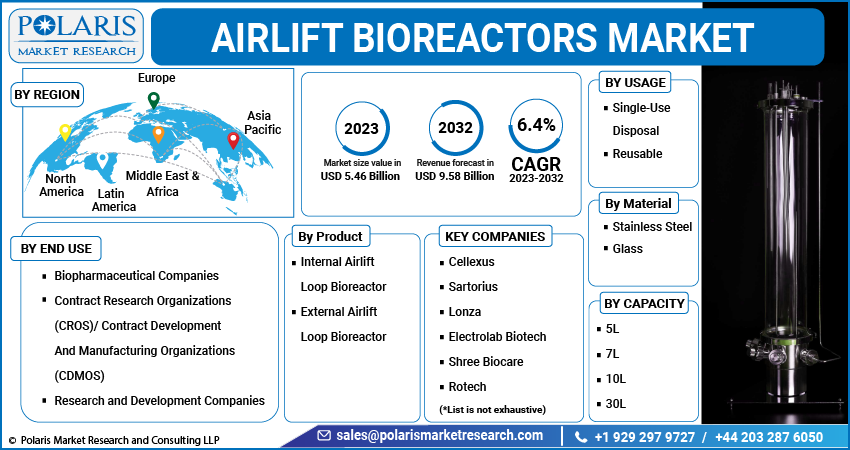

Airlift Bioreactors Market Share, Size, Trends, Industry Analysis Report, By Product (Internal Airlift Loop Bioreactor and External Airlift Loop Bioreactor); By Capacity; By Material; By Usages; By End Use; By Region; Segment Forecast, 2023-2032

- Published Date:Jul-2023

- Pages: 114

- Format: PDF

- Report ID: PM3638

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

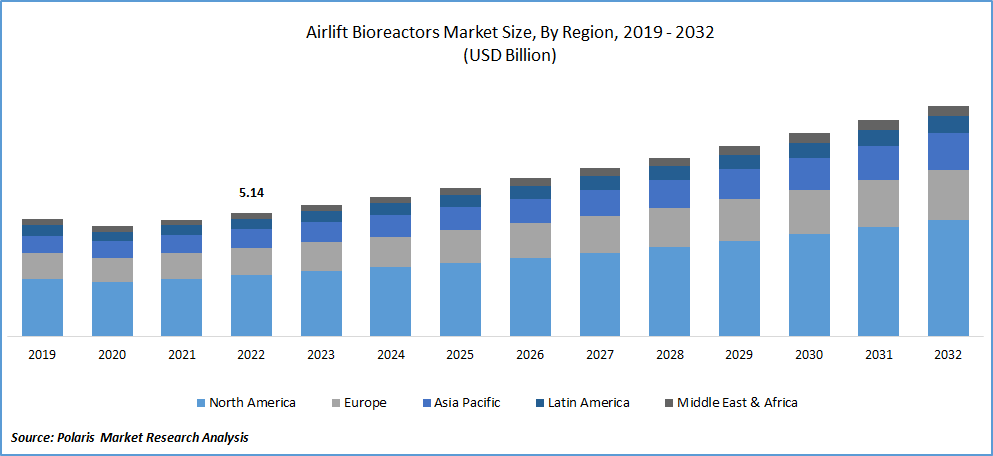

The global airlift bioreactors market was valued at USD 5.14 billion in 2022 and is expected to grow at a CAGR of 6.4% during the forecast period.

The Airlift Bioreactors Market refers to bioreactors that utilize airlift technology for various bioprocessing applications. Airlift bioreactors are specialized vessels used in biopharmaceutical and biotechnology industries to cultivate cells, microorganisms, or enzymes in a controlled environment.

To Understand More About this Research: Request a Free Sample Report

Unlike traditional stirred-tank bioreactors that rely on mechanical agitation, airlift bioreactors use gas sparging to circulate gas and liquid within the vessel. This circulation is achieved through the difference in density between the gas and liquid phases, resulting in the movement of cells and nutrients within the bioreactor.

Governments and funding agencies actively support research and development in biotechnology and bioprocessing. This factor will likely spur the market's growth across various regions. For example, India is recognized as a sunrise industry and a key part of its aim to become a USD 5 Tn economy by 2024 for bio-innovation & bio-manufacturing. The bio-economy sector in India has grown and was worth more than USD 80 Bn in 2022. It is predicted to surpass USD 150 billion by 2025 and reach USD 300 Bn by 2030. Funding programs and initiatives promoting bio-based industries, regenerative medicine, and sustainable manufacturing processes provide opportunities for the growth of the airlift bioreactor market.

Airlift bioreactors are used to produce biopharmaceuticals, such as therapeutic proteins, antibodies, vaccines, and enzymes. Airlift bioreactors' unique design and operational features make them suitable for a wide range of applications in bio-pharmaceutical manufacturing, bio-processing, regenerative medicine, waste treatment, and biochemical production. These cultivate microalgae and plant cells to produce biofuels, nutraceuticals, pigments, and other high-value compounds. Airlift bioreactors play a crucial role in tissue engineering and regenerative medicine applications. They provide a controlled environment for the culture and expansion of cells and tissues, facilitating cell proliferation, differentiation, and extracellular matrix synthesis.

Airlift bioreactors have played a crucial role in producing these products, providing efficient and scalable bioprocessing capabilities. The market witnessed a surge in adopting airlift bioreactors to meet the increased production needs during the pandemic. However, non-COVID-19-related projects and activities, including those involving airlift bioreactors, experienced temporary slowdowns as resources were reallocated to pandemic response efforts. Similarly, delayed projects & investments, disturbance in the supply chain, limited access to the facilities, economic uncertainties and budget constraints, and many other factors have also acted as hurdles in the growth of the market's development.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

- Expansion of the biopharmaceutical industry

Single-use bioreactor systems have gained popularity due to their advantages, such as reduced contamination risks, simplified operations, and shorter turnaround times. The excellent benefits of single-use bioreactors have led many businesses to invest in innovative products. For example, in April 2022, the recently released Cellexus single-use airlift bioreactor offered a more economical, effective technology. Airlift bioreactors can be designed as single-use systems, enabling faster and more efficient bioprocessing, especially in producing small-batch or niche products. It is gradually enhancing the growth of the airlift bioreactors worldwide.

Expanding the biopharmaceutical industry is one of the major factors likely to drive the market's development. The impact of new technologies and scientific innovation, increasing investments, and more effective manufacturing have all contributed to the industry's development during the past two decades. For example, the biopharmaceutical business has seen a significant transformation recently, moving from a generics-focused sector to a booming innovation engine in many nations. In 2020, Chinese biopharma businesses' market value surpassed USD 200 billion. The biopharmaceutical industry, including the production of therapeutic proteins, antibodies, and vaccines, is experiencing substantial growth. Therefore, this factor is significantly helping the market to expand at a rapid pace.

Report Segmentation

The market is primarily segmented based product, capacity, material, usage, end use, and region.

|

By Product |

By Capacity |

By Material |

By Usage |

By End Use |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Internal airlift loop bioreactors segment held largest market share in 2022

In 2022, the internal airlift loop bioreactors segment held the largest market share. Bioreactors have gained attention and adoption in various industries. These bioreactors offer unique advantages that contribute to their popularity and market dominance. They provide excellent mixing of the liquid phase and efficient mass transfer of gases and nutrients. Internal airlift loop bioreactors are highly scalable, allowing easy adaptation to different production scales. Furthermore, new advancements, evolving applications, and emerging technologies influence the market landscape.

30L capacity segment held the fastest market share in 2022

In 2022, the 30L segment held the fastest market share. This range has been widely used in various bioprocessing applications, including research and development, small-scale production, and pilot-scale studies. The 30L capacity is often considered an intermediate scale that offers flexibility, scalability, and cost-effectiveness advantages. Moreover, the 30L capacity range allows researchers and process developers to work with larger volumes than laboratory-scale bioreactors while maintaining a manageable scale for optimization and process development. This capacity enables more accurate scalability to larger production scales.

The biopharmaceutical companies segment held a significant market share in 2022

In 2022, the biopharmaceutical companies segment held a significant market share in volume and value. The biopharmaceutical industry has experienced substantial growth in recent years, driven by innovative therapies, the increasing prevalence of chronic diseases, and the demand for personalized medicine. These companies often require scalable manufacturing solutions to meet increasing demand and commercial production needs.

With their scalability and ability to maintain consistent hydrodynamic conditions during scale-up, airlift bioreactors provide an attractive option for biopharmaceutical companies seeking to transition from laboratory-scale to commercial-scale production. Apart from this, biopharmaceutical companies prioritize maintaining the integrity and purity of their products, and airlift bioreactors support these objectives by providing optimal conditions for cell growth and product formation.

North America accounted for the largest market share in 2022

In 2022, North America accounted for the largest airlift bioreactors market share. Advancements in biotechnology and bioprocessing, various product launches, and many other factors support the region's expansion. North America has a well-developed infrastructure to support bio-pharmaceutical manufacturing. For instance, approximately one-third of the market for bio-pharmaceuticals is accounted by the U.S, which also the world in bio-pharmaceutical R&D. As a result, the region attracts significant investments in biotechnology and biopharmaceutical industries, which further drives the adoption of airlift bioreactors.

Asia Pacific is the fastest-growing region in the global market and is expected to expand the market. Increasing demand for bio-based products is a prime factor promoting the market's expansion. For example, most of China's biofuel strategies have been centered on ethanol production, with conventional starch-based feedstocks accounting for about 99% of the country's ethanol production. Airlift bioreactors offer advantages in terms of improved mass transfer and enhanced oxygen transfer rates, making them attractive for the production of bio-based products. This factor will likely enhance the revenue for the market in this region.

Competitive Insight

The global players include Cellexus, Sartorius, Lonza, Electrolab Biotech, Shree Biocare, Rotech, Knik Technology, Solida Biotech, Zeta, and Kuhner Shaker.

Recent Developments

- In March 2022, Cellexus, a life sciences company located in Dundee, teamed up with Verder Liquids, a company based in Castleford, to offer pumps for the acid/base pump that comes standard with its CellMaker Plus and Low Flow bioreactor systems. Researchers worldwide use the CellMaker bioreactor system to grow cells in their labs for use in experiments to create new drugs and vaccines.

Airlift Bioreactors Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 5.46 billion |

|

Revenue forecast in 2032 |

USD 9.58 billion |

|

CAGR |

6.4% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019– 2021 |

|

Forecast period |

2023– 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Product, By Capacity, By Material, By Usage, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Cellexus, Sartorius, Lonza, Electrolab Biotech, Shree Biocare, Rotech, Knik Technology, Solida Biotech, Zeta, and Kuhner shaker |

FAQ's

The Airlift Bioreactors Market report covering key are product, capacity, material, usage, end use, and region.

Airlift Bioreactors Market Size Worth $ 9.58 Billion By 2032

The global airlift bioreactors market is expected to grow at a CAGR of 6.4% during the forecast period.

North America is Airlift Bioreactors Market.

key driving factors in Airlift Bioreactors Market are 1. Expansion of biopharmaceutical industry.