strong consumer purchasing power.

Alkyl Polyglucosides Market – Key Players and Competitive Insights

Major market players are investing heavily in research and development in order to expand their offerings, which will help the alkyl polyglucosides market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The market for alkyl polyglucosides is fragmented, with the presence of numerous global and regional market players. Major players in the alkyl polyglucosides market include Actylis; Airedale Group; Clariant AG; SEPPIC; BASF; Shanghai Fine Chemicals Co., Ltd; Dow; Kao Corporation; Croda International; LG Household & Health Care; and FENCHEM.

BASF, headquartered in Ludwigshafen, Germany, is one of the world's largest chemical producers, with a rich history dating back to its founding in 1865 as Badische Anilin- und Soda-Fabrik. The company operates in over 80 countries and maintains a vast network of production facilities, including six integrated sites and 390 other locations globally. BASF's diverse product portfolio spans multiple segments, including Chemicals, Materials, Industrial Solutions, Surface Technologies, Nutrition & Care, and Agricultural Solutions. One of BASF's notable products is alkyl polyglucoside, a class of non-ionic surfactants derived from renewable resources.

Clariant AG, a Swiss multinational specialty chemicals company, was established in 1995. Headquartered in Muttenz, Switzerland, Clariant has grown to encompass 68 subsidiaries across 36 countries, with major manufacturing sites located in Europe, North America, South America, China, and India. The company operates through three primary business units: Care Chemicals, Adsorbents & Additives, and Catalysts. Clariant markets its APGs under the brand name Plantacare, which is tailored for applications in personal care products such as shampoos, body washes, and facial cleansers.

List of Key Companies in Alkyl Polyglucosides Market

- Actylis

- Airedale Group

- Clariant AG

- SEPPIC

- BASF

- Shanghai Fine Chemicals Co., Ltd

- Dow

- Kao Corporation

- Croda International

- LG Household & Health Care

- FENCHEM

Alkyl Polyglucosides Industry Developments

June 2023: BASF, one of the world's largest chemical producers, announced its plans to expand production capacity for bio-based APGs in Asia Pacific and North America by setting up new production lines in Bangpakong, Thailand, and Cincinnati, Ohio.

Alkyl Polyglucosides Market Segmentation

By Product Outlook (Volume – Tons, Revenue – USD Million, 2020–2034)

- Coco

- Lauryl

- Decyl

- Capryl

By Raw Material Outlook (Volume – Tons, Revenue – USD Million, 2020–2034)

- Fatty Alcohol

- Glucose

- Others

By Functionality Outlook (Volume – Tons, Revenue – USD Million, 2020–2034)

- Cleansing Agent

- Emulsifying Agent

- Wetting Agent

- Degreasing Agent

- Solubilizing Agent

- Hydrotope

- Foaming Agent

- Others

By Application Outlook (Volume – Tons, Revenue – USD Million, 2020–2034)

- Cosmetics and Personal Care

- Home Care

- Textile

- Oil & Gas

- Water Treatment

- Others

By Regional Outlook (Volume – Tons, Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Alkyl Polyglucosides Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 810.31 million |

|

Market Size Value in 2025 |

USD 851.97 million |

|

Revenue Forecast by 2034 |

USD 1354.89 million |

|

CAGR |

5.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in tons, Revenue in USD million, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The alkyl polyglucosides market was valued at USD 810.31 million in 2024 and is projected to grow to USD 1354.89 million by 2034.

The global market is projected to register a CAGR of 5.3% from 2025 to 2034.

Asia Pacific had the largest share of the global market in 2024.

A few of the key players in the market are Actylis; Airedale Group; Clariant AG; SEPPIC; BASF; Shanghai Fine Chemicals Co., Ltd; Dow; Kao Corporation; Croda International; LG Household & Health Care; and FENCHEM.

The cosmetic and personal care segment is projected to register significant growth during the forecast period.

The coco segment held a larger market share in 2024.